Gambling On Tragedy: The Los Angeles Wildfires And The Ethics Of Disaster Betting Markets

Table of Contents

The Rise of Disaster Betting Markets

While outright betting on the specific details of a wildfire's devastation might not be readily available on mainstream platforms, the concept of disaster betting exists within related markets. The growth of markets predicting disaster impacts is fueled by the need to assess and manage risk. These markets often focus on quantifiable aspects like insurance claims or property damage. They are, in essence, speculative markets attempting to predict the future based on available data.

- Examples of analogous markets: Insurance companies utilize complex models to assess risk and price policies. Derivative markets, although not directly betting on wildfires, can indirectly reflect the anticipated financial impact of such disasters. Furthermore, some prediction markets exist that may indirectly incorporate variables related to wildfire damage, but often focus on broader societal or economic outcomes.

- Motivations for participation: Participants in these markets are driven by various factors. Financial gain is a primary motivator, but the desire to accurately predict disaster impacts and demonstrate analytical skill also plays a role. Some may see it as a form of sophisticated risk management.

- Data used for predictions: Sophisticated algorithms and models use a wealth of data for predictions. This includes historical wildfire data, weather patterns, population density, fuel load assessments, and even social media trends indicating potential evacuation patterns.

Ethical Concerns and the Commodification of Suffering

The ethical implications of profiting from human suffering and loss are profound. Disaster betting, in its various forms, raises serious questions about the commodification of tragedy.

- Exacerbating inequalities: The potential for exacerbating existing inequalities is significant. Those with resources and access to information are better positioned to profit, while those directly impacted by the disaster bear the brunt of the losses.

- Disrespect towards victims: Betting on disaster outcomes can be seen as deeply disrespectful to victims and their families. It trivializes their suffering and reduces a human tragedy to a mere financial opportunity.

- Psychological impact: For those affected by wildfires, the knowledge that others are profiting from their misfortune can add another layer of psychological trauma and distress.

- Comparison to other ethically questionable gambling: The ethical dilemmas raised by disaster betting are analogous to those found in other ethically questionable forms of gambling, such as betting on sports injuries, where profit is generated from the misfortune of athletes.

The Specific Case of the Los Angeles Wildfires

The devastating Los Angeles wildfires serve as a stark case study. These fires caused widespread destruction, displacing thousands and resulting in significant loss of life and property.

- Extent of damage and human cost: The scale of destruction included the loss of homes, businesses, and critical infrastructure. The human cost, encompassing loss of life, injuries, and psychological trauma, was immense.

- Direct and indirect betting markets: While direct betting markets on the specifics of the LA wildfire damage are unlikely to be publicly available, the indirect impacts were likely reflected in various financial markets, such as those related to insurance claims or reconstruction costs.

- Ethical dilemmas: The very existence of markets that might indirectly profit from the scale of the wildfires raises significant ethical questions. It forces a discussion on the line between legitimate risk assessment and callous profiteering from human suffering.

Regulatory and Legal Considerations

Currently, there's a lack of comprehensive regulation specifically targeting disaster betting markets. The legal landscape is complex and varies across jurisdictions.

- Legality in different jurisdictions: The legality of predictive markets and their use of disaster-related data depends greatly on local laws and regulations. Many jurisdictions lack specific legislation addressing this niche area.

- Role of government agencies: Government agencies play a crucial role in regulating financial markets, but their oversight of disaster-related predictive markets often falls into gaps between existing legislation.

- Potential for future legal challenges: As awareness grows, we can expect increased calls for stricter regulation or outright bans on forms of betting that exploit disaster situations. Legal challenges could shape the future of these markets.

Alternative Approaches and Responsible Prediction Markets

Instead of focusing on profiting from disaster scale, predictive markets can be designed to benefit disaster relief and preparedness.

- Markets benefiting disaster relief: Markets could be structured to channel profits directly into disaster relief funds, supporting rebuilding efforts and aiding victims.

- Transparency and responsible data usage: Transparency in data sources and modeling methodologies is crucial to ensure the ethical and responsible use of predictive markets.

- Incentivizing preparedness and mitigation: Instead of focusing on the scale of a disaster, markets could incentivize proactive measures such as improved wildfire prevention and community preparedness. This would shift the focus from speculation to responsible risk management.

Conclusion

The ethical concerns surrounding disaster betting, particularly in the context of the Los Angeles wildfires, are significant. The potential for exploitation exists alongside the potential for responsible prediction markets that could benefit disaster preparedness and relief. The commodification of tragedy demands critical examination. We must promote responsible gambling practices and ensure that predictive markets related to natural disasters do not profit from human suffering. The need for careful consideration of the social and moral implications of profiting from tragedy cannot be overstated. Let's strive for a future where predictive markets focus on mitigation and support, not the commodification of tragedy. We must engage in a thoughtful discussion and advocate for regulations that balance prediction with compassion and prevent the rise of unethical disaster betting.

Featured Posts

-

Village Roadshow Acquired By Alcon In 417 5 Million Stalking Horse Bid

Apr 24, 2025

Village Roadshow Acquired By Alcon In 417 5 Million Stalking Horse Bid

Apr 24, 2025 -

Is Google Fis 35 Unlimited Plan Right For You A Detailed Review

Apr 24, 2025

Is Google Fis 35 Unlimited Plan Right For You A Detailed Review

Apr 24, 2025 -

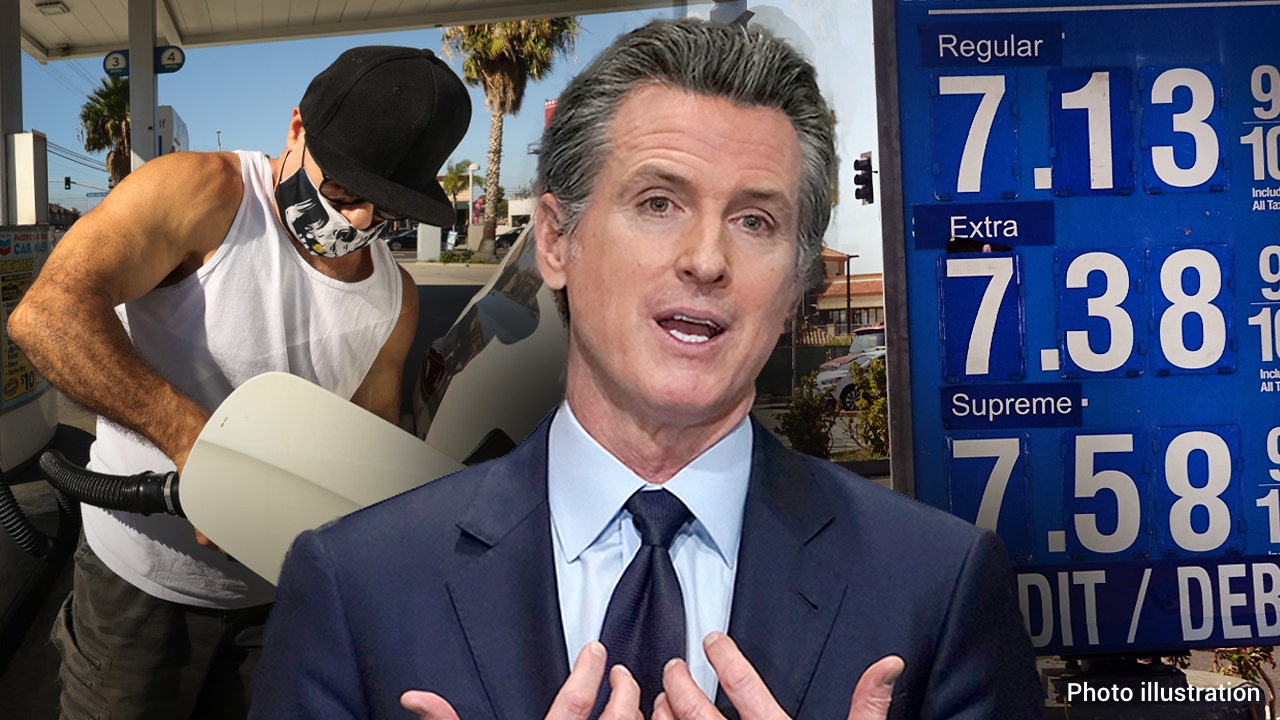

Rising Gas Prices In California Governor Newsoms Response And Call For Collaboration

Apr 24, 2025

Rising Gas Prices In California Governor Newsoms Response And Call For Collaboration

Apr 24, 2025 -

John Travoltas High Rollers Exclusive First Look At Posters And Photos

Apr 24, 2025

John Travoltas High Rollers Exclusive First Look At Posters And Photos

Apr 24, 2025 -

Od Djevojcice Do Zene Rast Ella Bleu Travolte Kceri Johna Travolte

Apr 24, 2025

Od Djevojcice Do Zene Rast Ella Bleu Travolte Kceri Johna Travolte

Apr 24, 2025