Future Of UTAC: Chinese Buyout Firm's Sale Consideration

Table of Contents

Financial Implications of a Chinese Buyout

A Chinese buyout could drastically alter UTAC's financial landscape. The future of UTAC's financial health hinges on the terms of the acquisition and the subsequent strategies employed by the new owners.

Potential Funding and Investment

The influx of capital from Chinese investors could be substantial, potentially fueling UTAC's growth trajectory.

- Increased R&D spending: Significant investment could lead to advancements in technology and product development.

- New market entry: Expansion into new geographical markets could significantly boost revenue streams.

- Acquisition of competitors: A Chinese buyer might leverage UTAC's position to consolidate market share through strategic acquisitions.

This increased funding could lead to improved financial stability and potentially reduce existing debt. However, it's crucial to consider the risks associated with leveraged buyouts, where excessive debt could strain the company's finances if revenue projections fail to materialize.

Impact on UTAC's Share Price and Valuation

The UTAC acquisition is likely to cause significant volatility in the company's share price. A premium offered by a Chinese buyer would likely inflate the short-term stock price.

- Short-term volatility: Expect fluctuations as investors react to news and speculation surrounding the deal.

- Long-term price predictions: The long-term impact depends on the success of the post-buyout integration and strategy.

- Impact on shareholder value: Shareholder returns will ultimately depend on the post-acquisition performance and the eventual sale price of their shares.

Regulatory hurdles, including potential antitrust reviews, could significantly impact the final valuation and complicate the acquisition process. The overall future of UTAC's valuation will depend on a complex interplay of factors.

Operational and Strategic Changes Following a Buyout

The integration of UTAC into a Chinese buyer's existing portfolio presents both challenges and opportunities. The UTAC's future operational model will likely undergo significant transformation.

Integration Challenges and Synergies

Merging two distinct corporate cultures, management styles, and operational processes will undoubtedly present challenges.

- Cultural differences: Bridging the gap between Chinese and [UTAC's current corporate culture] management styles requires careful planning and execution.

- Management restructuring: Restructuring is inevitable, with potential changes to leadership roles and organizational structure.

- Streamlining operations: Identifying and eliminating redundancies will be key to maximizing efficiency and cost savings.

However, potential synergies exist, particularly in supply chain optimization and access to new markets. A Chinese buyer could leverage existing supply chains and distribution networks to significantly benefit UTAC's operational efficiency.

Shift in Strategic Focus and Market Positioning

A change in ownership may fundamentally alter UTAC's strategic goals.

- Potential new target markets: The Chinese buyer might prioritize expansion into Asian markets or other regions.

- Product diversification: Investment could lead to the development of new products or services.

- Shifts in competitive landscape: UTAC's competitive position might change depending on the buyer's strategies and market presence.

The UTAC acquisition could lead to significant changes in branding and marketing strategies, aligning the company's image with the buyer's overall goals.

Geopolitical and Regulatory Considerations

The geopolitical landscape plays a crucial role in shaping the future of UTAC post-acquisition.

National Security Concerns and Regulatory Scrutiny

National security concerns and regulatory scrutiny are potential roadblocks.

- Potential delays or rejection of the buyout: Governments may impose conditions or even block the acquisition due to national security concerns.

- Conditions imposed by regulatory bodies: Authorities might mandate specific safeguards related to data privacy, technology transfer, and operational transparency.

Geopolitical tensions between China and other countries could further complicate the acquisition process, leading to delays or even a complete cancellation of the deal.

Impact on UTAC's Global Operations and Supply Chains

The buyout could significantly impact UTAC's global operations and supply chains.

- Restructuring of supply chains: The new owner might seek to optimize the supply chain by relocating manufacturing facilities or changing sourcing strategies.

- Potential for disruptions: Changes to supply chains could create short-term disruptions and logistical challenges.

- Shifts in manufacturing locations: Manufacturing could be shifted to China or other locations to reduce costs or improve access to markets.

The impact on UTAC's relationships with existing clients and partners remains to be seen, depending on how smoothly the integration proceeds and the buyer's post-acquisition strategies.

Conclusion: Navigating the Uncertain Future of UTAC

The potential Chinese buyout of UTAC presents a complex scenario with significant implications for its financial performance, operational strategies, and geopolitical standing. The future of UTAC is laden with both opportunities and risks. Careful consideration of the potential challenges and benefits associated with such a major transaction is essential. To stay informed about the unfolding developments regarding the future of UTAC, continue following industry news and conducting thorough research on the potential buyer's strategies and track record. The ongoing saga surrounding the UTAC acquisition will undoubtedly shape the company's future trajectory in significant ways.

Featured Posts

-

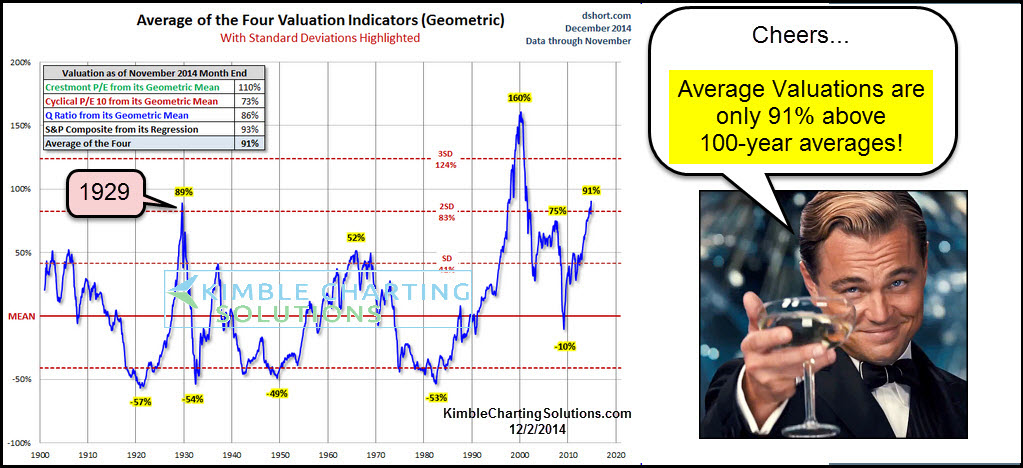

High Stock Market Valuations A Bof A Analysts Case For Investor Calm

Apr 24, 2025

High Stock Market Valuations A Bof A Analysts Case For Investor Calm

Apr 24, 2025 -

Breast Cancer Diagnosis After Missed Mammogram Lessons From Tina Knowles Experience

Apr 24, 2025

Breast Cancer Diagnosis After Missed Mammogram Lessons From Tina Knowles Experience

Apr 24, 2025 -

Why Middle Managers Are Essential For Company Success And Employee Well Being

Apr 24, 2025

Why Middle Managers Are Essential For Company Success And Employee Well Being

Apr 24, 2025 -

Chalet Girl Jobs In Europe A Realistic Look At The Perks And Challenges

Apr 24, 2025

Chalet Girl Jobs In Europe A Realistic Look At The Perks And Challenges

Apr 24, 2025 -

Increased Resistance To Ev Mandates From Car Dealerships

Apr 24, 2025

Increased Resistance To Ev Mandates From Car Dealerships

Apr 24, 2025