Examining Canada's Finances: The Need For Fiscal Responsibility

Table of Contents

Canada's Current Fiscal Landscape: A Detailed Overview

Understanding Canada's current financial situation is crucial to addressing the need for responsible fiscal management. The country faces a complex interplay of factors impacting its fiscal health. Let's delve into the key aspects.

-

National Debt and Deficit: Canada's national debt has been steadily increasing for years, fueled by both rising expenditures and slower revenue growth. The annual budget deficit represents the difference between government spending and revenue in a given fiscal year. This deficit adds to the accumulated national debt. Sustained deficits necessitate increased borrowing, escalating the overall debt burden.

-

Sources of Revenue and Expenditures: The Canadian government relies primarily on income taxes, corporate taxes, goods and services taxes (GST), and excise taxes to generate revenue. Major expenditures include healthcare, social security programs (like Old Age Security and Canada Pension Plan), education, defense, and infrastructure. An aging population and increasing demand for social services are putting significant pressure on government spending.

-

Key Statistics and Charts: (Note: Actual data would be inserted here from reputable sources like Statistics Canada. This section would include charts visually representing the national debt, deficit, revenue streams, and expenditure allocation.)

- Current level of national debt per capita: [Insert Statistic from Statistics Canada]

- Projected debt trajectory over the next 5-10 years: [Insert Statistic from Statistics Canada and/or relevant economic forecasts]

- Major areas of government spending and their percentage of the budget: [Insert Statistic from Statistics Canada, detailing percentages allocated to healthcare, social programs, etc.]

- Comparison to other G7 nations' fiscal health: [Insert comparative data from reputable international organizations like the OECD or IMF]

The Risks of Irresponsible Fiscal Management

The continued pursuit of unsustainable fiscal policies poses significant risks to Canada's economic future. Ignoring the need for sound fiscal policy can have severe consequences.

-

Impact on Future Economic Growth: High levels of debt can stifle economic growth. Increased interest payments consume a larger portion of government revenue, leaving less for investments in crucial areas like infrastructure and education. This "crowding out" effect can also discourage private sector investment.

-

Risks to Social Programs and Public Services: To service the debt, the government may be forced to reduce spending on vital social programs. This could lead to cuts in healthcare, education, and other essential services, potentially impacting the quality of life for Canadians.

-

Implications for Canada's Credit Rating and Borrowing Costs: High levels of debt can negatively affect Canada's credit rating, making it more expensive for the government to borrow money in the future. This increased borrowing cost further exacerbates the fiscal situation.

- Increased interest payments reducing funds for essential services: Higher interest rates directly impact the budget, diverting funds from essential programs.

- Crowding out of private investment: Government borrowing can increase interest rates, making it more expensive for businesses to invest and expand.

- Vulnerability to economic shocks: High debt levels make the economy more vulnerable to external shocks, such as recessions or global financial crises.

- Reduced long-term economic competitiveness: A high debt burden can hinder long-term economic growth and competitiveness on the global stage.

Strategies for Achieving Fiscal Responsibility in Canada

Implementing a plan for responsible fiscal management requires a multi-faceted approach. Here are some strategies that could help improve Canada's fiscal health:

-

Tax Reforms: The government could explore options such as broadening the tax base (e.g., closing tax loopholes) or making modest adjustments to tax rates. Any tax reform should carefully consider its impact on different income groups and economic sectors.

-

Spending Cuts and Efficiency Improvements: Identifying areas for spending cuts or efficiency improvements is crucial. This could involve streamlining government operations, reducing bureaucratic waste, and prioritizing investments in high-impact areas.

-

Promoting Economic Growth: Strong economic growth is essential to increase government revenue and reduce the debt-to-GDP ratio. Policies that promote innovation, entrepreneurship, and investment can contribute to sustainable economic expansion.

- Specific examples of spending cuts or efficiency improvements: [Provide concrete examples, e.g., streamlining government procurement processes, reducing administrative overhead]

- Potential impact of various tax reform options: [Analyze the potential revenue gains and distributional effects of various tax proposals]

- Realistic scenarios for achieving balanced budgets: [Present feasible budget scenarios outlining how to gradually reduce deficits and achieve balanced budgets]

- Importance of long-term fiscal planning: Long-term fiscal planning is crucial for developing sustainable fiscal strategies.

The Role of Transparency and Accountability

Transparency and accountability are paramount to fostering responsible fiscal management. Canadians deserve a clear understanding of how their tax dollars are being spent.

-

Transparent Government Budgeting: The government should adopt more transparent and accessible budgeting practices, providing detailed information about revenue and expenditure allocations.

-

Parliamentary Oversight: Parliamentary committees play a vital role in overseeing government spending and holding the executive branch accountable for fiscal decisions. Strengthening these oversight mechanisms is essential.

- Examples of successful transparency initiatives in other countries: [Highlight examples of successful transparency initiatives from other countries with strong fiscal responsibility]

- Recommendations for improving budget transparency in Canada: [Suggest specific measures to enhance budget transparency, such as open data initiatives]

- Strengthening parliamentary oversight committees: [Suggest ways to strengthen the role and effectiveness of parliamentary committees in overseeing government finances]

- The importance of public access to fiscal data: Public access to comprehensive fiscal data empowers citizens to monitor government spending and hold officials accountable.

Conclusion: Securing Canada's Future Through Fiscal Responsibility

Achieving fiscal responsibility is not merely a matter of accounting; it is a critical investment in Canada's future. The risks of inaction are substantial, threatening economic growth, social programs, and Canada's international standing. By implementing the strategies discussed, including tax reforms, spending efficiencies, and a commitment to transparency and accountability, Canada can secure its long-term economic and social well-being.

We urge readers to engage in informed discussions about Canada's fiscal future. Contact your elected officials and demand greater fiscal responsibility. Visit the websites of Statistics Canada and the Department of Finance Canada for detailed information and data. Let's work together to build a fiscally sound and prosperous future for Canada through responsible fiscal management and sound fiscal policy.

Featured Posts

-

Ftcs Appeal Of Microsoft Activision Merger A Deep Dive

Apr 24, 2025

Ftcs Appeal Of Microsoft Activision Merger A Deep Dive

Apr 24, 2025 -

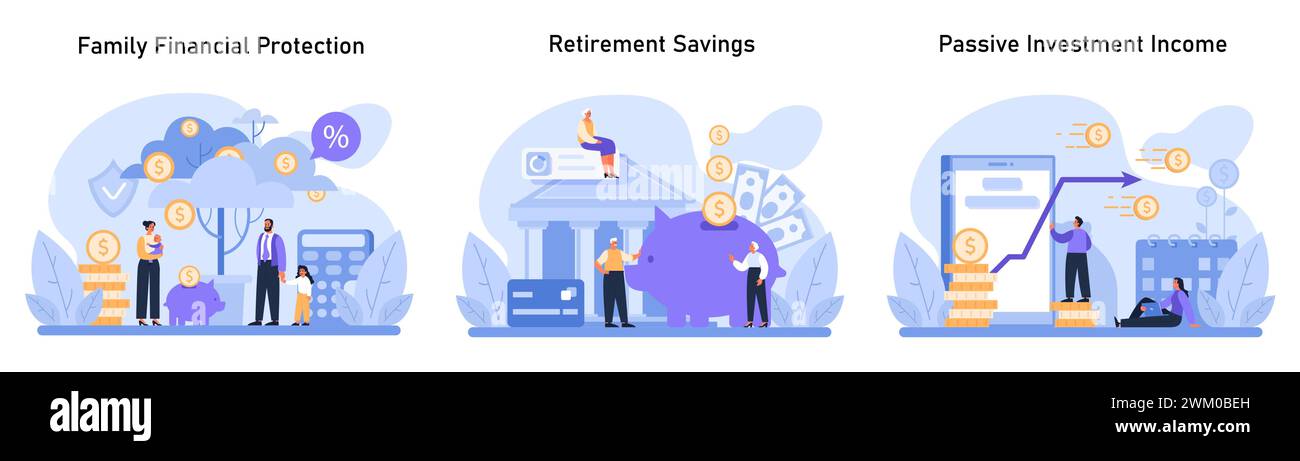

Russian Gas Phaseout The Eus Spot Market Strategy

Apr 24, 2025

Russian Gas Phaseout The Eus Spot Market Strategy

Apr 24, 2025 -

The Post Roe Landscape Examining The Role Of Otc Birth Control

Apr 24, 2025

The Post Roe Landscape Examining The Role Of Otc Birth Control

Apr 24, 2025 -

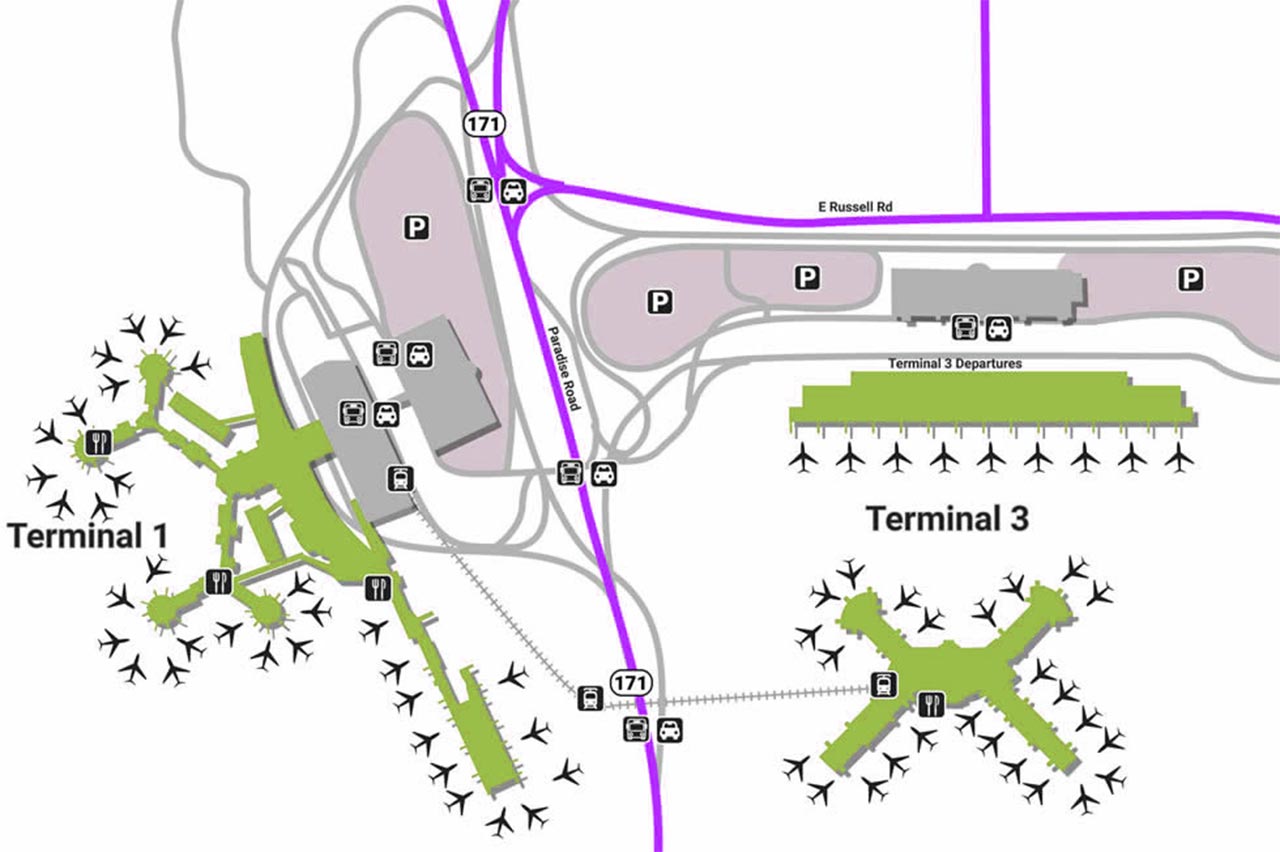

Faa Study Highlights Collision Concerns At Las Vegas Mc Carran International Airport

Apr 24, 2025

Faa Study Highlights Collision Concerns At Las Vegas Mc Carran International Airport

Apr 24, 2025 -

Is Google Fis 35 Unlimited Plan Right For You A Detailed Review

Apr 24, 2025

Is Google Fis 35 Unlimited Plan Right For You A Detailed Review

Apr 24, 2025