Dax Performance: How Bundestag Elections And Business Data Influence The Market

Table of Contents

The Impact of Bundestag Elections on Dax Performance

Bundestag elections inject significant uncertainty into the German market, directly influencing Dax performance. The potential for shifts in economic policy creates volatility and challenges for investors.

Political Uncertainty and Market Volatility

Elections inherently introduce uncertainty, impacting investor confidence. The anticipation of potential policy changes following the election often leads to market fluctuations. Investors react to the perceived risk associated with each party's platform, often leading to increased volatility in the weeks leading up to and immediately following the election.

- Examples of past election cycles and their effects on the DAX: Analyzing past elections reveals a clear pattern: periods of heightened uncertainty around election time often correlate with increased DAX volatility. The 2017 election, for example, saw some fluctuations in the DAX leading up to the final result, reflecting the uncertainty surrounding the coalition formation process.

- Analyzing pre-election and post-election market trends: Careful analysis of pre- and post-election market trends can provide valuable insights into the specific impact of particular political parties or coalitions on investor sentiment and the DAX.

- Specific policy areas and their potential influence on the DAX:

- Fiscal policy: Changes in taxation, government spending, and debt management directly impact business investment and consumer spending, which in turn influence the DAX.

- Regulation: New regulations impacting specific sectors (e.g., automotive, energy) can significantly affect the performance of related companies listed on the DAX.

- Trade policy: Changes to trade agreements and tariffs can have a profound effect on German exports and the overall economic climate, influencing the DAX.

Coalition Formation and its Economic Implications

The time it takes to form a coalition government following the election can also create prolonged uncertainty. This period of political limbo can significantly impact the DAX as investors await clarity on the new government's economic agenda.

- The time taken to form a coalition government: Protracted coalition negotiations can lead to extended periods of market uncertainty and volatility as investors remain hesitant to commit capital.

- Different coalition governments and their differing economic agendas: Different coalitions often prioritize different economic policies. For instance, a coalition focused on fiscal austerity may have a different impact on the DAX compared to one prioritizing increased government spending.

- Examples of past coalition effects on the Dax: Examining historical data on coalition formation and subsequent economic policies highlights the correlation between government composition and Dax performance.

- Impact of policy announcements from new governments on investor sentiment: The initial policy announcements from a new government can significantly shift investor sentiment and influence the DAX’s trajectory.

- Economic platforms of major political parties:

- Party A: Focus on environmental sustainability and green technologies.

- Party B: Emphasis on fiscal responsibility and reduced government debt.

- Party C: Prioritization of social welfare programs and increased government spending.

The Influence of Business Data on Dax Performance

Business data releases provide crucial insights into the health of the German economy, directly impacting Dax performance. Understanding and interpreting this data is essential for effective investment strategies.

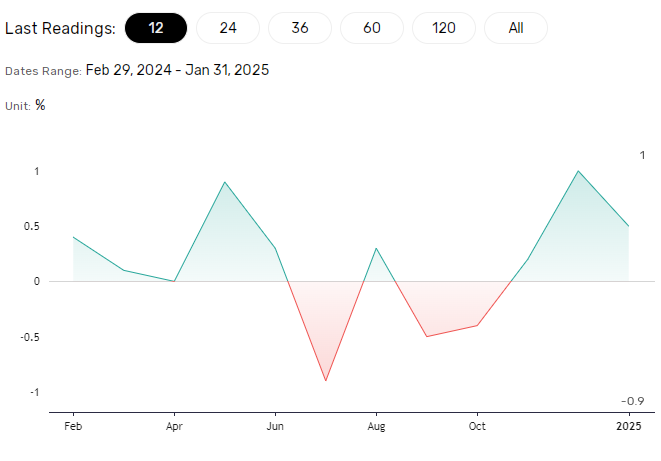

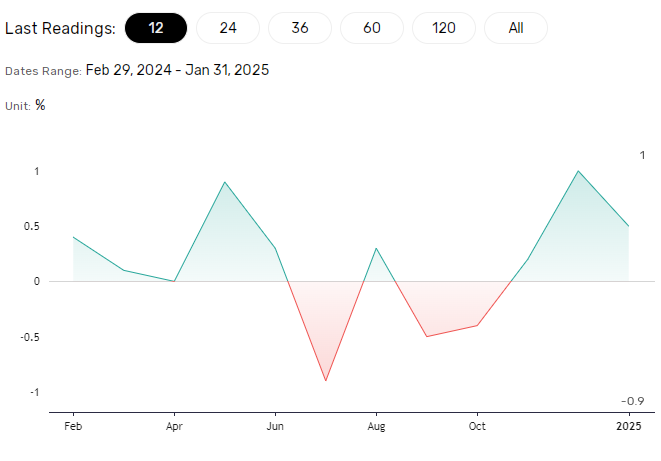

Key Economic Indicators and their Correlation with the DAX

Several key economic indicators are closely correlated with DAX performance. Changes in these indicators often translate to changes in investor sentiment and market movements.

- GDP growth: Strong GDP growth generally leads to increased investor confidence and a positive impact on the DAX. Conversely, slowing GDP growth can signal economic weakness and trigger negative market sentiment.

- Inflation rates: High inflation erodes purchasing power and can negatively impact the DAX. Low and stable inflation, however, is generally considered positive for the market.

- Unemployment figures: Low unemployment rates are generally viewed as a positive sign, boosting investor confidence and the DAX. High unemployment tends to have the opposite effect.

- Manufacturing PMI (Purchasing Managers' Index): The PMI provides insights into the health of the manufacturing sector, a key component of the German economy. A strong PMI indicates robust manufacturing activity, which often translates to positive DAX performance.

- Consumer confidence: High consumer confidence indicates strong consumer spending, boosting economic growth and positively influencing the DAX. Low consumer confidence suggests reduced spending and potential economic slowdown.

- Other relevant data: Industrial production, trade balance, and retail sales data also provide valuable insights into the German economy and impact the DAX.

Analyzing and Interpreting Business Data for Investment Decisions

Effective interpretation of business data is critical for informed investment decisions.

- Significance of data releases and their timing: Understanding the significance of data releases and their timing is vital. Unexpectedly strong or weak data releases can trigger significant market movements.

- Comparing current data to historical trends: Comparing current data to historical trends helps investors understand the relative strength or weakness of the German economy.

- Utilizing technical analysis: Technical analysis techniques can be used to interpret data and predict potential DAX movements.

- Different data points and trading strategies: Different data points can lead to different trading strategies. For example, strong GDP growth might lead to a long position, while rising inflation could prompt a more cautious approach.

- The role of market sentiment: Market sentiment plays a crucial role in how investors react to business data releases. Even positive data can be negatively interpreted if the overall market sentiment is pessimistic.

- Resources for accessing reliable economic data: Reliable sources for economic data include the Destatis (German Federal Statistical Office), the European Central Bank (ECB), and reputable financial news outlets.

Conclusion

Dax performance is intricately linked to both Bundestag elections and the release of key business data. Understanding the potential impact of political uncertainty and economic indicators is critical for making informed investment decisions in the German stock market.

Call to Action: Stay informed about upcoming Bundestag elections and crucial business data releases to optimize your Dax investment strategy. Regularly analyze Dax performance trends in relation to these factors to improve your understanding of the German market and achieve better investment outcomes. Learn more about Dax performance prediction by following [link to relevant resource].

Featured Posts

-

Jabeur Falls To Rybakina In Hard Fought Mubadala Open Match

Apr 27, 2025

Jabeur Falls To Rybakina In Hard Fought Mubadala Open Match

Apr 27, 2025 -

Gensol Promoters Face Pfc Action Eo W Transfer For Fraudulent Documents

Apr 27, 2025

Gensol Promoters Face Pfc Action Eo W Transfer For Fraudulent Documents

Apr 27, 2025 -

Bucking Fastard Werner Herzogs New Film With Real Life Sister Leads

Apr 27, 2025

Bucking Fastard Werner Herzogs New Film With Real Life Sister Leads

Apr 27, 2025 -

Government Appoints Vaccine Skeptic To Head Immunization Autism Research

Apr 27, 2025

Government Appoints Vaccine Skeptic To Head Immunization Autism Research

Apr 27, 2025 -

Real Time Analysis The Economic Impact Of The Canadian Travel Boycott On The Us

Apr 27, 2025

Real Time Analysis The Economic Impact Of The Canadian Travel Boycott On The Us

Apr 27, 2025