Chinese Stocks In Hong Kong Surge: Trade Tension Easing Fuels Rally

Table of Contents

Easing US-China Trade Tensions: The Primary Catalyst

The primary driver of the recent rally in Chinese stocks in Hong Kong is undoubtedly the easing of US-China trade tensions. Years of escalating trade disputes, often referred to as the "US-China trade war," created significant uncertainty and volatility in the market. However, recent developments have shifted the sentiment considerably.

Reduced Tariffs and Trade Restrictions

The announcement of reduced tariffs and the suspension of certain trade restrictions has directly impacted the performance of Chinese companies listed in Hong Kong. Specific examples, such as the reduction of tariffs on certain technology products or the postponement of new tariffs on others, have provided immediate relief. These actions demonstrate a move towards de-escalation and have instilled a sense of optimism regarding future trade relations. This positive shift in the US-China trade deal narrative has calmed investor fears and encouraged greater investment.

- Direct Impact: Reduced tariffs translate to lower costs for Chinese companies, improving profitability and boosting their stock prices.

- Improved Forecasts: Analysts have revised their growth forecasts upward for many Chinese companies, reflecting the positive impact of eased trade tensions.

- Increased Competitiveness: The reduction in tariffs allows Chinese companies to compete more effectively in global markets.

Improved Market Sentiment and Investor Confidence

Decreased trade uncertainty has been instrumental in boosting investor confidence. The reduced risk associated with investing in Chinese assets has attracted significant foreign investment, fueling the rally in Hong Kong-listed Chinese stocks. Furthermore, positive economic indicators emerging from China, such as strong consumer spending and industrial production, have further enhanced investor confidence. The increased trading volume in Hong Kong's stock market serves as compelling evidence of this renewed optimism.

- Foreign Investment Surge: Capital inflows from international investors have noticeably increased, indicating a renewed appetite for Chinese assets.

- Positive Economic Data: Stronger-than-expected economic data from China has reinforced positive market sentiment.

- Increased Trading Volume: The surge in trading volume reflects the increased activity and interest in the Hong Kong stock market.

Specific Sectors Driving the Rally in Hong Kong-Listed Chinese Stocks

While the overall market has benefited from easing trade tensions, certain sectors have experienced particularly strong growth.

Technology Sector Outperformance

The technology sector has been a standout performer, with major Chinese tech companies listed in Hong Kong demonstrating exceptional growth. This strong performance can be attributed to several factors, including increased demand for technology products and services, ongoing government support for the tech sector in China, and the overall positive global outlook for the technology industry. Companies like Alibaba and Tencent, amongst others, have seen significant gains.

- Increased Demand: The global demand for technology products and services remains strong, benefiting Chinese tech giants.

- Government Support: Continued government investment and favorable policies in China contribute to the sector's growth.

- Innovation and Expansion: Constant innovation and strategic expansion initiatives further contribute to the sector's robust performance.

Growth in Consumer Discretionary and Financials

The consumer discretionary and financial sectors have also shown significant growth. Rising consumer spending in China, fueled by a recovering economy and increasing disposable incomes, has driven the performance of consumer discretionary stocks. Similarly, the financial sector has benefited from increased economic activity and positive market sentiment.

- Rising Consumer Spending: Increased consumer confidence and spending contribute to the success of consumer-focused companies.

- Economic Recovery: The continued economic recovery in China benefits both consumer and financial sectors.

- Market Confidence: A positive outlook on the overall market fuels confidence in the financial sector.

Potential Risks and Future Outlook for Chinese Stocks in Hong Kong

While the current market conditions appear positive, investors must acknowledge potential risks and challenges.

Geopolitical Risks and Unresolved Trade Issues

Despite the easing of tensions, geopolitical risks and unresolved trade issues remain. The US-China relationship remains complex, and future policy changes could introduce uncertainty into the market. Investors need to carefully assess these potential risks and adjust their investment strategies accordingly.

- Uncertain Geopolitical Landscape: The global political climate continues to present risks to international trade and investment.

- Potential for Future Trade Disputes: The possibility of future trade disagreements cannot be discounted.

- Economic Sanctions: The potential of future economic sanctions always remains a risk.

Regulatory Changes and Market Volatility

Regulatory changes in China or Hong Kong could significantly impact the market. Investors should be aware of the inherent volatility of the stock market and implement appropriate risk management strategies. Diversification and thorough due diligence are crucial for navigating this dynamic environment.

- Regulatory Uncertainty: Changes in regulations can impact the performance of specific companies and sectors.

- Market Volatility: Stock markets are inherently volatile, and sudden changes can affect investment returns.

- Risk Management Strategies: Employing a sound investment strategy, including diversification and risk assessment, is key.

Conclusion: Navigating the Surge in Chinese Stocks in Hong Kong

The recent surge in Hong Kong-listed Chinese stocks is primarily driven by the easing of US-China trade tensions and improved investor confidence. Strong performance across various sectors, particularly technology, consumer discretionary, and financials, has contributed significantly to the growth. However, investors must remain cognizant of the potential risks associated with geopolitical uncertainties, regulatory changes, and inherent market volatility. Careful consideration of these factors, along with thorough research and potentially professional advice, is crucial before making any investment decisions related to Chinese stocks in Hong Kong. Learn more about investing in Chinese stocks in Hong Kong and make informed decisions. Remember to diversify your portfolio and understand the risks involved before investing in any specific market, including this one.

Featured Posts

-

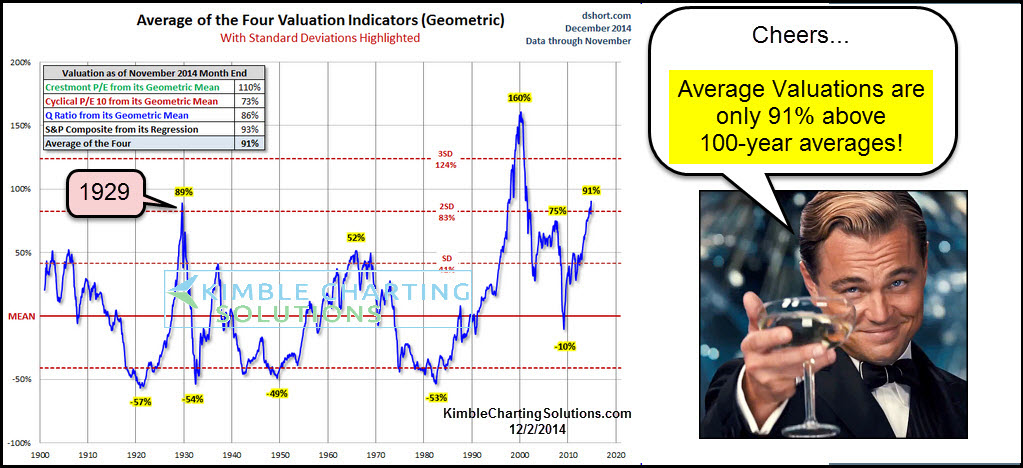

High Stock Market Valuations A Bof A Analysts Case For Investor Calm

Apr 24, 2025

High Stock Market Valuations A Bof A Analysts Case For Investor Calm

Apr 24, 2025 -

Stock Market Today Dow Jumps 1000 Points Nasdaq And S And P 500 Surge

Apr 24, 2025

Stock Market Today Dow Jumps 1000 Points Nasdaq And S And P 500 Surge

Apr 24, 2025 -

Zuckerbergs Next Chapter Navigating The Trump Presidency

Apr 24, 2025

Zuckerbergs Next Chapter Navigating The Trump Presidency

Apr 24, 2025 -

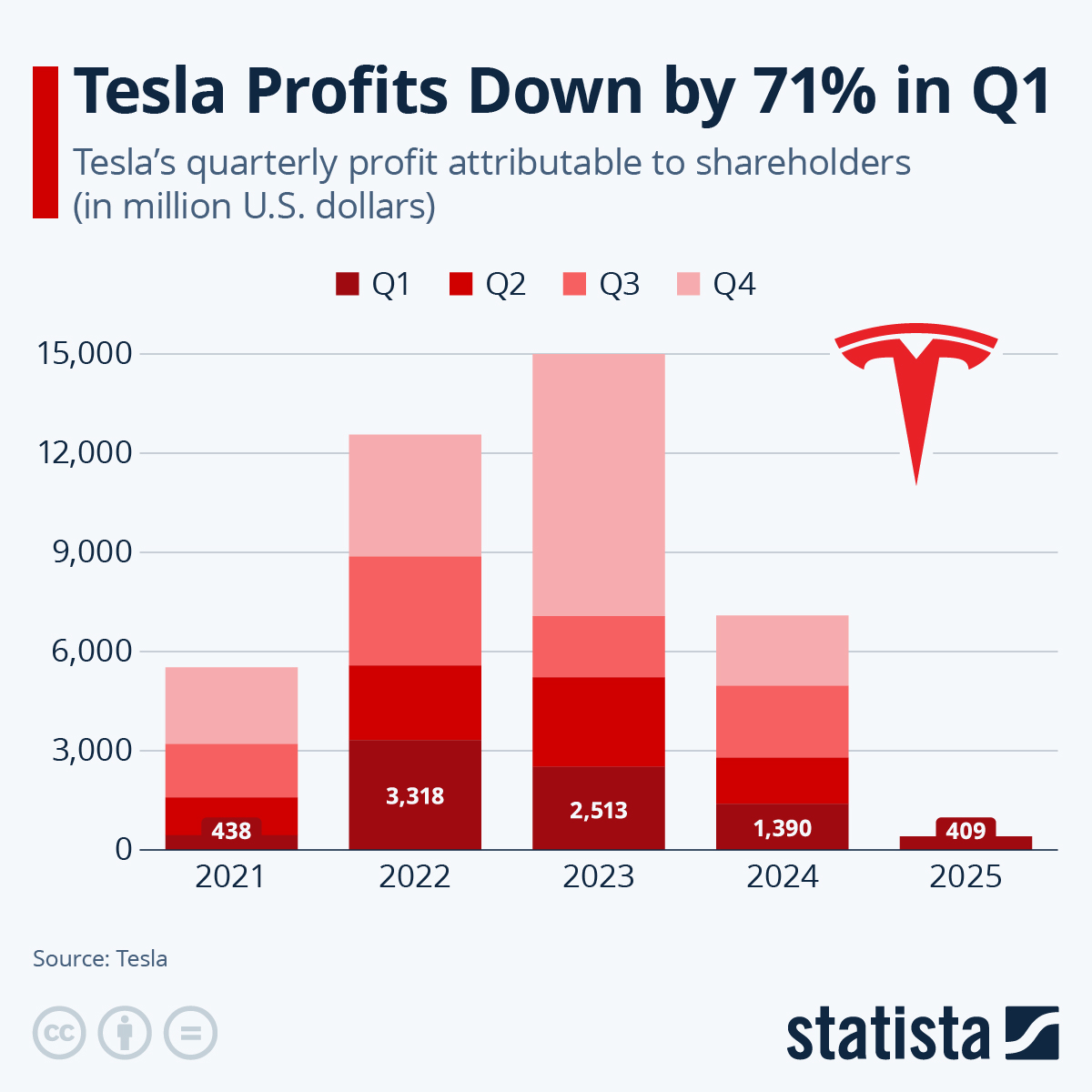

Tesla Q1 Earnings Report Analyzing The Impact Of Musks Actions

Apr 24, 2025

Tesla Q1 Earnings Report Analyzing The Impact Of Musks Actions

Apr 24, 2025 -

Ftc Investigates Open Ais Chat Gpt What It Means For Ai

Apr 24, 2025

Ftc Investigates Open Ais Chat Gpt What It Means For Ai

Apr 24, 2025