China's Energy Security: Middle Eastern LPG As A Strategic Alternative To US Supplies

Table of Contents

The Rise of LPG in China's Energy Mix

China's domestic demand for LPG is experiencing exponential growth, driven by several factors. This versatile fuel plays a crucial role across various sectors, from residential cooking and heating to the burgeoning petrochemical industry. However, China's domestic production capacity struggles to keep pace with this escalating demand, necessitating significant imports to meet the nation's energy needs.

- Increasing Urbanization and Rising Living Standards: Rapid urbanization and improved living standards have led to increased LPG consumption for cooking and heating in both urban and rural areas. This trend is expected to continue for the foreseeable future.

- Government Policies Promoting Cleaner Fuels: The Chinese government is actively promoting cleaner fuels as part of its broader environmental goals. LPG, being a relatively cleaner-burning fuel compared to coal, is receiving significant government support, further boosting demand.

- LPG's Role as a Transitional Fuel: As China transitions towards a more sustainable energy mix, LPG serves as a crucial bridging fuel, providing a cleaner alternative to coal while renewable energy infrastructure is further developed.

Geopolitical Shifts: Reducing Reliance on US LPG

Historically, the United States has been a major supplier of LPG to China. However, recent geopolitical shifts have prompted China to diversify its sources. Trade tensions, tariffs, and concerns regarding the reliability of US supply chains have highlighted the vulnerabilities of relying on a single major supplier.

- Trade Tensions and Tariffs: The ongoing trade disputes between the US and China have created uncertainty and instability in energy trade relationships, pushing China to explore alternative sources.

- The Desire for Greater Energy Independence: China's strategic goal of enhanced energy independence and reduced vulnerability to external shocks is driving its diversification efforts. This is a key aspect of its national security strategy.

- Concerns Regarding the Reliability and Stability of US LPG Supply Chains: Potential disruptions to US LPG supply chains due to unforeseen events or policy changes have increased the urgency for China to secure alternative, more reliable sources.

Middle Eastern LPG: A Viable Alternative

The Middle East boasts substantial LPG reserves and production capacity, making it an attractive alternative for China. Its geographical proximity offers shorter shipping routes, potentially reducing transportation costs and transit times. Furthermore, established trade relationships between China and Middle Eastern nations facilitate smoother transactions.

- Major Middle Eastern LPG Exporters: Countries like Saudi Arabia, Qatar, and Iran possess significant LPG production capabilities, offering a diverse range of potential suppliers for China.

- Transportation Costs and Logistics: While transportation costs need careful evaluation, the geographical proximity of the Middle East compared to the US significantly reduces shipping distances and associated expenses.

- Potential for Long-Term Contracts and Strategic Partnerships: China can leverage its economic clout to negotiate favorable long-term contracts and strategic partnerships with Middle Eastern LPG producers, ensuring a stable supply.

Challenges and Considerations for China's Middle Eastern LPG Strategy

While Middle Eastern LPG presents significant opportunities, China must also address potential challenges. Price volatility in the global LPG market, geopolitical risks in the Middle East, infrastructural limitations, and competition from other Asian importers all pose significant hurdles.

- The Impact of Global LPG Price Fluctuations: Global LPG prices can fluctuate significantly due to various factors, creating uncertainty and impacting China's energy costs. Effective hedging strategies are crucial.

- Regional Political Instability: Geopolitical instability in the Middle East poses risks to LPG supply chains. China needs robust risk assessment and management strategies.

- Investment Requirements for Upgrading Port Facilities and Storage Infrastructure: China may need to invest in expanding its port facilities and storage infrastructure to handle increased LPG imports.

- Competition from Other Asian Countries: China faces competition from other Asian nations vying for Middle Eastern LPG supplies, necessitating proactive strategies to secure its share.

Environmental Implications of Increased LPG Imports

The increased reliance on LPG necessitates a careful consideration of environmental impacts. While LPG is cleaner than coal, it still contributes to greenhouse gas emissions. China must address these concerns through appropriate mitigation strategies.

- Greenhouse Gas Emissions: LPG combustion emits greenhouse gases, contributing to climate change. China needs to adopt strategies to minimize these emissions.

- Measures to Reduce Emissions: Implementing carbon capture and storage technologies and promoting energy efficiency can help mitigate the environmental impact of LPG consumption.

- Transition Towards Cleaner Energy Sources: LPG serves as a transitional fuel. China's long-term strategy must include a transition towards cleaner, renewable energy sources.

Securing China's Energy Future Through Strategic LPG Diversification

In conclusion, securing China's energy future requires a diversified and strategic approach to LPG procurement. The shift away from US supplies towards Middle Eastern LPG presents both significant opportunities and challenges. While the Middle East offers a viable alternative with geographical advantages and potential for strategic partnerships, China must carefully manage price volatility, geopolitical risks, and environmental considerations. Further research and discussion are crucial for optimizing China’s LPG import strategy, ensuring enhanced energy security while implementing sustainable sourcing practices and mitigating environmental impacts. This includes exploring collaborations with Middle Eastern partners for a secure and sustainable supply of LPG.

Featured Posts

-

Uil State Bound Hisd Mariachis Viral Whataburger Moment

Apr 24, 2025

Uil State Bound Hisd Mariachis Viral Whataburger Moment

Apr 24, 2025 -

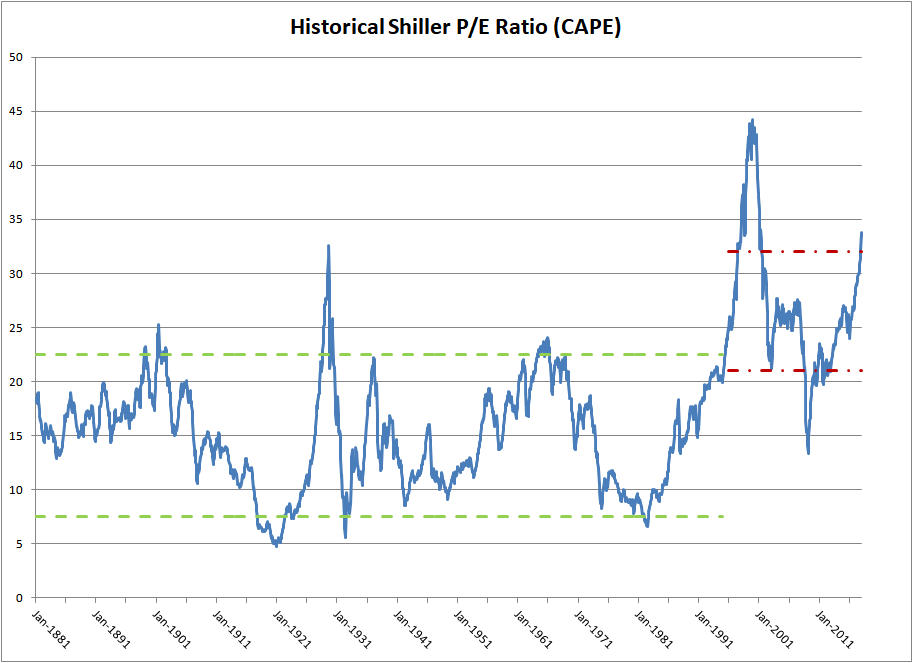

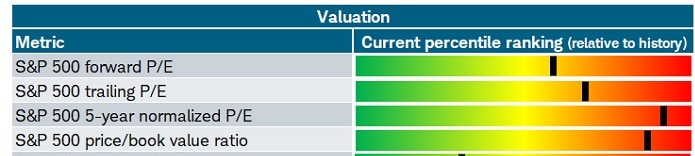

Stock Market Valuations Bof A Explains Why Investors Shouldnt Be Concerned

Apr 24, 2025

Stock Market Valuations Bof A Explains Why Investors Shouldnt Be Concerned

Apr 24, 2025 -

Why Current Stock Market Valuations Are Not A Cause For Investor Alarm Bof A

Apr 24, 2025

Why Current Stock Market Valuations Are Not A Cause For Investor Alarm Bof A

Apr 24, 2025 -

Steffy Liam And Finn The Bold And The Beautiful Spoilers For Thursday February 20th

Apr 24, 2025

Steffy Liam And Finn The Bold And The Beautiful Spoilers For Thursday February 20th

Apr 24, 2025 -

Fox News Faces Defamation Lawsuit From Ray Epps Over January 6th Allegations

Apr 24, 2025

Fox News Faces Defamation Lawsuit From Ray Epps Over January 6th Allegations

Apr 24, 2025