Stock Market Valuations: BofA Explains Why Investors Shouldn't Be Concerned

Table of Contents

The Role of Interest Rates in Stock Market Valuations

A fundamental relationship exists between interest rates and stock market valuations: they generally move inversely. Lower interest rates tend to support higher stock valuations, while rising rates often put downward pressure on prices. This is because lower rates make borrowing cheaper for companies, fueling investment and growth. It also reduces the opportunity cost of investing in stocks; when bonds offer lower returns, stocks become comparatively more attractive.

The current interest rate environment, while experiencing some upward pressure, remains relatively low in historical context. This supportive environment continues to underpin stock market valuations.

- Lower interest rates make borrowing cheaper for companies: This allows them to expand operations, invest in research and development, and ultimately drive higher earnings, justifying higher valuations.

- Lower rates reduce the opportunity cost of investing in stocks: Investors are less inclined to seek safer, lower-yielding alternatives like bonds when interest rates are low.

- While predictions are inherently uncertain, many economists forecast interest rate increases to remain gradual, limiting their negative impact on market valuations.

Strong Corporate Earnings and Profitability

Despite economic headwinds, many companies have demonstrated impressive earnings and profitability. This robust performance, in many sectors, provides a strong justification for current market valuations. Healthy corporate profits indicate a resilient economy and underpin investor confidence.

- Numerous publicly traded companies have consistently exceeded earnings expectations, demonstrating underlying strength in the market. (Specific examples could be cited here, depending on the current market conditions).

- Several factors contribute to this strength, including technological innovation leading to increased efficiency and productivity, strong consumer spending in key markets, and strategic corporate decisions driving growth.

- Key financial indicators such as revenue growth, profit margins, and return on equity (ROE) remain positive for many major companies, further supporting higher stock market valuations.

Long-Term Growth Potential and Innovation

Looking beyond short-term fluctuations, the long-term growth potential fueled by technological advancements and emerging industries offers another compelling reason for current valuations. Innovation acts as a powerful engine for economic expansion and increased productivity.

- High-growth sectors like renewable energy, artificial intelligence, biotechnology, and cloud computing offer significant potential for future returns, justifying higher valuations in related companies.

- Continuous innovation leads to increased productivity, creating a virtuous cycle of economic growth that supports higher stock prices over the long term.

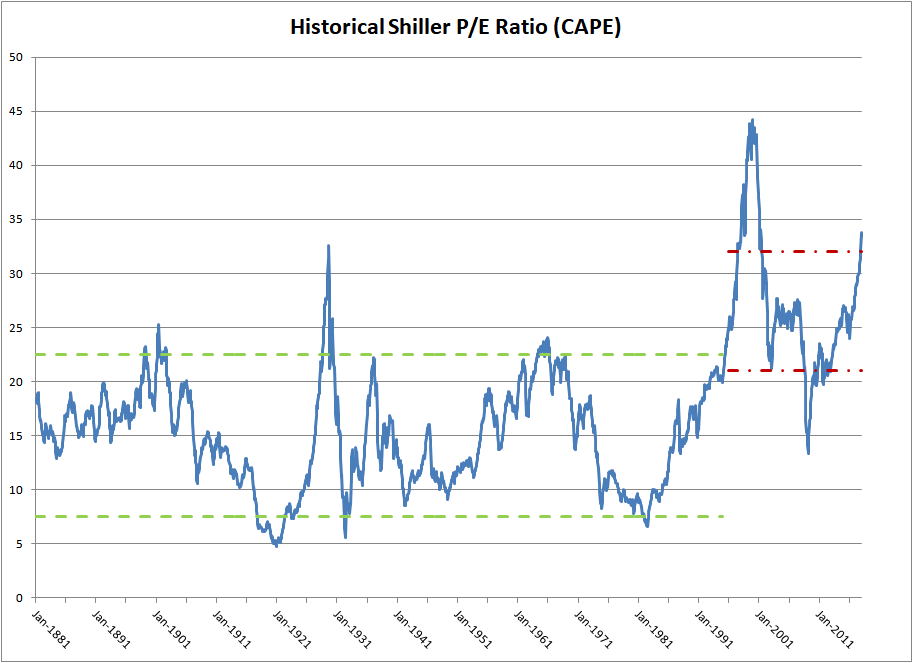

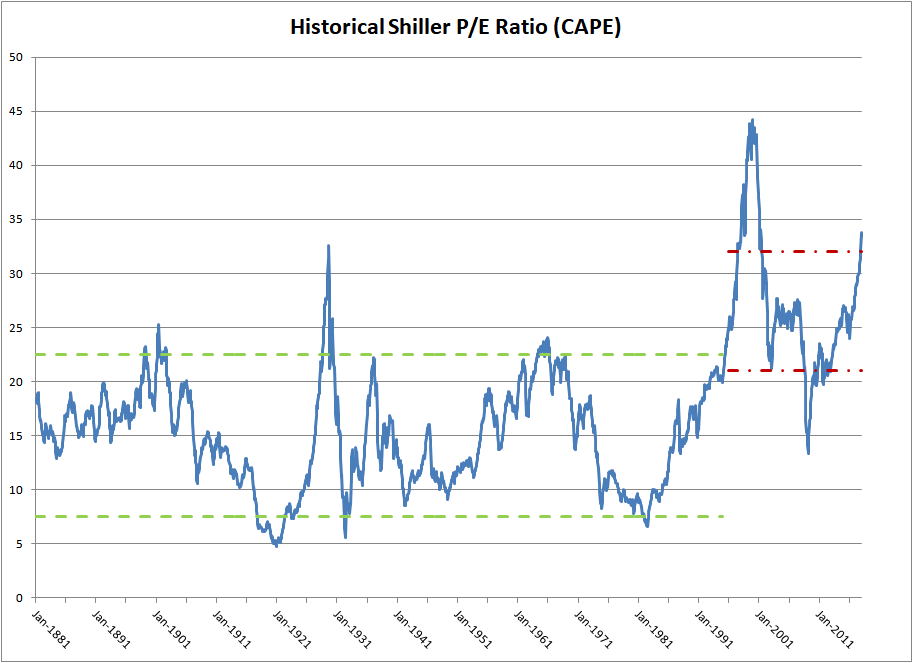

Comparing Current Valuations to Historical Context

Assessing current stock market valuations requires considering historical context. While current P/E ratios might seem high compared to long-term averages, they are not unprecedented. History reveals periods of even higher valuations, followed by periods of healthy market growth.

- Charts illustrating historical trends in valuation multiples (P/E ratios, price-to-sales ratios, etc.) can help contextualize current levels, showing that high valuations have occurred previously without necessarily leading to immediate market crashes.

- By studying past periods of high valuations, investors can gain perspective and recognize that market corrections are a normal part of the cycle, rather than an automatic signal for panic selling.

- It is important to acknowledge potential biases and limitations in historical comparisons. Past performance is not necessarily indicative of future results, and comparing across different economic eras requires careful consideration of various influencing factors.

Addressing Specific Valuation Concerns

High stock market valuations inevitably raise concerns, particularly about the potential for a market bubble or significant correction. While a market correction is always a possibility, it's crucial to approach it with perspective.

- A moderate correction can be a healthy market adjustment, allowing for a more sustainable long-term growth trajectory.

- Long-term investment strategies, focusing on fundamental analysis and diversification, are designed to mitigate risks associated with market fluctuations.

- Diversification across different asset classes and sectors is crucial for managing risk, preventing overexposure to any single market segment.

Conclusion

In summary, while high stock market valuations warrant attention, they don't necessarily signal impending doom. Factors such as low interest rates, strong corporate earnings, significant long-term growth potential, and historical context all contribute to a more nuanced understanding of the current market. Don't let temporary fluctuations in stock market valuations deter you from your long-term investment goals. Understand the factors influencing current market valuations and make informed investment decisions based on a long-term perspective. Continue to monitor these key indicators to make well-informed decisions regarding your investment portfolio. A well-diversified strategy, grounded in sound fundamental analysis, can help you navigate the complexities of stock market valuations and achieve your financial goals.

Featured Posts

-

Betting On Natural Disasters The Los Angeles Wildfires And The Changing Landscape Of Gambling

Apr 24, 2025

Betting On Natural Disasters The Los Angeles Wildfires And The Changing Landscape Of Gambling

Apr 24, 2025 -

Liams Unstable Behavior And Bridgets Shocking Find The Bold And The Beautiful April 16 Recap

Apr 24, 2025

Liams Unstable Behavior And Bridgets Shocking Find The Bold And The Beautiful April 16 Recap

Apr 24, 2025 -

Life As A Chalet Girl Honest Accounts From Europes Exclusive Ski Destinations

Apr 24, 2025

Life As A Chalet Girl Honest Accounts From Europes Exclusive Ski Destinations

Apr 24, 2025 -

Fiscal Responsibility A Missing Element In Canadas Liberal Vision

Apr 24, 2025

Fiscal Responsibility A Missing Element In Canadas Liberal Vision

Apr 24, 2025 -

Chinas Automotive Market Obstacles And Opportunities For Premium Brands Bmw Porsche

Apr 24, 2025

Chinas Automotive Market Obstacles And Opportunities For Premium Brands Bmw Porsche

Apr 24, 2025