Canadian Dollar Performance: A Mixed Bag

Table of Contents

Factors Affecting Canadian Dollar Strength

Several key factors significantly influence the strength of the Canadian dollar. Let's delve into the most impactful ones.

Commodity Prices and the CAD

Canada's economy is heavily reliant on commodity exports, creating a strong correlation between commodity prices and the Canadian dollar. Canadian dollar commodity prices are a major driver of CAD strength.

- Rising commodity prices: Generally lead to increased demand for the CAD, as foreign buyers need to purchase the currency to acquire Canadian resources. For example, a surge in oil prices typically strengthens the CAD.

- Falling commodity prices: Conversely, weakening commodity prices tend to depress the Canadian dollar's value. The recent dip in lumber prices, for instance, put downward pressure on the CAD.

- Specific Examples: In Q3 2023, oil prices experienced a 15% increase, leading to a corresponding rise in the CAD against the USD. Conversely, a 10% drop in natural gas prices in early 2024 resulted in a slight weakening of the Canadian dollar. Analyzing oil prices CAD, natural gas CAD, and lumber prices CAD is crucial for understanding CAD movement.

Interest Rate Differentials

The Bank of Canada's interest rate decisions play a crucial role in determining the CAD's attractiveness to foreign investors. Canadian dollar interest rate policy directly impacts its value.

- Higher Canadian interest rates: Compared to major trading partners like the US and the Eurozone, higher interest rates in Canada attract foreign investment, boosting demand for the CAD.

- Lower Canadian interest rates: Conversely, lower rates relative to other countries can lead to capital outflow, weakening the CAD.

- Rate Expectations: Market anticipation of future interest rate hikes or cuts also significantly influences the Canadian dollar. For example, expectations of aggressive rate hikes can strengthen the CAD before the actual decision is implemented. Keeping an eye on Bank of Canada interest rates is vital for predicting CAD movements.

Geopolitical Events and the CAD

Global political instability and economic shocks create uncertainty and impact the Canadian dollar. Geopolitical risk Canadian dollar is a major influence.

- Global Uncertainty: Events like the war in Ukraine or heightened US-China trade tensions introduce uncertainty into the global markets, often leading investors to seek refuge in "safe-haven" currencies like the US dollar. This usually weakens the CAD.

- Risk Aversion: During periods of heightened global risk aversion, capital often flows out of riskier assets and currencies, including the Canadian dollar, resulting in CAD volatility.

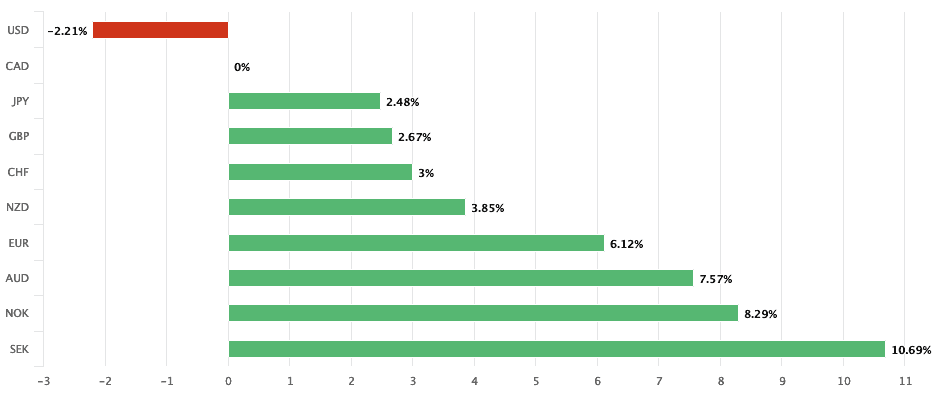

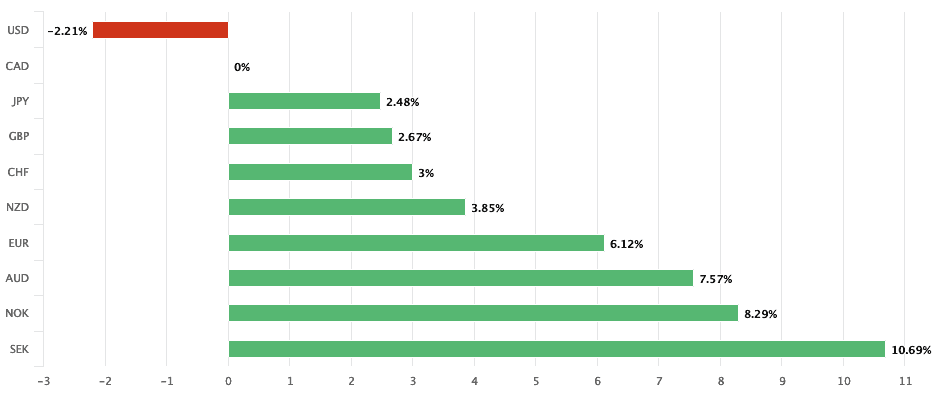

Recent Canadian Dollar Performance Analysis

Let's analyze the Canadian dollar's recent performance against major currencies.

Short-Term Fluctuations

The CAD has experienced considerable short-term volatility.

- USD/CAD: Fluctuated between 1.33 and 1.38 over the past three months, driven by fluctuating oil prices and Bank of Canada interest rate pronouncements.

- EUR/CAD: Showed a range of 1.45 to 1.50 due to Eurozone economic concerns and general market sentiment.

- GBP/CAD: Traded within a band of 1.65 to 1.70, mirroring global economic uncertainty and Brexit-related impacts.

Long-Term Trends

Over the past five years, the Canadian dollar has shown a relatively stable, yet cyclical, trend.

- Long-term outlook: While significant fluctuations have occurred, the overall long-term trend reveals a relatively stable CAD, reflecting the resilience of the Canadian economy.

Predicting Future Canadian Dollar Performance

Predicting the future trajectory of the Canadian dollar requires careful consideration of multiple factors.

Economic Forecasts

Major financial institutions offer varying predictions for the CAD's future.

- Forecasts: While predictions vary, many forecast a moderately stable CAD in 2024 and 2025, contingent upon global economic conditions and commodity prices. Consult reports from reputable sources for the most current CAD forecast 2024 and Canadian dollar outlook 2025.

Investment Strategies

Based on the current outlook, various investment strategies may be considered. (Disclaimer: This is not financial advice.)

- Hedging: Businesses involved in international trade can utilize hedging strategies to mitigate risks associated with CAD fluctuations.

- Diversification: Diversifying investment portfolios across different currencies can help reduce risk.

- Currency Trading: Currency trading, though potentially risky, allows investors to profit from predicted CAD movements. However, it's crucial to remember that CAD trading strategies require expertise and risk management.

Conclusion: Understanding Canadian Dollar Performance

The Canadian dollar's performance is a complex interplay of commodity prices, interest rate differentials, and geopolitical events. Understanding these factors is crucial for navigating the complexities of the Canadian economy. Analyzing short-term fluctuations and long-term trends provides valuable insights into the Canadian dollar's behavior. By closely monitoring these influences, you can gain a better understanding and potentially anticipate future Canadian Dollar Performance. To stay informed about the latest developments in Canadian Dollar Performance and make well-informed decisions, subscribe to our newsletter, follow us on social media, and check back for regular updates. Keeping abreast of the CAD's value is vital for both investment strategies and international business operations.

Featured Posts

-

Eus Plan To Eliminate Russian Gas Focusing On The Spot Market

Apr 24, 2025

Eus Plan To Eliminate Russian Gas Focusing On The Spot Market

Apr 24, 2025 -

A Fiscally Responsible Vision For Canadas Future

Apr 24, 2025

A Fiscally Responsible Vision For Canadas Future

Apr 24, 2025 -

Future Of Utac Chinese Buyout Firms Sale Consideration

Apr 24, 2025

Future Of Utac Chinese Buyout Firms Sale Consideration

Apr 24, 2025 -

Positive Market Sentiment Indias Nifty Index On An Upward Trajectory

Apr 24, 2025

Positive Market Sentiment Indias Nifty Index On An Upward Trajectory

Apr 24, 2025 -

T Mobile To Pay 16 Million For Data Security Violations

Apr 24, 2025

T Mobile To Pay 16 Million For Data Security Violations

Apr 24, 2025