BofA On Stock Market Valuations: Addressing Investor Concerns

Table of Contents

BofA's Current Assessment of Stock Market Valuations

Are Stocks Overvalued, Undervalued, or Fairly Valued?

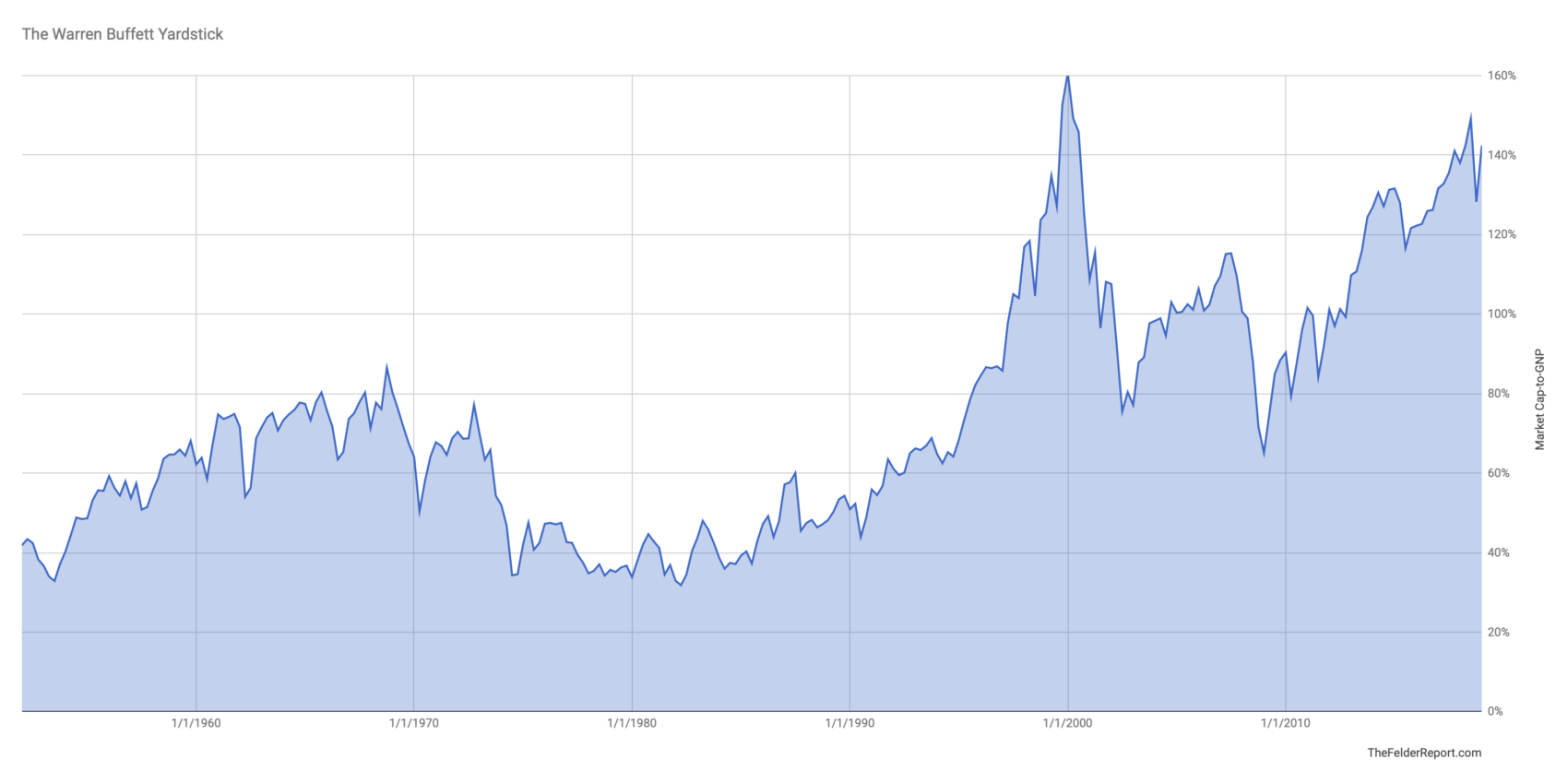

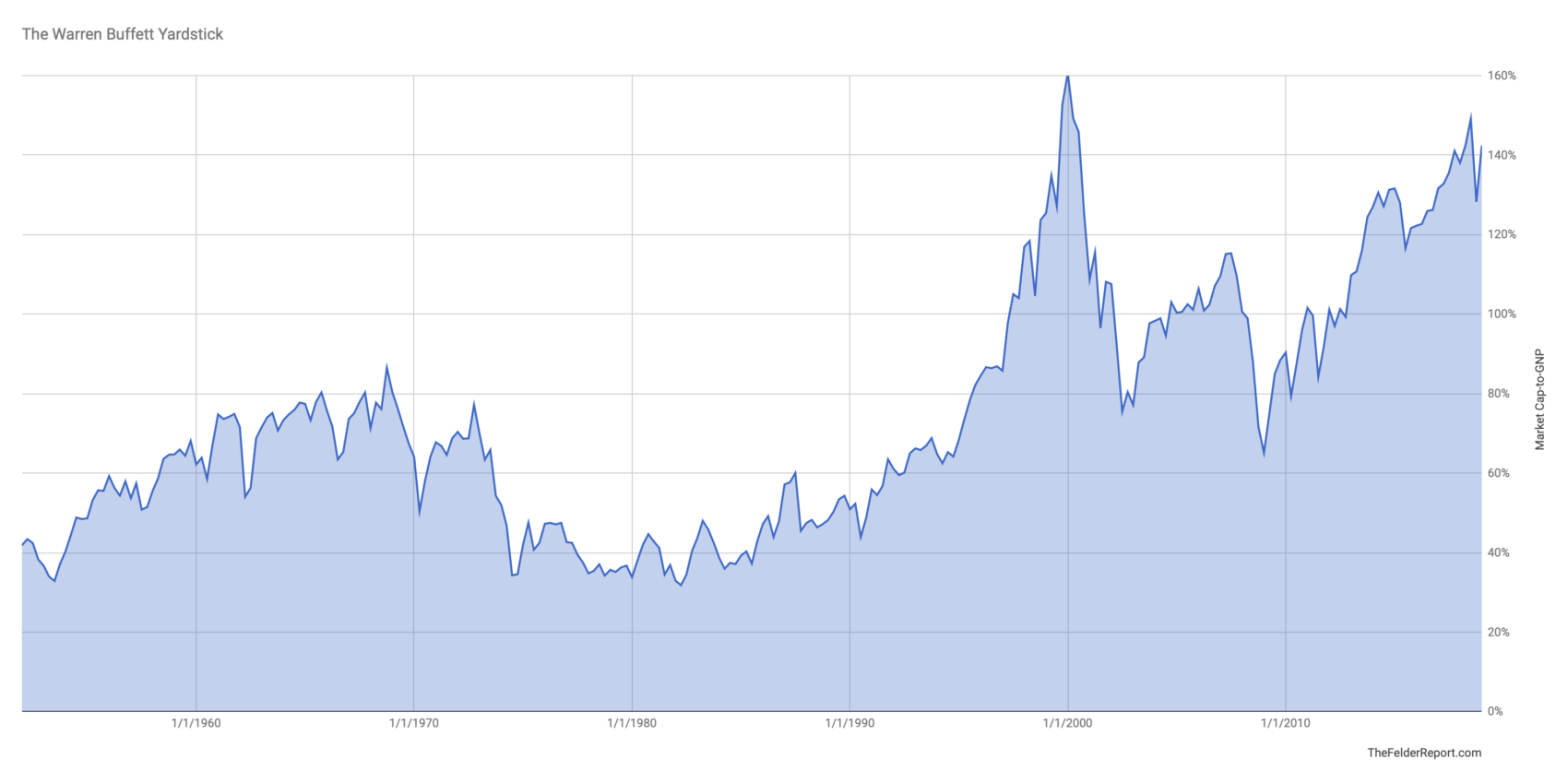

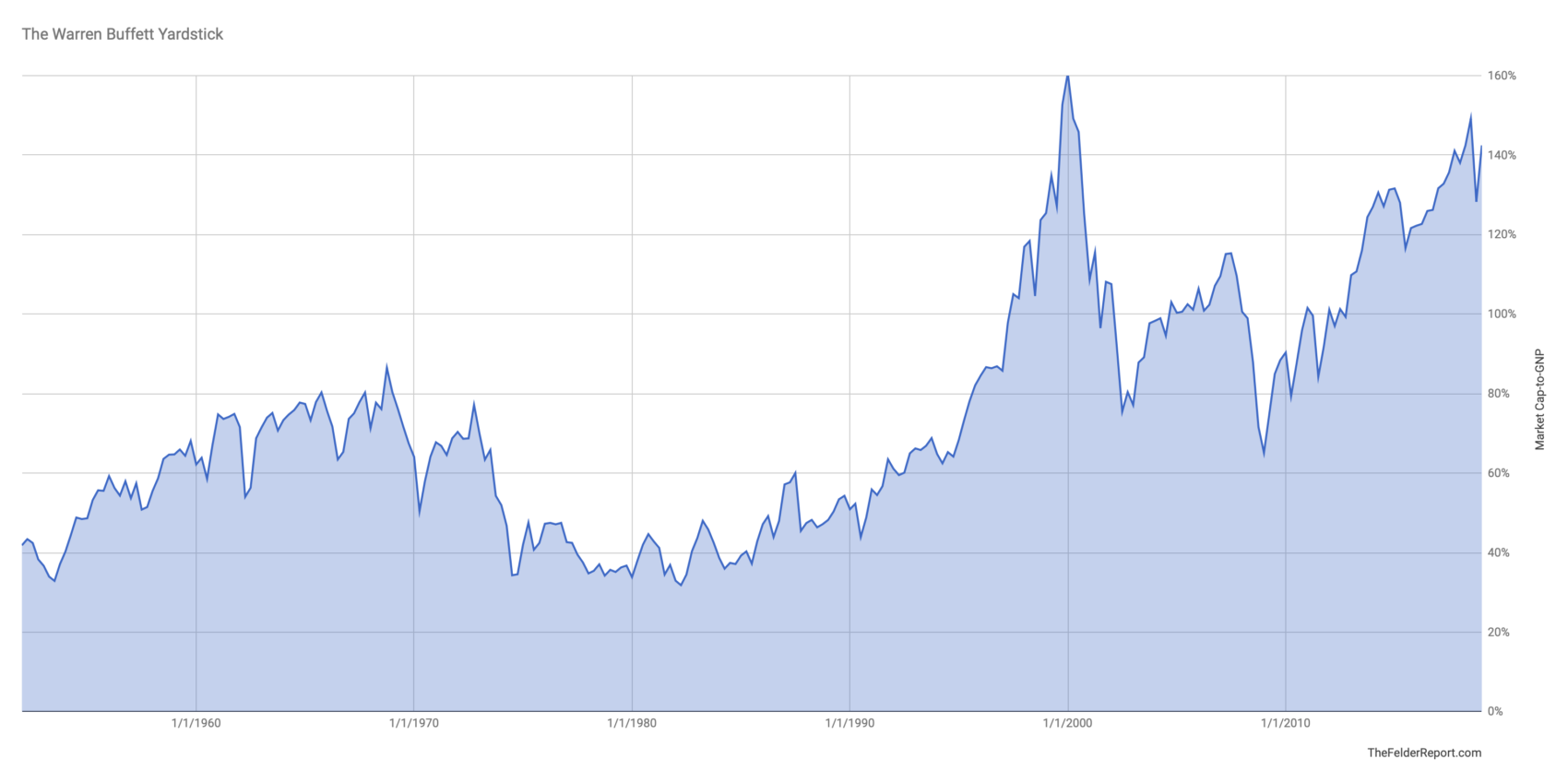

BofA's assessment of stock market valuations often employs various metrics, including the Price-to-Earnings ratio (P/E) and the Shiller PE ratio (CAPE), to gauge market health. While specific numbers fluctuate based on the release of BofA's reports, their analysis generally provides a nuanced perspective rather than a simple "overvalued" or "undervalued" label. They consider a multitude of factors before forming their conclusions.

- Key Findings (based on hypothetical BofA reports): BofA might suggest that, while some sectors appear richly valued based on traditional P/E ratios, considering long-term growth prospects and interest rate environments presents a more complex picture. Specific sectors might be highlighted as potentially overvalued in the short-term, but possessing long-term growth potential.

- Sector-Specific Assessments (hypothetical): For example, BofA might suggest that technology stocks, while currently showing elevated P/E ratios, could still offer growth potential, whereas certain cyclical sectors might be seen as comparatively undervalued due to near-term economic headwinds. This requires careful analysis of each sector's individual prospects.

Key Factors Influencing BofA's Valuation Analysis

BofA's valuation analysis incorporates numerous macroeconomic factors. Their insights are not based solely on market mechanics but also on a comprehensive understanding of the global economic climate.

- Interest Rates: Rising interest rates typically impact stock valuations negatively as they increase the cost of borrowing for businesses and make bonds a more attractive investment. BofA's analysis considers the rate of increase, the terminal rate, and its impact on corporate earnings. (Example data: "BofA projects a terminal rate of X%, impacting corporate earnings by Y%").

- Inflation: Persistent inflation erodes purchasing power and influences corporate profitability. BofA's analysis likely considers inflation's impact on consumer spending and its effect on company margins. (Example data: "BofA forecasts inflation to average Z% this year, impacting corporate profit margins by A%").

- Economic Growth Projections: BofA incorporates GDP growth projections into its analysis, assessing the impact of economic expansion or contraction on corporate earnings and overall market performance. (Example data: "BofA anticipates GDP growth of B% next year, significantly influencing stock valuations.")

- Geopolitical Risks: Geopolitical events and uncertainties, such as conflicts or trade wars, can significantly influence investor sentiment and market volatility. BofA factors these risks into its valuation models, projecting potential impacts on various sectors and the overall market.

Addressing Investor Concerns Regarding Stock Market Volatility

BofA's Perspective on Market Risks

BofA likely identifies several key risks that could impact stock market valuations and investor portfolios. Understanding these risks is crucial for informed decision-making.

- Recession Risk: BofA's economic forecasts play a key role here. Their analysis likely includes probabilities of a recession and its potential severity, factoring in leading economic indicators and their past predictive power.

- Inflation Persistence: The longer inflation remains elevated, the greater the risk to corporate profits and stock valuations. BofA's analysis might emphasize the potential for unexpected inflationary pressures.

- Geopolitical Instability: Unforeseen geopolitical events can trigger market corrections. BofA's assessments incorporate a wide range of potential geopolitical risks and their potential impact on global markets.

BofA's Suggested Risk Mitigation Strategies: Diversification across asset classes, including bonds and alternative investments, is likely a key recommendation, alongside maintaining a suitable risk tolerance level aligned with individual investment goals and time horizons.

BofA's Recommendations for Investors

BofA's recommendations are tailored to the specific market conditions they assess. They usually suggest actionable steps for investors of different risk profiles.

- Sector Allocation: BofA might suggest overweighting certain sectors they deem undervalued or possessing strong growth potential, while reducing exposure to sectors perceived as overvalued.

- Diversification Strategies: Maintaining a diversified portfolio is crucial to mitigate risk. BofA likely emphasizes diversification not only across sectors but also across asset classes.

- Risk Tolerance: Investors should assess their risk tolerance and adjust their portfolio accordingly. BofA's advice usually reflects this crucial element of investment strategy.

Long-Term Outlook on Stock Market Valuations According to BofA

BofA's Projections for Future Market Performance

BofA's long-term outlook typically incorporates both positive and negative scenarios, acknowledging the inherent uncertainties in market forecasting.

- Growth Projections: BofA projects long-term market growth rates based on a variety of factors, such as long-term economic growth prospects, technological advancements, and demographic trends.

- Volatility Predictions: BofA's analysis includes estimates of future market volatility, considering various factors, including interest rate changes and geopolitical risks.

- Return Expectations: BofA provides an outlook for potential returns on investments over the long term, acknowledging that past performance is not necessarily indicative of future results.

Opportunities and Challenges for Investors

BofA's analysis likely highlights both opportunities and challenges for investors in the long term.

- Potential Investment Opportunities: These might include specific sectors predicted for significant growth, or specific investment strategies tailored to the long-term outlook.

- Challenges for Investors: These challenges could include managing increased volatility, navigating interest rate changes, and adapting to unforeseen geopolitical events.

Conclusion

BofA's analysis on stock market valuations provides a crucial perspective for investors navigating current market uncertainties. Their assessment considers various macroeconomic factors and identifies potential risks and opportunities. By understanding BofA's insights on current valuation levels, potential market risks, and future projections, investors can make more informed decisions. Remember to conduct your own thorough research, stay informed about market trends, and consider consulting with a financial advisor for personalized guidance on understanding stock market valuations and managing stock market valuation risks effectively.

Featured Posts

-

Bof A On Stock Market Valuations Addressing Investor Concerns

Apr 22, 2025

Bof A On Stock Market Valuations Addressing Investor Concerns

Apr 22, 2025 -

China And Indonesia Deepen Security Cooperation

Apr 22, 2025

China And Indonesia Deepen Security Cooperation

Apr 22, 2025 -

Closer Security Collaboration Between China And Indonesia

Apr 22, 2025

Closer Security Collaboration Between China And Indonesia

Apr 22, 2025 -

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Issue Delays Mission

Apr 22, 2025

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Issue Delays Mission

Apr 22, 2025 -

Exec Office365 Breach Nets Millions For Hacker Fbi Alleges

Apr 22, 2025

Exec Office365 Breach Nets Millions For Hacker Fbi Alleges

Apr 22, 2025