Auto Carrier's Financial Projections Show $70 Million Hit From US Port Fees

Table of Contents

The $70 Million Impact: A Detailed Breakdown

The $70 million figure represents a projected loss, encompassing both direct cost increases and a predicted decrease in revenue due to significant delays in shipping caused by the increased US port fees. This isn't simply a matter of increased operational costs; it's a cascading effect impacting the entire supply chain.

- Specific port(s) affected: While the specific ports haven't been publicly named by the carrier to protect commercial interests, sources suggest major ports on the West Coast, including Los Angeles and Long Beach, are primarily affected due to their high volume of auto imports.

- Types of fees that have increased: The increase stems from a combination of factors, including higher container handling fees, increased storage charges for delayed shipments, and additional administrative fees. These costs have significantly escalated, creating a substantial burden on the auto carrier's bottom line.

- Percentage increase in fees compared to previous years: Reports indicate a 20-30% increase in certain fees compared to the previous year, depending on the specific port and type of service. This substantial jump represents a considerable challenge for the automotive industry's logistics.

- Timeline of fee increases and their impact on the carrier's projections: The fee increases began gradually in the first half of the year but intensified in the latter half, leading to the significant $70 million projection in the carrier's financial model for the year. These increases directly correlate with the observed delays and increased costs.

Impact on the Auto Industry Supply Chain

The impact of these increased US port fees extends far beyond the single auto carrier. The entire automotive supply chain is feeling the pressure.

- Potential for increased car prices for consumers: The added costs are likely to be passed on to consumers in the form of higher vehicle prices. This could dampen consumer demand, especially in an already volatile market.

- Delays in vehicle deliveries: Increased port congestion and processing times due to the fee increases are leading to significant delays in vehicle deliveries, frustrating buyers and disrupting dealership inventories.

- Impact on manufacturing schedules and production targets: Manufacturing schedules are being impacted by these delays, causing potential production shortfalls and putting pressure on manufacturers to meet targets.

- Potential for shifts in import/export strategies: The industry is exploring alternative strategies, including exploring ports in other countries or prioritizing rail transportation, in response to the substantial increases in US port fees.

The Carrier's Response and Mitigation Strategies

The auto carrier is actively seeking ways to mitigate the financial blow from increased US port fees.

- Cost-cutting measures implemented: The carrier has initiated various cost-cutting measures across its operations, focusing on optimizing routes and streamlining processes to absorb some of the increased costs.

- Negotiations with port authorities: The company is actively negotiating with port authorities to seek relief or adjustments to the new fee structures, advocating for more transparent and predictable pricing models.

- Changes in logistics and transportation strategies: The carrier is reviewing its logistics and transportation strategies, exploring options such as improved scheduling, utilizing different routes, and exploring alternative modes of transport.

- Potential lobbying efforts to influence port fee policies: The carrier, along with industry associations, may consider lobbying efforts to advocate for policy changes that would address the concerns around the increases in US port fees.

Looking for Alternative Solutions

The auto carrier, and the broader automotive industry, are actively seeking alternative solutions to navigate the challenges posed by increased US port fees.

- Rail transportation as an alternative: Increased use of rail transportation to move vehicles inland from ports is being explored as a way to reduce reliance on potentially expensive port-related fees.

- Utilizing ports in neighboring countries: The possibility of shifting some import operations to neighboring countries with more favorable port fee structures is under evaluation.

- Exploring partnerships with other logistics companies: Collaborating with other logistics companies may provide opportunities for economies of scale and potentially more competitive pricing options.

Regulatory Scrutiny and Future Outlook for US Port Fees

The substantial increases in US port fees have attracted regulatory scrutiny.

- Potential for investigations into pricing practices: Regulatory bodies may investigate the justification for the steep fee increases to ensure they are fair and reasonable.

- Discussion on the long-term sustainability of current US port fee structures: The current fee structure's long-term sustainability is being debated, given its impact on various industries and the potential for further disruptions to supply chains.

- Prediction for future increases in US port fees: Concerns remain about the potential for further increases in US port fees in the future, prompting the industry to proactively develop strategies for navigating this uncertainty.

Conclusion

This article highlighted the substantial $70 million financial blow faced by a major auto carrier due to increased US port fees. The impact extends beyond this single company, threatening the entire automotive supply chain through potential price hikes, delivery delays, and logistical challenges. The carrier's response and the broader industry's adaptation strategies will be crucial in navigating this turbulent period. The future outlook remains uncertain, pending investigations into current pricing practices and potential adjustments to US port fee policies.

Call to Action: Stay informed about the evolving situation regarding US port fees and their effects on the auto industry. Continue to follow our updates for the latest insights into the impact of rising US port fees on the automotive sector and beyond.

Featured Posts

-

My Favorite Florida Escape A Cnn Anchors Perspective

Apr 26, 2025

My Favorite Florida Escape A Cnn Anchors Perspective

Apr 26, 2025 -

Exclusive Access A Business Model For Investing In Elon Musks Private Companies

Apr 26, 2025

Exclusive Access A Business Model For Investing In Elon Musks Private Companies

Apr 26, 2025 -

Ftc Launches Probe Into Open Ai And Chat Gpt Key Questions Answered

Apr 26, 2025

Ftc Launches Probe Into Open Ai And Chat Gpt Key Questions Answered

Apr 26, 2025 -

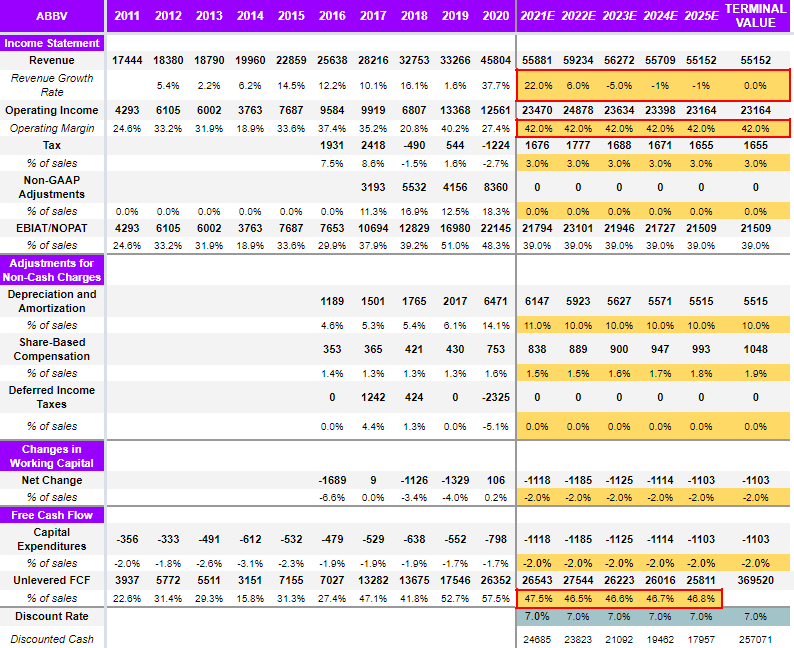

Stronger Than Expected Abb Vie Abbv Sales Fuel Profit Guidance Increase

Apr 26, 2025

Stronger Than Expected Abb Vie Abbv Sales Fuel Profit Guidance Increase

Apr 26, 2025 -

Green Bay Hosts Nfl Draft 2024 First Round Preview And Predictions

Apr 26, 2025

Green Bay Hosts Nfl Draft 2024 First Round Preview And Predictions

Apr 26, 2025