A Side Hustle For Elon Musk's Friends: Access To Private Company Stakes

Table of Contents

The Allure of Private Company Investments

Private company investments offer a compelling alternative to traditional public market investing. The potential for significantly higher returns compared to publicly traded stocks is a major draw. This higher growth potential stems from investing in companies during their early stages of development, before their valuation is fully reflected in the public markets. The exclusivity surrounding these investments further enhances their desirability. Access is often limited to a select group of high-net-worth individuals and sophisticated investors.

- Higher potential ROI: Private companies can experience exponential growth, leading to substantially higher returns on investment than publicly traded stocks.

- Early access to innovation: Gain exposure to cutting-edge technologies and disruptive business models before they become mainstream.

- Diversified portfolio: Private investments offer a valuable diversification tool, reducing reliance on the volatility of public markets.

- Significant capital appreciation: Successful private investments can lead to substantial capital appreciation, significantly boosting your overall wealth.

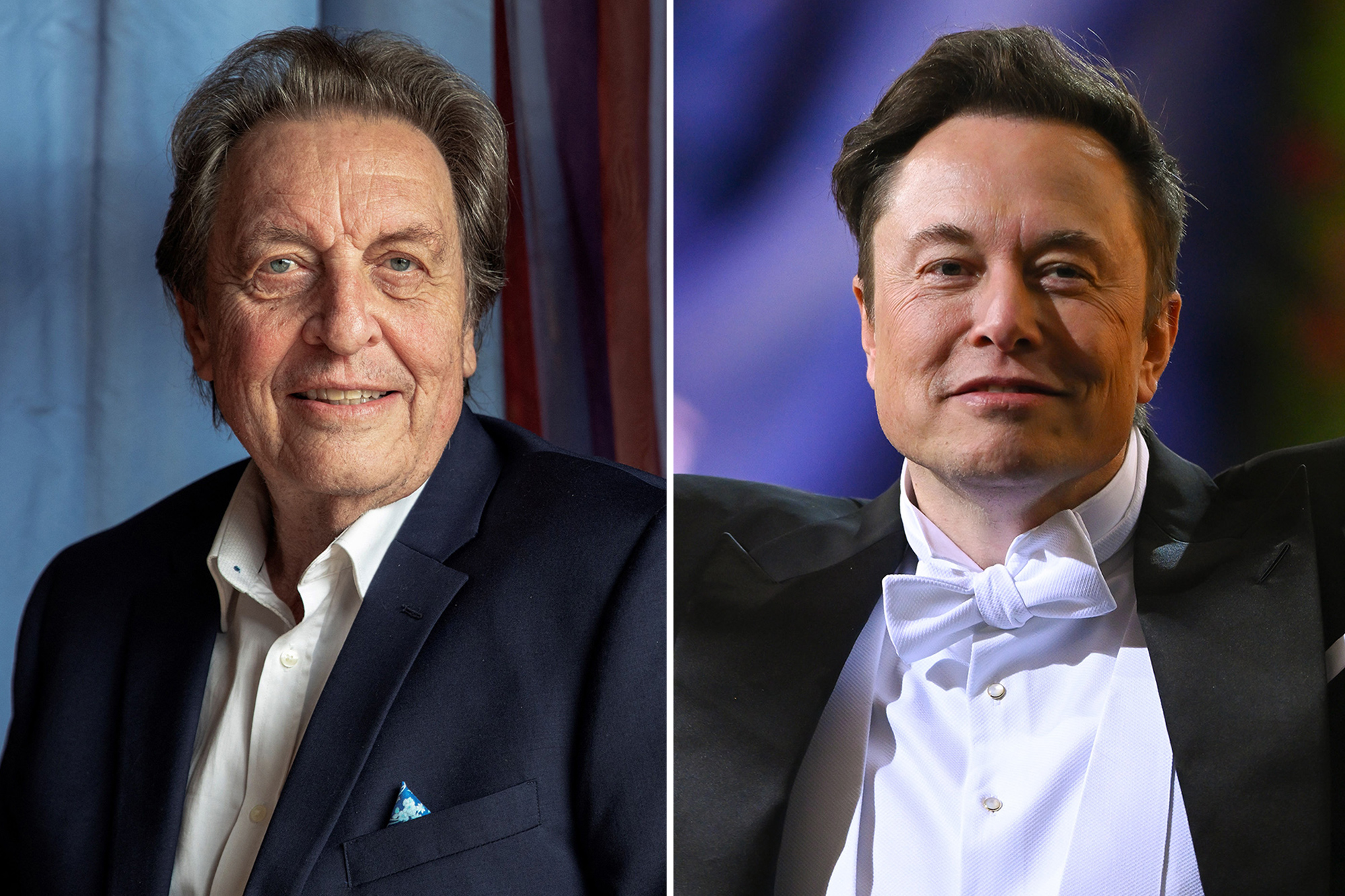

Networking and Access: The Elon Musk Factor

Gaining access to private company stakes is heavily reliant on networking. Strong connections within the investment community are essential to uncovering these exclusive opportunities. The "Elon Musk effect" highlights this; his reputation and extensive network grant him and his close associates access to a unique pipeline of promising investments.

- The power of networks: Building and nurturing relationships with venture capitalists, angel investors, and other high-net-worth individuals is crucial.

- The Elon Musk effect: Association with influential figures like Elon Musk can unlock doors to previously inaccessible investment opportunities.

- Exclusive deal flow: Networking within elite circles provides access to a constant stream of promising private investment opportunities.

- Mentorship and guidance: Connections with successful entrepreneurs can provide invaluable mentorship and insights into the private investment landscape.

Navigating the Complexities of Private Equity

While the potential rewards are significant, investing in private companies presents unique challenges. Illiquidity is a key concern; these investments are not easily converted to cash. Accurately valuing private companies also poses significant difficulties, as there's no readily available market price.

- Illiquidity: Private company stakes are typically illiquid, meaning it can be difficult and time-consuming to sell your shares when desired.

- Valuation challenges: Determining the fair market value of a private company requires significant due diligence and expertise.

- Due diligence is paramount: Thorough research and due diligence are critical to mitigate investment risks.

- Professional advice is essential: Seek guidance from financial advisors, legal professionals, and tax specialists experienced in private equity.

- Understanding investment structures: Familiarize yourself with various investment structures, such as equity and debt financing, to make informed decisions.

Alternative Avenues to Access Private Company Stakes

While direct connections are highly advantageous, alternative routes exist for accessing private company stakes. These options provide broader access for those without extensive networks.

- Venture capital and private equity funds: Investing through established funds diversifies risk and leverages professional expertise.

- Crowdfunding platforms: Platforms like SeedInvest and Republic offer opportunities to invest in private companies with smaller capital commitments.

- Angel investor networks: Joining angel investor networks provides access to deal flow and mentorship opportunities.

- Secondary market transactions: The secondary market allows investors to purchase shares of private companies from existing shareholders.

Conclusion: Unlocking the Potential of Private Company Stakes

Accessing private company stakes offers the potential for substantial financial returns but necessitates careful consideration of the inherent risks and complexities. Building a strong network, conducting thorough due diligence, and seeking professional advice are crucial for success in this arena. A side hustle like Elon Musk's friends might seem exclusive, but through diligent effort and informed strategies, individuals can explore and leverage the lucrative potential of private company stakes. Ready to explore the world of private company investments and potentially build a side hustle like Elon Musk's friends? Begin your research today and leverage your network to unlock the lucrative potential of private company stakes!

Featured Posts

-

Cassidy Hutchinson Key Witness To January 6th Announces Memoir

Apr 26, 2025

Cassidy Hutchinson Key Witness To January 6th Announces Memoir

Apr 26, 2025 -

Blockchain Analytics Leader Chainalysis Integrates Ai With Alterya Purchase

Apr 26, 2025

Blockchain Analytics Leader Chainalysis Integrates Ai With Alterya Purchase

Apr 26, 2025 -

The Growing Trend Of Betting On California Wildfires La And Beyond

Apr 26, 2025

The Growing Trend Of Betting On California Wildfires La And Beyond

Apr 26, 2025 -

Unlocking Potential The Value Of Middle Management In Modern Organizations

Apr 26, 2025

Unlocking Potential The Value Of Middle Management In Modern Organizations

Apr 26, 2025 -

Elon Musks Network Monetizing Access To Private Company Investments

Apr 26, 2025

Elon Musks Network Monetizing Access To Private Company Investments

Apr 26, 2025