Blockchain Analytics Leader Chainalysis Integrates AI With Alterya Purchase

Table of Contents

Enhanced Blockchain Investigation Capabilities through AI Integration

The integration of AI into Chainalysis's blockchain analytics platform marks a significant advancement in investigative capabilities. This powerful combination allows for a more efficient and effective approach to uncovering complex financial crimes involving cryptocurrencies.

Improved Transaction Tracing and Pattern Recognition

AI algorithms can process and analyze vast datasets of blockchain transactions far more efficiently than human analysts. This allows for the rapid identification of suspicious patterns and connections that might otherwise go unnoticed. The increased speed and accuracy provided by Chainalysis AI integration are game-changers in the fight against financial crime.

- Faster identification of money laundering schemes: AI can quickly identify layered transactions and complex money movement patterns indicative of money laundering.

- Improved tracing of cryptocurrency flows across multiple exchanges and wallets: The AI tracks cryptocurrency movements across various platforms and wallets, creating a comprehensive view of the flow of funds.

- Enhanced detection of sophisticated mixing techniques used to obscure illicit transactions: AI can detect even the most sophisticated techniques used to obfuscate the origin and destination of funds, such as mixers and tumblers.

Automated Risk Assessment and Prioritization

AI-powered risk assessment automates the process of identifying potentially risky transactions and addresses. This allows investigators to prioritize their efforts and focus on high-impact cases. This automation is crucial for optimizing resources and maximizing the effectiveness of investigations.

- Reduced workload for analysts, allowing them to focus on high-risk cases: Analysts can spend less time on manual analysis and more time on strategic investigations.

- More efficient allocation of resources for investigations: Resources are directed towards the most critical investigations, improving overall efficiency.

- Proactive identification of potential threats: AI can identify emerging threats and patterns, allowing for proactive intervention.

Strengthened Regulatory Compliance and Due Diligence

The Chainalysis AI integration significantly strengthens regulatory compliance and due diligence processes for businesses operating in the cryptocurrency space. This is particularly critical given the increasingly stringent regulations surrounding cryptocurrencies globally.

Streamlined KYC/AML Processes

The integration of AI streamlines Know Your Customer (KYC) and Anti-Money Laundering (AML) processes by automating risk assessments and flagging potentially suspicious activities. This reduces the burden on compliance teams and improves the overall effectiveness of KYC/AML programs.

- Reduced compliance costs for businesses operating in the crypto space: Automating processes lowers the cost of compliance.

- Improved compliance with evolving regulations across jurisdictions: The AI adapts to changing regulations, ensuring ongoing compliance.

- Enhanced protection against financial crimes: Improved detection of suspicious activity protects businesses from financial crimes.

Improved Data Management and Reporting

AI facilitates better data management and reporting, providing more comprehensive insights into blockchain activity for compliance purposes. This improved data management ensures that businesses have the information they need to meet regulatory requirements.

- Easier generation of compliance reports for regulators: The system generates reports that meet regulatory requirements easily and efficiently.

- Improved audit trails for tracking transactions and investigations: Detailed audit trails provide greater transparency and accountability.

- Enhanced transparency in cryptocurrency operations: Improved data management and reporting increases transparency in cryptocurrency transactions.

The Impact on Combating Illicit Cryptocurrency Activities

The enhanced capabilities of Chainalysis AI integration significantly impact the fight against illicit cryptocurrency activities. This includes improved detection and disruption of darknet market activity and more effective enforcement of sanctions.

Enhanced Detection of Darknet Market Activity

AI-powered analytics enable more effective detection and disruption of illicit activities on darknet markets and other underground networks. This allows law enforcement to identify and target key players involved in illegal activities.

- Identification of key players involved in illegal activities: AI helps identify individuals and groups engaged in illicit activities.

- Tracking the flow of funds related to criminal enterprises: The AI tracks the movement of funds associated with criminal activities.

- Improved asset recovery efforts: Improved tracking of funds facilitates more effective asset recovery efforts.

Combating Sanctions Evasion

Chainalysis's AI integration enhances the ability to identify and track cryptocurrency transactions that violate international sanctions. This is crucial for preventing sanctioned entities from using cryptocurrencies to evade sanctions.

- Improved enforcement of sanctions against targeted individuals and entities: More effective enforcement of international sanctions.

- Strengthened global cooperation in combating financial crimes: Improved data sharing and collaboration between law enforcement agencies.

- Reduced the effectiveness of sanctions evasion techniques: Makes it more difficult for sanctioned entities to evade sanctions using cryptocurrencies.

Conclusion

Chainalysis's acquisition of Alterya and integration of AI represent a significant leap forward in blockchain analytics. This powerful combination offers enhanced investigation capabilities, stronger regulatory compliance tools, and a more robust defense against illicit cryptocurrency activities. The implications are far-reaching, promising to increase transparency and security within the cryptocurrency ecosystem. To stay ahead in the ever-evolving world of cryptocurrency investigations, leveraging cutting-edge tools like Chainalysis’ AI-powered blockchain analytics is essential. Explore the possibilities of Chainalysis AI integration and its impact on your organization’s blockchain security and regulatory compliance strategy today.

Featured Posts

-

End Of An Era Ryujinx Emulator Development Ceases After Nintendo Contact

Apr 26, 2025

End Of An Era Ryujinx Emulator Development Ceases After Nintendo Contact

Apr 26, 2025 -

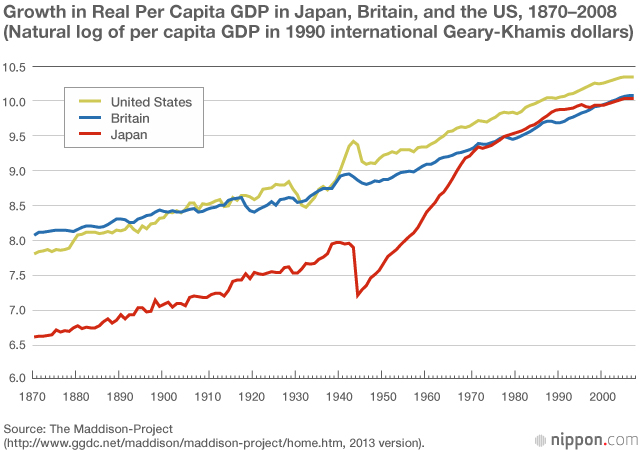

Californias Economic Rise Overtaking Japans Gdp

Apr 26, 2025

Californias Economic Rise Overtaking Japans Gdp

Apr 26, 2025 -

Open Ai Under Ftc Scrutiny Implications Of The Chat Gpt Probe

Apr 26, 2025

Open Ai Under Ftc Scrutiny Implications Of The Chat Gpt Probe

Apr 26, 2025 -

Europe Rejects Ai Rulebook Amidst Trump Administration Pressure

Apr 26, 2025

Europe Rejects Ai Rulebook Amidst Trump Administration Pressure

Apr 26, 2025 -

Nintendos Action Forces Ryujinx Emulator Development To Cease

Apr 26, 2025

Nintendos Action Forces Ryujinx Emulator Development To Cease

Apr 26, 2025