$70 Million Blow: Auto Carrier's Projected Losses From US Port Fee Increases

Table of Contents

The $70 Million Loss: A Detailed Breakdown

The projected $70 million loss for this single auto carrier isn't an isolated incident; it's a stark warning sign of the broader challenges facing the industry. Let's break down the contributing factors.

Increased Port Fees: The Main Culprit

The primary driver of this massive loss is the dramatic increase in US port fees. These increases affect various aspects of shipping, including:

- Container Handling Fees: A significant jump in these fees, averaging a 25% increase across major ports like Los Angeles, Long Beach, and Savannah, directly impacts the cost of moving vehicles.

- Terminal Fees: These fees, which cover the use of port facilities, have also experienced substantial increases, adding further pressure to already strained budgets.

- Drayage Fees: The cost of transporting containers between the port and inland distribution centers has risen sharply, adding to the overall shipping expense.

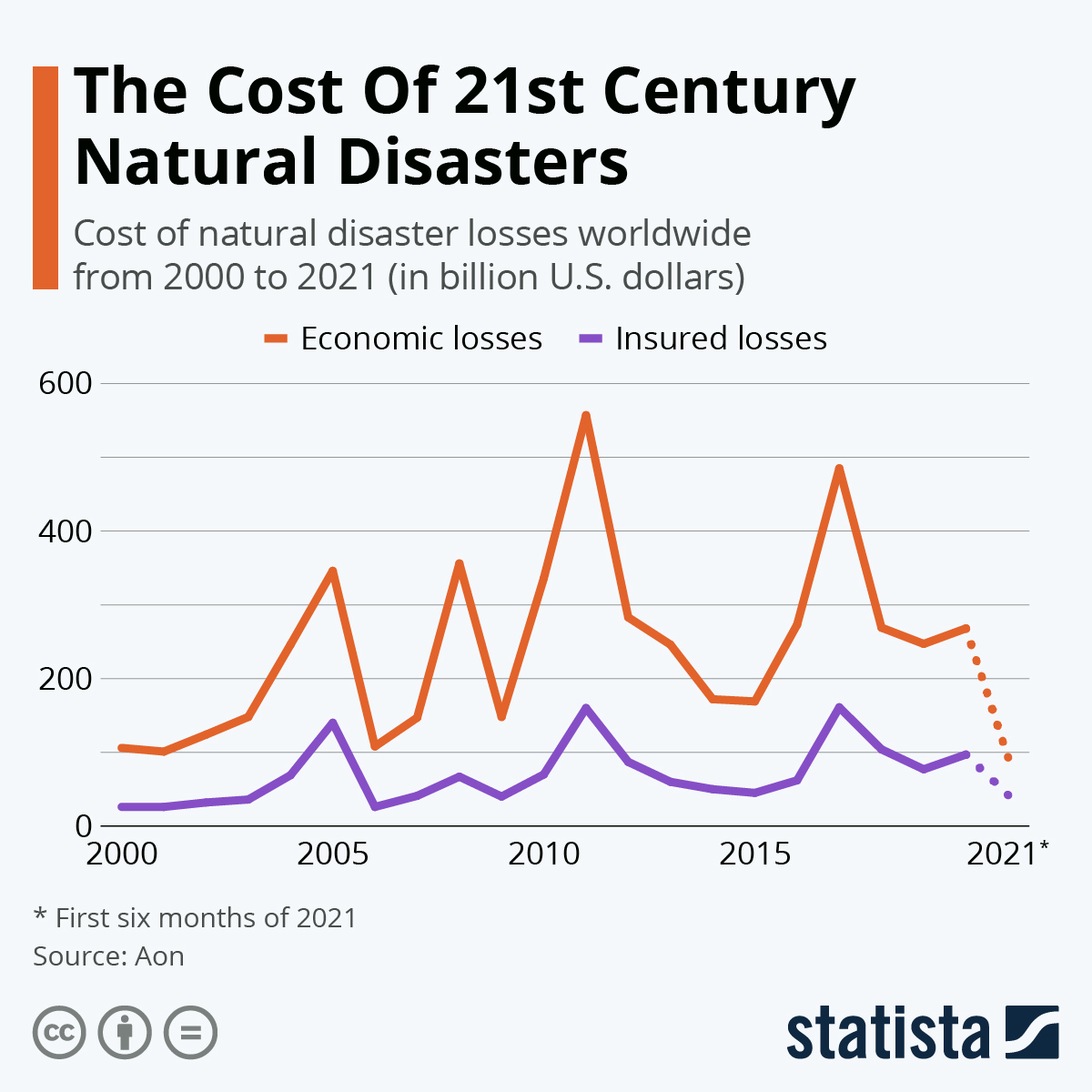

Data Visualization: [Insert chart/graph here showing a comparison of projected losses in 2023 vs. previous years, clearly illustrating the impact of fee increases.] The chart clearly shows a dramatic spike in projected losses directly correlating with the announced fee increases. Specific ports like Los Angeles saw a 30% increase in terminal fees, while Savannah experienced a 20% rise in container handling charges.

Beyond the Direct Costs: Secondary Impacts

The financial burden extends beyond the direct increase in port fees. Secondary impacts further contribute to the $70 million loss projection:

- Increased Insurance Premiums: The heightened risk of delays and potential damage due to port congestion leads to higher insurance premiums for auto carriers.

- Delays and Storage Costs: Port congestion causes significant delays, resulting in increased storage costs for vehicles awaiting shipment.

- Administrative Burden: Managing the increased paperwork and complexities associated with navigating higher fees adds to administrative overhead.

- Potential for Price Increases for Consumers: Ultimately, these increased costs are likely to be passed on to consumers through higher vehicle prices.

The Broader Impact on the Automotive Industry

The impact of increased US port fees extends far beyond a single auto carrier. The ripple effect threatens the entire automotive industry.

Supply Chain Disruptions

Increased port fees exacerbate existing supply chain vulnerabilities.

- Bottlenecks and Delays: Higher costs contribute to increased port congestion, leading to significant delays in vehicle delivery and impacting just-in-time manufacturing.

- Part Shortages: Delays in shipping parts and components can lead to production stoppages and shortages of specific vehicle models.

- Impact on Just-in-Time Manufacturing: The increased unpredictability and delays severely disrupt just-in-time manufacturing strategies, forcing manufacturers to hold larger inventories and incur additional costs.

Price Increases for Consumers

The increased freight costs and supply chain disruptions are inevitably passed on to consumers.

- Higher Vehicle Prices: Consumers will likely face higher prices for new and used vehicles as manufacturers absorb some costs and pass others along.

- Impact on Consumer Demand: Higher prices could dampen consumer demand, potentially impacting market saturation and sales figures.

- Competitive Pressures: Automakers face intense competitive pressures, forcing them to carefully balance absorbing some costs with passing others to consumers.

Potential Solutions and Mitigation Strategies

Addressing this crisis requires a multi-pronged approach involving collaboration and innovative solutions.

Negotiating with Port Authorities

Auto carriers need to actively engage with port authorities to negotiate more favorable rates.

- Improved Efficiency: Collaboration on port efficiency initiatives could help reduce congestion and processing times.

- Volume Discounts: Negotiating volume discounts based on shipping volume could offer cost savings.

- Industry-Wide Collaboration: Unified action by automakers and logistics providers can strengthen negotiating power.

Exploring Alternative Transportation Methods

Reducing reliance on ports is crucial for long-term sustainability.

- Rail Transportation: Increased investment in rail infrastructure and optimized rail transport could offer a viable alternative for moving vehicles inland.

- Cost-Effectiveness Analysis: A thorough cost-benefit analysis of alternative transportation methods is necessary to assess their feasibility.

- Environmental Considerations: The environmental impact of alternative transportation methods, such as rail, should be carefully considered.

Conclusion

The projected $70 million loss for this single auto carrier serves as a stark warning of the devastating impact of increased US port fees on the automotive industry. The consequences extend far beyond financial losses, encompassing supply chain disruptions, higher consumer prices, and increased competitive pressures. Understanding the implications of these rising US port fees is crucial for all stakeholders. Automakers, logistics providers, and consumers need to proactively seek solutions, including negotiating with port authorities, exploring alternative transportation methods, and advocating for policy changes that address port congestion and promote a more efficient and affordable shipping environment. The need for immediate action to mitigate the long-term effects of these rising costs cannot be overstated. Stay informed and actively participate in finding solutions to navigate this critical challenge facing the automotive industry.

Featured Posts

-

Analysis Trump Administrations Impact On European Ai Rulebook

Apr 26, 2025

Analysis Trump Administrations Impact On European Ai Rulebook

Apr 26, 2025 -

A Side Hustle For Elon Musks Friends Access To Private Company Stakes

Apr 26, 2025

A Side Hustle For Elon Musks Friends Access To Private Company Stakes

Apr 26, 2025 -

Thursday Night Football Nfl Drafts First Round Begins In Green Bay

Apr 26, 2025

Thursday Night Football Nfl Drafts First Round Begins In Green Bay

Apr 26, 2025 -

Us Port Fees To Cost Auto Carrier 70 Million A Worst Case Scenario

Apr 26, 2025

Us Port Fees To Cost Auto Carrier 70 Million A Worst Case Scenario

Apr 26, 2025 -

White House Cocaine Incident Secret Service Concludes Investigation

Apr 26, 2025

White House Cocaine Incident Secret Service Concludes Investigation

Apr 26, 2025