5 Key Dos And Don'ts To Succeed In The Private Credit Boom

Table of Contents

DO: Understand the Private Credit Landscape

Successfully participating in the private credit boom demands a thorough understanding of the market. This involves a deep dive into deal structures and diligent market research.

Deep Dive into Deal Structures

Private credit encompasses various strategies, each with unique risk and return profiles. Understanding these nuances is crucial.

- Research various asset classes within private credit: This includes real estate debt, leveraged loans, mezzanine financing, and other specialized lending areas. Each asset class presents different risk-reward profiles and requires specialized expertise. For instance, real estate debt might offer stability but lower returns compared to leveraged loans, which carry higher risk but potentially higher returns.

- Assess the creditworthiness of borrowers meticulously: Rigorous credit analysis is paramount. This includes evaluating financial statements, assessing cash flow projections, and understanding the borrower's business model and industry dynamics. Ignoring this step can lead to significant losses in the private credit boom.

- Understand the nuances of different deal structures: Familiarize yourself with senior debt, subordinated debt, mezzanine financing, and other structures. Each structure carries different levels of risk and seniority in the capital stack. Understanding these differences is vital for making informed investment decisions within the private credit boom.

Market Research and Due Diligence

Thorough market research and due diligence are essential for identifying promising opportunities and mitigating potential risks in the private credit boom.

- Analyze macroeconomic trends impacting the private credit market: Interest rate changes, inflation, and economic growth all significantly influence the private credit market. Understanding these macro factors is crucial for making well-informed investment choices.

- Identify emerging sectors and potential investment themes: Stay informed about industry trends and emerging sectors showing strong potential for growth. This might include renewable energy, technology, or healthcare, depending on market conditions. These sectors often offer compelling opportunities within the private credit boom.

- Employ rigorous due diligence processes for all potential investments: This involves independent verification of information, comprehensive financial analysis, and legal review. Skipping this crucial step can lead to significant financial losses during the private credit boom.

DO: Build Strong Relationships

Networking and leveraging your network are critical for success in the competitive private credit market.

Network Strategically

Building strong relationships with key players is crucial for accessing deal flow and gaining valuable insights.

- Attend industry conferences and networking events: These events provide opportunities to meet potential borrowers, sponsors, and investors. Active participation and engagement are key to building a strong network within the private credit boom.

- Cultivate relationships with potential co-investors: Collaborating with other investors can provide access to larger deals and diversify risk. These relationships are especially valuable during the fast-paced private credit boom.

- Build trust and reputation through consistent performance: Demonstrating reliability and competence builds trust and enhances your reputation, leading to more opportunities in the private credit boom.

Leverage Your Network

Your network serves as a valuable resource for deal sourcing and market intelligence.

- Tap into your network for deal flow and market intelligence: Your contacts can provide early access to promising investment opportunities and insights into market trends. This is particularly valuable in the dynamic private credit boom.

- Collaborate with other professionals to share expertise and resources: Leveraging the expertise of other professionals expands your capabilities and reduces risk. This collaborative approach is increasingly important in the competitive private credit boom.

- Participate in industry forums and discussions: Staying engaged in industry conversations provides valuable insights and keeps you updated on the latest trends affecting the private credit boom.

DON'T: Neglect Risk Management

Robust risk management is crucial for navigating the complexities and potential pitfalls of the private credit boom.

Comprehensive Risk Assessment

Implementing rigorous risk management procedures helps identify and mitigate potential losses.

- Conduct thorough credit analysis, including stress testing scenarios: This involves assessing the borrower's financial health under various economic conditions. Stress testing helps determine the resilience of the investment during downturns within the private credit boom.

- Diversify your portfolio across various asset classes and borrowers: Spreading your investments across different asset classes and borrowers helps reduce overall portfolio risk. This diversification is crucial for navigating the volatility of the private credit boom.

- Establish clear risk tolerance levels and adhere to them: Knowing your risk limits helps prevent impulsive decisions and protects against significant losses within the private credit boom.

Underestimate Due Diligence

Thorough due diligence is non-negotiable in the private credit market. Cutting corners can have severe consequences.

- Verify the information provided by borrowers: Independent verification of all information provided by borrowers is essential. This helps prevent fraud and inaccurate information within the private credit boom.

- Analyze the financial statements and operating performance: A comprehensive review of financial records helps assess the borrower’s financial health and future prospects. This is fundamental to successful investment in the private credit boom.

- Assess the legal and regulatory compliance: Ensuring that borrowers are compliant with all relevant laws and regulations protects your investments from legal and financial risks in the private credit boom.

DON'T: Overlook Legal and Regulatory Compliance

Navigating the legal and regulatory landscape is vital for avoiding potential issues.

Stay Updated on Regulations

The regulatory environment for private credit is constantly evolving. Staying informed is crucial.

- Understand the relevant laws and regulations: Staying up-to-date on laws and regulations helps prevent costly errors and legal challenges. This is particularly critical within the evolving landscape of the private credit boom.

- Ensure compliance with all applicable requirements: Adherence to all regulations protects your investments and maintains a strong reputation within the private credit boom.

- Seek professional legal and regulatory advice: Consulting with experienced legal professionals ensures compliance and protects against potential risks in the private credit boom.

Secure Appropriate Legal Counsel

Engaging experienced legal counsel provides invaluable support and protection.

- Review and negotiate deal documents: Legal experts can help you understand the complexities of legal documentation and ensure your interests are protected during negotiations. This is especially crucial in the dynamic private credit boom.

- Ensure compliance with legal and regulatory requirements: Legal counsel assists in maintaining compliance with applicable laws and regulations, safeguarding your investments in the private credit boom.

- Protect your interests throughout the investment process: Experienced legal professionals advocate for your interests, minimizing your exposure to risk and maximizing returns within the private credit boom.

DO: Adapt and Innovate

The private credit market is dynamic and requires constant adaptation and innovation.

Stay Ahead of the Curve

Monitoring market trends and adapting strategies are critical for long-term success.

- Analyze emerging technologies and their impact on the private credit market: New technologies are transforming the industry; understanding and adapting to these changes is key to success in the private credit boom.

- Embrace new investment strategies and approaches: Flexibility and a willingness to adopt new approaches are crucial for navigating the changing dynamics of the private credit boom.

- Continuously seek opportunities for innovation and improvement: Constant improvement and adaptation are crucial for maintaining a competitive edge in the ever-evolving private credit boom.

Leverage Technology

Technology offers significant opportunities to enhance efficiency and decision-making.

- Employ data analytics and AI for due diligence: Utilizing technology speeds up due diligence and enhances the accuracy of risk assessments, maximizing returns in the private credit boom.

- Utilize CRM systems for relationship management: Technology streamlines relationship management, improving communication and collaboration within the private credit boom.

- Explore fintech solutions for portfolio management: Fintech tools offer improved portfolio management capabilities, enhancing efficiency and transparency in navigating the private credit boom.

Conclusion

The private credit boom presents significant opportunities for investors who understand the market dynamics and employ a strategic approach. By following these key dos and don'ts – understanding the landscape, building strong relationships, managing risks effectively, ensuring regulatory compliance, and adapting to market changes – you can significantly increase your chances of success in this exciting and rapidly growing sector. Don't miss out on the potential of the private credit boom; take action today and leverage these insights to maximize your returns.

Featured Posts

-

Faas Focus On Collision Avoidance A Las Vegas Airport Case Study

Apr 24, 2025

Faas Focus On Collision Avoidance A Las Vegas Airport Case Study

Apr 24, 2025 -

Impact Of Chinas Rare Earth Export Controls On Teslas Optimus Robot Project

Apr 24, 2025

Impact Of Chinas Rare Earth Export Controls On Teslas Optimus Robot Project

Apr 24, 2025 -

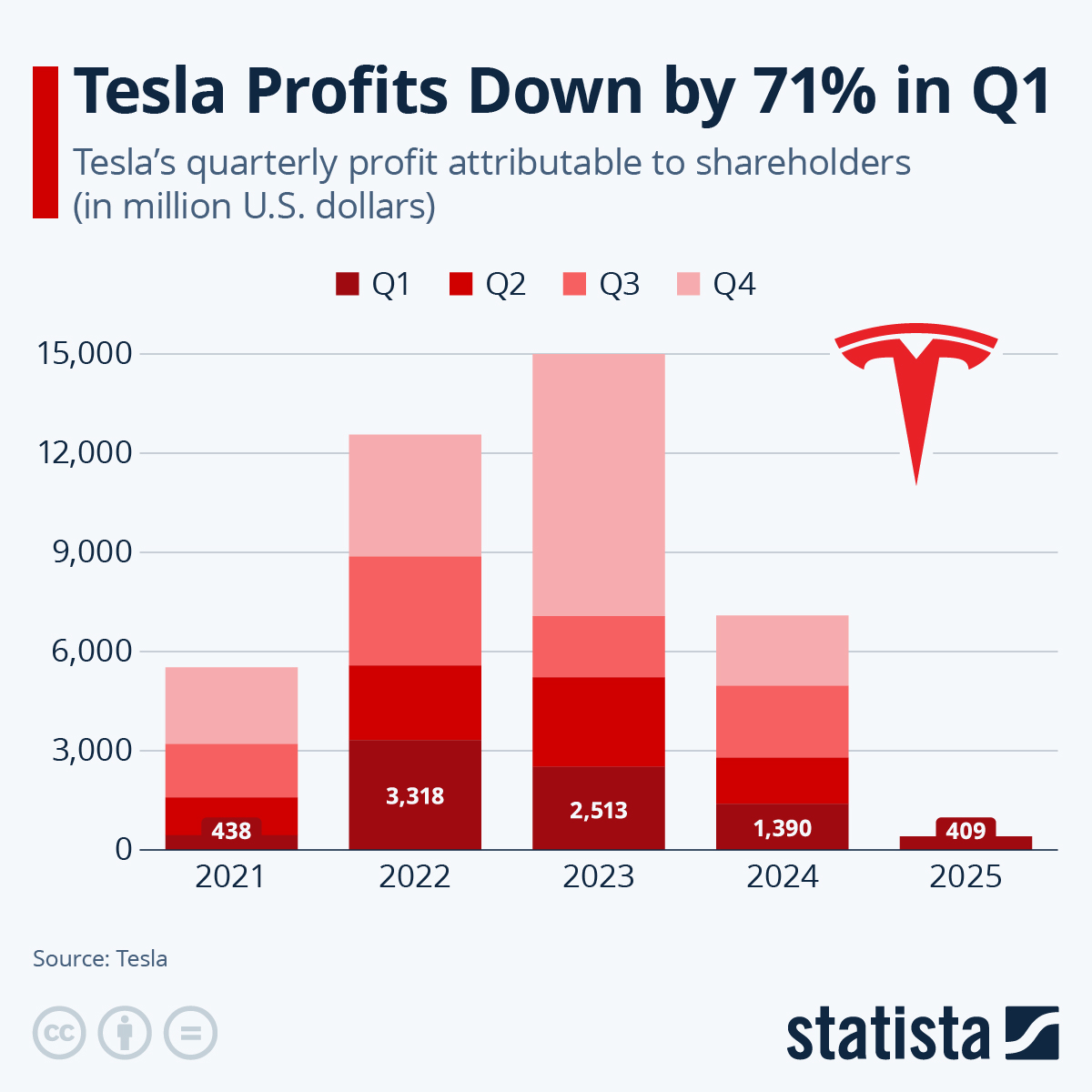

Tesla Q1 Earnings Report Analyzing The Impact Of Musks Actions

Apr 24, 2025

Tesla Q1 Earnings Report Analyzing The Impact Of Musks Actions

Apr 24, 2025 -

La Fires Fuel Landlord Price Gouging Claims A Selling Sunset Star Speaks Out

Apr 24, 2025

La Fires Fuel Landlord Price Gouging Claims A Selling Sunset Star Speaks Out

Apr 24, 2025 -

Market Analysis Assessing The Future Of Chinese Stocks In Hong Kong

Apr 24, 2025

Market Analysis Assessing The Future Of Chinese Stocks In Hong Kong

Apr 24, 2025