X's New Financials: Debt Sale Impacts And Company Transformation

Table of Contents

The Debt Sale: Details and Rationale

The Specifics of the Debt Sale

X Corporation recently sold [Amount] in debt. The terms of the sale, as detailed in the company's press release dated [Date] and SEC filing [Filing Number], include an interest rate of [Interest Rate]% and a repayment schedule spanning [Number] years. The buyer(s) of this debt were [Buyer Name(s)]. Key terms of the sale include:

- Interest Rate: [Interest Rate]%

- Maturity Date: [Date]

- Buyer(s): [Buyer Name(s)]

- Type of Debt: [e.g., High-yield bonds, Term loan]

X's Stated Reasons for the Debt Sale

X Corporation cited several reasons for the debt sale, primarily focusing on strengthening its financial position and enabling strategic investments. The company's official statements emphasize a desire to:

- Reduce its overall debt burden, leading to improved financial flexibility.

- Free up capital for strategic investments in research and development, and expansion into new markets.

- Optimize its capital structure for long-term sustainability and growth.

These claims appear credible given X's previous financial performance and current market conditions. The high level of existing debt may have limited the company's agility, hindering its ability to capitalize on emerging opportunities.

Market Reaction to the Debt Sale

The immediate market reaction to the announcement was largely positive. X Corporation's stock price saw a [Percentage]% increase in the days following the announcement. Analysts generally viewed the debt sale favorably, citing the improved capital structure and enhanced financial flexibility as positive signs for future growth. While some expressed concerns about the long-term implications of the sale, the overall sentiment was optimistic. Credit rating agencies [Name of agency/agencies] [Increased/Decreased/Maintained] X Corporation's credit rating reflecting [Reason for the change].

Impact on X's Financial Performance

Improved Debt-to-Equity Ratio

The debt sale significantly improved X's debt-to-equity ratio. Before the sale, the ratio stood at [Previous Ratio]; post-sale, it decreased to [New Ratio]. This reduction indicates a stronger financial foundation and reduced financial risk. The improved ratio also enhances X's creditworthiness, potentially leading to more favorable borrowing terms in the future.

Increased Cash Flow and Liquidity

The influx of cash from the debt sale has substantially boosted X's cash flow and liquidity. This is evident in the increase in cash and cash equivalents on the balance sheet. The improved liquidity provides X with the financial resources to pursue strategic acquisitions, invest in innovative technologies, and weather any unexpected economic downturns. The increased cash flow from operating activities further supports the long-term sustainability of the business.

Potential Impact on Profitability

While the debt sale might lead to short-term reductions in net income due to decreased interest income, the long-term impact on profitability is expected to be positive. The reduced debt burden will significantly lower interest expense, directly impacting the bottom line. The increased investment in research and development and expansion into new markets also has the potential to boost revenue streams and drive long-term profitability. This will ultimately lead to increased earnings per share.

Company Transformation Initiatives

Strategic Realignment and Restructuring

Following the debt sale, X Corporation initiated a strategic realignment and restructuring, including [mention specific actions, e.g., restructuring of certain business units, divestiture of non-core assets]. These steps are designed to streamline operations, improve efficiency, and better align the company with its long-term strategic goals. These actions may include:

- Mergers and acquisitions to expand market share.

- Layoffs of redundant employees to reduce operating costs.

- Restructuring of business units to focus on key revenue drivers.

Investments in New Technologies or Markets

The improved financial position has enabled X Corporation to invest in new technologies and expand into new markets. Significant investments are planned in [mention areas of investment, e.g., AI, sustainable energy, international expansion]. These investments are expected to drive future growth and position X Corporation at the forefront of innovation within its industry.

Enhanced Operational Efficiency

X's financial restructuring has facilitated several initiatives aimed at enhancing operational efficiency. These include:

- Streamlining supply chain processes.

- Implementing new technologies to automate tasks and reduce operational costs.

- Negotiating better terms with suppliers.

Conclusion: Analyzing X's Future Based on its New Financials

The debt sale has significantly reshaped X Corporation's financial landscape. The improved debt-to-equity ratio, increased liquidity, and reduced interest expense are all positive developments. While there were some short-term challenges related to the restructuring process, the strategic investments and operational improvements are poised to yield substantial long-term benefits. The company's future trajectory looks promising, based on its improved financials and the strategic initiatives undertaken. However, close monitoring of X's performance and adaptation to market changes will be crucial for sustaining this positive momentum. Stay tuned for further updates on X's new financials and its continued evolution.

Featured Posts

-

Retail Investor Behavior During Market Downturns A Deep Dive

Apr 28, 2025

Retail Investor Behavior During Market Downturns A Deep Dive

Apr 28, 2025 -

Resistance Grows Car Dealers Oppose Government Ev Mandates

Apr 28, 2025

Resistance Grows Car Dealers Oppose Government Ev Mandates

Apr 28, 2025 -

Identifying The Countrys Fastest Growing Business Areas

Apr 28, 2025

Identifying The Countrys Fastest Growing Business Areas

Apr 28, 2025 -

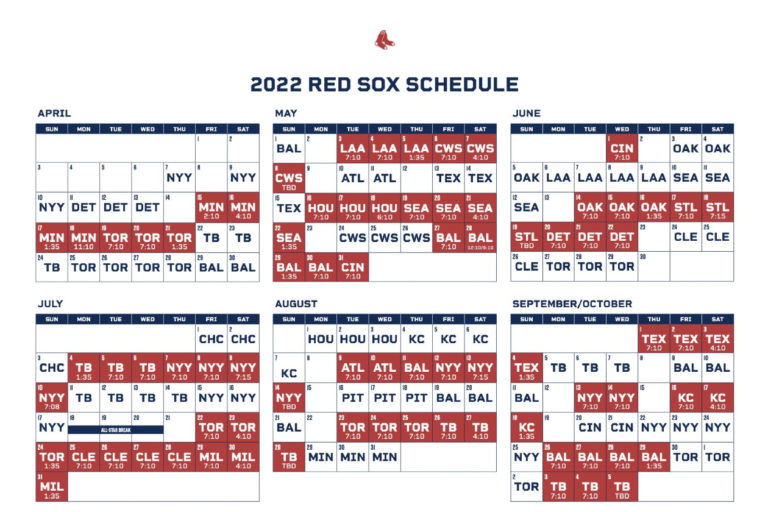

Red Sox 2025 Finding A Replacement For Tyler O Neill

Apr 28, 2025

Red Sox 2025 Finding A Replacement For Tyler O Neill

Apr 28, 2025 -

Red Sox Vs Blue Jays Lineup Analysis Featuring Walker Buehler And Returning Outfielder

Apr 28, 2025

Red Sox Vs Blue Jays Lineup Analysis Featuring Walker Buehler And Returning Outfielder

Apr 28, 2025