US Market Down, Emerging Markets Up: A Year In Review

Table of Contents

Decline of the US Market: Understanding the Downturn

Inflationary Pressures and Interest Rate Hikes

The US market's decline is largely attributed to the aggressive measures taken by the Federal Reserve to combat persistent inflation. Rising inflation erodes purchasing power and increases the cost of borrowing, impacting businesses and consumer spending.

- Higher interest rates: The Fed's interest rate hikes increased borrowing costs for businesses, making expansion and investment more challenging. This also led to higher bond yields, making bonds a more attractive investment than stocks for some investors.

- Reduced company valuations: Higher interest rates directly impact company valuations, particularly those with high debt levels. Increased borrowing costs reduce profitability, leading to lower stock prices.

- Negative investor sentiment: The combination of inflation and interest rate hikes created a climate of uncertainty and risk aversion, leading to a decrease in investor confidence and market volatility. Sectors like technology, highly sensitive to interest rate changes, experienced significant declines. For example, the tech-heavy Nasdaq Composite Index saw a substantial drop in 2022. (Source: [Insert reputable source for Nasdaq data])

Geopolitical Uncertainty and its Ripple Effect

Geopolitical instability, including the war in Ukraine and escalating tensions between the US and China, further dampened investor sentiment and contributed to the US market downturn.

- Market volatility: These events caused significant market volatility, as investors reacted to evolving geopolitical risks and their potential impact on the global economy.

- Sector-specific impacts: The energy sector experienced price fluctuations due to the war in Ukraine, while the technology sector faced challenges due to increased US-China trade tensions and supply chain disruptions.

- Investor apprehension: The uncertainty surrounding geopolitical events led to increased investor apprehension and a reluctance to commit capital to the market.

The Rise of Emerging Markets: Opportunities and Challenges

Strong Economic Growth in Key Emerging Markets

Despite global headwinds, several emerging markets demonstrated strong economic growth. Countries like India and several nations in Southeast Asia showed resilience and impressive expansion.

- India's growth: India's robust domestic consumption and ongoing infrastructure development fueled significant economic growth. (Source: [Insert reputable source for India's GDP growth data])

- Southeast Asia's expansion: Southeast Asian economies benefited from a combination of factors, including strong export performance and government initiatives promoting economic diversification. (Source: [Insert reputable source for Southeast Asia's economic growth data])

- Increased domestic consumption: Many emerging markets experienced increased domestic consumption, driven by a growing middle class and rising disposable incomes.

Attractive Investment Opportunities in Emerging Markets

The growth in emerging markets has created attractive investment opportunities, particularly in sectors poised for rapid expansion.

- Higher potential returns: Emerging markets often offer the potential for higher returns compared to developed markets, albeit with higher risk.

- Growth sectors: Sectors like technology, renewable energy, and infrastructure in many emerging markets present significant growth potential. For example, the rapid adoption of mobile technology in certain regions has created lucrative investment opportunities.

- Successful investments: Several investors have achieved significant returns by strategically investing in high-growth emerging markets. (Insert examples of successful investments with sources, if possible)

Risks and Challenges in Emerging Markets

Investing in emerging markets carries inherent risks that investors must carefully consider.

- Political instability: Political instability and policy uncertainty can negatively impact market performance and investment returns.

- Currency fluctuations: Significant currency fluctuations can erode investment returns, particularly for investors who are not hedging their currency exposure.

- Risk mitigation: Investors can mitigate these risks through diversification, thorough due diligence, and employing appropriate risk management strategies.

Comparing US and Emerging Market Performance: A Detailed Analysis

Key Performance Indicators (KPIs)

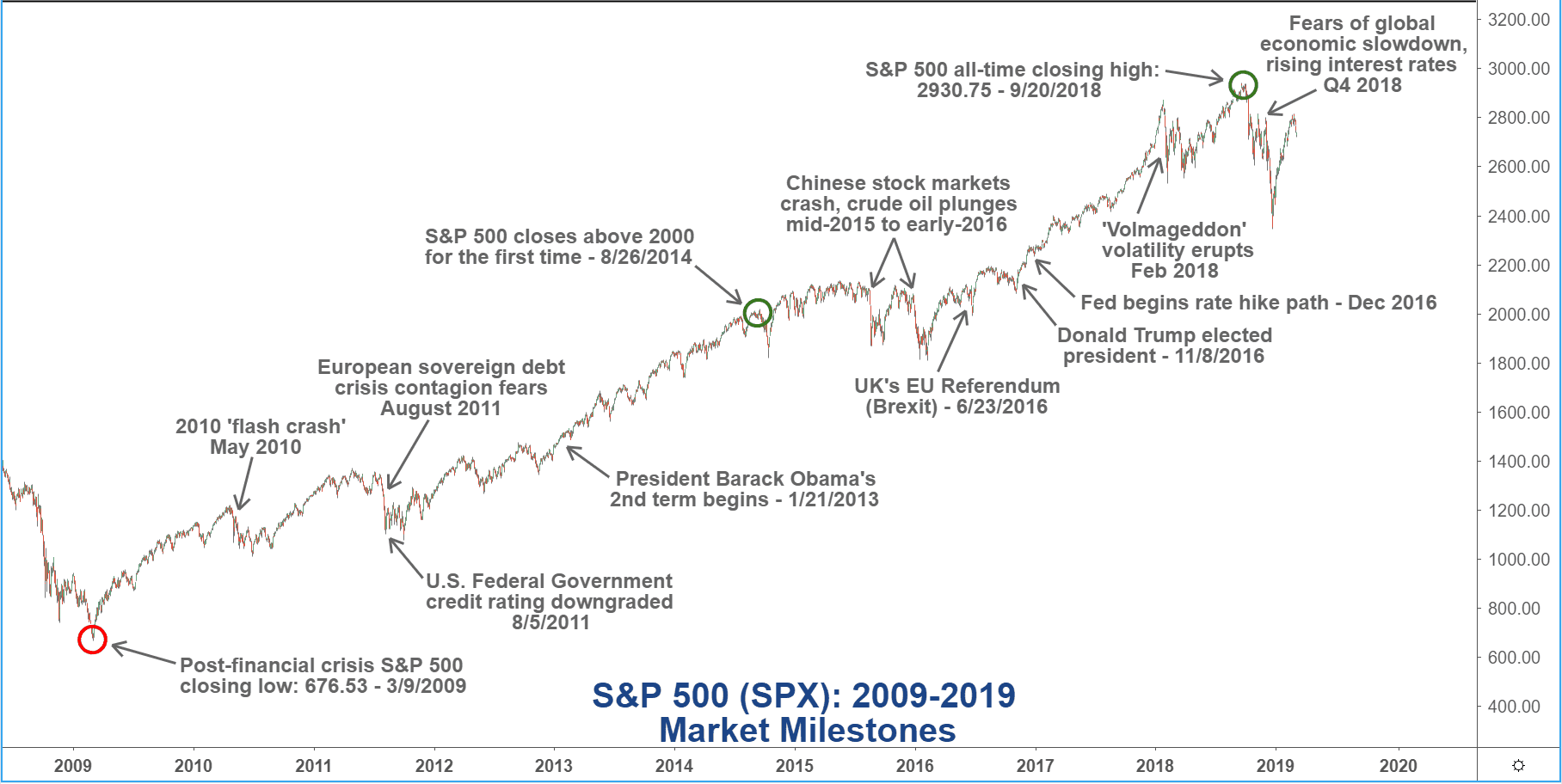

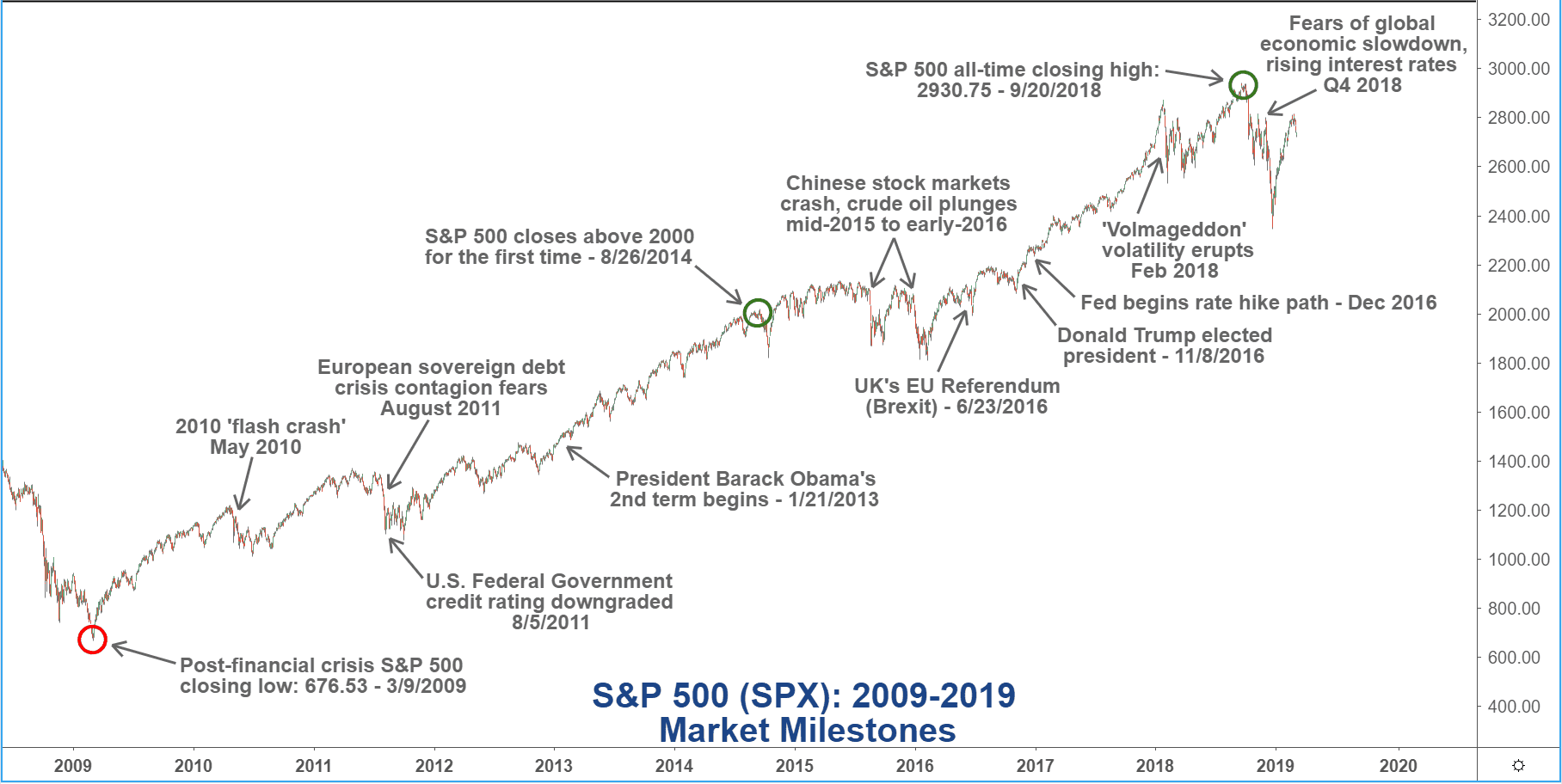

A comparison of key performance indicators highlights the contrasting performance of US and emerging markets. [Insert charts and graphs comparing GDP growth, inflation rates, and relevant stock market indices for the US and selected emerging markets. Clearly label axes and provide data sources].

Long-Term Investment Strategies

Developing a long-term investment strategy requires a balanced approach, considering both the opportunities and risks associated with investing in both US and emerging markets. Diversification across various asset classes and geographies is crucial to manage risk and maximize long-term returns.

Conclusion

The divergence in performance between the US and emerging markets in the past year underscores the importance of a diversified investment strategy. While the US market faced challenges from inflation and geopolitical uncertainty, several emerging markets demonstrated remarkable resilience and growth. This presents both significant opportunities and risks. Explore the potential of emerging markets, but remember to conduct thorough research and consider your risk tolerance before making any investment decisions. Learn more about investing in emerging markets for higher returns, but always prioritize a well-diversified portfolio that aligns with your financial goals. Diversify your portfolio with promising emerging market opportunities and carefully assess the risks involved.

Featured Posts

-

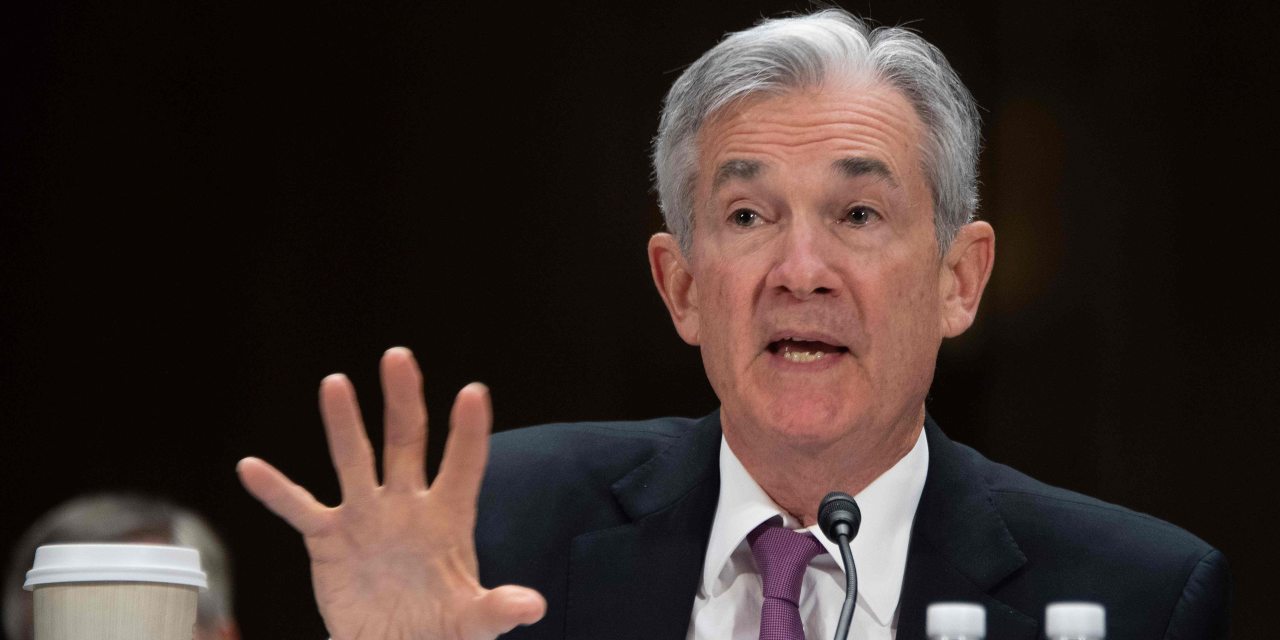

Is Powell Safe Trump Denies Plans To Fire Federal Reserve Chair

Apr 24, 2025

Is Powell Safe Trump Denies Plans To Fire Federal Reserve Chair

Apr 24, 2025 -

Canadas Conservatives Tax Cuts And Deficit Reduction Plan

Apr 24, 2025

Canadas Conservatives Tax Cuts And Deficit Reduction Plan

Apr 24, 2025 -

India Stock Market Niftys Strong Gains And Future Outlook

Apr 24, 2025

India Stock Market Niftys Strong Gains And Future Outlook

Apr 24, 2025 -

Mark Zuckerberg And The Trump Administration A New Era For Meta

Apr 24, 2025

Mark Zuckerberg And The Trump Administration A New Era For Meta

Apr 24, 2025 -

Zuckerbergs Next Chapter Navigating The Trump Presidency

Apr 24, 2025

Zuckerbergs Next Chapter Navigating The Trump Presidency

Apr 24, 2025