US Dollar Gains Momentum: Impact Of Trump's Less Aggressive Fed Rhetoric

Table of Contents

Trump's Shift in Fed Rhetoric and its Market Implications

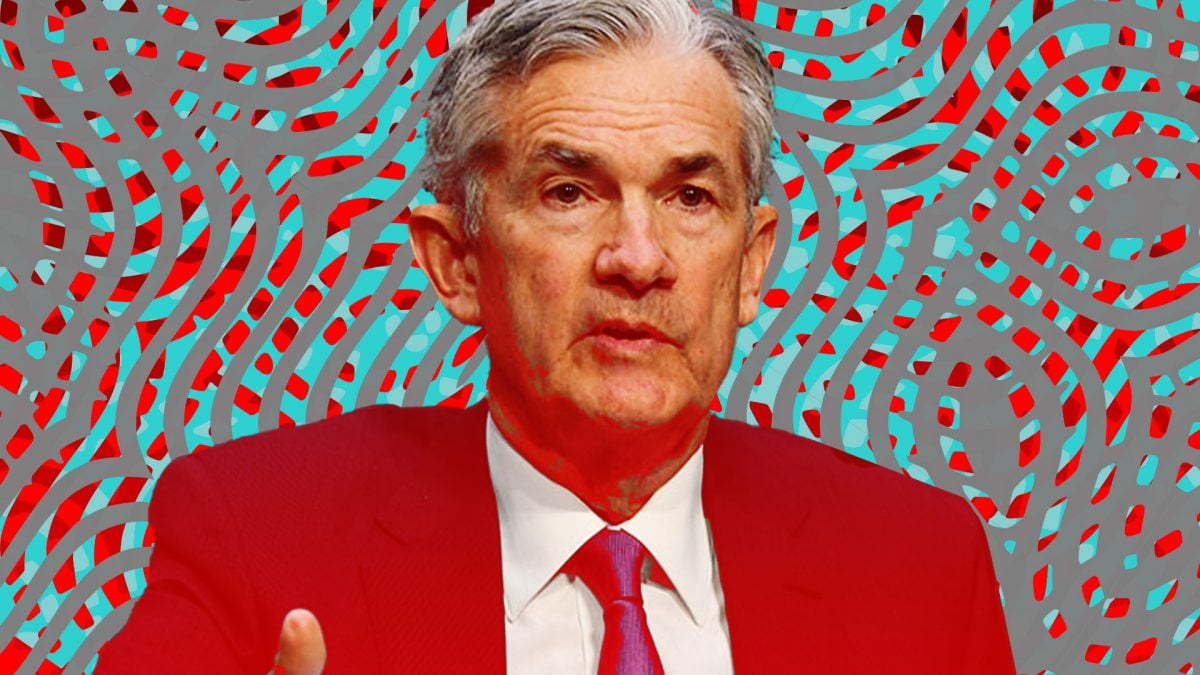

Historically, President Trump has been a vocal critic of the Federal Reserve's monetary policy. His criticisms, often expressed through tweets and public statements, frequently targeted interest rate hikes and what he perceived as overly cautious monetary easing. These pronouncements often created market uncertainty and volatility.

However, a noticeable shift in his rhetoric has emerged recently. The overt criticism has lessened, replaced by a more subdued, potentially hands-off approach. This change in tone is significant, potentially signaling a new era of reduced political pressure on the central bank.

- Examples of past criticisms: Numerous tweets directly criticizing former Fed Chair Jerome Powell, accusing him of hindering economic growth. Public statements labeling interest rate hikes as "crazy" and "too tough."

- Evidence of the recent shift in tone: A noticeable reduction in public criticism of the Fed's actions. More measured comments in speeches and interviews regarding monetary policy. A perceived acceptance of the Fed's independence.

- Analysis of the impact of this change on investor confidence: This change in tone has likely boosted investor confidence, suggesting a decreased risk of politically motivated interference in monetary policy. This, in turn, can attract more foreign investment, increasing demand for the US dollar.

The Strengthening US Dollar: Causes and Consequences

The US dollar has recently appreciated against many major currencies, including the Euro, the Yen, and the Pound. While Trump's altered stance on the Fed plays a role, other factors contribute to this strengthening.

- Global economic uncertainty: Geopolitical instability and economic slowdowns in other regions have increased the safe-haven demand for the US dollar.

- Safe-haven demand for the dollar: The US dollar is often seen as a safe haven asset during times of global uncertainty, leading to increased demand.

- Interest rate differentials: Higher interest rates in the US compared to other countries make US dollar-denominated assets more attractive to foreign investors.

- US economic performance relative to other countries: Relative strength of the US economy compared to its peers can boost demand for the dollar.

A strong dollar, however, has both positive and negative consequences for the US economy:

- Impact on exports and imports: A stronger dollar makes US exports more expensive and imports cheaper, potentially hurting US exporters and benefiting consumers.

- Effect on inflation: Cheaper imports can help keep inflation down, while a stronger dollar can reduce inflationary pressures from rising import costs.

- Influence on corporate profits: Multinational corporations with significant overseas operations can see their profits impacted by fluctuations in the dollar's value.

- Consequences for international trade: A strong dollar can lead to trade imbalances and increased competition for US businesses in global markets.

Analyzing the Interplay Between Fed Policy and the Dollar's Value

The Federal Reserve's actions significantly influence the value of the US dollar. Its monetary policy tools, such as interest rates and quantitative easing (QE), directly impact the supply and demand for the dollar.

A less aggressive Fed, as potentially signaled by Trump's changed rhetoric, can contribute to a stronger dollar. By not aggressively lowering interest rates or engaging in extensive QE, the Fed can make dollar-denominated assets more attractive.

- Explanation of the mechanism (interest rates, quantitative easing, etc.): Higher interest rates attract foreign investment, increasing demand for the dollar. QE, while increasing the money supply, can impact inflation and exchange rates depending on its implementation and market conditions.

- Potential for future Fed policy adjustments: The Fed's future decisions will heavily influence the dollar's trajectory. Any shifts in its approach to inflation or economic growth could lead to further currency fluctuations.

- How market expectations of future Fed actions affect the current dollar value: Market participants anticipate future Fed actions, influencing the current exchange rate. Expectations of tighter monetary policy, for example, can strengthen the dollar even before the actual policy change.

Alternative Explanations for the US Dollar's Rise

While Trump's less aggressive stance on the Fed might contribute to the US dollar's rise, it's essential to acknowledge other influencing factors.

- Geopolitical events: Global political events can significantly impact currency markets. Instability in other regions could drive investors towards the perceived safety of the US dollar.

- Global market trends: Broader global economic trends, independent of US policy, can influence the dollar's value. For instance, a global recession in other major economies could benefit the US dollar.

- Other economic indicators: Factors like the US trade balance, inflation rates, and consumer confidence also influence the dollar's strength.

Conclusion: The Future of the US Dollar and Trump's Influence

In summary, the recent strengthening of the US dollar is a complex phenomenon. While President Trump's less confrontational approach towards the Federal Reserve may have played a contributing role by reducing market uncertainty and boosting investor confidence, it's crucial to recognize other important factors influencing the dollar's value. The interplay between the Fed's policy decisions, global economic conditions, and geopolitical events determines the trajectory of the US dollar. Trump's changed rhetoric likely represents one piece of a larger puzzle.

Stay informed about the future trajectory of the US dollar and the impact of ongoing developments in Fed policy and the administration's approach to the economy. Understanding these dynamics is crucial for navigating the complexities of the global financial landscape and making informed investment decisions.

Featured Posts

-

Subsystem Issue Forces Blue Origin To Postpone Rocket Launch

Apr 24, 2025

Subsystem Issue Forces Blue Origin To Postpone Rocket Launch

Apr 24, 2025 -

The Unseen Side Of Luxury Skiing The Stories Of Chalet Girls In Europe

Apr 24, 2025

The Unseen Side Of Luxury Skiing The Stories Of Chalet Girls In Europe

Apr 24, 2025 -

New Google Fi 35 Unlimited Plan A Budget Friendly Option

Apr 24, 2025

New Google Fi 35 Unlimited Plan A Budget Friendly Option

Apr 24, 2025 -

Lg C3 77 Inch Oled Tv Is It Worth The Hype

Apr 24, 2025

Lg C3 77 Inch Oled Tv Is It Worth The Hype

Apr 24, 2025 -

Remembering Jett Travolta John Travolta Shares Emotional Photo On What Would Have Been His Sons 33rd Birthday

Apr 24, 2025

Remembering Jett Travolta John Travolta Shares Emotional Photo On What Would Have Been His Sons 33rd Birthday

Apr 24, 2025