Two More ECB Interest Rate Cuts Possible: Simkus's Assessment Of Trade Impact

Table of Contents

Simkus's Rationale for Predicting Further Interest Rate Cuts

Dr. Simkus's prediction of further ECB interest rate cuts is rooted in a careful analysis of several key economic indicators. He argues that the current monetary policy is not effectively addressing the challenges facing the Eurozone. His reasoning centers around the following points:

-

Weakening Economic Growth in the Eurozone: Recent GDP growth figures suggest a slowing economy, raising concerns about a potential recession. This sluggish growth reduces the pressure on the ECB to maintain high interest rates to combat inflation.

-

Persistently High Inflation Despite Previous Rate Hikes: Despite several interest rate hikes by the ECB, inflation remains stubbornly high. This indicates that the current monetary policy may not be as effective as initially hoped, prompting the need for a different approach.

-

Concerns About a Potential Recession: The combination of high inflation and slowing economic growth increases the risk of a recession. Interest rate cuts could be seen as a preemptive measure to mitigate the severity of a potential downturn.

-

Analysis of Specific Eurozone Countries' Economic Health: Simkus's analysis extends beyond broad Eurozone figures, considering the diverse economic performances of individual member states. Countries experiencing significant economic hardship may benefit disproportionately from further rate cuts.

-

Comparison with Other Central Bank Actions Globally: By comparing the ECB's actions with those of other central banks worldwide, Simkus highlights potential adjustments needed to align the Eurozone's monetary policy with global economic realities.

Potential Impact of Interest Rate Cuts on the Euro

Further interest rate cuts by the ECB are likely to exert significant pressure on the Euro's exchange rate. A weaker Euro is a probable outcome. This is because lower interest rates generally reduce the attractiveness of Euro-denominated assets to foreign investors.

-

Impact on Investor Confidence: Lower interest rates can decrease investor confidence, leading to capital outflows and a weakening of the Euro.

-

Influence on Foreign Investment Flows: Reduced interest rates make investing in the Eurozone less appealing compared to regions with higher returns, potentially leading to a decrease in foreign direct investment.

-

Effects on Imports and Exports within the Eurozone: A weaker Euro could boost exports by making Eurozone goods more competitive internationally, but it could also increase the cost of imports.

-

Comparison with Previous Rate Cut Cycles: By examining the historical impact of previous ECB rate cut cycles on the Euro's exchange rate, Simkus provides valuable context for his predictions.

The Trade Implications of Lower Interest Rates

The predicted interest rate cuts will have a varied impact on different sectors of the European trade market.

-

Impact on Exporting Businesses: Lower interest rates could initially benefit exporting businesses by making their goods cheaper in international markets, thereby increasing competitiveness. However, this could be offset by increased input costs if the weaker Euro drives up the price of imported raw materials.

-

Effect on Importing Businesses: Importing businesses may face increased costs due to a weaker Euro, potentially squeezing profit margins and impacting consumer prices.

-

Potential Changes in Consumer Spending and Investment Patterns: Lower interest rates may stimulate consumer spending and business investment, but the effect will depend on factors like inflation and consumer confidence.

-

Sector-Specific Analysis: The impact of interest rate cuts will vary significantly across sectors. For instance, the tourism sector might benefit from increased inbound tourism due to a cheaper Euro, while manufacturing sectors relying heavily on imported raw materials could face challenges.

-

Analysis of Potential Winners and Losers in the Trade Landscape: Simkus’s assessment will likely identify specific sectors poised to benefit from the rate cuts and others facing potential difficulties.

Alternative Economic Scenarios and Their Implications

Predicting the future is inherently uncertain, and several alternative economic scenarios could influence the accuracy of Simkus's prediction.

-

Scenario 1: Inflation Remains High, Necessitating Further Rate Cuts: If inflation remains stubbornly high despite the initial cuts, further reductions may be necessary, potentially leading to a more significant weakening of the Euro.

-

Scenario 2: Inflation Falls Faster Than Expected, Limiting the Need for Further Cuts: If inflation falls more rapidly than anticipated, the ECB might reconsider the need for additional rate cuts, potentially lessening the impact on the Euro and trade.

-

Scenario 3: Unexpected Geopolitical Events Affecting the Eurozone Economy: Unexpected geopolitical events, such as further energy crises or international conflicts, could significantly disrupt the economic outlook and alter the need for interest rate adjustments.

-

Risk Assessment and Mitigation Strategies for Businesses: Businesses should conduct thorough risk assessments to understand the potential impact of different scenarios on their operations and develop appropriate mitigation strategies.

Conclusion: The Future of ECB Interest Rates and Their Trade Impact

Dr. Simkus's prediction of two more ECB interest rate cuts, driven by concerns about weakening economic growth and persistently high inflation, presents a significant development for the Eurozone economy. The predicted impact on the Euro exchange rate and various sectors of the European trade market is multifaceted and complex. While a weaker Euro could boost exports, it could also increase import costs. The potential for a recession further adds to the complexity of this situation. It is crucial to consider alternative economic scenarios and their implications. Stay updated on further developments regarding the ECB interest rate cuts. Learn more about managing risks related to ECB interest rate changes. Monitor the impact of potential ECB interest rate cuts on your business strategy. For further insights, refer to the ECB website [link to ECB website] and Dr. Simkus's analysis [link to Simkus's analysis, if available].

Featured Posts

-

Camille Claudel Bronze Sculpture Sells For 3 Million At French Auction

Apr 27, 2025

Camille Claudel Bronze Sculpture Sells For 3 Million At French Auction

Apr 27, 2025 -

Werner Herzogs Next Film Bucking Fastard Casts Real Life Sisters

Apr 27, 2025

Werner Herzogs Next Film Bucking Fastard Casts Real Life Sisters

Apr 27, 2025 -

Mubadala Abu Dhabi Open Rybakina Claims Victory Over Jabeur

Apr 27, 2025

Mubadala Abu Dhabi Open Rybakina Claims Victory Over Jabeur

Apr 27, 2025 -

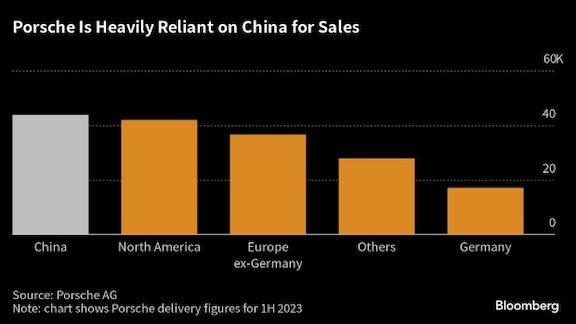

Are Bmw And Porsche Losing Ground In China A Market Analysis

Apr 27, 2025

Are Bmw And Porsche Losing Ground In China A Market Analysis

Apr 27, 2025 -

Hhs Investigation Into Autism And Vaccines Concerns Over Anti Vaccine Activist Appointment

Apr 27, 2025

Hhs Investigation Into Autism And Vaccines Concerns Over Anti Vaccine Activist Appointment

Apr 27, 2025