Trump's Statement: No Immediate Threat To Powell's Position As Fed Chair

Table of Contents

The President's Statement: A Word-by-Word Analysis

President Trump's recent statement on Jerome Powell, while not explicitly supportive or condemnatory, lacked the harsh criticism previously leveled against the Fed Chair. While the exact wording varies depending on the source, the general sentiment conveyed a sense of cautious neutrality. For example, a recent report paraphrased the President as saying something along the lines of, "The economy is strong, and we have a good working relationship. We'll see what happens."

The tone was notably less aggressive than in previous pronouncements. This shift in rhetoric is significant, suggesting a potential change in the President's approach to the Fed.

- "Strong economy": This claim, while generally accepted, requires closer scrutiny. Are we considering GDP growth, job creation rates, inflation levels, or a combination of these factors? A deeper dive into current economic indicators is needed for a complete picture.

- "Good relationship": This phrase contrasts sharply with past characterizations of the relationship between the President and the Fed Chair, which have often been described as strained or adversarial. What specific events or policies may have contributed to this apparent improvement?

- Lack of explicit criticism: The absence of direct attacks on Powell's monetary policy decisions is noteworthy. This could indicate a strategic shift, a temporary truce, or a recognition of the potential negative consequences of openly challenging the Fed Chair.

Market Reactions to Trump's Statement on Powell

The markets reacted cautiously but positively to Trump's seemingly softer stance on Powell. The immediate aftermath saw a modest increase in major stock market indices, with the Dow Jones Industrial Average experiencing a small but perceptible rise. Bond yields also reacted positively, suggesting increased investor confidence. The US dollar, however, showed a more muted response, reflecting the inherent uncertainties still surrounding the situation.

- Dow Jones Industrial Average: A slight uptick, indicating some relief among investors regarding the possibility of further disruptions to monetary policy.

- Yield Curve: The yield curve flattened slightly, suggesting a reduction in concerns about an imminent recession or significant economic downturn, partially driven by the seemingly reduced risk of abrupt changes at the Fed.

- US Dollar: The US dollar experienced minimal movement, reflecting the ongoing uncertainty about the long-term implications of the President’s statement and the Fed's future direction.

Political Implications of Maintaining Powell as Fed Chair

Maintaining Powell as Fed Chair carries significant political ramifications for President Trump. While a change could potentially align monetary policy more closely with the President's economic agenda, it also carries significant risks. Replacing Powell could unsettle financial markets, potentially harming the economy and damaging Trump's image heading into a re-election campaign.

- Impact on Trump's reelection chances: Replacing a seemingly stable Fed Chair close to an election could be viewed negatively by voters, potentially impacting his chances of reelection.

- Relationship with Congress: A contentious replacement could lead to further friction between the executive and legislative branches, further polarizing the political landscape.

- Influence on future economic policy: Keeping Powell allows for a degree of continuity in monetary policy, which could be seen as beneficial for economic stability in the short term.

Alternative Scenarios: Potential Future Appointments to the Fed

If President Trump were to decide to replace Jerome Powell, several potential candidates could emerge. These individuals would likely have differing economic philosophies and policy preferences, leading to significant variations in the Fed's approach to monetary policy. Their potential appointments would inevitably trigger market volatility and significant political debate.

- Potential candidates: Speculation includes names of economists and financial experts known for their varying viewpoints on monetary policy.

- Likely policy stances: These potential appointees would likely advocate for either a more expansionary or contractionary monetary policy, leading to different economic outcomes.

Conclusion: The Future of Jerome Powell as Fed Chair

Trump's recent statement, while not an explicit endorsement, appears to have temporarily eased concerns about Jerome Powell's immediate future as Fed Chair. However, the inherent uncertainties remain. The lack of direct criticism is a notable shift, but the long-term implications are yet to be seen. His continuing assessment of Powell and the Fed's performance will continue to impact market sentiment and the overall political landscape. Stay tuned for further updates on the evolving situation surrounding Trump’s stance on Powell and the future of the Federal Reserve. Continue to follow our coverage for the latest analysis on Trump's statements regarding Fed Chair Jerome Powell and the future of monetary policy.

Featured Posts

-

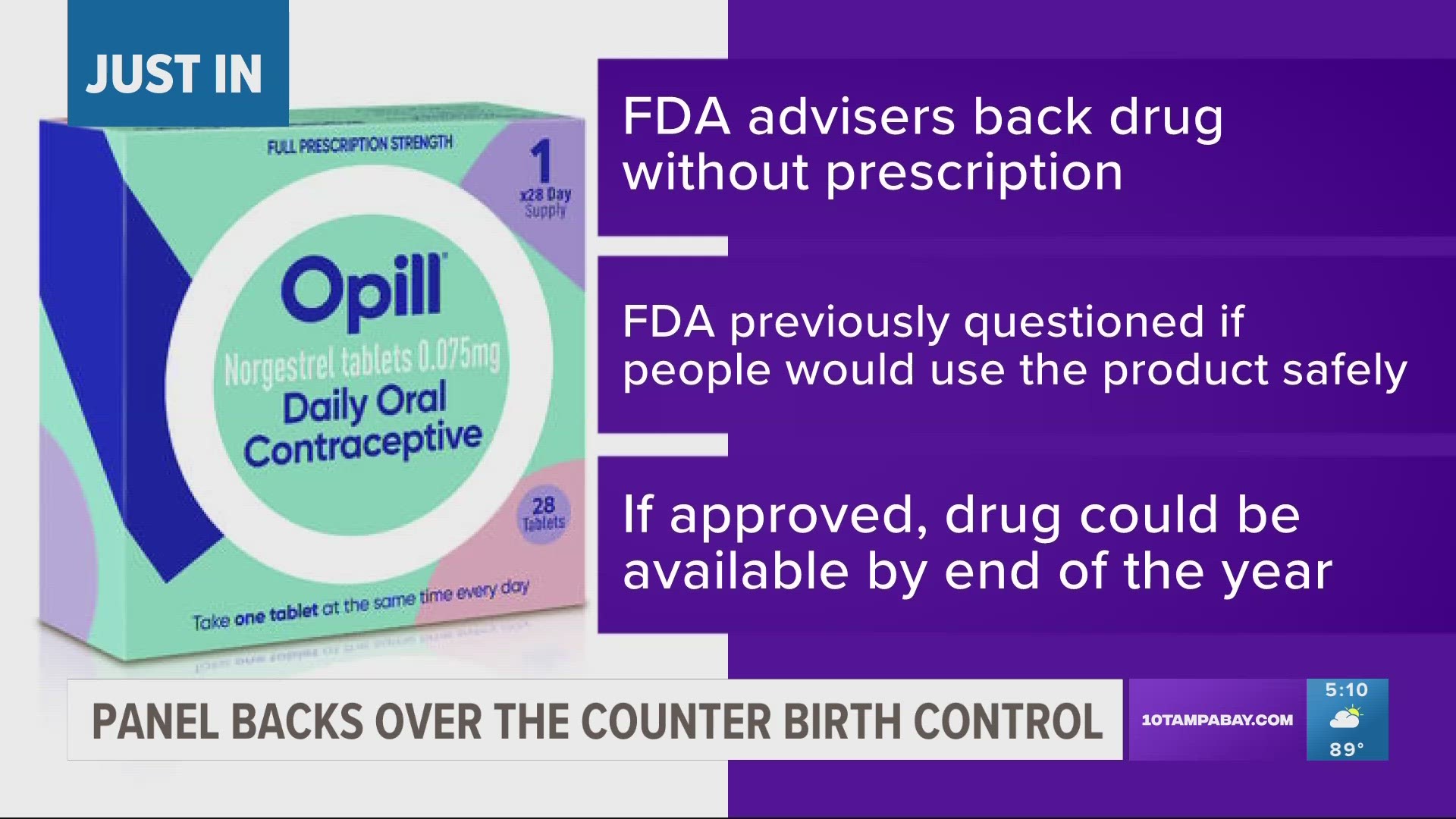

Over The Counter Birth Control A Post Roe Game Changer

Apr 24, 2025

Over The Counter Birth Control A Post Roe Game Changer

Apr 24, 2025 -

Open Ais Chat Gpt Under Ftc Scrutiny A Deep Dive Into The Investigation

Apr 24, 2025

Open Ais Chat Gpt Under Ftc Scrutiny A Deep Dive Into The Investigation

Apr 24, 2025 -

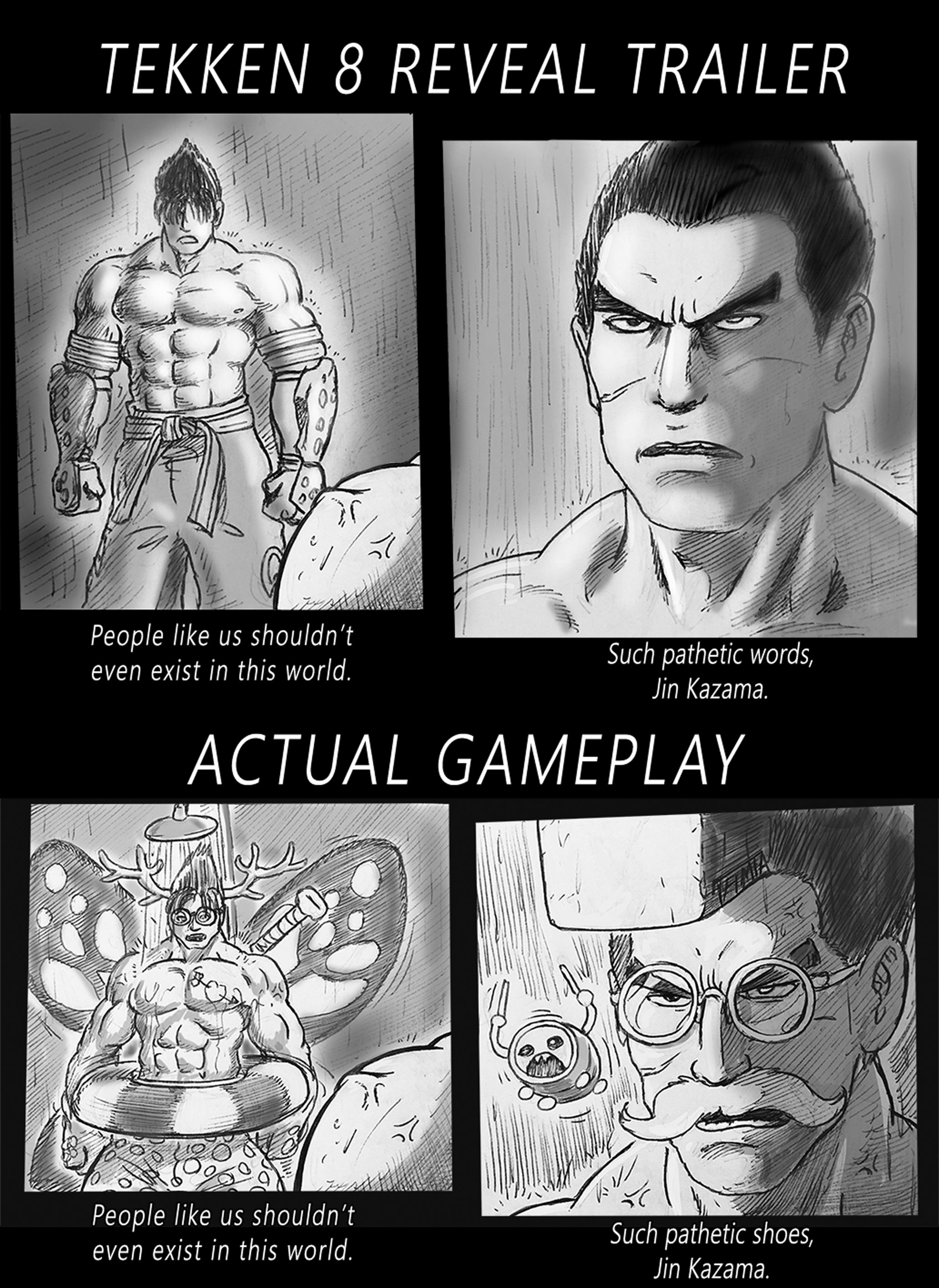

Working As A Chalet Girl In Europe Expectations Vs Reality For Wealthy Clients

Apr 24, 2025

Working As A Chalet Girl In Europe Expectations Vs Reality For Wealthy Clients

Apr 24, 2025 -

The Bold And The Beautiful Wednesday April 9 Recap Steffys Anger Finns Fate And Liams Plea

Apr 24, 2025

The Bold And The Beautiful Wednesday April 9 Recap Steffys Anger Finns Fate And Liams Plea

Apr 24, 2025 -

Financial Strategies Of Elite Universities Amidst Political Scrutiny

Apr 24, 2025

Financial Strategies Of Elite Universities Amidst Political Scrutiny

Apr 24, 2025