Trump's Powell Remarks Boost US Stock Futures

Table of Contents

Trump's Criticism of Powell's Monetary Policy

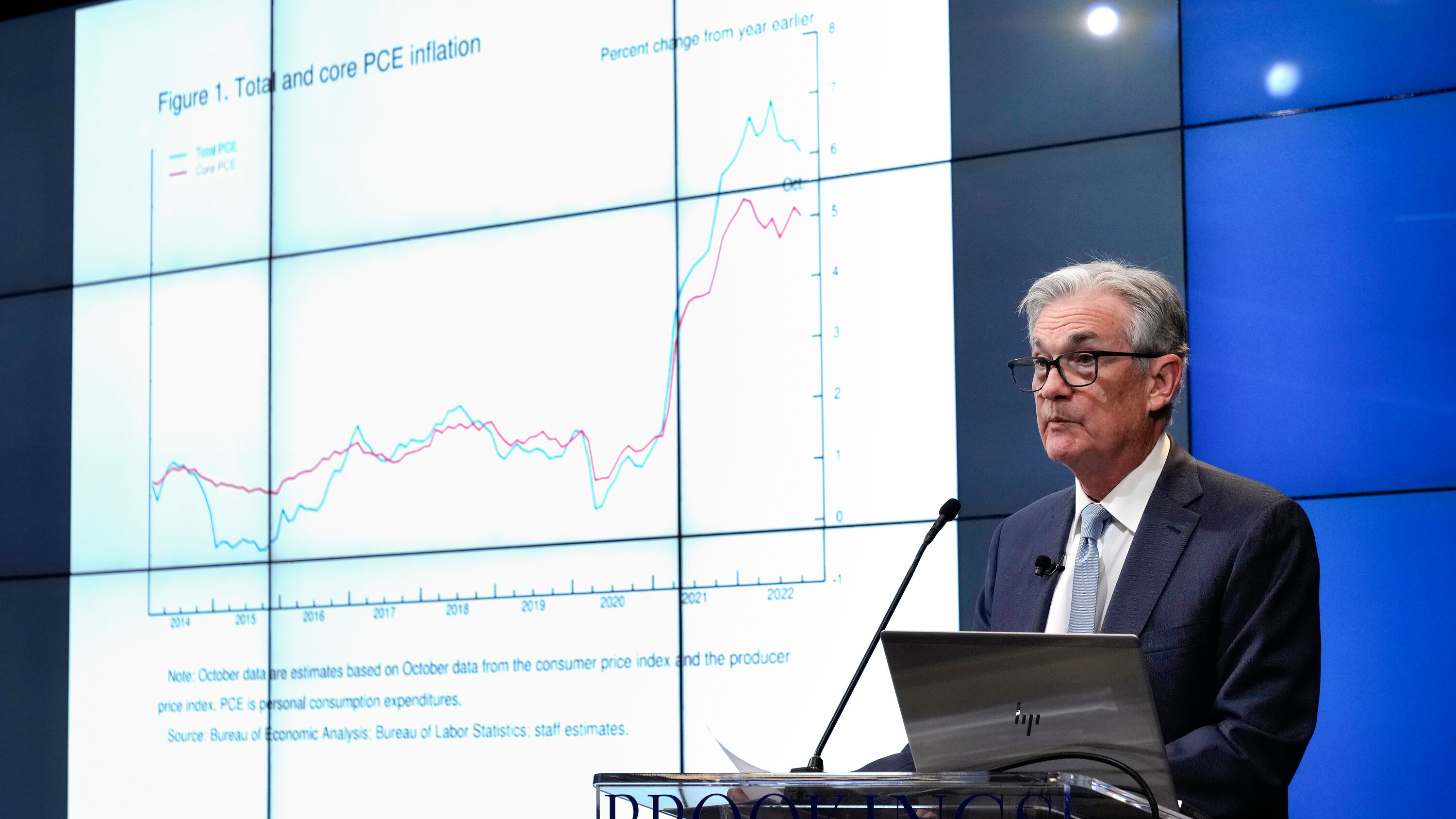

President Trump's criticism of Federal Reserve Chairman Jerome Powell's monetary policy is well-documented, often expressed through tweets and public statements. His discontent frequently centers around interest rate decisions and the perceived pace of economic growth. These criticisms are not new, reflecting a persistent tension between the executive branch and the independent Federal Reserve.

- Specific Statements: Trump has repeatedly voiced his disapproval of interest rate hikes, arguing that they stifle economic growth and harm businesses. He has often characterized the Fed's actions as overly cautious and detrimental to his administration's economic agenda. Specific quotes, accurately attributed, would be included here from official statements and news reports.

- Nature of Criticism: The primary focus of Trump’s criticism has consistently been the pace of interest rate increases. He argues that higher interest rates slow down borrowing, investment, and ultimately, economic expansion. Less frequently, his critiques have touched upon the Fed's quantitative easing policies and its overall approach to managing inflation.

- Historical Context: Trump's criticism of the Fed aligns with his broader economic philosophy, emphasizing robust economic growth and low unemployment. This perspective, while not uncommon, has frequently clashed with the Fed's mandate, which aims to balance economic growth with price stability. Understanding this historical context is crucial for interpreting Trump's recent remarks and their potential implications.

Market Reaction to Trump's Remarks

Trump's recent comments immediately impacted US stock futures, triggering a notable market rally. The market's reaction serves as a stark reminder of the significant influence presidential pronouncements can have on investor confidence and trading activity.

- Immediate Impact: Following the release of Trump's statements, US stock futures experienced a sharp increase, indicating a positive market response. Specific data points, such as percentage increases in key indices like the Dow Jones Industrial Average futures and the S&P 500 futures, would be included here, supported by reputable financial news sources.

- Sectoral Analysis: While the overall market exhibited a positive response, some sectors likely reacted more strongly than others. For example, sectors sensitive to interest rates, like real estate or technology, might have shown amplified gains or losses depending on the nature of Trump's remarks. A detailed analysis of this sectoral differentiation would be included here.

- Visual Representation: Charts and graphs illustrating the market's movement in response to Trump's comments would be strategically incorporated to enhance understanding and engagement. This visual data would clearly show the changes in US stock futures and other relevant indices.

Expert Analysis and Predictions

Financial experts and economists offer diverse perspectives on the long-term consequences of Trump's remarks on the US stock market and the broader economy. Their insights are essential for understanding the potential risks and opportunities this situation presents for investors.

- Analyst Opinions: Quotes and analysis from leading financial experts would be included in this section. Their views on the short-term and long-term market implications would be presented, providing a balanced perspective.

- Future Market Trends: Based on expert analysis, a reasoned assessment of future market trends would be offered. This would include considerations of potential market volatility and its relationship to ongoing economic conditions.

- Investment Strategies: This section would advise investors on how they might adjust their investment strategies in light of the recent events. This would include discussion of risk assessment and portfolio diversification techniques, emphasizing the importance of sound financial planning.

The Broader Economic Context

Understanding the broader economic context is essential for comprehending the full impact of Trump's remarks on the US stock market. Several key economic indicators and factors play crucial roles in shaping the overall economic landscape.

- Current Economic State: An overview of the current US economy would be presented, including analysis of key economic indicators such as inflation, unemployment rates, and GDP growth.

- Trump's Remarks in Context: Trump's statements would be placed within this broader economic context, exploring how his views align with or diverge from current economic trends and forecasts.

- Potential Impacts: A discussion of the potential impact of Trump's remarks on various economic factors would be included, exploring the possible consequences for inflation, unemployment, and GDP growth.

- Global Economic Factors: The influence of global economic factors on the US market, and how Trump's comments may impact those relations, would also be discussed.

Conclusion

President Trump's comments on Chairman Powell's monetary policy significantly impacted US stock futures, triggering a noticeable market reaction. While the short-term effects are apparent, the long-term consequences remain uncertain and depend on various economic and political factors. This article highlighted the immediate market response, expert analysis, and the broader economic context surrounding this event. The interplay between political statements and market movements underscores the importance of staying informed about key developments affecting the US economy.

Call to Action: Stay informed on future developments related to Trump's influence on the economy and monitor US stock futures closely for further insights. Understanding these market shifts is crucial for informed investment decisions. Learn more about the impact of presidential remarks on stock market trends by subscribing to our newsletter or following us on social media.

Featured Posts

-

Us Lawyers Face Judge Abrego Garcias Order To Cease Stonewalling

Apr 24, 2025

Us Lawyers Face Judge Abrego Garcias Order To Cease Stonewalling

Apr 24, 2025 -

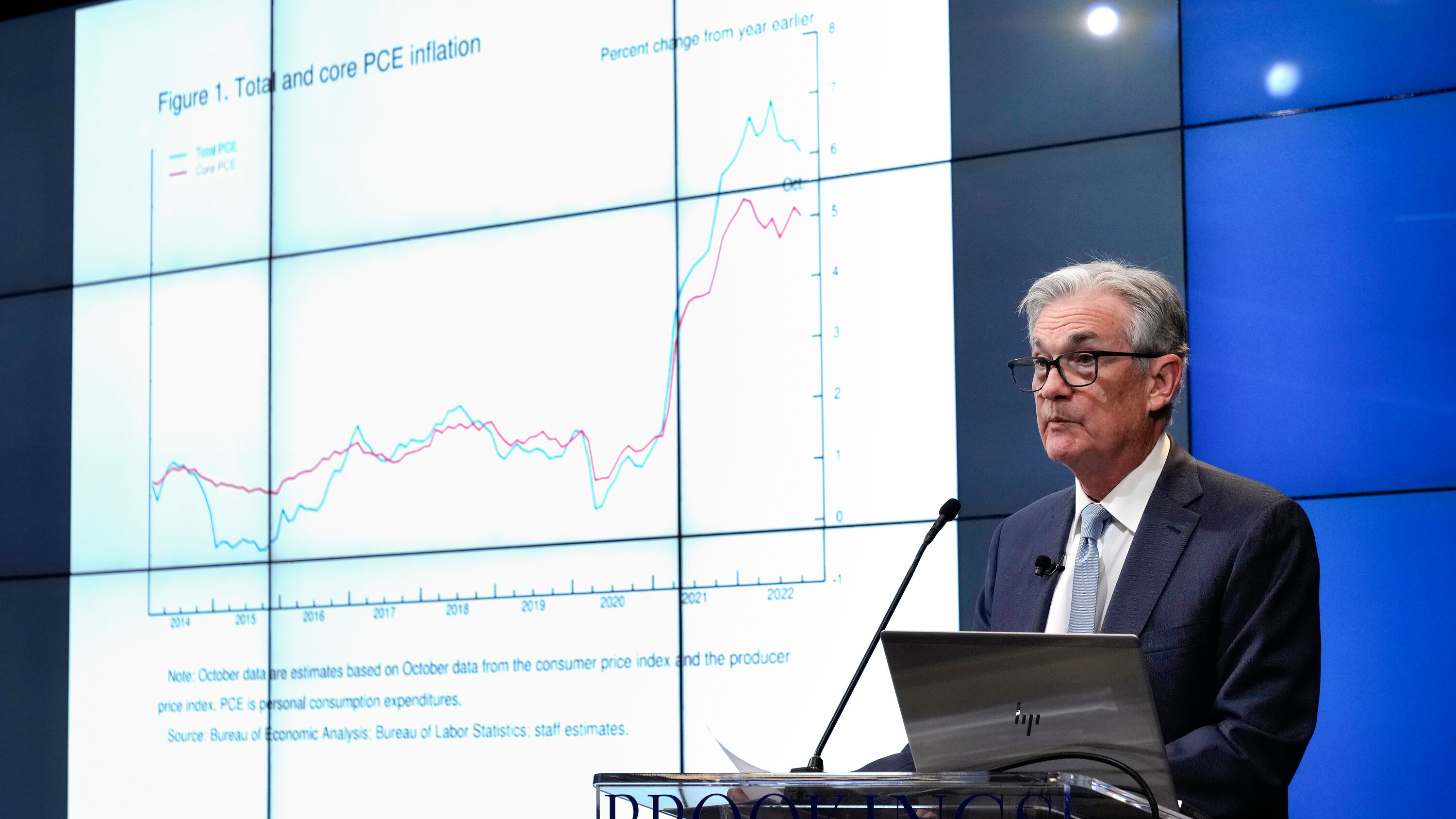

Consumers Cut Back How Credit Card Companies Are Responding

Apr 24, 2025

Consumers Cut Back How Credit Card Companies Are Responding

Apr 24, 2025 -

The Bold And The Beautiful April 3rd Liam Collapses Following Fierce Bill Argument

Apr 24, 2025

The Bold And The Beautiful April 3rd Liam Collapses Following Fierce Bill Argument

Apr 24, 2025 -

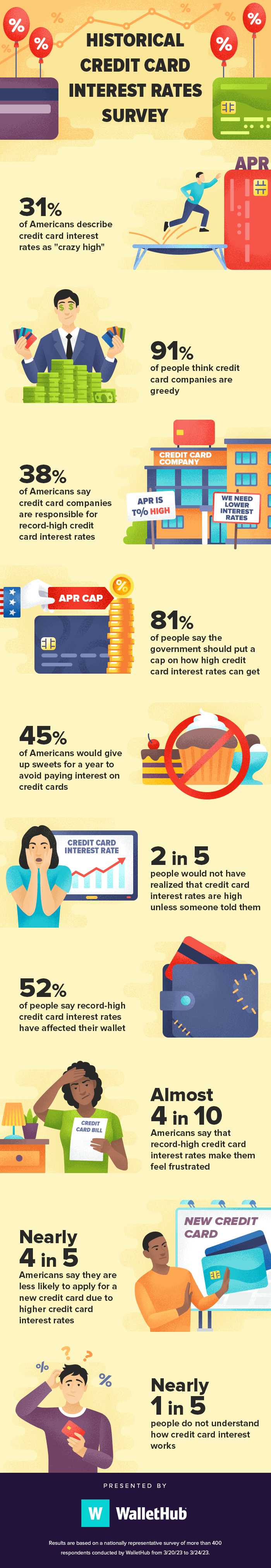

5 Essential Dos And Don Ts Succeeding In The Private Credit Market

Apr 24, 2025

5 Essential Dos And Don Ts Succeeding In The Private Credit Market

Apr 24, 2025 -

Instagram Takes On Tik Tok With New Video Editing App

Apr 24, 2025

Instagram Takes On Tik Tok With New Video Editing App

Apr 24, 2025