Tesla's Rise Lifts US Stocks: Tech Giants Power Market Growth

Table of Contents

Tesla's Influence on the US Stock Market

Record-Breaking Performance and Investor Sentiment

Tesla's recent stock price surges have dramatically impacted investor confidence. The company's consistent delivery of record-breaking quarters, fueled by increased production and expansion into new markets, has created a positive feedback loop. This remarkable growth has significantly boosted Tesla's market capitalization and influenced the overall market sentiment.

- Examples of record-breaking performance: Consistently exceeding production targets, reporting record quarterly revenues and profits, successful launches of new vehicle models (e.g., Cybertruck anticipation), and expansion into new energy sectors.

- Positive news impacting stock price: Announcements of new Gigafactories, strategic partnerships, and advancements in battery technology have all contributed to positive investor sentiment and increased Tesla stock performance.

- Keyword integration: Analyzing Tesla's stock performance is crucial for understanding shifts in investor confidence and broader market trends. The company's market capitalization is now among the highest globally, reflecting the immense faith investors have in its future.

The Ripple Effect on Related Industries

Tesla's success isn't confined to its own operations. Its growth has created a ripple effect, positively impacting other companies within the EV sector, battery technology, and renewable energy. The increased demand for electric vehicles and related components has stimulated investment and innovation across the entire supply chain.

- Companies benefiting from Tesla's growth: Suppliers of battery materials, charging infrastructure providers, and companies involved in autonomous driving technology are experiencing increased demand and revenue.

- Supply chain relationships: Tesla's massive scale requires a robust supply chain, benefiting numerous companies involved in the production and distribution of its vehicles and energy products. This creates significant opportunities for growth and economic expansion.

- Keyword integration: The expansion of the EV sector, advancements in battery technology, and the surge in renewable energy stocks are all directly linked to Tesla's market leadership and influence.

The Broader Tech Sector's Contribution to Market Growth

Performance of Major Tech Companies

The strong performance of Tesla isn't an isolated incident. Other major tech companies, including Apple, Microsoft, Google (Alphabet), Amazon, and Facebook (Meta) – often referred to as FAANG stocks – have also significantly contributed to overall market growth. Their consistent innovation and robust financial performance have bolstered investor confidence and propelled the stock market higher.

- Stock performance data for major tech companies: Consistent year-over-year growth in revenue and earnings for many of these companies indicates a healthy and expanding tech sector.

- Market share analysis: The dominance of these tech giants in their respective markets further underscores their importance to the overall market’s strength.

- Keyword integration: The collective performance of tech stocks, coupled with their significant market share, directly impacts the overall health and growth of the US stock market. Understanding tech sector growth is vital for any serious investor.

Innovation and Future Growth Potential

Technological innovation is a core driver of the tech sector's growth and its impact on the broader market. Emerging technologies like artificial intelligence (AI), cloud computing, and the metaverse hold immense potential for future market expansion.

- Emerging technologies and their market impact: AI is transforming various industries, while cloud computing is becoming the backbone of modern business. The metaverse promises to revolutionize the way we interact digitally.

- Predictions for future growth: Analysts predict continued robust growth in these sectors, contributing significantly to the overall growth of the US economy and the stock market.

- Keyword integration: Continued investment in technological innovation, particularly in AI and cloud computing, will be key drivers of future market trends and growth.

Economic Factors Amplifying Tesla's and Tech's Impact

Low Interest Rates and Investor Appetite for Risk

Macroeconomic factors have played a significant role in amplifying the impact of Tesla and the broader tech sector. Low interest rates have encouraged investors to seek higher-yielding assets, leading to increased investment in growth stocks like those in the technology sector.

- Analysis of interest rate environments: Periods of low interest rates typically correlate with increased investment in riskier assets like tech stocks, driving up their valuations.

- Risk tolerance of investors: Low interest rates generally increase investor risk tolerance, making them more willing to invest in growth-oriented companies even with higher perceived risks.

- Keyword integration: Understanding the relationship between interest rates, investor behavior, and market volatility is crucial to assessing the future performance of the tech sector and Tesla specifically.

Global Economic Recovery and Demand for Tech Products

The global economic recovery following the pandemic has fueled demand for tech products and services, benefiting tech companies significantly. Increased consumer spending and business investment have boosted revenue for many tech firms, contributing to strong stock performance.

- Global economic indicators: Positive global economic indicators, such as rising consumer confidence and increased industrial production, point to continued demand for tech products and services.

- Demand for tech products: This demand is driving revenue growth for tech companies across various sectors, from software to hardware to e-commerce.

- Keyword integration: The global economic recovery is closely linked to the demand for tech products, which in turn positively affects revenue growth and stock prices.

Conclusion

Tesla's rise has had a profound impact on the US stock market, acting as a catalyst for growth within the broader tech sector. The company's record-breaking performance has boosted investor confidence, creating a ripple effect that extends to related industries. Simultaneously, the overall strong performance of major tech companies, coupled with low interest rates and a global economic recovery, has further amplified this positive trend. Understanding Tesla's influence and the overall health of the tech sector is critical for navigating the current economic landscape. Stay informed about Tesla's progress and the overall tech sector to make informed investment decisions. Understanding Tesla's rise and its influence on the market is crucial for navigating current economic trends.

Featured Posts

-

Gpu Prices Soar Are We Heading For Another Crisis

Apr 28, 2025

Gpu Prices Soar Are We Heading For Another Crisis

Apr 28, 2025 -

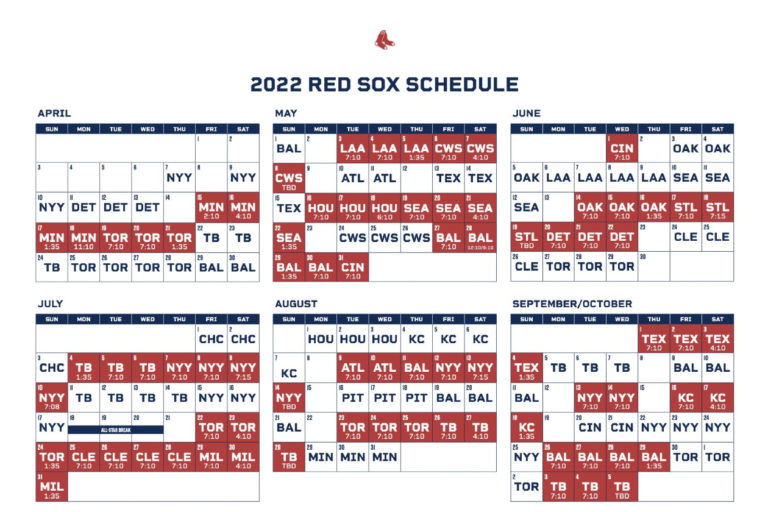

Red Sox 2025 Finding A Replacement For Tyler O Neill

Apr 28, 2025

Red Sox 2025 Finding A Replacement For Tyler O Neill

Apr 28, 2025 -

Can We Curb Americas Truck Bloat Examining Current Strategies And Future Needs

Apr 28, 2025

Can We Curb Americas Truck Bloat Examining Current Strategies And Future Needs

Apr 28, 2025 -

Latest Mets News Neuse Optioned Megills Return To Rotation

Apr 28, 2025

Latest Mets News Neuse Optioned Megills Return To Rotation

Apr 28, 2025 -

Latest U S Iran Nuclear Negotiations End Without Breakthrough

Apr 28, 2025

Latest U S Iran Nuclear Negotiations End Without Breakthrough

Apr 28, 2025