Tesla, SpaceX, And The EPA: The Impact Of Elon Musk's DOGE Strategy

Table of Contents

The Dogecoin Effect on Tesla's Stock Price and Brand Image

Musk's tweets and public pronouncements about DOGE have sent shockwaves through the financial markets, directly impacting Tesla's stock price and brand perception.

Market Volatility and Investor Sentiment

- Significant Price Swings: Several instances show a clear correlation between Musk's DOGE-related tweets and significant fluctuations in Tesla's stock price. For example, a single tweet praising DOGE can trigger a surge, while a critical remark can lead to a sharp decline. This volatility creates uncertainty for investors.

- Investor Concerns and Reputation: Many investors view Musk's DOGE focus as a distraction from Tesla's core business – developing and manufacturing electric vehicles. This raises concerns about his commitment to long-term strategic goals and negatively impacts Tesla's image as a serious technological innovator. Some question whether the company's resources are being appropriately allocated.

Brand Perception and Target Audience

- Appeal to Younger Consumers: Musk's association with DOGE has broadened Tesla's appeal to a younger, cryptocurrency-savvy demographic. This group often views Musk as a forward-thinking innovator, aligning Tesla with the cutting-edge world of digital assets.

- Concerns from Traditional Investors: Conversely, more traditional investors may view this association negatively, perceiving it as risky and potentially unprofessional. This could deter potential investors seeking stability and predictable returns.

- Marketing Strategy Shifts: Tesla's marketing hasn't explicitly integrated DOGE, but the indirect association through Musk's public persona subtly alters its brand perception. This necessitates a nuanced understanding of how to manage the positive and negative impacts of this association.

SpaceX and Dogecoin: A Less Direct but Still Significant Connection

While SpaceX's operational activities aren't directly tied to DOGE, Musk's public persona significantly influences the perception of this space exploration company.

Indirect Influence through Brand Association

- The Halo Effect: Musk's actions, including his DOGE advocacy, create a "halo effect" where positive (or negative) perceptions of one venture influence perceptions of his other ventures. His DOGE activities might thus impact investor confidence in SpaceX.

- Investor Concerns and Risk Perception: Some investors might view Musk's involvement with DOGE as a sign of excessive risk-taking, impacting their willingness to invest in SpaceX, a venture demanding significant financial resources and long-term commitment.

Potential for Future DOGE Integration (Speculative)

It's purely speculative, but the possibility of DOGE integration in future SpaceX projects can be considered:

- Challenges and Opportunities: Integrating a highly volatile cryptocurrency like DOGE into space exploration presents significant challenges, including price fluctuations and regulatory hurdles. However, it could also open up innovative financing models and partnerships.

- Regulatory Implications: Any attempt to incorporate DOGE into SpaceX transactions would necessitate navigating complex regulatory landscapes regarding cryptocurrency usage in international space commerce.

Regulatory Scrutiny: The EPA and the Implications of Musk's DOGE Activities

Musk's preoccupation with DOGE raises questions about potential conflicts of interest and regulatory compliance, particularly concerning Tesla's environmental commitments and securities regulations.

Environmental Concerns and Corporate Responsibility

- Conflicts of Interest: Promoting a cryptocurrency, whose mining process consumes significant energy, could clash with Tesla's commitment to environmental sustainability and its efforts to promote clean energy. This conflict potentially attracts EPA scrutiny.

- EPA Response: The EPA might scrutinize Tesla's environmental impact statements and sustainability claims more closely, considering the potential indirect environmental impact of Musk's DOGE advocacy.

Securities Law Compliance and Market Manipulation Concerns

- Market Manipulation Concerns: Musk's public statements about DOGE have been scrutinized for potential violations of securities laws related to market manipulation, impacting not only Tesla but also the broader cryptocurrency market.

- SEC Role: The Securities and Exchange Commission (SEC) plays a vital role in investigating potential securities law violations stemming from Musk's public pronouncements and their impact on market behavior.

Conclusion: Navigating the Complex Landscape of Elon Musk's DOGE Strategy

Musk's DOGE strategy presents a complex interplay between his personal brand, the financial performance of his companies (Tesla and SpaceX), and the responses from regulatory bodies like the EPA and the SEC. His actions, while potentially boosting brand appeal to certain demographics, also introduce volatility and regulatory risks. The long-term impact remains uncertain, but it clearly demonstrates the intricate and evolving relationship between entrepreneurs, cryptocurrencies, and regulatory oversight. What will the future hold for Elon Musk’s DOGE strategy and its impact on his companies?

Featured Posts

-

California Gas Prices Soar Newsoms Plea For Oil Industry Cooperation

Apr 24, 2025

California Gas Prices Soar Newsoms Plea For Oil Industry Cooperation

Apr 24, 2025 -

The Los Angeles Wildfires When Disaster Becomes A Gambling Opportunity

Apr 24, 2025

The Los Angeles Wildfires When Disaster Becomes A Gambling Opportunity

Apr 24, 2025 -

T Mobile Data Breaches Result In 16 Million Penalty

Apr 24, 2025

T Mobile Data Breaches Result In 16 Million Penalty

Apr 24, 2025 -

Liam And Steffy A Bold And The Beautiful Preview Next 2 Weeks

Apr 24, 2025

Liam And Steffy A Bold And The Beautiful Preview Next 2 Weeks

Apr 24, 2025 -

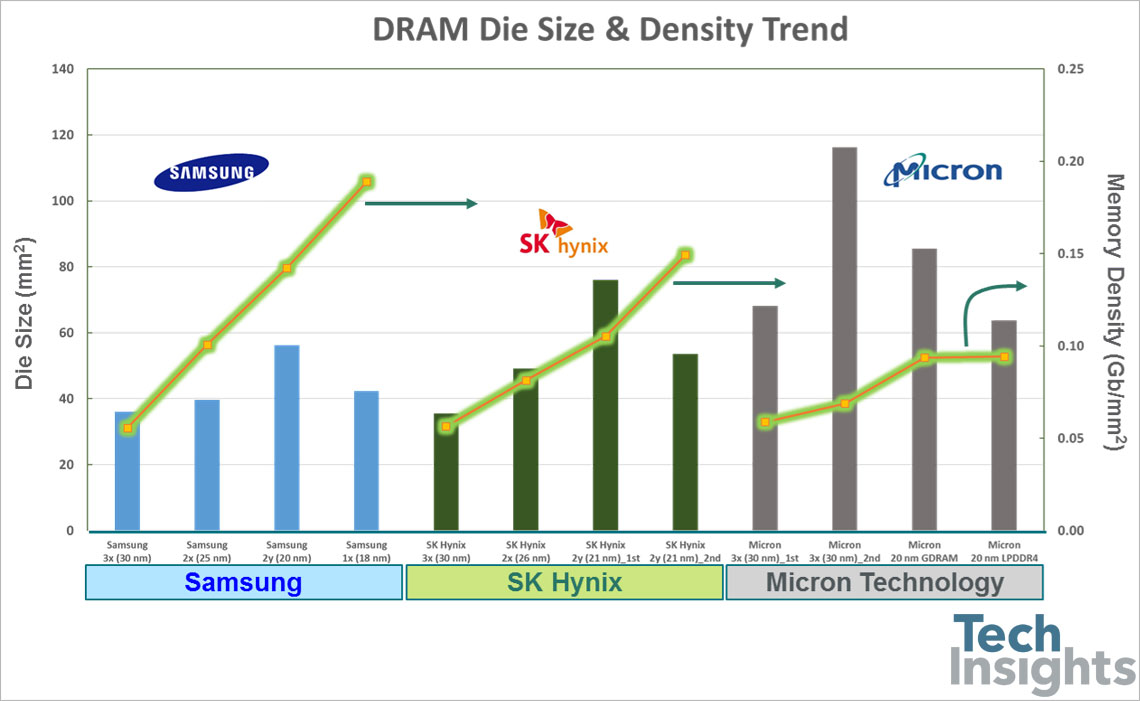

Shifting Sands Sk Hynix Emerges As Potential Dram Market Leader

Apr 24, 2025

Shifting Sands Sk Hynix Emerges As Potential Dram Market Leader

Apr 24, 2025