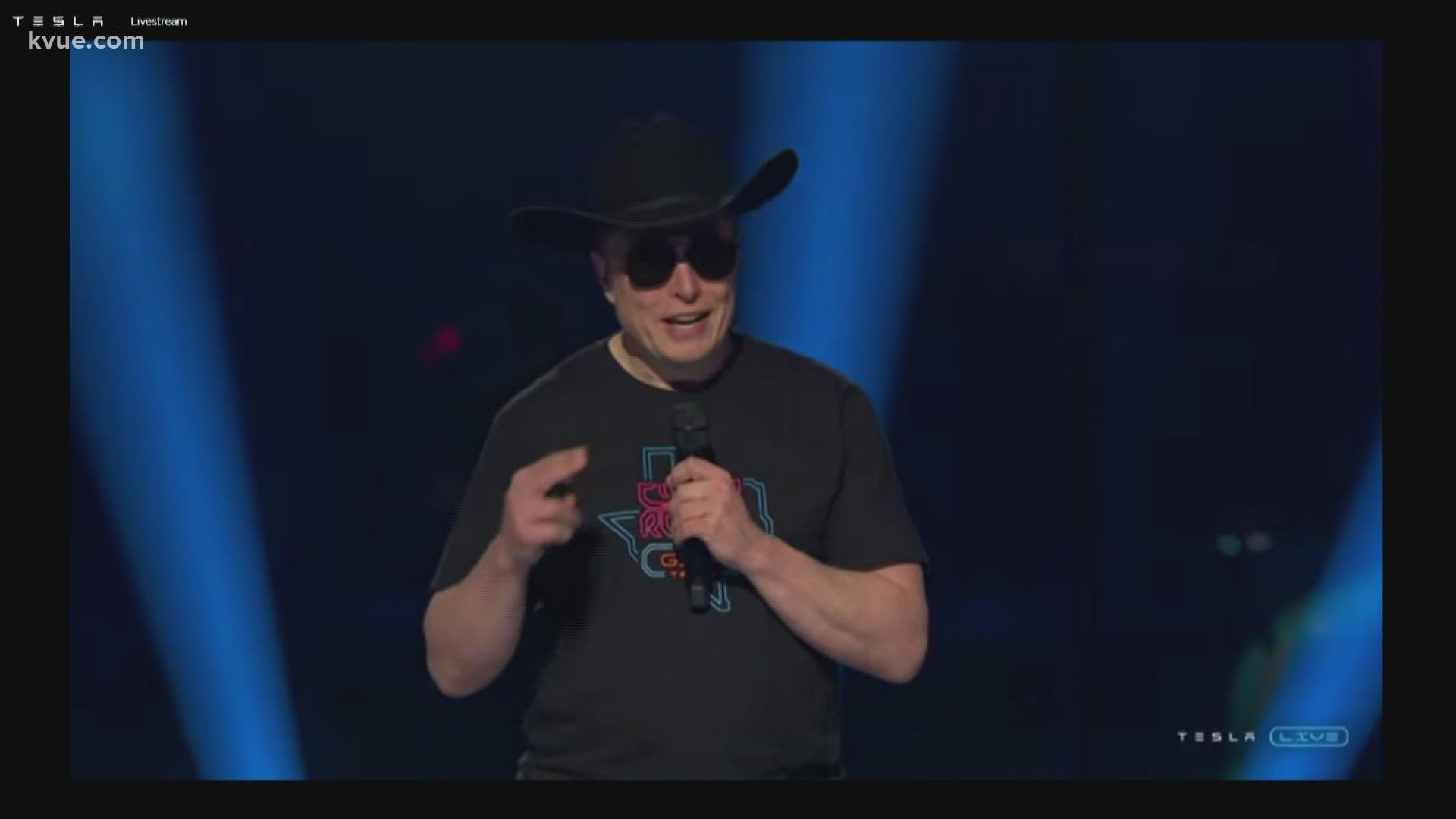

Tesla Q1 Profits Plummet Amid Musk Backlash And Trump Ties

Table of Contents

The Impact of Elon Musk's Controversial Actions

Elon Musk's actions, both in his role as CEO of Tesla and as the owner of X (formerly Twitter), have significantly impacted Tesla's brand image and investor sentiment. His controversial tweets, impulsive decisions, and involvement in ventures like Dogecoin have created uncertainty and eroded investor confidence. The keywords associated with this section – Elon Musk controversies, Tesla brand image, Musk Twitter, Dogecoin, and Tesla investor sentiment – highlight the key issues.

-

Erratic Tweets and Social Media Behavior: Musk's frequent and often controversial tweets have led to market volatility in Tesla stock. His impulsive pronouncements, regardless of their accuracy, have created a climate of uncertainty that negatively impacts investor confidence and the overall perception of the company. Several instances of this behavior directly correlate with significant drops in Tesla's stock price.

-

The Twitter Acquisition and Its Ramifications: The acquisition of Twitter (now X), a deal fraught with financial risk and operational challenges, has diverted significant resources and attention away from Tesla. The controversy surrounding the acquisition, including questions about its funding and Musk’s management style, has further undermined investor trust in his leadership.

-

Dogecoin Promotion and its Impact on Tesla's Reputation: Musk's vocal support for Dogecoin, a cryptocurrency with high volatility and a history of market manipulation accusations, has damaged Tesla's reputation among those who view the promotion as irresponsible and potentially damaging to the company's image. This has also raised concerns about potential conflicts of interest.

-

Negative Press and Public Perception: The cumulative effect of these controversies has led to a significant amount of negative press coverage, contributing to a decline in public perception of both Musk and Tesla. This negative publicity directly translates into decreased investor confidence and potentially lower sales.

The Influence of Trump Ties on Tesla's Public Image

Musk's increasingly overt public support for Donald Trump and his political agenda represents another significant factor contributing to Tesla's Q1 profit decline. This alignment carries significant implications for the company’s public image and sales, particularly among consumers who hold opposing political views. Keywords like Trump and Tesla, political affiliations, Tesla political impact, Republican support, and Tesla public relations aptly capture this section's focus.

-

Alienation of Customer Segments: Musk's vocal support for Trump has the potential to alienate a significant portion of Tesla's customer base, particularly those who strongly disapprove of Trump's policies and political stance. This could lead to decreased sales and brand loyalty.

-

Political Polarization and its Effects on Sales: The highly polarized political climate in the United States and globally means that Musk's association with Trump could activate boycotts and negatively influence purchasing decisions among potential customers.

-

Potential for Negative Campaigns: Musk's political stance leaves Tesla vulnerable to targeted negative campaigns, potentially impacting brand perception and sales.

-

Impact on International Markets: Musk's political associations could also negatively impact Tesla's sales in international markets where Trump's popularity is low.

Weakening Demand and Increased Competition

Tesla's reduced profits are also a consequence of weakening demand for its vehicles and the growing intensity of competition within the EV market. The keywords for this section – Tesla sales, electric vehicle market, EV competition, Tesla price cuts, and Tesla market share – clearly define its focus.

-

Rise of New Competitors: The EV market is experiencing a rapid influx of new competitors offering increasingly competitive products. This increased competition is putting pressure on Tesla's market share and pricing strategies.

-

Tesla's Price Cuts and Profitability: Tesla’s recent price cuts, while aimed at boosting sales, have also significantly impacted its profit margins. This strategy, while necessary in a competitive market, has directly contributed to the reduction in overall profitability.

-

Declining Sales Figures: Tesla's Q1 sales figures reflect a decline in demand, indicating a softening market and increased pressure from competitors. This drop in sales volume is a major contributor to the reduced profitability.

-

Market Share Erosion: Tesla's market share in several key markets is showing signs of erosion, signaling a shift in consumer preferences and the effectiveness of competitor strategies.

Supply Chain Issues and Inflationary Pressures

Adding to the challenges, Tesla, like many other manufacturers, continues to grapple with supply chain disruptions and inflationary pressures. Keywords relevant to this subsection include Tesla supply chain, inflation, raw materials costs, manufacturing costs, and Tesla production.

-

Supply Chain Disruptions: Ongoing supply chain issues continue to impact Tesla's production capabilities and increase its manufacturing costs. This increased cost directly affects profitability.

-

Inflationary Pressures on Costs: Rising prices for raw materials and other essential inputs are further squeezing Tesla's profit margins. Inflationary pressures add another layer of difficulty to the company’s financial performance.

-

Impact on Production and Profitability: The combined effect of supply chain issues and inflation is a significant constraint on Tesla's production capacity and overall profitability.

Conclusion

Tesla's significant Q1 profit plummet is a multifaceted issue stemming from a confluence of factors: Elon Musk's controversies and his political alignment with Trump have damaged the brand image and investor confidence; increased competition and weakening demand have pressured sales and margins; and ongoing supply chain disruptions and inflationary pressures have further constrained profitability. These factors all contributed to the disappointing Tesla Q1 earnings.

To fully understand the future of Tesla, it's crucial to stay informed about the evolving situation and the ongoing impact of these influential factors. Continue following our coverage for further analysis of Tesla Q1 earnings and subsequent financial reports. We'll keep you updated on how these factors impact the future of Tesla and the electric vehicle market. Understanding the interplay of these issues is key to predicting Tesla's future financial performance and its position within the increasingly competitive electric vehicle market.

Featured Posts

-

Building A Sustainable Canada Prioritizing Fiscal Responsibility

Apr 24, 2025

Building A Sustainable Canada Prioritizing Fiscal Responsibility

Apr 24, 2025 -

Zaboravljeni Film Tarantino I Travolta U Neuspjesnoj Suradnji

Apr 24, 2025

Zaboravljeni Film Tarantino I Travolta U Neuspjesnoj Suradnji

Apr 24, 2025 -

Klaus Schwab Under Scrutiny World Economic Forum Faces New Inquiry

Apr 24, 2025

Klaus Schwab Under Scrutiny World Economic Forum Faces New Inquiry

Apr 24, 2025 -

Celebrities Affected By The La Palisades Fires A Comprehensive List Of Home Losses

Apr 24, 2025

Celebrities Affected By The La Palisades Fires A Comprehensive List Of Home Losses

Apr 24, 2025 -

Why Middle Managers Are Essential For Company Success And Employee Well Being

Apr 24, 2025

Why Middle Managers Are Essential For Company Success And Employee Well Being

Apr 24, 2025