Tesla Earnings Miss Expectations: Political Factors Weigh Heavily On Q1 Results

Table of Contents

Supply Chain Disruptions and Production Challenges

Global supply chain issues significantly hampered Tesla's production capabilities and, consequently, its earnings. The ongoing semiconductor shortage, a problem plaguing many industries, directly impacted Tesla's ability to produce vehicles at its desired rate. This "Tesla production" slowdown translated into fewer vehicles delivered and, ultimately, lower revenue. Furthermore, the increased costs of raw materials, including lithium – a critical component in EV batteries – and steel, added significant pressure to profit margins. Logistics bottlenecks and shipping delays further exacerbated the situation, hindering the timely delivery of both components and finished vehicles.

- Impact of the chip shortage on Tesla's vehicle production: Production lines were frequently idled due to a lack of essential chips, directly impacting vehicle output.

- Increased costs of raw materials like lithium and steel: The rising prices of these crucial materials significantly increased the cost of manufacturing each vehicle, squeezing profit margins.

- Logistics bottlenecks and delays in shipping: Global shipping disruptions resulted in longer lead times for parts and finished vehicles, further contributing to production delays and increased costs. This directly affected "Tesla vehicle deliveries."

Regulatory Hurdles and Government Policies

Tesla faces a complex regulatory landscape across its various markets, and shifting government policies significantly influenced its Q1 performance. New and stricter emission standards in several key regions forced Tesla to adapt its vehicle development strategies and potentially incur additional costs. Furthermore, the evolving regulations surrounding autonomous driving technology presented significant challenges, impacting the rollout and commercial viability of its advanced driver-assistance systems. Trade wars and tariffs in different countries also impacted Tesla's international operations, creating additional complexities and potentially reducing profitability in specific markets.

- Impact of new emission standards on Tesla's vehicle development: Meeting increasingly stringent emission regulations requires significant investment in research and development, adding to operational costs.

- Challenges faced with autonomous driving regulations: Varying regulatory frameworks across different jurisdictions create hurdles in deploying and scaling Tesla's autonomous driving features.

- Trade wars and tariffs affecting Tesla's international operations: Import and export restrictions and tariffs increased the cost of doing business in certain regions.

Geopolitical Instability and Market Uncertainty

Geopolitical instability and the resulting market uncertainty significantly affected Tesla's Q1 performance. The war in Ukraine, for example, caused disruptions in raw material supply chains, further exacerbating the challenges already presented by the semiconductor shortage. Rising inflation globally impacted consumer spending, reducing demand for high-priced vehicles like Tesla's. This decreased consumer demand, coupled with broader economic uncertainty, also negatively affected investor sentiment and the overall "Tesla stock price," contributing to market volatility.

- Effect of the war in Ukraine on raw material prices and supply chains: The conflict disrupted crucial supply lines, leading to price increases and shortages of essential components.

- Impact of rising inflation on consumer spending and vehicle purchases: Increased inflation reduced consumer disposable income, impacting demand for luxury goods such as Tesla vehicles.

- Uncertainty in the global economy affecting investor confidence in Tesla: The overall economic climate and geopolitical uncertainty led to decreased investor confidence, impacting Tesla's stock valuation.

Competition and Market Dynamics

Tesla is no longer alone in the electric vehicle market. The "electric vehicle competition" is intensifying, with established automakers and new entrants aggressively pursuing market share. This increased competition placed pressure on Tesla's pricing strategies and profitability. Competitors are increasingly offering comparable vehicles at more competitive price points, creating pricing pressure. Furthermore, rapid technological advancements from rivals are challenging Tesla's technological leadership.

- Growth of competing EV brands and their market impact: The expanding presence of competitive EV brands is eroding Tesla's market dominance.

- Pricing pressure from competitors: Competitors are offering comparable EVs at lower prices, forcing Tesla to respond with potentially lower profit margins.

- Technological advancements from rivals: The rapid pace of technological innovation from competitors is threatening Tesla's technological advantage.

Conclusion

The "Tesla Earnings Miss Expectations" in Q1 2024 can be attributed to a confluence of factors, with external political and economic forces playing a significant role. Supply chain disruptions, regulatory hurdles, geopolitical instability, and intensifying competition all contributed to the company's disappointing results. While Tesla faces considerable challenges, it also possesses considerable technological expertise and brand recognition. The outlook for future performance depends heavily on how effectively Tesla navigates these challenges and what impact future political developments will have on their earnings. Keep an eye on how Tesla navigates these challenges and what impact future political developments will have on their earnings; the future performance of the company will remain a key indicator of the EV market's health and trajectory. Stay updated on further developments related to Tesla Earnings Miss Expectations and continue following the company's performance in subsequent quarters.

Featured Posts

-

Chalet Girl Jobs In Europe A Realistic Look At The Perks And Challenges

Apr 24, 2025

Chalet Girl Jobs In Europe A Realistic Look At The Perks And Challenges

Apr 24, 2025 -

A More Global Church Examining Pope Francis Complex Legacy

Apr 24, 2025

A More Global Church Examining Pope Francis Complex Legacy

Apr 24, 2025 -

Is Voting Liberal Right For You William Watsons Platform Review

Apr 24, 2025

Is Voting Liberal Right For You William Watsons Platform Review

Apr 24, 2025 -

7

Apr 24, 2025

7

Apr 24, 2025 -

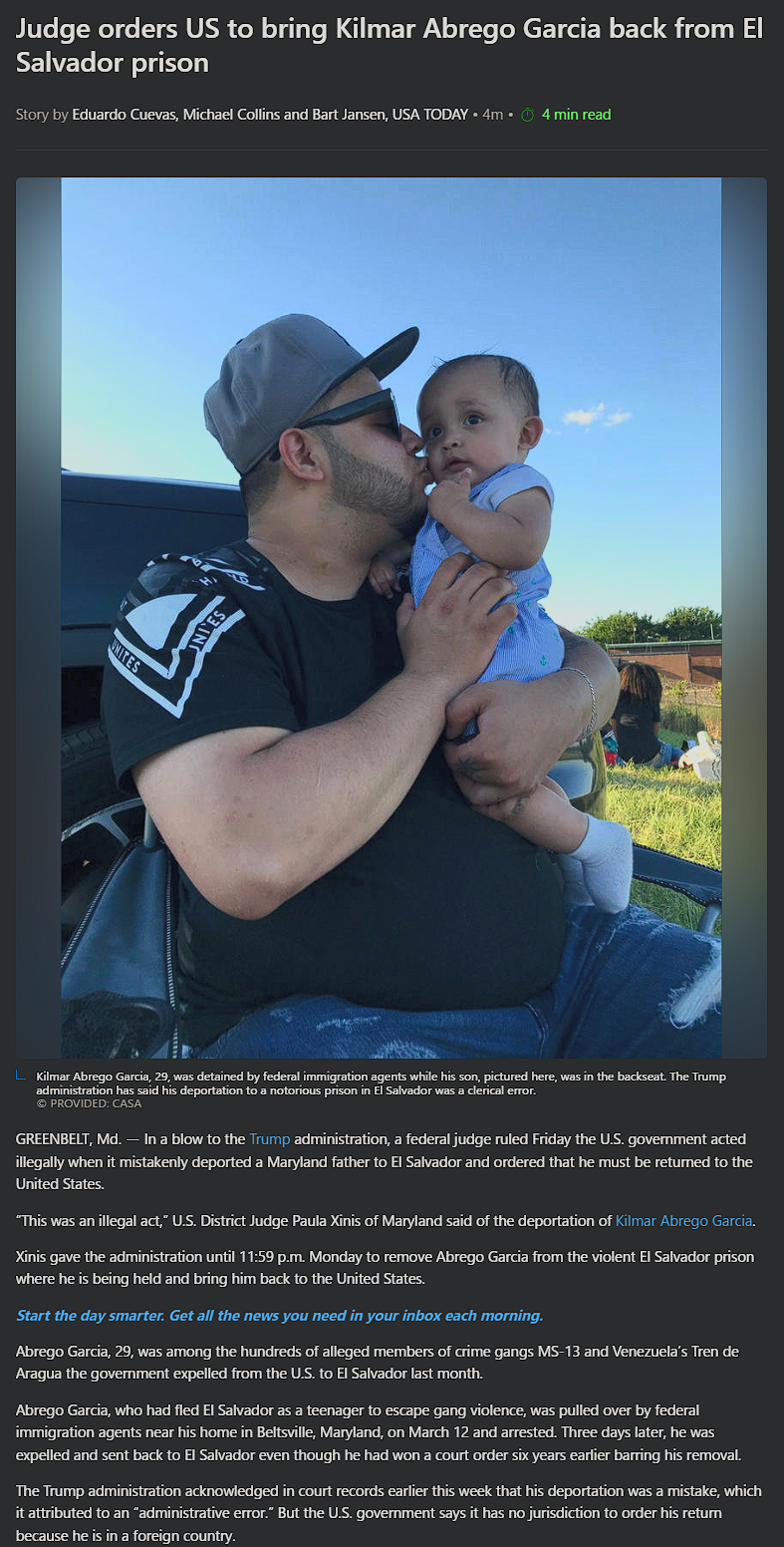

Judge Abrego Garcias Warning Stonewalling In Us Legal Cases Must End

Apr 24, 2025

Judge Abrego Garcias Warning Stonewalling In Us Legal Cases Must End

Apr 24, 2025