Tesla And Tech Drive US Stock Market Surge

Table of Contents

Tesla's Impact on Market Sentiment

Tesla's exceptional performance has significantly boosted investor confidence, not only in the electric vehicle (EV) sector but also in the broader tech industry. The company's recent success stems from a confluence of factors: strong financial results, innovative product launches, and positive media coverage.

- Strong Q[Quarter] earnings exceeding expectations: Consistently surpassing analyst predictions demonstrates Tesla's robust financial health and growth potential, influencing investor sentiment positively. This strong financial performance directly correlates with a rise in Tesla's stock price and broader market optimism.

- Successful launches of new models or features: The introduction of new vehicles and cutting-edge technologies keeps Tesla at the forefront of innovation, attracting both consumers and investors. Announcements of new features, such as autonomous driving advancements, generate excitement and propel stock prices.

- Positive media coverage and analyst upgrades: Favorable media attention and positive analyst reports reinforce investor confidence in Tesla's future prospects, creating a self-reinforcing cycle of positive market sentiment. This positive press coverage extends beyond financial news, impacting public perception and contributing to market enthusiasm.

- Growing market share in the electric vehicle market: Tesla's continued dominance in the EV sector solidifies its position as a market leader, attracting further investment and reinforcing its status as a growth stock. This leadership position fuels confidence in the long-term viability of the EV industry and associated technologies.

- Expansion into new markets and energy sectors: Tesla's diversification into energy storage and solar power demonstrates its ambition and potential for growth beyond the automotive sector, adding another layer of appeal to investors seeking long-term growth opportunities. This diversification reduces risk and broadens investment appeal.

The Broader Tech Sector's Contribution

Beyond Tesla, the broader technology sector has played a crucial role in the recent market surge. Major tech companies like Apple, Microsoft, and Google have delivered strong financial results, fueled by technological innovation and increasing consumer demand.

- Strong growth in cloud computing and software services: The ongoing shift towards cloud-based solutions has driven significant revenue growth for many tech giants, attracting investors seeking stable and high-growth opportunities. The cloud computing market is expected to continue growing, making it an attractive investment sector.

- Increased demand for AI and related technologies: The rising popularity of artificial intelligence (AI) and related technologies has created new opportunities for growth and innovation, bolstering investor confidence in the future of the tech sector. AI-related investments are seen as high-growth potential, attracting significant investment.

- Positive investor sentiment towards the future of the tech sector: The perception of continued innovation and technological advancements has fostered a positive outlook for the tech sector among investors, leading to increased investment and higher stock valuations. This positive sentiment is fueled by ongoing innovation and the potential for future breakthroughs.

- Successful product launches and market penetration: New product launches and successful market penetration by major tech companies contribute to positive financial results and increased investor confidence. This sustained success in the market demonstrates the ability of tech companies to translate innovation into tangible financial returns.

- Government support and investment in technological development: Government initiatives and investments in technological research and development further strengthen the outlook for the tech sector, providing an additional boost to investor sentiment. This support from governments worldwide underscores the strategic importance of the technology sector to national economies.

Macroeconomic Factors Influencing the Surge

While Tesla and the tech sector are significant drivers, macroeconomic factors also contribute to the market's upward trend.

- Lower-than-expected inflation rates: Easing inflation concerns reduce the likelihood of aggressive interest rate hikes by central banks, creating a more favorable environment for stock market growth. Lower inflation boosts consumer spending and reduces the risk of an economic downturn.

- Easing concerns about potential recession: Decreased fears of an imminent recession encourage investors to take on more risk, leading to increased investment in the stock market, including tech stocks. Reduced recessionary fears increase investor confidence and encourage risk-taking behavior.

- Increased consumer spending: Robust consumer spending fuels demand for goods and services, benefiting companies across various sectors, including technology and those related to the EV industry. Increased consumer confidence translates into stronger economic growth.

- Government economic stimulus policies: Government interventions designed to stimulate economic growth can have a positive impact on the stock market, particularly in sectors like technology that are seen as key drivers of future economic growth. Stimulus packages can create artificial demand and boost economic growth in the short term.

- Global economic recovery: A strengthening global economy creates a more positive outlook for businesses and investors worldwide, contributing to increased stock market valuations. A global recovery enhances market sentiment and provides opportunities for investment across diverse sectors.

Risks and Potential Corrections

Despite the positive momentum, several risks could lead to a market correction.

- Potential overvaluation of certain tech stocks: Some tech stocks may be overvalued relative to their fundamentals, making them vulnerable to price corrections if investor sentiment shifts. Overvalued stocks are particularly susceptible to market downturns and corrections.

- Geopolitical uncertainties and global economic instability: Geopolitical events and global economic uncertainty can negatively impact investor confidence and lead to a market downturn. Unforeseen events can quickly erode confidence and trigger market corrections.

- Changes in interest rates or monetary policy: Changes in interest rates by central banks can impact borrowing costs for businesses and investors, influencing investment decisions and potentially leading to market corrections. Interest rate adjustments are a powerful tool used to manage economic growth.

- Increased competition within the tech sector: Intense competition within the tech industry can put pressure on profit margins and stock valuations, leading to potential corrections. Competition can lead to price wars and reduce profitability, impacting stock performance.

- Potential regulatory hurdles facing Tesla and other tech companies: Increased regulatory scrutiny and potential policy changes can negatively impact the performance of Tesla and other tech companies, influencing the broader market. Regulatory hurdles can slow down growth and reduce profitability.

Conclusion: Understanding the Tesla and Tech Driven US Stock Market Surge

The recent surge in the US stock market is largely attributed to the exceptional performance of Tesla and the broader strength of the tech sector. This growth is further supported by favorable macroeconomic factors. However, it is crucial to acknowledge the potential risks and vulnerabilities associated with this upward trend. Understanding both the positive and negative aspects is key to making informed investment decisions. Stay updated on the latest developments in Tesla and tech stocks to navigate the complexities of this dynamic market. Continue to monitor the impact of Tesla and tech on the US stock market surge for a comprehensive understanding of its trajectory. Further research into macroeconomic trends and individual company performance will enhance your ability to make sound investment choices in this exciting and rapidly evolving sector.

Featured Posts

-

Qayd Eam Shrtt Abwzby Yhny Mnswbyh Wytfqd Jahzyt Aleml Khlal Almnawbat

Apr 28, 2025

Qayd Eam Shrtt Abwzby Yhny Mnswbyh Wytfqd Jahzyt Aleml Khlal Almnawbat

Apr 28, 2025 -

The Countrys Top Business Locations Growth Trends And Opportunities

Apr 28, 2025

The Countrys Top Business Locations Growth Trends And Opportunities

Apr 28, 2025 -

Jj Redick Praises Espns Decision On Richard Jefferson

Apr 28, 2025

Jj Redick Praises Espns Decision On Richard Jefferson

Apr 28, 2025 -

Aaron Judge Equals Babe Ruths Legendary Yankees Record

Apr 28, 2025

Aaron Judge Equals Babe Ruths Legendary Yankees Record

Apr 28, 2025 -

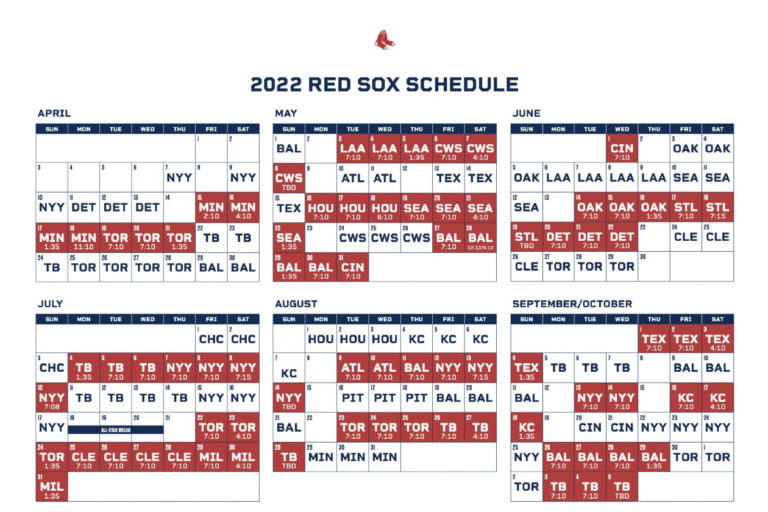

The Red Sox 2025 Outfield An Espn Projection

Apr 28, 2025

The Red Sox 2025 Outfield An Espn Projection

Apr 28, 2025