Stock Market Valuations: BofA Explains Why Investors Shouldn't Worry

Table of Contents

BofA's Key Arguments Against Excessive Valuation Worries:

BofA's analysis rests on several pillars, challenging the notion that current stock market valuations are excessively high and unsustainable. They present a multifaceted argument that considers macroeconomic factors, corporate performance, and future growth potential.

The Role of Low Interest Rates:

Historically low interest rates significantly influence stock market valuation. These low rates directly impact discounted cash flow (DCF) models, a cornerstone of stock valuation.

- Lower discount rates: Low interest rates lead to lower discount rates in DCF models. This means that future cash flows are valued more highly, justifying higher price-to-earnings (P/E) ratios.

- Impact on valuation metrics: Lower discount rates inflate the present value of future earnings, resulting in higher valuations across the board. This effect is amplified when applied to companies with strong future growth prospects.

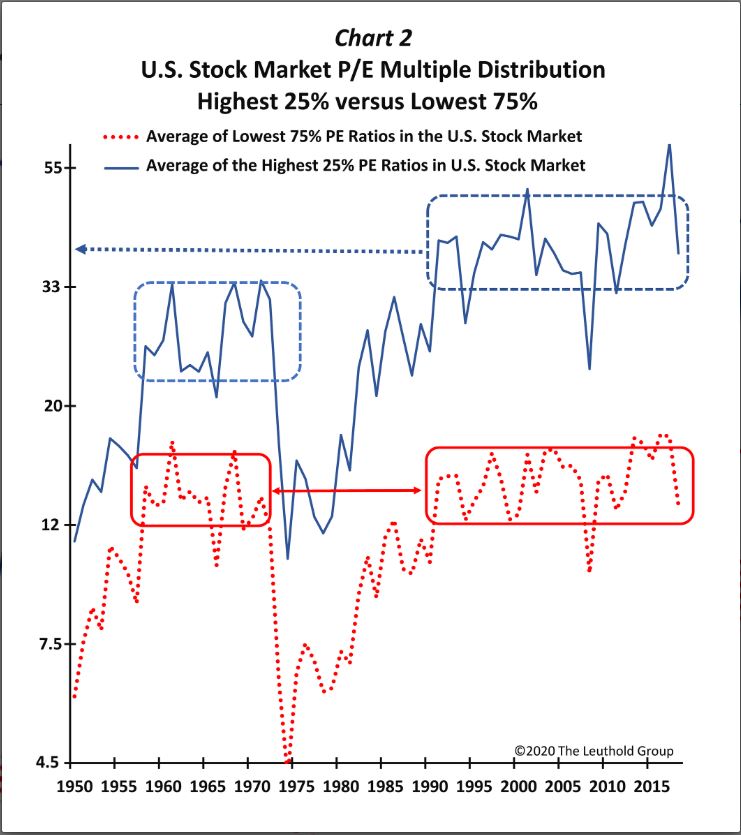

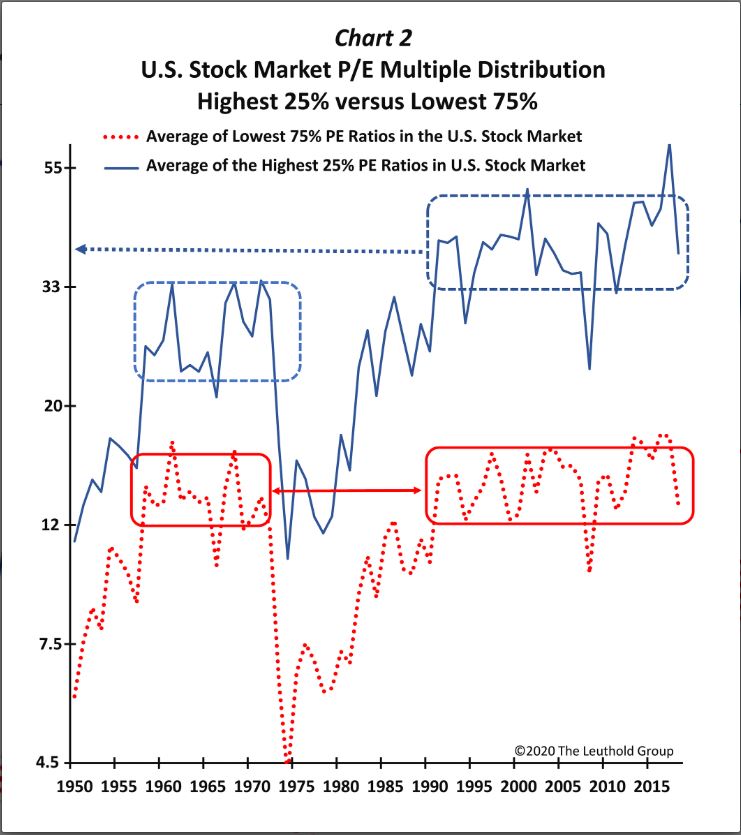

- BofA's data: (While specific data from BofA's report would need to be inserted here, a statement like this would be appropriate: "BofA's analysis demonstrates that, considering the prevailing low interest rate environment, current P/E ratios are not as alarming as they initially appear.") This shows the significance of contextualizing valuation metrics within the broader macroeconomic landscape. Keywords: low interest rates, P/E ratio, discounted cash flow, valuation metrics, stock market analysis.

Strong Corporate Earnings and Profitability:

Beyond interest rates, BofA highlights the robust performance of many corporations. Strong corporate earnings and sustained profit growth provide a solid foundation for current valuations.

- Positive earnings trend: Many sectors are demonstrating impressive earnings growth, exceeding analyst expectations.

- Strong performing sectors: (Examples of strong-performing sectors, along with supporting data, would be inserted here. For example: "The technology sector, particularly software companies, has shown exceptional profitability, with average earnings growth exceeding 15% year-on-year.")

- Robust fundamentals: These positive results showcase the underlying strength of the corporate sector, supporting higher valuations. Keywords: corporate earnings, profitability, strong corporate fundamentals, sector performance, earnings growth.

Future Growth Potential and Innovation:

BofA’s optimistic outlook extends beyond current performance to encompass future growth potential. Technological innovation and the emergence of new industries are key drivers in their analysis.

- Technological innovation: Disruptive technologies in areas like artificial intelligence, biotechnology, and renewable energy are creating significant growth opportunities.

- Emerging markets: Expanding markets in developing economies present further potential for growth and expansion for many companies.

- Long-term growth prospects: These factors collectively contribute to a compelling long-term growth narrative, supporting current market valuations. Keywords: future growth, technological innovation, emerging markets, disruptive technologies, long-term growth.

Addressing Specific Valuation Concerns:

While BofA presents a positive outlook, acknowledging specific concerns is crucial for a balanced perspective.

High Price-to-Sales Ratios:

High price-to-sales (P/S) ratios in certain sectors are often cited as a cause for concern.

- Justification for high P/S ratios: High P/S ratios can be justified when coupled with substantial projected revenue growth. Investors are essentially paying a premium for anticipated future revenue expansion.

- Historical comparisons: Comparing current P/S ratios with historical data and industry averages provides context and reveals whether current ratios are exceptionally high or within a reasonable range.

- Revenue growth potential: Companies with strong revenue growth trajectories can justify premium valuations, even if their current earnings are relatively modest. Keywords: price-to-sales ratio, revenue growth, market multiples, historical comparisons.

Potential for Market Correction:

The possibility of a market correction cannot be ignored.

- BofA's view on market corrections: While BofA acknowledges the possibility of a short-term correction, they believe any downturn would likely be temporary.

- Factors mitigating correction severity: Several factors, such as the strong corporate earnings mentioned above and the continuing low-interest-rate environment, could mitigate the severity and duration of any potential correction.

- Market volatility: Acknowledging the inherent volatility of the stock market is essential; however, BofA's analysis suggests that the fundamentals support a positive long-term outlook. Keywords: market correction, market volatility, risk mitigation, market downturn.

Conclusion: Why You Shouldn't Panic About Stock Market Valuations (According to BofA)

BofA's analysis offers a compelling counterpoint to widespread anxieties surrounding stock market valuations. Their arguments, emphasizing low interest rates, strong corporate earnings, and significant future growth potential driven by technological innovation, paint a picture of a market with considerable resilience. While acknowledging the possibility of short-term corrections, their overall message is one of cautious optimism. Don't let short-term fluctuations in stock market valuations deter you from your long-term investment goals. Maintain a well-diversified portfolio and consider your long-term investment strategy. Remember that market timing is notoriously difficult, and a long-term approach often yields the best results. Continue to research and stay informed about stock market valuations and the broader economic environment. Investing in the stock market involves inherent risk, and conducting thorough research before making investment decisions is crucial.

Featured Posts

-

Hegseths Leaked Military Plans Signal Chats Reveal Family Involvement

Apr 22, 2025

Hegseths Leaked Military Plans Signal Chats Reveal Family Involvement

Apr 22, 2025 -

Papal Conclaves Explained The Process Of Selecting A New Pope

Apr 22, 2025

Papal Conclaves Explained The Process Of Selecting A New Pope

Apr 22, 2025 -

Toxic Chemicals From Ohio Train Derailment Months Long Building Contamination

Apr 22, 2025

Toxic Chemicals From Ohio Train Derailment Months Long Building Contamination

Apr 22, 2025 -

Analyzing The Economic Costs Of Trumps Policies

Apr 22, 2025

Analyzing The Economic Costs Of Trumps Policies

Apr 22, 2025 -

127 Years Of Brewing History Ends Anchor Brewing Company To Close

Apr 22, 2025

127 Years Of Brewing History Ends Anchor Brewing Company To Close

Apr 22, 2025