Stock Market Today: Dow Futures, Dollar, And Trade War Impact

Table of Contents

Dow Futures: A Leading Indicator

Dow futures contracts are derivative instruments whose prices are tied to the anticipated future value of the Dow Jones Industrial Average (DJIA). They act as a leading indicator, offering a glimpse into investor sentiment and potential market movements before they impact the actual index. Understanding Dow futures is crucial for navigating the stock market today.

Understanding Dow Futures Contracts:

- Investor Sentiment: Changes in Dow futures contracts reflect the collective optimism or pessimism of investors regarding the DJIA's future performance. A rise in futures suggests bullish sentiment, anticipating price increases, while a fall points towards bearish sentiment.

- DJIA Correlation: While not perfectly correlated, Dow futures often move in tandem with the DJIA. Significant discrepancies can signal potential corrections or surprises in the market.

- Hedging and Speculation: Institutional investors extensively utilize Dow futures for hedging (protecting against losses) and speculation (profiting from price fluctuations). This activity significantly impacts the futures market's liquidity and volatility.

Analyzing Current Dow Futures Trends:

Analyzing current trends requires examining specific price levels and their significance within the context of recent economic news and geopolitical events. For example, a sustained breach of a key resistance level might indicate a stronger upward trend, signaling increased investor confidence. Conversely, a consistent drop below a support level could signify weakening market sentiment.

- Key Price Levels: [Insert relevant current Dow futures price levels and their significance. Consider including a chart or graph visualizing recent trends].

- Driving Factors: Recent economic data releases (e.g., employment figures, inflation rates), geopolitical developments (e.g., international conflicts, policy changes), and corporate earnings announcements all influence Dow futures trends.

- Visual Representation: [Include a chart or graph showing recent Dow futures movements, clearly labeled and referenced within the text].

The US Dollar's Influence on the Stock Market

The US dollar's strength significantly impacts the stock market today, particularly for US multinational corporations. There's an inverse relationship: a stronger dollar generally hurts the profitability of these companies.

Dollar Strength and its Impact on Stocks:

- International Operations: A strong dollar makes US goods more expensive overseas, reducing export competitiveness and profitability for companies with significant international sales. Conversely, it makes imports cheaper.

- Import/Export Prices: A stronger dollar lowers import costs for US businesses and consumers, potentially reducing inflation. However, it can harm export-oriented industries.

- Investor Confidence: Dollar strength can influence investor confidence and capital flows. A rising dollar might attract foreign investment, while a weakening dollar could lead to capital flight.

Current Dollar Trends and Market Implications:

Analyzing the current value of the US dollar requires examining key exchange rates against other major currencies (e.g., Euro, Yen, British Pound). The Federal Reserve's monetary policy plays a vital role, as interest rate changes influence the dollar's attractiveness to international investors.

- Exchange Rates: [Insert relevant current exchange rates and their implications for the US economy and the stock market].

- Federal Reserve Influence: The Fed's actions, such as interest rate hikes or cuts, directly affect the dollar's value and therefore the stock market.

- Market Reactions: Dollar fluctuations often cause ripple effects in the stock market, impacting specific sectors and overall market sentiment.

The Lingering Impact of Trade Wars

Trade wars introduce significant uncertainty and volatility into the stock market today. Tariffs and trade restrictions disrupt established supply chains, impact industries differentially, and affect consumer prices.

Trade War Uncertainty and Market Volatility:

- Sectoral Impact: Sectors heavily reliant on international trade (e.g., agriculture, technology) are particularly vulnerable to trade war disruptions. Tariffs directly increase costs and reduce competitiveness.

- Supply Chain Disruptions: Trade wars can cause delays, shortages, and increased costs throughout the supply chain, affecting businesses and consumers alike.

- Investor Sentiment: The uncertainty surrounding trade negotiations significantly impacts investor confidence, leading to increased market volatility.

Assessing Current Trade War Risks:

Analyzing the current situation involves monitoring ongoing trade negotiations, assessing the likelihood of new tariffs or trade restrictions, and considering potential resolutions. Expert opinions and forecasts provide valuable insights into potential future scenarios.

- Recent Developments: [Summarize recent developments in major trade negotiations and their market impact].

- Potential Scenarios: Consider various scenarios—escalation, de-escalation, or stalemate—and their respective consequences for specific sectors and the overall market.

- Expert Forecasts: [Include expert opinions or forecasts regarding future trade war developments and their market impact].

Conclusion

Understanding the stock market today requires analyzing the interconnectedness of Dow futures, the US dollar, and the ongoing impact of trade wars. Dow futures offer a glimpse into investor sentiment, while the dollar's strength influences multinational corporations' profitability. Trade wars introduce uncertainty and volatility, disproportionately affecting certain sectors. Staying informed about these factors is crucial for navigating the complex dynamics of the market.

Call to Action: Stay informed about the stock market today by regularly checking for updates and analysis. Understanding the interplay between Dow futures, the dollar, and trade issues is crucial for effective investment strategies. Continue monitoring the stock market today to make informed decisions. Learn more about effective stock market investment strategies to navigate these challenges.

Featured Posts

-

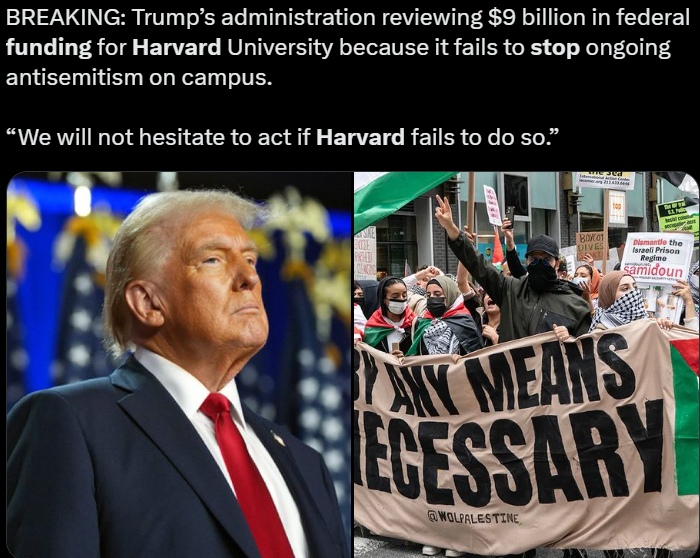

1 Billion Harvard Funding At Risk Exclusive Insight Into Trump Administrations Ire

Apr 22, 2025

1 Billion Harvard Funding At Risk Exclusive Insight Into Trump Administrations Ire

Apr 22, 2025 -

The Impact Of Trumps Trade Actions On Americas Global Financial Position

Apr 22, 2025

The Impact Of Trumps Trade Actions On Americas Global Financial Position

Apr 22, 2025 -

Ftc Appeals Microsoft Activision Merger Ruling

Apr 22, 2025

Ftc Appeals Microsoft Activision Merger Ruling

Apr 22, 2025 -

Canadas 500 Million Bread Price Fixing Case Key Hearing Approaches

Apr 22, 2025

Canadas 500 Million Bread Price Fixing Case Key Hearing Approaches

Apr 22, 2025 -

Fsus Post Shooting Class Resumption Plan Concerns And Controversy

Apr 22, 2025

Fsus Post Shooting Class Resumption Plan Concerns And Controversy

Apr 22, 2025