Simkus Warns Of Further ECB Rate Cuts Due To Negative Trade Impacts

Table of Contents

Simkus's Rationale Behind the Warning of Further ECB Rate Cuts

Simkus, a highly respected figure with decades of experience analyzing European economic trends, bases their prediction on a careful assessment of current economic realities. Their expertise in monetary policy and international trade provides a strong foundation for this concerning outlook. Simkus's analysis points to several key factors:

-

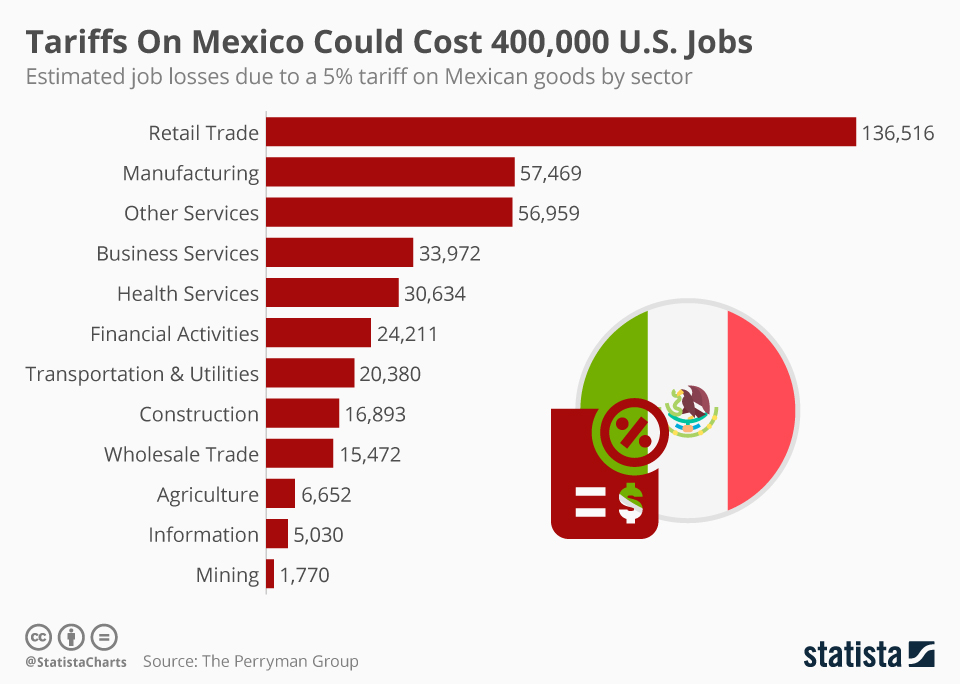

Weakening Eurozone economy due to global trade tensions: The ongoing US-China trade war and Brexit uncertainty have created a significant drag on Eurozone growth. Reduced exports and decreased investor confidence are key contributors to this slowdown.

-

Falling inflation and risks of deflation: Inflation rates remain stubbornly low, edging dangerously close to deflationary territory. This necessitates intervention to prevent a potentially devastating economic spiral.

-

Potential for recessionary pressures: Several leading economic indicators are flashing warning signs, suggesting the Eurozone is at increasing risk of slipping into a recession. Preventive measures, such as further ECB rate cuts, are seen as necessary to avert this scenario.

-

Analysis of current economic indicators: Simkus's warning is not based on speculation but on a meticulous analysis of hard data, including GDP growth rates, consumer spending, industrial production, and unemployment figures.

-

Comparison to past ECB actions in similar economic situations: By studying the ECB's responses to previous economic downturns, Simkus highlights a pattern of aggressive rate cuts in the face of declining growth and deflationary pressures. This historical precedent reinforces the likelihood of further rate reductions.

Negative Trade Impacts Fueling the Need for ECB Rate Cuts

The primary catalyst behind Simkus's prediction is the confluence of significant negative trade impacts:

-

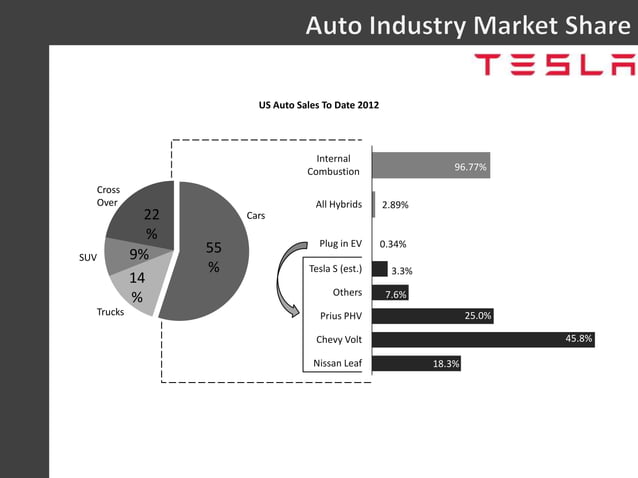

US-China trade war and its ripple effect on the Eurozone: The ongoing trade dispute between the US and China is not only impacting those two economies but is also significantly disrupting global supply chains and reducing demand for Eurozone exports.

-

Brexit uncertainties and their impact on trade flows: The unresolved issues surrounding Brexit continue to create uncertainty and hamper trade between the UK and the Eurozone, further weakening the economic outlook.

-

Geopolitical risks and their contribution to economic slowdown: Increased geopolitical instability in various parts of the world adds to the overall uncertainty and negatively impacts investor confidence, leading to decreased investment and economic growth.

-

Supply chain disruptions and increased production costs: The trade tensions have caused significant disruptions to global supply chains, leading to increased production costs and reduced competitiveness for Eurozone businesses.

-

Decreased consumer and business confidence: The negative economic outlook has dampened consumer and business confidence, leading to reduced spending and investment, creating a vicious cycle of economic contraction.

Potential Consequences of Further ECB Rate Cuts

While intended to stimulate economic growth, further ECB rate cuts are not without potential drawbacks. The consequences are complex and multifaceted:

-

Stimulating economic growth by lowering borrowing costs: Lower interest rates make borrowing cheaper for businesses and consumers, potentially boosting investment and spending, thereby stimulating economic growth.

-

Weakening the Euro, potentially boosting exports: A weaker Euro can make Eurozone exports more competitive on the global market, potentially offsetting some of the negative trade impacts.

-

Increased risk of inflation in the long term: While fighting deflation in the short term, prolonged periods of low interest rates can lead to increased inflation in the future.

-

Potential for asset bubbles due to increased liquidity: Abundant liquidity in the market can fuel asset bubbles in areas such as real estate and stocks, creating further economic instability.

-

Impact on savings and retirement plans: Low interest rates can significantly reduce returns on savings and retirement plans, negatively impacting individuals' financial security.

Alternative Economic Strategies to ECB Rate Cuts

While rate cuts may be deemed necessary, Simkus suggests exploring alternative economic strategies alongside, or instead of, further interest rate reductions. These could include:

-

Fiscal stimulus measures by Eurozone governments: Governments could implement fiscal stimulus packages, such as increased public spending or tax cuts, to boost aggregate demand.

-

Structural reforms to improve competitiveness: Structural reforms aimed at increasing efficiency, reducing bureaucracy, and improving the business environment could enhance the Eurozone's long-term competitiveness.

-

Investment in infrastructure and innovation: Investment in infrastructure projects and technological innovation can create jobs, stimulate growth, and enhance long-term productivity.

-

Targeted support for specific sectors affected by trade issues: Providing targeted support to industries disproportionately affected by trade disputes can help mitigate the negative impact on employment and economic growth.

Conclusion

Simkus's warning of further ECB rate cuts is a serious call to attention. The underlying factors – the significant negative trade impacts currently affecting the Eurozone – paint a concerning picture. While rate cuts might offer a short-term solution to combat deflationary pressures, the potential long-term consequences, including inflation and asset bubbles, necessitate careful consideration. Understanding the impact of potential ECB rate cuts and the exploration of alternative economic strategies are vital to navigating this challenging economic climate. Stay informed about the impact of future ECB rate cuts by following reputable financial news sources and conducting your own research. The future of the Eurozone economy hinges on informed decision-making and proactive strategies to mitigate the risks associated with these crucial policy decisions.

Featured Posts

-

Alberto Ardila Olivares Tu Garantia Para Marcar Goles

Apr 27, 2025

Alberto Ardila Olivares Tu Garantia Para Marcar Goles

Apr 27, 2025 -

Understanding Teslas Canadian Price Adjustments And Inventory Strategy

Apr 27, 2025

Understanding Teslas Canadian Price Adjustments And Inventory Strategy

Apr 27, 2025 -

Patrick Schwarzeneggers Surprise Cameo White Lotus And Ariana Grande Connection

Apr 27, 2025

Patrick Schwarzeneggers Surprise Cameo White Lotus And Ariana Grande Connection

Apr 27, 2025 -

Swarovski Campaign Showcases Ariana Grandes Unique Dip Dyed Hair

Apr 27, 2025

Swarovski Campaign Showcases Ariana Grandes Unique Dip Dyed Hair

Apr 27, 2025 -

Canada Auto Sector Job Losses Trumps Tariffs Deliver A Posthaste Blow

Apr 27, 2025

Canada Auto Sector Job Losses Trumps Tariffs Deliver A Posthaste Blow

Apr 27, 2025