Revealed: X's Post-Debt Sale Financials And Company Evolution

Table of Contents

Analyzing X's Post-Debt Sale Financial Performance

Revenue and Growth

Prior to the debt sale, X's revenue streams primarily consisted of [List X's primary revenue sources before the debt sale]. Following the debt sale, the company experienced a [Increase/Decrease] in overall revenue. This change can be attributed to several factors, including [List contributing factors, e.g., new market penetration, increased sales of specific products, cost-cutting measures resulting in increased sales volume].

- Before Debt Sale: [Insert data on revenue, e.g., $100 million annually]

- After Debt Sale: [Insert data on revenue, e.g., $120 million annually, showing percentage change]

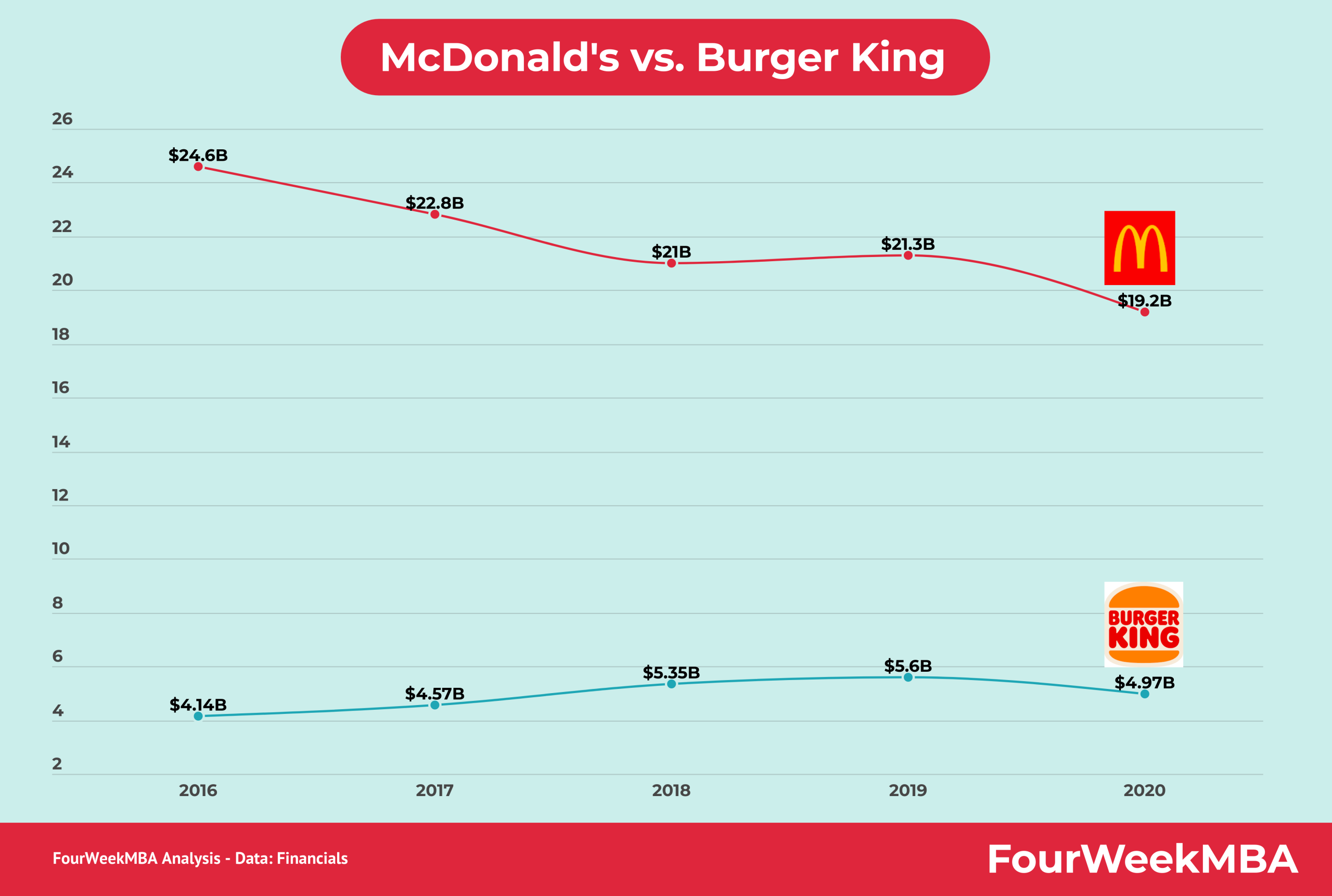

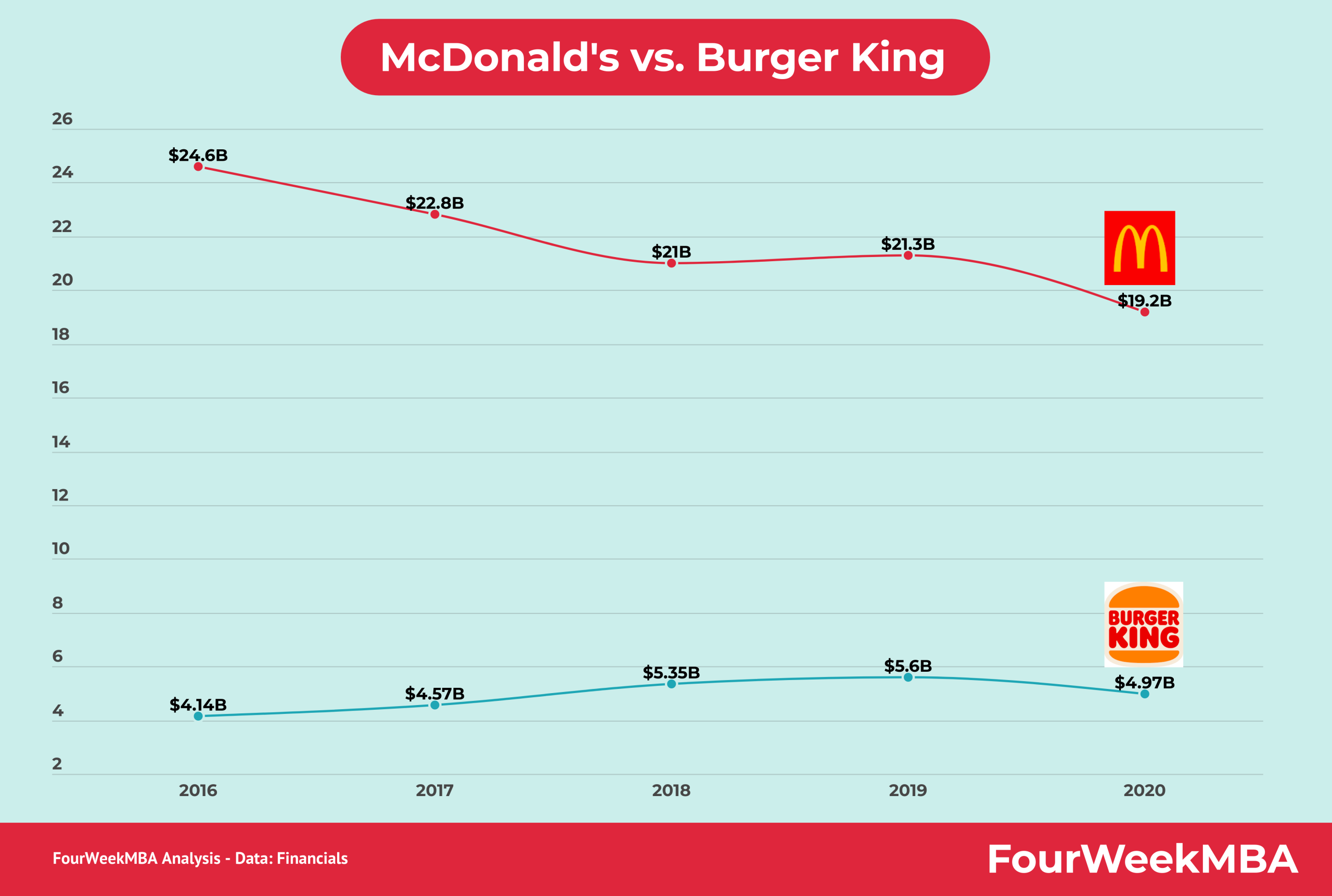

The following chart illustrates the revenue growth trajectory:

[Insert chart/graph visualizing revenue before and after the debt sale]

Key contributing factors to this revenue growth include improved operational efficiency and a strategic focus on high-margin products. This improved financial reporting shows a clear trend of positive revenue growth and profitability.

Debt Reduction and Leverage

The debt sale significantly impacted X's debt levels. Before the sale, the company carried a substantial debt burden, resulting in a high leverage ratio of [Insert previous leverage ratio]. Post-debt sale, X's total debt decreased by [Insert percentage or dollar amount], leading to a reduction in the leverage ratio to [Insert new leverage ratio]. This improved financial stability is reflected in a better credit rating. The strategic move to reduce debt has significantly improved X's long-term financial stability and reduced the risk of default.

- Debt before Sale: [Insert specific data]

- Debt after Sale: [Insert specific data]

- Leverage Ratio before Sale: [Insert data]

- Leverage Ratio after Sale: [Insert data]

This debt reduction has positively impacted X's credit rating and enabled it to secure more favorable financing terms in the future.

Profitability and Margins

The impact of the debt sale on profitability is evident in improved profit margins. While the gross profit margin remained relatively stable at [Insert percentage], the operating margin saw a significant increase from [Insert previous percentage] to [Insert new percentage] due to cost optimization initiatives. The net profit margin also improved substantially, rising from [Insert previous percentage] to [Insert new percentage], reflecting the success of the debt restructuring and subsequent operational efficiencies. This improvement in return on investment (ROI) is a testament to the success of the post-debt sale strategies.

- Gross Profit Margin (Before): [Insert data]

- Gross Profit Margin (After): [Insert data]

- Operating Margin (Before): [Insert data]

- Operating Margin (After): [Insert data]

- Net Profit Margin (Before): [Insert data]

- Net Profit Margin (After): [Insert data]

These figures clearly demonstrate a positive trend in profitability post-debt sale, highlighting the efficacy of the implemented strategies.

Examining X's Strategic Evolution Post-Debt Sale

Business Model Adjustments

Post-debt sale, X underwent a strategic pivot, adjusting its business model to focus on [Explain the new focus areas]. This involved [Explain the specific changes made to the business model, e.g., shifting from a B2B to a B2C model, or expanding into new product lines]. The rationale behind this strategic repositioning was to [Explain the strategic reasoning, e.g., capitalize on emerging market trends, improve profitability, and enhance competitive advantage].

This business model innovation is a key factor in X's post-debt sale success.

Investment and Acquisitions

Since the debt sale, X has strategically invested in [Mention specific investments, e.g., research and development, new technologies]. Furthermore, the company has pursued a mergers and acquisitions strategy, acquiring [Mention acquired companies and the rationale for acquisition]. These acquisitions were aimed at expanding market reach, integrating complementary technologies, and strengthening its competitive position within the [Insert industry] sector. This corporate development is fueling further growth.

This strategic investment and acquisition approach is a key element of X's growth strategy.

Operational Efficiency and Restructuring

As part of its post-debt sale restructuring, X implemented several operational efficiency measures. This included [List specific measures, e.g., streamlining processes, automation of tasks, workforce optimization]. These cost optimization efforts led to significant improvements in efficiency and cost reduction, positively impacting profitability and financial stability. While the restructuring involved some organizational change, resulting in a [Describe changes to the workforce and organizational structure], the overall impact on efficiency and productivity was highly positive.

The focus on process improvement has significantly streamlined operations at X.

Conclusion: Understanding X's Future Trajectory: Post-Debt Sale Outlook

In conclusion, X's post-debt sale journey has been marked by significant improvements in financial performance and strategic evolution. The company successfully reduced its debt burden, enhanced its profitability, and implemented a revised business model, demonstrating resilience and adaptability. The strategic investments and acquisitions further underscore its commitment to growth and market expansion. Analyzing X's financials reveals a clear path toward sustained growth and stability. However, sustained success requires continued focus on operational efficiency and careful navigation of market dynamics. To stay updated on X's progress and further research into its post-debt sale performance, follow X's post-debt journey and analyze X's financials closely. Understand X's transformation; it's a compelling case study in corporate restructuring and strategic evolution. Continue to analyze X's financial performance and X company evolution for a complete understanding of this dynamic transformation.

Featured Posts

-

Gpu Prices Soar Are We Heading For Another Crisis

Apr 28, 2025

Gpu Prices Soar Are We Heading For Another Crisis

Apr 28, 2025 -

Mike Breen On Marv Albert A Legacy Of Basketball Broadcasting Excellence

Apr 28, 2025

Mike Breen On Marv Albert A Legacy Of Basketball Broadcasting Excellence

Apr 28, 2025 -

Emotional Goodbye Espn Bids Farewell To Cassidy Hubbarth

Apr 28, 2025

Emotional Goodbye Espn Bids Farewell To Cassidy Hubbarth

Apr 28, 2025 -

Mets Young Pitcher The Key To Cracking The Starting Rotation

Apr 28, 2025

Mets Young Pitcher The Key To Cracking The Starting Rotation

Apr 28, 2025 -

Mets Pitchers Name Rotation Spot Earned

Apr 28, 2025

Mets Pitchers Name Rotation Spot Earned

Apr 28, 2025