Restoring Fiscal Prudence: A New Vision For Canada's Economy

Table of Contents

Addressing Canada's Debt Burden

Canada's growing debt burden demands immediate attention. Restoring fiscal health requires a two-pronged approach: reducing government spending and increasing government revenue.

Reducing Government Spending

Streamlining government operations and eliminating wasteful spending is crucial. This necessitates a comprehensive review of existing programs and services to identify redundancies and inefficiencies. Performance-based budgeting, which allocates resources based on measurable outcomes, can significantly improve efficiency.

- Streamlining Intergovernmental Transfers: A review of intergovernmental agreements can uncover opportunities for consolidation and improved coordination, reducing administrative overhead.

- Reducing Bureaucratic Layers: Eliminating unnecessary bureaucratic layers can lead to significant cost savings and improved decision-making processes. A targeted review of departmental structures can identify areas for consolidation and simplification.

- Implementing Zero-Based Budgeting: This approach requires each program to justify its funding from scratch each year, forcing a critical evaluation of its necessity and effectiveness.

Increasing Government Revenue

Responsible tax reform is essential to broaden the tax base and improve tax collection. This should not simply mean raising taxes across the board, but rather a strategic review of existing tax policies.

- Closing Tax Loopholes: Addressing tax loopholes exploited by high-income earners and corporations can generate significant additional revenue.

- Optimizing the Carbon Tax: While controversial, a well-designed carbon tax can generate revenue while incentivizing environmentally friendly behavior. Revenue from carbon taxes should be transparently allocated to support green initiatives and reduce other taxes.

- Enhancing Tax Collection: Investing in modern tax collection technologies and improving compliance measures can significantly improve revenue collection.

Investing in Long-Term Economic Growth

Fiscal prudence is not merely about austerity; it’s about investing strategically in areas that drive long-term economic growth.

Strategic Infrastructure Investment

Investing in crucial infrastructure projects is vital for boosting productivity and competitiveness. This should focus on projects with a clear return on investment and a strong economic impact assessment.

- High-Speed Rail: A national high-speed rail network can improve connectivity, boost tourism, and stimulate economic activity in underserved regions.

- Smart Grid Upgrades: Investing in smart grid technology can improve energy efficiency, reduce reliance on fossil fuels, and create new jobs in the green economy.

- Public-Private Partnerships: Leveraging private sector expertise and capital through public-private partnerships (P3s) can accelerate infrastructure development and reduce the burden on taxpayers.

Supporting Innovation and Technology

Investing in innovation and technology is crucial for future economic prosperity. This requires targeted support for research and development, as well as initiatives to foster entrepreneurship.

- Tax Credits for R&D: Providing generous tax credits for research and development can incentivize companies to invest in innovation and create high-paying jobs.

- Investment in STEM Education: Investing in science, technology, engineering, and mathematics (STEM) education is crucial to building a future-ready workforce.

- Incubators and Accelerators: Supporting startup incubators and accelerators can foster the growth of innovative companies and create new job opportunities.

Enhancing Fiscal Transparency and Accountability

Building public trust requires enhancing fiscal transparency and accountability.

Improving Budget Transparency

Clear and accessible reporting standards are essential for ensuring that citizens understand how their tax dollars are being spent.

- Online Budget Portals: Creating user-friendly online portals that provide detailed budget information is crucial for increasing transparency.

- Independent Fiscal Council: An independent fiscal council can provide non-partisan analysis of government finances and help ensure accountability.

Strengthening Accountability Mechanisms

Robust accountability mechanisms are essential to ensure that government officials are held responsible for their fiscal decisions.

- Performance Reviews: Regular performance reviews of government programs and initiatives can help identify areas for improvement and ensure accountability.

- Public Inquiries: Independent public inquiries can investigate allegations of fiscal mismanagement and ensure transparency.

Conclusion

Restoring fiscal prudence is not merely about balancing budgets; it's about building a sustainable and prosperous future for Canada. By implementing responsible fiscal policies that combine debt reduction, strategic investment, and enhanced transparency, Canada can achieve long-term economic growth and improve the lives of all Canadians. This requires a commitment to responsible fiscal management and a long-term vision that prioritizes sound fiscal policy. Let's work together to champion fiscal prudence and secure Canada's economic future. Demand responsible fiscal management from our leaders and support policies that promote long-term economic prosperity. Join the conversation and contribute to a brighter future built on the principles of fiscal prudence.

Featured Posts

-

Life As A Chalet Girl Honest Accounts From Europes Exclusive Ski Destinations

Apr 24, 2025

Life As A Chalet Girl Honest Accounts From Europes Exclusive Ski Destinations

Apr 24, 2025 -

Chainalysis Integrates Ai With Alterya Acquisition

Apr 24, 2025

Chainalysis Integrates Ai With Alterya Acquisition

Apr 24, 2025 -

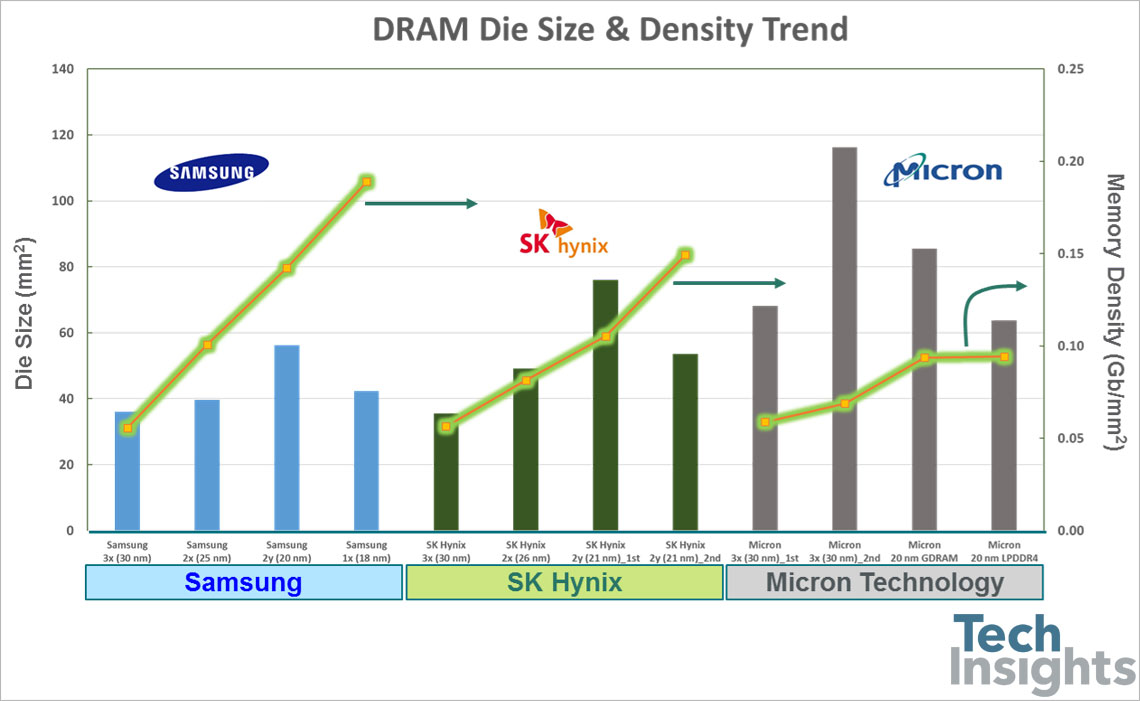

Shifting Sands Sk Hynix Emerges As Potential Dram Market Leader

Apr 24, 2025

Shifting Sands Sk Hynix Emerges As Potential Dram Market Leader

Apr 24, 2025 -

T Mobile To Pay 16 Million For Data Security Violations

Apr 24, 2025

T Mobile To Pay 16 Million For Data Security Violations

Apr 24, 2025 -

A Body Found Sharks Present Israeli Beachs Shift From Attraction To Incident

Apr 24, 2025

A Body Found Sharks Present Israeli Beachs Shift From Attraction To Incident

Apr 24, 2025