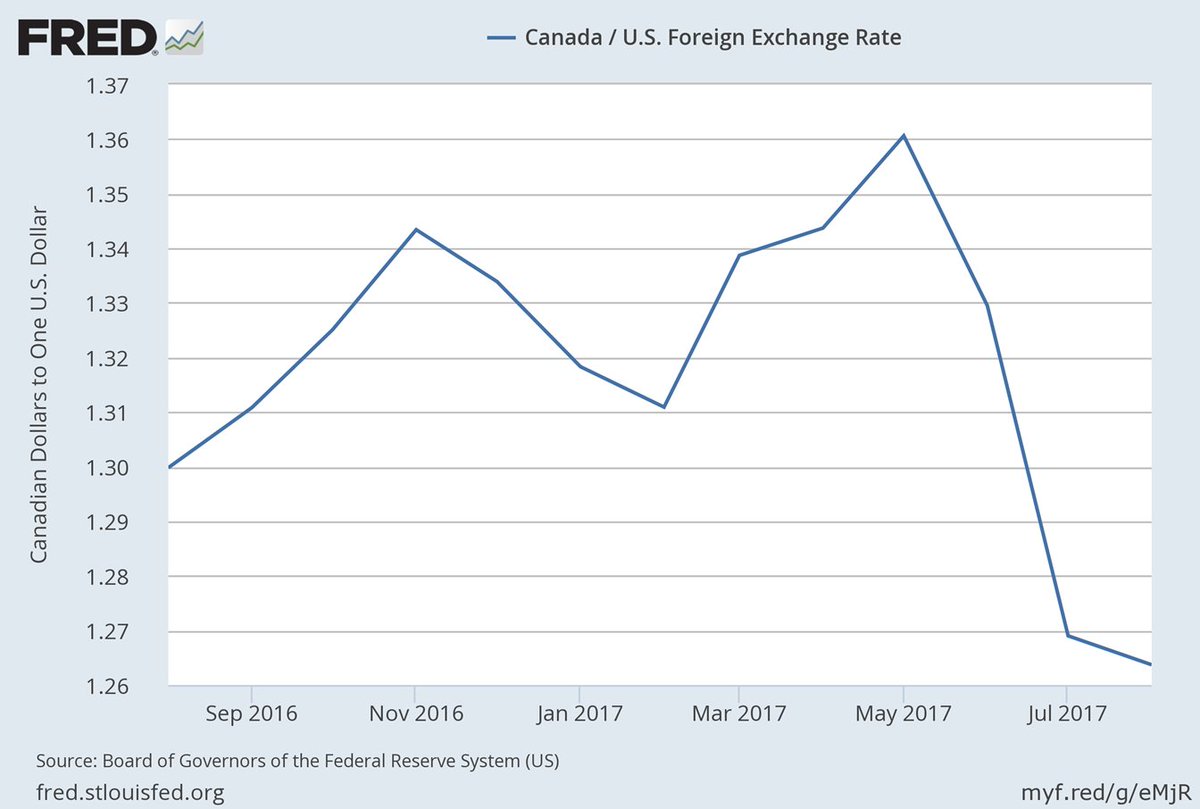

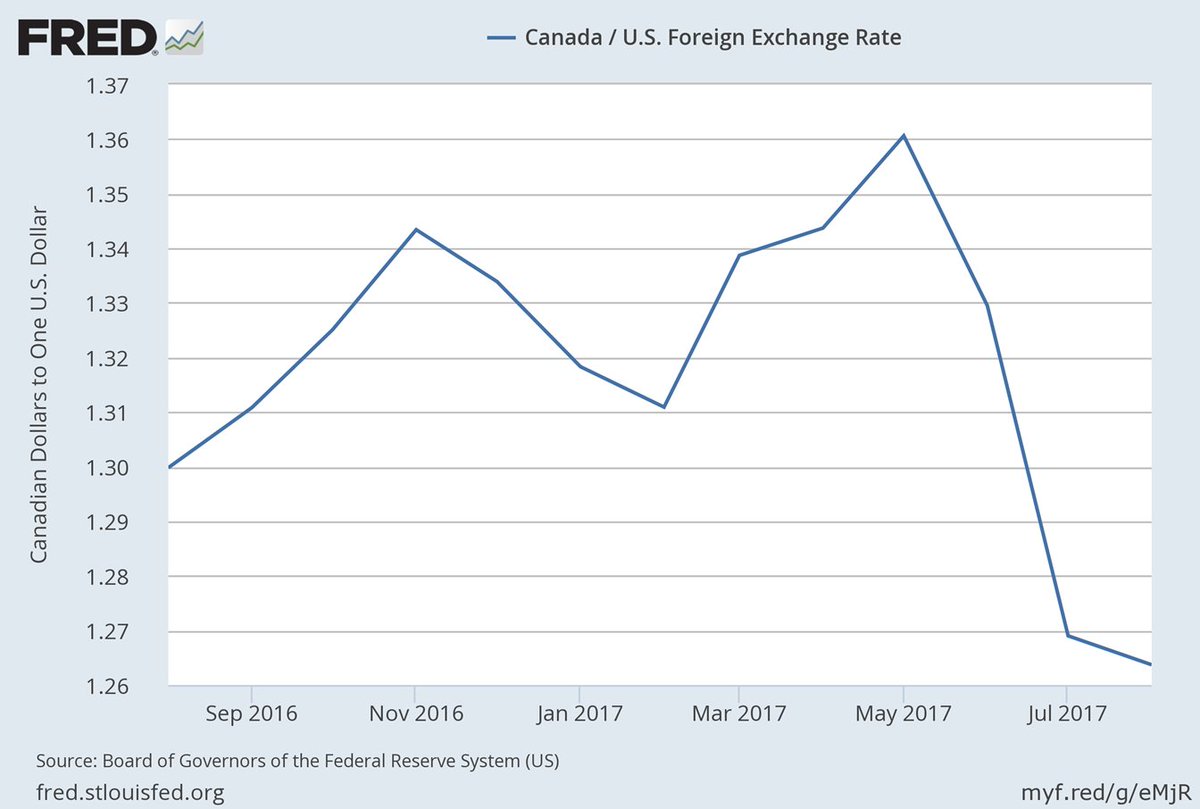

Recent Trends In The Canadian Dollar Exchange Rate

Table of Contents

Impact of Commodity Prices on the Canadian Dollar Exchange Rate

The Canadian dollar, often referred to as the "Loonie," is heavily influenced by commodity prices, given Canada's significant exports in this sector. Understanding this correlation is key to grasping the fluctuations in the Canadian dollar exchange rate.

Role of Oil Prices

Oil prices play a dominant role in determining the CAD exchange rate. Canada is a major oil producer, and changes in global oil markets directly impact the country's export earnings and, consequently, the value of its currency.

- Rising oil prices generally strengthen the CAD: Increased demand for Canadian oil leads to higher export revenues, boosting the demand for the Canadian dollar.

- Falling oil prices weaken the CAD: Conversely, a decline in oil prices reduces export earnings, weakening the Canadian dollar's value.

- Example: The sharp drop in oil prices in 2020 due to the COVID-19 pandemic significantly weakened the CAD against the US dollar. Conversely, the recent surge in oil prices has contributed to a strengthening of the CAD. Specific data points illustrating these fluctuations should be included here, sourced from reputable financial institutions.

Influence of Other Commodities

While oil is the dominant factor, other Canadian exports also influence the CAD exchange rate. These include lumber, potash, and various metals.

- Lumber prices: Fluctuations in global lumber demand directly affect Canadian exports and the CAD. Strong demand for lumber typically leads to a stronger CAD.

- Potash prices: As a major potash exporter, Canada's currency is sensitive to changes in the global fertilizer market.

- Metal prices: Exports of metals like nickel, aluminum, and zinc also contribute to the overall strength or weakness of the CAD.

- Example: A surge in global demand for lumber due to construction activity in the US could lead to a strengthening of the Canadian dollar. Conversely, a slowdown in global construction could weaken the CAD.

Influence of Interest Rate Differentials on the Canadian Dollar Exchange Rate

Interest rate differentials between Canada and other major economies significantly influence the CAD exchange rate. The Bank of Canada's monetary policy plays a pivotal role in these fluctuations.

Bank of Canada's Monetary Policy

The Bank of Canada's interest rate decisions directly impact the attractiveness of the Canadian dollar to foreign investors.

- Interest rate hikes generally strengthen the CAD: Higher interest rates make Canadian assets more appealing to foreign investors seeking higher returns, increasing demand for the CAD.

- Interest rate cuts generally weaken the CAD: Lower interest rates reduce the attractiveness of Canadian assets, leading to a decline in demand for the CAD.

- Inflation's impact: The Bank of Canada's decisions are heavily influenced by inflation. High inflation typically leads to interest rate hikes to curb price increases, while low inflation may result in interest rate cuts. Specific examples of recent rate changes and their effect on the Canadian dollar should be detailed here.

Comparison with Other Major Currencies

The CAD exchange rate is also affected by interest rate differentials with other major economies such as the US, the Eurozone, and the UK.

- Carry trade: Investors often engage in "carry trades," borrowing in low-interest-rate currencies and investing in high-interest-rate currencies to profit from the interest rate differential. This can significantly impact currency exchange rates.

- Example: If Canadian interest rates are higher than US interest rates, investors may borrow in US dollars and invest in Canadian dollar assets, increasing demand for the CAD.

Geopolitical Factors Affecting the Canadian Dollar Exchange Rate

Geopolitical events significantly influence the Canadian dollar exchange rate. These events create uncertainty in the global markets, affecting investor sentiment and capital flows.

US-Canada Relations

Given the close economic ties between Canada and the US, the political and economic climate in the US significantly affects the CAD.

- Trade agreements: Changes in trade relations between the two countries can have a substantial impact on the CAD exchange rate.

- US economic performance: A strong US economy generally benefits the Canadian economy and strengthens the CAD, while a weak US economy can negatively impact the Canadian dollar.

- Political stability: Political uncertainty in the US can create volatility in the CAD exchange rate as investors seek safer havens.

Global Economic Uncertainty

Global events like wars, pandemics, and global recessions can also affect the CAD exchange rate.

- Safe-haven flows: During times of global uncertainty, investors often move their funds to perceived "safe-haven" currencies, potentially impacting the CAD's value. The CAD's performance during recent global crises should be illustrated with data points.

- Example: The COVID-19 pandemic initially led to a significant weakening of the CAD as investors sought safety in other currencies.

Forecasting the Canadian Dollar Exchange Rate: Challenges and Opportunities

Accurately forecasting the Canadian dollar exchange rate is challenging due to the complex interplay of factors discussed above.

Predicting Future Trends

Many factors influence the CAD exchange rate, making accurate predictions difficult.

- Forecasting methods: Various methods exist, such as fundamental analysis (examining economic indicators), technical analysis (analyzing price charts), and econometric models, each with its limitations.

- Unpredictability of external factors: Unexpected geopolitical events or sudden shifts in commodity prices can significantly impact forecasts.

Opportunities for Investors

Despite the challenges, understanding these trends can present opportunities for investors.

- Hedging strategies: Businesses and investors can use hedging strategies to mitigate risks associated with CAD fluctuations.

- Diversification: Diversifying investments across different currencies can reduce exposure to CAD volatility.

Conclusion

The Canadian dollar exchange rate is influenced by a complex interplay of commodity prices, interest rate differentials, and geopolitical factors. Understanding these dynamics is crucial for businesses and investors to make informed decisions. The impact of oil prices, Bank of Canada's monetary policy, and global events on the CAD exchange rate are all critical considerations. While forecasting the future value of the CAD is challenging, monitoring these trends and utilizing risk mitigation strategies can help navigate the complexities of the Canadian currency exchange market. Stay ahead of the curve by consistently monitoring recent trends in the Canadian dollar exchange rate and adapting your strategies accordingly. Understanding these fluctuations is key to making informed financial decisions. [Link to a relevant resource, e.g., a currency converter]

Featured Posts

-

John Travoltas Pulp Fiction Steakhouse Experience A Miami Culinary Adventure

Apr 24, 2025

John Travoltas Pulp Fiction Steakhouse Experience A Miami Culinary Adventure

Apr 24, 2025 -

Ai Boom Propels Sk Hynix Past Samsung In Dram Production

Apr 24, 2025

Ai Boom Propels Sk Hynix Past Samsung In Dram Production

Apr 24, 2025 -

Nba All Star Game Draymond Green Moses Moody And Buddy Hield Participate

Apr 24, 2025

Nba All Star Game Draymond Green Moses Moody And Buddy Hield Participate

Apr 24, 2025 -

Ella Bleu Travolta Pogled Na Zivot Kceri Johna Travolte

Apr 24, 2025

Ella Bleu Travolta Pogled Na Zivot Kceri Johna Travolte

Apr 24, 2025 -

The Los Angeles Wildfires And The Perilous Trend Of Betting On Natural Disasters

Apr 24, 2025

The Los Angeles Wildfires And The Perilous Trend Of Betting On Natural Disasters

Apr 24, 2025