Private Credit Stress: Examining The Recent Rise In Defaults And Distress

Table of Contents

Rising Interest Rates and Their Impact on Private Credit

The aggressive interest rate hikes implemented by central banks globally have significantly impacted the private credit market. These increases directly translate to higher borrowing costs for companies relying on private credit, including loans from non-bank lenders and direct lending arrangements. This increased cost of capital profoundly affects borrowers, particularly those with high leverage and floating-rate debt.

- Increased refinancing risk: As interest rates rise, refinancing existing debt becomes considerably more expensive, forcing borrowers to either accept significantly higher payments or face potential defaults.

- Difficulty servicing debt: The higher interest burden reduces borrowers' ability to service their existing debts, putting a strain on their cash flow and increasing the likelihood of defaults.

- Potential for defaults: The combined effect of higher borrowing costs and reduced cash flow dramatically increases the risk of default, particularly for businesses operating on thin margins.

- Specific sectors heavily impacted: The real estate and leveraged buyout sectors have been particularly vulnerable, experiencing a significant rise in distressed situations and defaults due to their reliance on debt financing.

The Role of Inflation and Economic Slowdown

The current inflationary environment, coupled with a potential economic slowdown, has further exacerbated private credit stress. High inflation erodes purchasing power, reducing consumer spending and impacting business investment. This decrease in demand directly affects borrowers' ability to generate sufficient revenue to repay their loans.

- Reduced profitability for businesses: Inflationary pressures increase input costs, squeezing profit margins and impacting businesses' ability to meet their debt obligations.

- Decreased cash flow for borrowers: Reduced sales and increased operating costs lead to a decrease in cash flow, making debt repayment increasingly challenging.

- Increased defaults across various sectors: The combined impact of reduced demand and increased costs has resulted in a rise in defaults across various sectors, highlighting the widespread nature of the problem.

- Impact on collateral values: Inflation and economic uncertainty can also negatively impact the value of collateral, further increasing the risk for lenders and exacerbating private credit distress.

Changes in the Private Credit Market Landscape

The recent increase in private credit stress can also be attributed to shifts in the market landscape. Increased regulatory scrutiny, changes in investor sentiment, and the influx of less experienced lenders in previous years have contributed to the current instability.

- Increased due diligence requirements: Regulators are increasingly scrutinizing lending practices, demanding more robust due diligence and risk assessment, potentially reducing the availability of credit.

- Shift in investor risk appetite: Investors are becoming more risk-averse, leading to a decrease in liquidity and making it harder for borrowers to secure funding or refinance existing debt.

- Impact of decreased liquidity in the market: Reduced investor confidence has led to decreased liquidity in the private credit market, making it more challenging for borrowers to find new lenders or refinance.

- Potential for future regulatory changes: The current challenges may lead to further regulatory changes impacting lending practices and potentially increasing compliance costs for lenders.

The Implications of Leveraged Buyouts and Highly Leveraged Companies

Leveraged buyouts (LBOs) and highly leveraged companies are particularly vulnerable to private credit stress. These entities often rely heavily on debt financing, making them highly susceptible to interest rate increases and economic downturns.

- Increased financial fragility: High levels of debt leave these companies with limited financial flexibility, making them more vulnerable to shocks.

- Vulnerability to economic downturns: During economic downturns, these companies may struggle to generate sufficient cash flow to service their debt, leading to defaults.

- The domino effect of defaults: Defaults in highly leveraged companies can have a cascading effect, impacting other businesses and potentially destabilizing the broader financial system.

Conclusion: Navigating the Challenges of Private Credit Stress

The rise in defaults and distress within the private credit market is a complex issue stemming from a confluence of factors, including rising interest rates, inflation, economic slowdown, and changes in the market landscape. Understanding and mitigating private credit stress is crucial for both lenders and borrowers. By carefully assessing risk, implementing robust due diligence processes, and maintaining a cautious approach to investment, we can navigate these challenges and minimize potential losses. Learn more about managing private credit risks by seeking professional financial advice and staying informed about market trends to successfully navigate the complexities of private credit. Understanding private credit risks is paramount to mitigating private credit stress and ensuring the long-term stability of the financial system.

Featured Posts

-

Chargers To Kick Off 2025 Season In Brazil Justin Herberts Role

Apr 27, 2025

Chargers To Kick Off 2025 Season In Brazil Justin Herberts Role

Apr 27, 2025 -

Ariana Grandes Dramatic Hair And Tattoo Transformation A Look At The Styling And Artistic Choices

Apr 27, 2025

Ariana Grandes Dramatic Hair And Tattoo Transformation A Look At The Styling And Artistic Choices

Apr 27, 2025 -

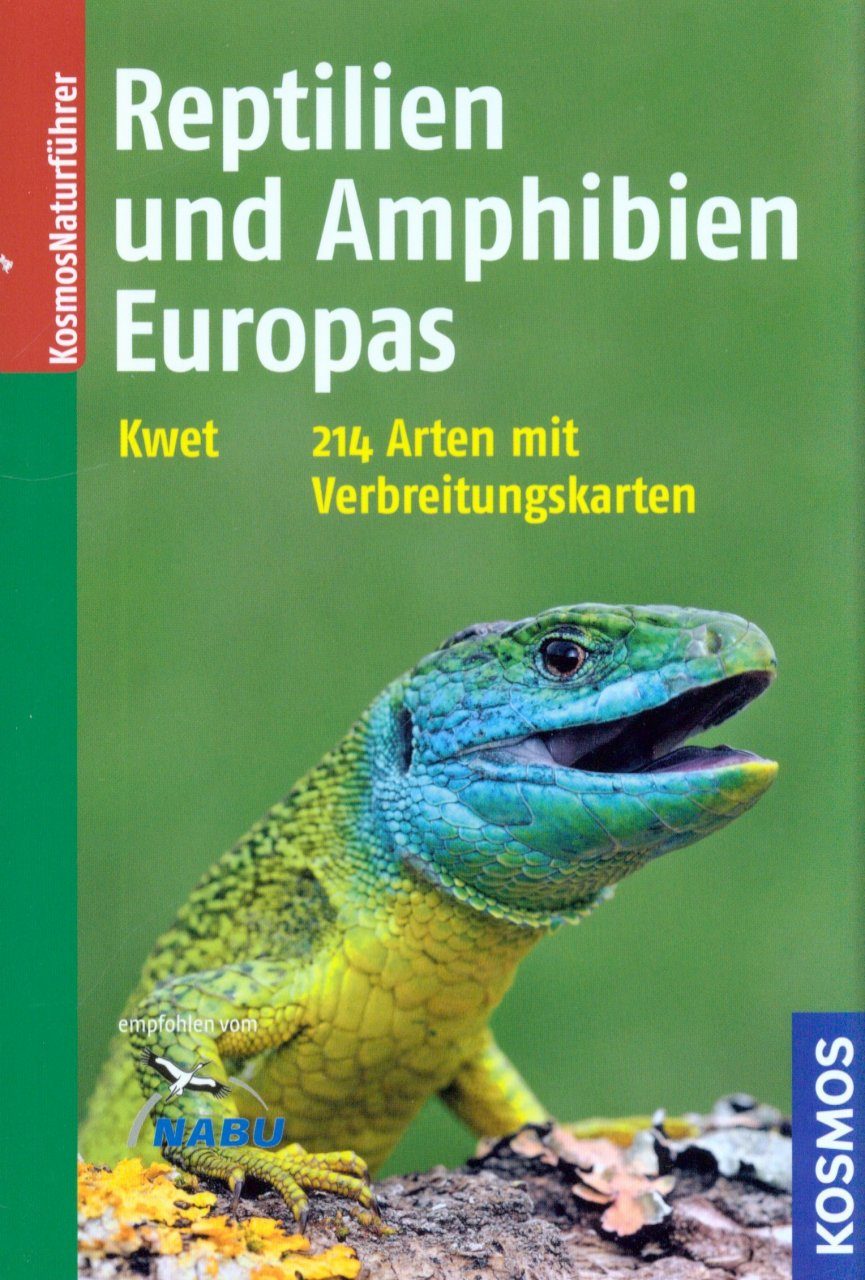

Neuer Atlas Zu Amphibien Und Reptilien In Thueringen Erschienen

Apr 27, 2025

Neuer Atlas Zu Amphibien Und Reptilien In Thueringen Erschienen

Apr 27, 2025 -

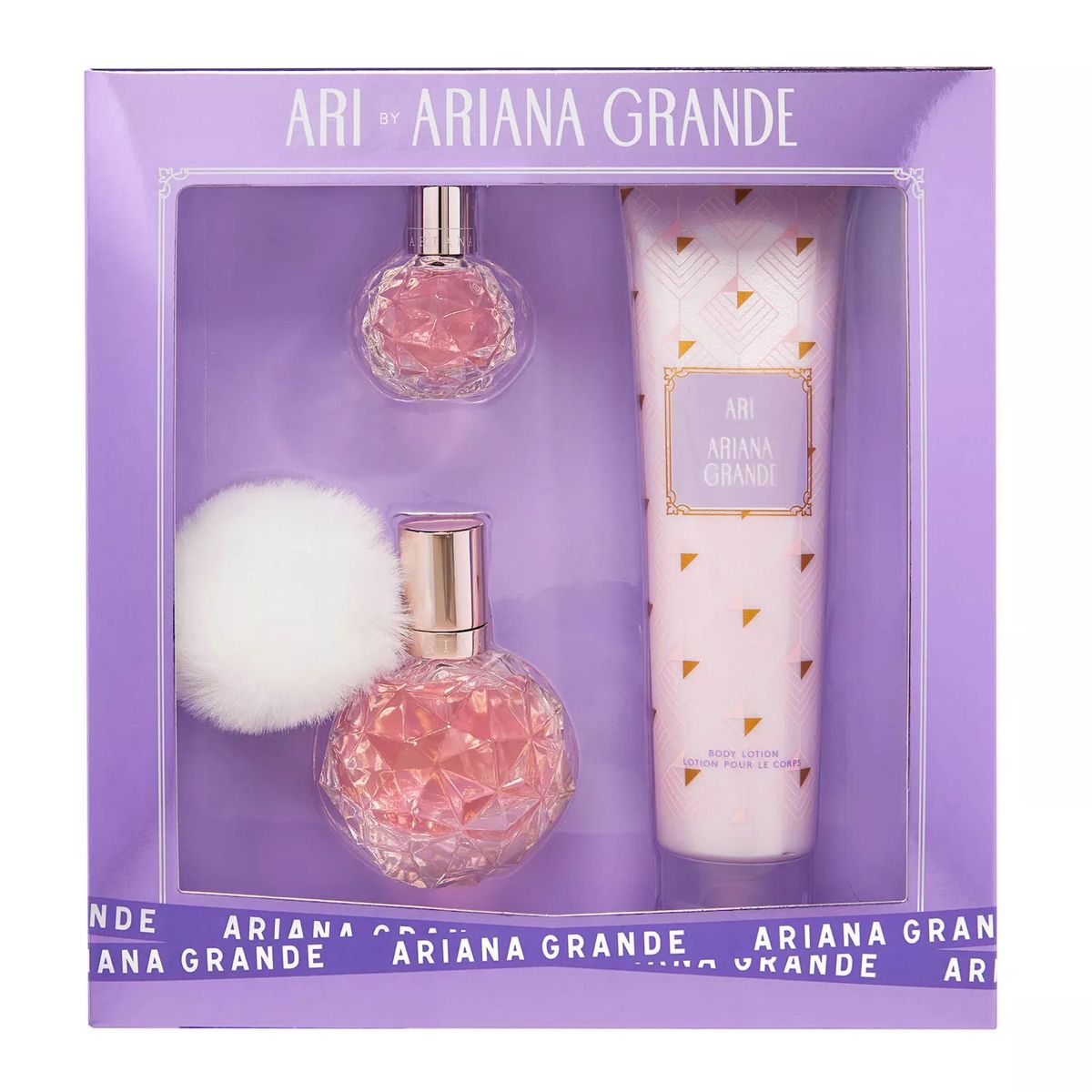

How To Buy Ariana Grandes Lovenote Fragrance Set Online Pricing And Best Deals

Apr 27, 2025

How To Buy Ariana Grandes Lovenote Fragrance Set Online Pricing And Best Deals

Apr 27, 2025 -

A Review Of Horse Fatalities At The Grand National Ahead Of 2025

Apr 27, 2025

A Review Of Horse Fatalities At The Grand National Ahead Of 2025

Apr 27, 2025