Private Credit Jobs: 5 Essential Do's And Don'ts For Success

Table of Contents

5 Essential Do's for Success in Private Credit Jobs

Landing your dream private credit job requires proactive effort and a strategic approach. Here are five crucial "do's" to significantly increase your chances of success:

Do #1: Network Strategically and Build Relationships

Networking is paramount in the private credit world. It's not just about collecting business cards; it's about building genuine relationships.

- Attend industry conferences: Events like SuperReturn, PEI's conferences, and regional industry gatherings are invaluable for meeting professionals and learning about new opportunities.

- Utilize LinkedIn effectively: Optimize your LinkedIn profile with relevant keywords like "private credit," "credit analyst," "portfolio management," "alternative investments," and "private debt." Actively engage with posts, join relevant groups, and connect with people in the field.

- Join professional organizations: The CFA Institute, for example, provides access to a network of finance professionals and valuable continuing education opportunities.

- Conduct informational interviews: Reach out to individuals working in private credit firms to learn about their experiences and gain valuable insights into the industry. These conversations can uncover hidden job opportunities and provide invaluable advice.

- Remember, many private credit jobs are never advertised publicly. Networking is your key to unlocking these hidden opportunities and gaining a competitive edge.

Do #2: Master the Core Skills

Private credit roles demand a strong foundation in finance and analytical skills.

- Develop strong financial modeling skills: Proficiency in Excel, and specialized financial modeling software like Argus or Bloomberg, is essential for analyzing investments and creating financial projections.

- Gain expertise in credit analysis, underwriting, and portfolio management: Understand how to assess credit risk, structure deals, and manage a portfolio of private debt investments.

- Understand various debt structures: Familiarize yourself with different debt structures, including senior secured loans, mezzanine debt, and subordinated debt, and their associated risk profiles.

- Develop strong valuation skills: Master various valuation methodologies, including discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions.

- Continuous learning and professional development are crucial in this ever-evolving field. Stay ahead of the curve by continually enhancing your skills.

Do #3: Tailor Your Resume and Cover Letter

Your application materials are your first impression. Generic applications won't cut it in this competitive market.

- Highlight relevant experience and skills: Quantify your achievements whenever possible. Instead of saying "improved efficiency," say "improved efficiency by 15% through process optimization."

- Use keywords from job descriptions: Carefully review job descriptions and incorporate relevant keywords into your resume and cover letter.

- Showcase your understanding of private credit investment strategies: Demonstrate your knowledge of different investment strategies, such as direct lending, fund investing, and special situations investing.

- Tailor each application: Customize your resume and cover letter for each job you apply for, highlighting the skills and experience most relevant to the specific role and company.

- Craft a compelling narrative that showcases your skills and ambition within the context of the specific private credit role.

Do #4: Ace the Interview Process

The interview is your opportunity to showcase your personality and knowledge.

- Prepare for behavioral questions: Use the STAR method (Situation, Task, Action, Result) to structure your responses to behavioral questions.

- Research the firm and interviewer: Thoroughly research the firm's investment strategy, recent deals, and the interviewer's background.

- Demonstrate a deep understanding of private credit markets: Show your knowledge of current market trends, regulatory changes, and economic factors affecting the private credit industry.

- Practice your responses to technical questions: Be prepared to answer technical questions about financial modeling, valuation, and credit analysis, potentially including case studies.

- Ask insightful questions: Prepare thoughtful questions to demonstrate your genuine interest in the role and the firm.

Do #5: Continuously Upskill and Adapt

The private credit industry is dynamic and constantly evolving.

- Stay updated on market trends and regulatory changes: Follow industry publications, attend webinars, and network with peers to stay informed about the latest developments.

- Pursue relevant certifications: Consider pursuing certifications such as the CFA charter, CAIA charter, or other relevant qualifications to enhance your credibility and expertise.

- Attend workshops and seminars: Participate in workshops and seminars to expand your knowledge and network with industry professionals.

- Engage with industry publications and research: Stay up-to-date on market trends and research by reading industry publications and conducting your own research.

- Remember that continuous learning is not just beneficial; it's essential for long-term success in this fast-paced industry.

5 Essential Don'ts for Success in Private Credit Jobs

Avoiding these pitfalls will significantly improve your chances of securing a private credit position.

Don't #1: Neglect Networking

Failing to network actively will severely limit your access to opportunities. The private credit world thrives on relationships; neglecting this crucial aspect will put you at a significant disadvantage in a highly competitive market.

Don't #2: Underestimate the Importance of Technical Skills

Lacking proficiency in financial modeling, credit analysis, and relevant software will significantly hinder your application. These are not optional; they're fundamental requirements for success in the field.

Don't #3: Submit Generic Applications

Submitting generic applications demonstrates a lack of interest and effort. Each application should be tailored to the specific requirements of the role and the firm.

Don't #4: Be Unprepared for Interviews

Unpreparedness signals a lack of seriousness and commitment. Thorough preparation is crucial for making a positive impression and showcasing your capabilities.

Don't #5: Become Complacent

The private credit industry is constantly evolving. Becoming complacent can lead to stagnation and missed opportunities. Continuous learning is crucial to maintaining a competitive edge.

Conclusion: Securing Your Dream Private Credit Job

Securing your dream private credit job requires a strategic combination of networking, mastering core skills, and continuous learning. By actively following the "do's" and avoiding the "don'ts" outlined in this article, you can significantly enhance your prospects of achieving a successful and rewarding career in private credit. Start by researching firms that align with your interests, actively networking within the industry, and pursuing relevant certifications. Take control of your private credit career today – the opportunities are waiting!

Featured Posts

-

Jj Redick On Espns Jefferson Decision A Positive Reaction

Apr 28, 2025

Jj Redick On Espns Jefferson Decision A Positive Reaction

Apr 28, 2025 -

Red Sox Lineup Shuffle Casas Demoted Struggling Outfielder Returns

Apr 28, 2025

Red Sox Lineup Shuffle Casas Demoted Struggling Outfielder Returns

Apr 28, 2025 -

Recognizing The Telltale Signs Of A Silent Divorce

Apr 28, 2025

Recognizing The Telltale Signs Of A Silent Divorce

Apr 28, 2025 -

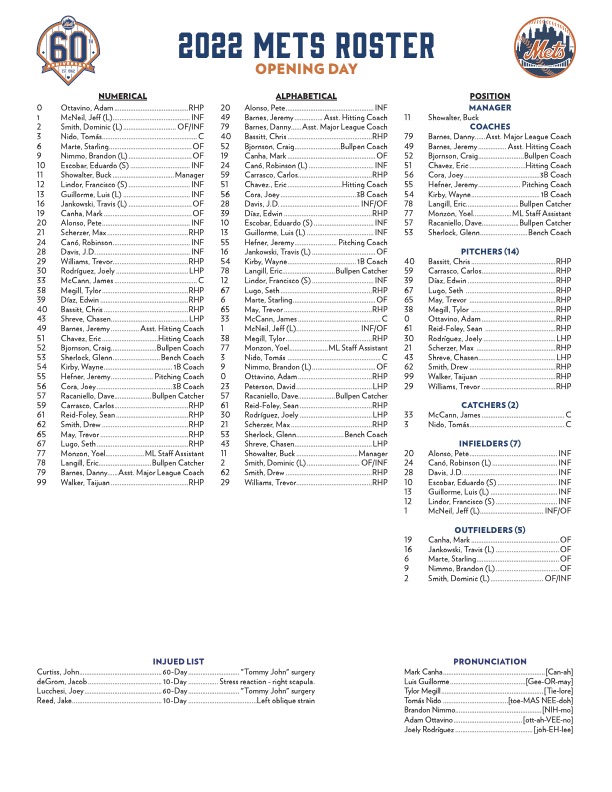

Predicting The Mets Opening Day Roster A Spring Training Week 1 Analysis

Apr 28, 2025

Predicting The Mets Opening Day Roster A Spring Training Week 1 Analysis

Apr 28, 2025 -

Alabtkar Fy Tb Alhyat Alshyt Almdydt Abwzby Thtdn Mntda Ealmya

Apr 28, 2025

Alabtkar Fy Tb Alhyat Alshyt Almdydt Abwzby Thtdn Mntda Ealmya

Apr 28, 2025