Power Finance Corporation (PFC) Announces Fourth Dividend For FY25 On March 12

Table of Contents

Dividend Details and Implications

The PFC dividend for FY25 amounts to Rs. X per share (replace X with the actual amount). This announcement provides crucial information for shareholders looking to maximize their investment returns. Understanding the key dates is essential:

- Record Date: [Insert Record Date] – This is the cutoff date to be eligible for the dividend. Shareholders who own PFC stock on or before this date will receive the dividend.

- Ex-Dividend Date: [Insert Ex-Dividend Date] – Shares traded on or after this date will not include the dividend.

- Payment Date: March 12, 2025 – The dividend will be credited to eligible shareholder accounts on this date.

This dividend announcement has several implications for shareholders:

- Increased Shareholder Return: The dividend directly increases the return on investment for PFC shareholders.

- Dividend Yield: The dividend yield (calculated by dividing the annual dividend per share by the share price) can be compared to previous years and market benchmarks to assess the attractiveness of the investment. [Insert calculation and comparison here, e.g., "This represents a dividend yield of Y%, higher than last year's Z%."].

- Potential Impact on PFC Stock Price: The announcement might influence the PFC stock price, potentially causing short-term fluctuations.

PFC's Financial Performance in FY25

PFC's strong FY25 financial performance underpins this generous dividend announcement. The company demonstrated robust growth across key financial metrics:

- Revenue: [Insert Revenue Figures] – Showing substantial growth compared to the previous fiscal year.

- Profits: [Insert Profit Figures] – Reflecting efficient operations and strategic investments.

- Notable Projects: [Mention significant projects undertaken by PFC during FY25, showcasing the company's contribution to the power sector].

This positive financial performance showcases PFC’s resilience and ability to navigate the challenges within the power sector while delivering value to its investors. The Annual Report, available on their website, provides a more detailed view of PFC's FY25 financial health.

How the Dividend Affects Investors

The PFC dividend impacts various investor types differently:

- Tax Implications: The dividend income is subject to applicable taxes. Individual shareholders will have different tax implications based on their income tax bracket. Institutional investors will also have their own tax considerations. [Provide brief information on tax implications for individual and institutional investors].

- Investment Strategies: Investors can choose to reinvest the dividend back into PFC stock, diversify their portfolio, or use it for other purposes. Long-term investors might view the dividend as a stable income stream, while short-term investors may factor it into their trading decisions.

- Shareholder Value: The dividend directly contributes to overall shareholder value, demonstrating PFC's commitment to returning profits to its investors. This is a key factor to consider when evaluating investment opportunities within the Indian power sector. A comparison of PFC’s dividend policy with competitors in the sector would provide further context for investors.

PFC's Future Outlook

PFC is well-positioned for continued growth, playing a crucial role in the expanding Indian power sector. Their future plans include [Mention key strategic initiatives and upcoming projects]. The growing demand for power infrastructure in India presents significant investment opportunities for PFC, suggesting a positive outlook for future growth and shareholder returns. This makes PFC an attractive option for long-term investors seeking exposure to the Indian power sector.

Conclusion

Power Finance Corporation's announcement of a fourth dividend for FY25, amounting to Rs. X per share, payable on March 12, is a significant development for investors. This generous dividend reflects PFC's robust financial performance in FY25 and highlights its commitment to delivering shareholder value. Understanding the record date, ex-dividend date, and tax implications is crucial for investors to effectively manage their portfolios. The positive financial outlook for PFC and the Indian power sector as a whole indicates promising opportunities for future investment. Learn more about Power Finance Corporation’s dividend policy and stay informed about future PFC dividends by visiting the official PFC investor relations page: [Insert Link Here].

Featured Posts

-

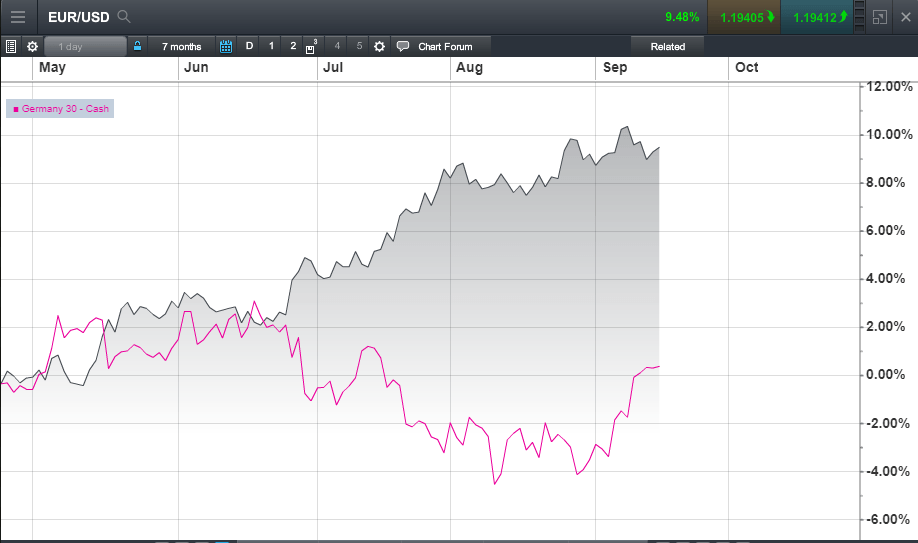

The Daxs Reaction To German Elections And Economic Indicators

Apr 27, 2025

The Daxs Reaction To German Elections And Economic Indicators

Apr 27, 2025 -

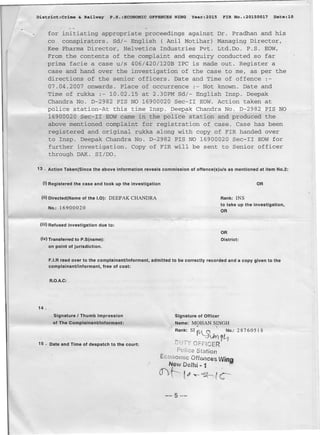

Pfc Investigation Leads To Eo W Transfer Halt For Gensol Promoters Fake Documents Found

Apr 27, 2025

Pfc Investigation Leads To Eo W Transfer Halt For Gensol Promoters Fake Documents Found

Apr 27, 2025 -

Pfcs Action Against Gensol Promoters Eo W Transfer Due To Fake Documents

Apr 27, 2025

Pfcs Action Against Gensol Promoters Eo W Transfer Due To Fake Documents

Apr 27, 2025 -

Trumps Tariffs A Posthaste Threat To Canadian Auto Sector Employment

Apr 27, 2025

Trumps Tariffs A Posthaste Threat To Canadian Auto Sector Employment

Apr 27, 2025 -

Two Wind Farms And A Pv Plant Approved For Pne Group In Germany

Apr 27, 2025

Two Wind Farms And A Pv Plant Approved For Pne Group In Germany

Apr 27, 2025