Nixon's Shadow: Will The U.S. Dollar Repeat Its Worst 100-Day Performance?

Table of Contents

Economic Indicators Mirroring the 1971 Crisis

The 1971 crisis was preceded by significant economic turmoil. Today, several key indicators raise concerns about a potential repeat performance of the U.S. dollar's worst 100-day period.

Inflationary Pressures

Inflation is a major threat to the U.S. dollar's strength. Looking at current economic data, we see troubling similarities to the period before Nixon's actions.

- CPI (Consumer Price Index): The current CPI is [insert current CPI data and source], showing [insert analysis of trend – e.g., a concerning upward trend].

- PPI (Producer Price Index): The PPI, a measure of inflation at the producer level, stands at [insert current PPI data and source], indicating [insert analysis of trend].

- Core Inflation: Excluding volatile food and energy prices, core inflation remains at [insert current core inflation data and source], suggesting [insert analysis of trend].

High inflation erodes the purchasing power of the dollar, making it less attractive to foreign investors and potentially triggering a devaluation.

Geopolitical Instability

Geopolitical instability significantly impacts currency markets. The current global landscape presents several potential threats to the U.S. dollar.

- The War in Ukraine: The ongoing conflict has created significant uncertainty in energy markets and global supply chains, impacting the dollar's value.

- U.S.-China Relations: Strained relations and ongoing trade tensions contribute to market volatility and uncertainty.

- Global Political Uncertainty: Political instability in various regions adds to the overall risk aversion among investors, potentially driving capital away from the dollar.

Geopolitical uncertainty weakens investor confidence, leading to capital flight and a decline in the dollar's value.

Federal Reserve Policy

The Federal Reserve's monetary policy plays a crucial role in influencing the dollar's exchange rate.

- Interest Rate Hikes: The Fed's recent interest rate hikes aim to combat inflation but could also strengthen the dollar in the short term, attracting foreign investment seeking higher returns. However, aggressive rate hikes could also trigger a recession, weakening the dollar in the long run.

- Quantitative Easing (QE): Past QE programs injected liquidity into the market, potentially weakening the dollar. The current stance of the Fed on QE is [insert current Fed policy regarding QE].

- Other Monetary Tools: The Fed's use of other tools, such as reserve requirements, also influence the money supply and, consequently, the dollar's value.

The effectiveness of the Fed's actions in maintaining the dollar's stability remains a subject of debate among economists.

Historical Parallels and Divergences

While comparing the current situation to 1971 offers valuable insights, it's crucial to acknowledge both similarities and critical differences.

Comparing the 1971 Context to Today's Situation

Several parallels exist between 1971 and the present: high inflation, geopolitical tensions, and a weakening global economic outlook. However, key differences exist:

- Globalization: The global economy is far more interconnected today than in 1971, making the impact of dollar fluctuations more widespread and complex.

- Financial Markets: The sophistication and scale of today's financial markets amplify the speed and magnitude of market reactions to economic events.

- Technological Advancements: Instantaneous communication and access to information drastically change the speed at which market sentiment shifts.

Direct comparison isn't perfect; the global economic landscape has changed significantly since 1971.

Lessons Learned from Past Currency Crises

Analyzing previous currency crises provides valuable insights.

- Asian Financial Crisis (1997-98): This crisis highlighted the vulnerability of emerging markets to capital flight and the contagion effect on regional currencies.

- 2008 Financial Crisis: The 2008 crisis showed the systemic risk associated with interconnected financial institutions and the impact of a major economic downturn on the dollar.

Past crises offer valuable lessons, but the specific context and interplay of factors differ, making precise predictions challenging.

Predicting the Future: Will History Repeat Itself?

Predicting the future of the U.S. dollar is inherently uncertain.

Expert Opinions and Market Sentiment

Financial analysts hold diverse views on the dollar's future:

- [Insert summary of bullish forecasts and their rationale.]

- [Insert summary of bearish forecasts and their rationale.]

Market sentiment is highly volatile, making it difficult to gauge the overall outlook.

Scenario Planning

Different scenarios are possible, depending on economic and political developments:

- Scenario 1 (Optimistic): Inflation eases, geopolitical tensions subside, and the Fed successfully manages the economy, leading to a stable or slightly stronger dollar.

- Scenario 2 (Pessimistic): Inflation persists, geopolitical risks escalate, and the economy enters a recession, causing a significant decline in the U.S. dollar's value.

- Scenario 3 (Moderate): A mix of positive and negative developments leads to moderate fluctuations in the dollar's value, with periods of strength and weakness.

Each scenario carries different implications for the global economy.

Conclusion

The potential for a repeat of the U.S. dollar's 1971 crisis is a subject of ongoing debate among economists and market analysts. While historical parallels exist, crucial differences in the global economic landscape make direct comparison challenging. The current economic climate presents a complex interplay of inflationary pressures, geopolitical risks, and the Federal Reserve's policy responses, all influencing the U.S. dollar's future trajectory. To navigate this uncertainty, staying informed about economic indicators and geopolitical developments is crucial. Further research into U.S. dollar volatility and its potential impact is highly recommended. Monitor relevant news and analysis to make informed decisions about your finances and investments, understanding the risks associated with potential U.S. dollar fluctuations.

Featured Posts

-

Aaron Judge And Wife Welcome First Child

Apr 28, 2025

Aaron Judge And Wife Welcome First Child

Apr 28, 2025 -

Luigi Mangiones Supporters Their Platform And Aspirations

Apr 28, 2025

Luigi Mangiones Supporters Their Platform And Aspirations

Apr 28, 2025 -

Astedwa Lfn Abwzby 19 Nwfmbr Antlaq Almerd

Apr 28, 2025

Astedwa Lfn Abwzby 19 Nwfmbr Antlaq Almerd

Apr 28, 2025 -

Mhrjan Abwzby Alsynmayy Aldwly Njwm Ealmywn Yltqwn Fy Aldwrt 22

Apr 28, 2025

Mhrjan Abwzby Alsynmayy Aldwly Njwm Ealmywn Yltqwn Fy Aldwrt 22

Apr 28, 2025 -

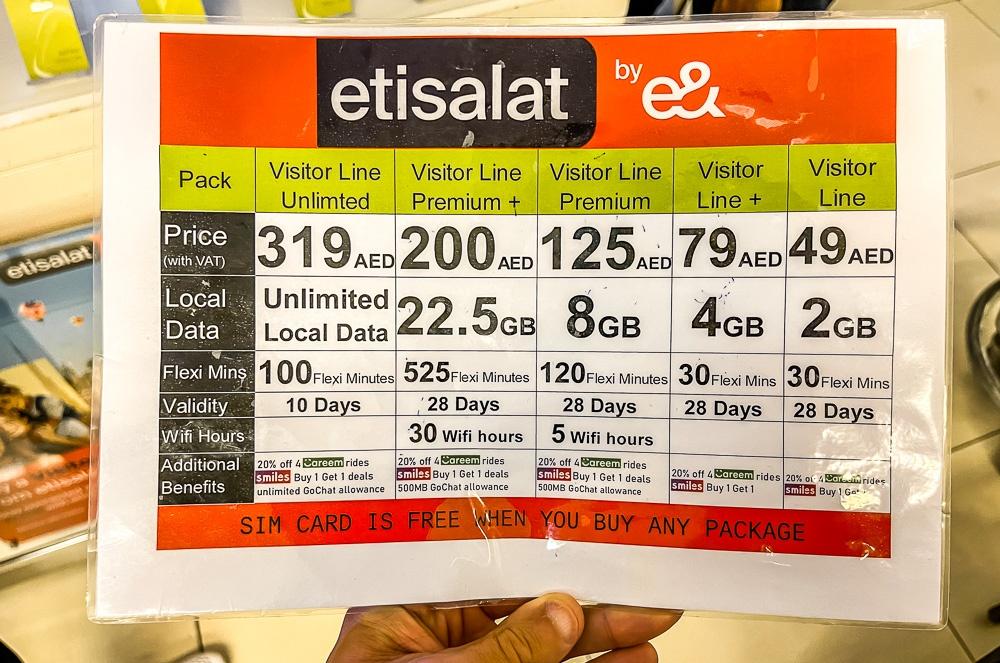

Unlock Abu Dhabi 10 Gb Sim And 15 Attraction Discount

Apr 28, 2025

Unlock Abu Dhabi 10 Gb Sim And 15 Attraction Discount

Apr 28, 2025