Market Volatility Forces Dow To Delay Large Canadian Construction Project

Table of Contents

Dow's Delayed Canadian Construction Project: A Detailed Overview

Dow's delayed project, a massive petrochemical plant tentatively located near Sarnia, Ontario, was initially estimated to cost $5 billion CAD. While Dow hasn't publicly disclosed the precise reasons for the delay, industry analysts point to the escalating costs and uncertainties driven by market volatility as the primary factors. The project, originally slated for completion in 2025, is now indefinitely postponed, pending a reassessment of market conditions.

- Project Specifics: The project involved the construction of a state-of-the-art petrochemical plant utilizing advanced materials and technologies. Specific materials included specialized polymers, requiring intricate supply chains.

- Key Stakeholders: Major contractors, numerous subcontractors, and various levels of government agencies were involved, creating a complex web of interconnected interests.

- Economic Impact: The delay has created uncertainty and concern, potentially leading to job losses and a negative economic ripple effect on the local community. The postponement also impacts the projected tax revenues for the region.

Analyzing the Impact of Market Volatility on the Canadian Construction Industry

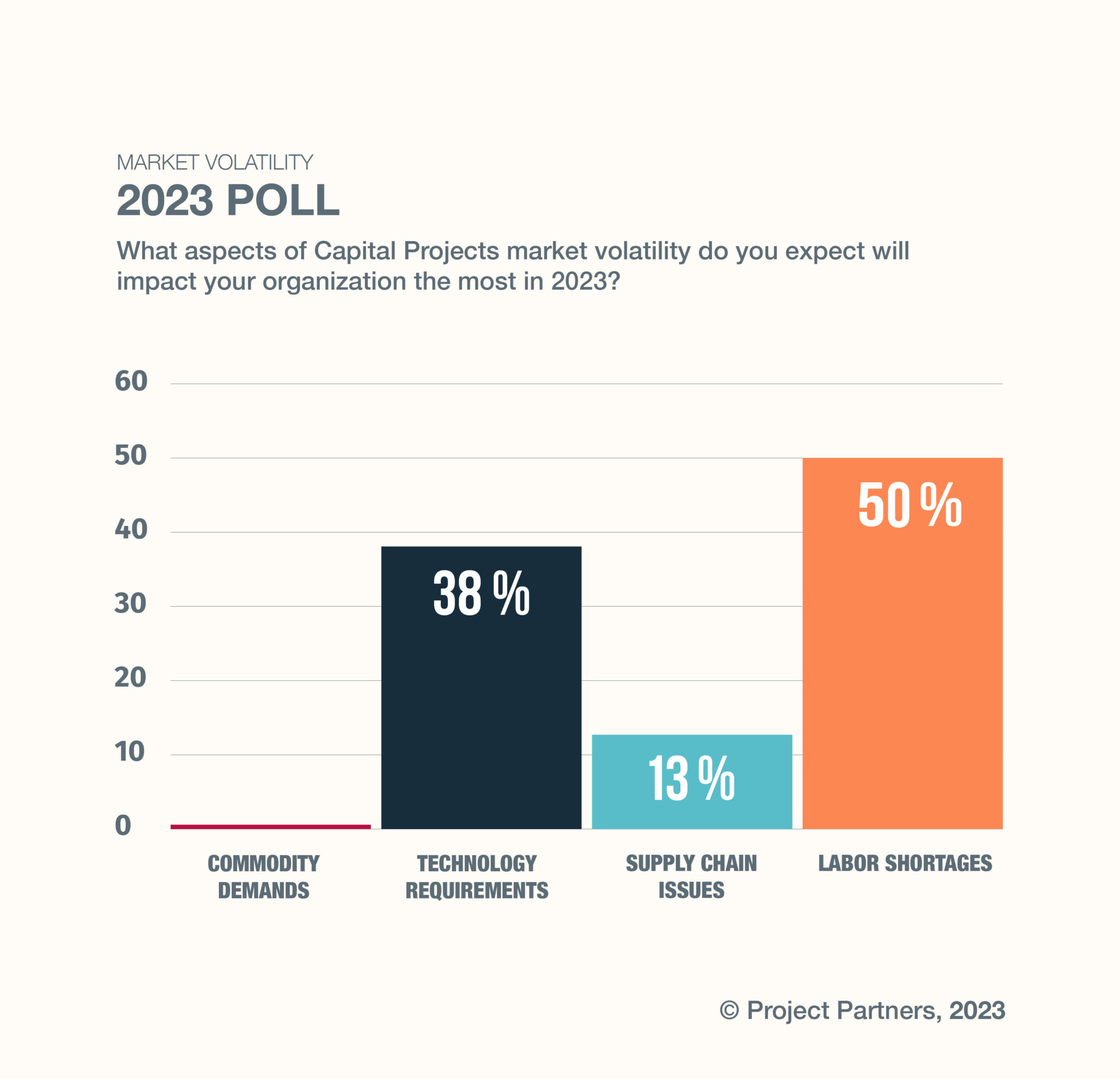

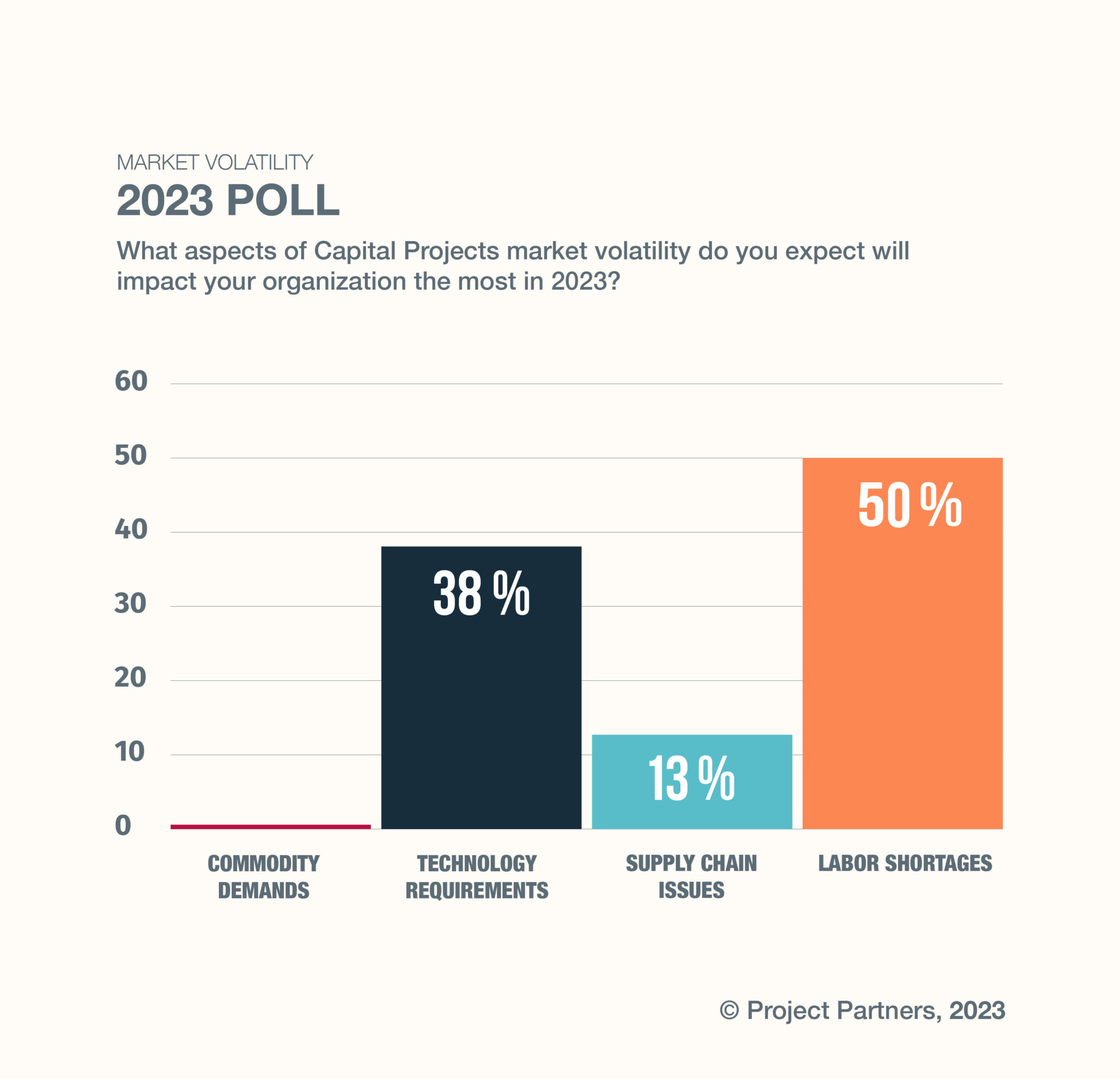

The current Canadian economic climate is characterized by significant market volatility, directly impacting the construction sector. Factors such as rising interest rates, persistent inflation, material shortages, and ongoing supply chain disruptions are creating a perfect storm for large-scale projects. This instability makes accurate cost projections difficult and increases the risk of financial overruns, forcing companies like Dow to reconsider their investments.

- Rising Material Costs: The price of lumber, steel, and concrete has skyrocketed in recent years, significantly increasing construction costs. These increases outpace inflation rates, squeezing profit margins.

- Inflationary Pressures: Persistent inflation erodes the purchasing power of construction budgets, necessitating project re-evaluations and potentially leading to delays or cancellations.

- Interest Rate Hikes: Higher interest rates increase the cost of borrowing, making it more expensive to secure financing for large-scale projects, further contributing to project delays.

- Financing Challenges: Securing sufficient and affordable financing has become a major hurdle for large-scale construction endeavors, particularly given the heightened risks associated with volatile markets. This is particularly challenging for projects with long timelines.

Potential Long-Term Effects and Mitigation Strategies

The long-term consequences of Dow's delayed project extend beyond the immediate financial impact on the company. The delay signals a broader trend impacting investor confidence and the overall growth potential of the Canadian construction industry. For the Canadian economy, this translates to reduced investment and potential job losses across the supply chain.

Mitigation strategies to manage market volatility in future projects include:

- Robust Risk Assessment: Implementing comprehensive risk assessments that account for market fluctuations is crucial for effective project planning.

- Alternative Financing: Exploring alternative financing options, such as project finance, can help reduce reliance on traditional bank loans and mitigate interest rate risks.

- Price Hedging: Utilizing strategies to hedge against material price fluctuations can safeguard against unexpected cost increases. This could involve futures contracts or other risk management tools.

- Supply Chain Resilience: Building more resilient supply chains by diversifying sourcing and developing stronger relationships with suppliers is essential to lessen the impact of disruptions.

Conclusion: Market Volatility's Impact on Canadian Construction – What's Next?

Dow's decision to delay its large Canadian construction project underscores the significant impact of market volatility on the Canadian construction landscape. Rising interest rates, inflation, material shortages, and supply chain disruptions are creating a challenging environment for large-scale projects, necessitating a proactive approach to risk management. The long-term consequences for the Canadian economy are significant, emphasizing the need for innovative strategies to navigate these turbulent market conditions. Understanding the impact of market volatility is crucial for all stakeholders involved in large-scale Canadian construction projects. Learn more about mitigating risks and adapting to fluctuating market conditions by regularly checking our website for the latest news and analysis on the impact of market volatility on the Canadian construction sector.

Featured Posts

-

Private Credit Under Pressure A Weekly Update On Market Cracks And Concerns

Apr 27, 2025

Private Credit Under Pressure A Weekly Update On Market Cracks And Concerns

Apr 27, 2025 -

Sister Faith Vs Sister Chance Deconstructing The Female Dynamic In Zulawskis Possession

Apr 27, 2025

Sister Faith Vs Sister Chance Deconstructing The Female Dynamic In Zulawskis Possession

Apr 27, 2025 -

Entdecken Sie Die Herpetofauna Thueringens Der Neue Amphibien Und Reptilienatlas

Apr 27, 2025

Entdecken Sie Die Herpetofauna Thueringens Der Neue Amphibien Und Reptilienatlas

Apr 27, 2025 -

Cybercriminal Makes Millions Targeting Executive Office365 Accounts

Apr 27, 2025

Cybercriminal Makes Millions Targeting Executive Office365 Accounts

Apr 27, 2025 -

Top Seed Pegula Defeats Defending Champ Collins In Charleston

Apr 27, 2025

Top Seed Pegula Defeats Defending Champ Collins In Charleston

Apr 27, 2025