Land Your Dream Private Credit Job: 5 Essential Dos And Don'ts

Table of Contents

Do: Network Strategically

Networking is crucial in the private credit industry. It's not just about who you know, but about building genuine relationships that can lead to opportunities.

Attend Industry Events

Industry events are goldmines for networking. They offer unparalleled opportunities to connect with professionals, learn about new trends, and even uncover hidden job opportunities.

- Research upcoming events: Utilize online resources like LinkedIn Events, Eventbrite, and industry-specific websites to find conferences, workshops, and meetups related to private credit, leveraged finance, and alternative investments.

- Prepare a concise elevator pitch: Practice a brief and compelling summary of your skills and career aspirations tailored to the private credit field. Highlight your key accomplishments and what you bring to the table.

- Actively engage: Don't just passively attend; engage in conversations, exchange business cards, and follow up with new contacts after the event. Genuine connection is key.

Leverage LinkedIn

LinkedIn is an invaluable tool for private credit professionals. Use it strategically to expand your network and gain valuable insights.

- Optimize your profile: Make sure your profile highlights your skills and experience relevant to private credit, including keywords like "credit underwriting," "financial modeling," "portfolio management," and "leveraged finance."

- Join relevant groups: Engage in discussions within LinkedIn groups focused on private credit, alternative investments, and related fields. This shows your interest and keeps you updated on industry news.

- Connect with recruiters: Connect with recruiters and hiring managers specializing in private credit placements. They often have exclusive insights into job openings.

Do: Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. They need to showcase your skills and experience in a way that resonates with private credit firms.

Highlight Relevant Skills

Your resume should clearly demonstrate your proficiency in areas crucial to private credit.

- Quantify your accomplishments: Use numbers and data to show the impact of your work. Instead of "Improved efficiency," write "Improved efficiency by 15%, resulting in $X cost savings."

- Use relevant keywords: Carefully review job descriptions and incorporate relevant keywords throughout your resume and cover letter. This helps Applicant Tracking Systems (ATS) identify your application as a good fit.

- Tailor to each application: Generic applications rarely succeed. Customize your resume and cover letter to reflect the specific requirements and culture of each firm you target.

Showcase Private Credit Experience (if any)

Even seemingly unrelated experiences can be valuable.

- Describe responsibilities and achievements concisely: Focus on quantifiable results and impactful contributions.

- Emphasize transferable skills: Highlight skills like analytical abilities, problem-solving skills, and financial modeling, even if gained in different industries.

- Consider adding a portfolio section: If you have relevant projects (e.g., financial models, investment analyses), include links or brief descriptions in a portfolio section.

Don't: Neglect Due Diligence

Thorough research is paramount before applying for any private credit role.

Research the Firm

Understanding the firm's investment strategy, portfolio companies, and culture is crucial.

- Review the firm's website and news articles: Gain insights into their investment philosophy, recent deals, and overall performance.

- Research the leadership team: Understanding the backgrounds and experience of key personnel can provide valuable context.

- Assess the firm's reputation and values: Look for reviews and testimonials to gauge the firm's culture and employee satisfaction.

Underestimate the Interview Process

Private credit interviews are known for their rigor. Preparation is key.

- Practice your answers: Anticipate common interview questions (behavioral, technical, and case studies) and practice your responses.

- Research common private credit interview questions: Utilize online resources to familiarize yourself with typical questions and prepare thoughtful answers.

- Prepare insightful questions: Asking thoughtful questions demonstrates your genuine interest and engagement.

Do: Demonstrate Financial Acumen

Private credit requires strong analytical and financial skills. Showcase your expertise.

Showcase Analytical Skills

Demonstrate your ability to analyze financial statements, conduct due diligence, and make informed decisions.

- Highlight proficiency in financial modeling and valuation techniques: Show you understand DCF, LBO modeling, and other relevant techniques.

- Demonstrate understanding of credit risk assessment: Show your knowledge of credit metrics, risk mitigation strategies, and credit analysis methodologies.

- Be ready to discuss experience with financial software and tools: Familiarity with Bloomberg Terminal, Excel, and other relevant software is essential.

Highlight Relevant Certifications

Certifications like CFA, CAIA, or others demonstrate your commitment to the field.

- List certifications prominently: Include these on your resume and LinkedIn profile.

- Be prepared to discuss their relevance: Explain how your certifications have enhanced your skills and knowledge in private credit.

Don't: Rush the Process

Landing your dream job takes time and perseverance.

Be Patient and Persistent

Don't let rejections discourage you.

- Network consistently: Continuously engage with people in the industry.

- Refine your application materials: Use feedback to improve your resume, cover letter, and interview skills.

- Stay positive and persistent: Maintain a positive attitude and keep applying.

Neglect Your Personal Brand

Your professional image matters, both online and offline.

- Maintain a professional online presence: Ensure your LinkedIn profile and other online presence reflect your professionalism.

- Build relationships with mentors and peers: Seek guidance and support from experienced professionals.

- Seek feedback and continuous improvement: Regularly solicit feedback and strive for continuous improvement in your skills and approach.

Conclusion

Securing your dream private credit job requires a strategic and diligent approach. By following these dos and don'ts—from strategic networking and meticulous resume tailoring to demonstrating financial acumen and maintaining patience—you can significantly increase your chances of success. Remember to consistently network, research firms thoroughly, and showcase your unique skills and experience. Don't be discouraged by setbacks; keep refining your approach and pursuing your goal of landing your dream private credit job. Start applying your newfound knowledge today and begin your journey to securing your ideal role in the private credit sector!

Featured Posts

-

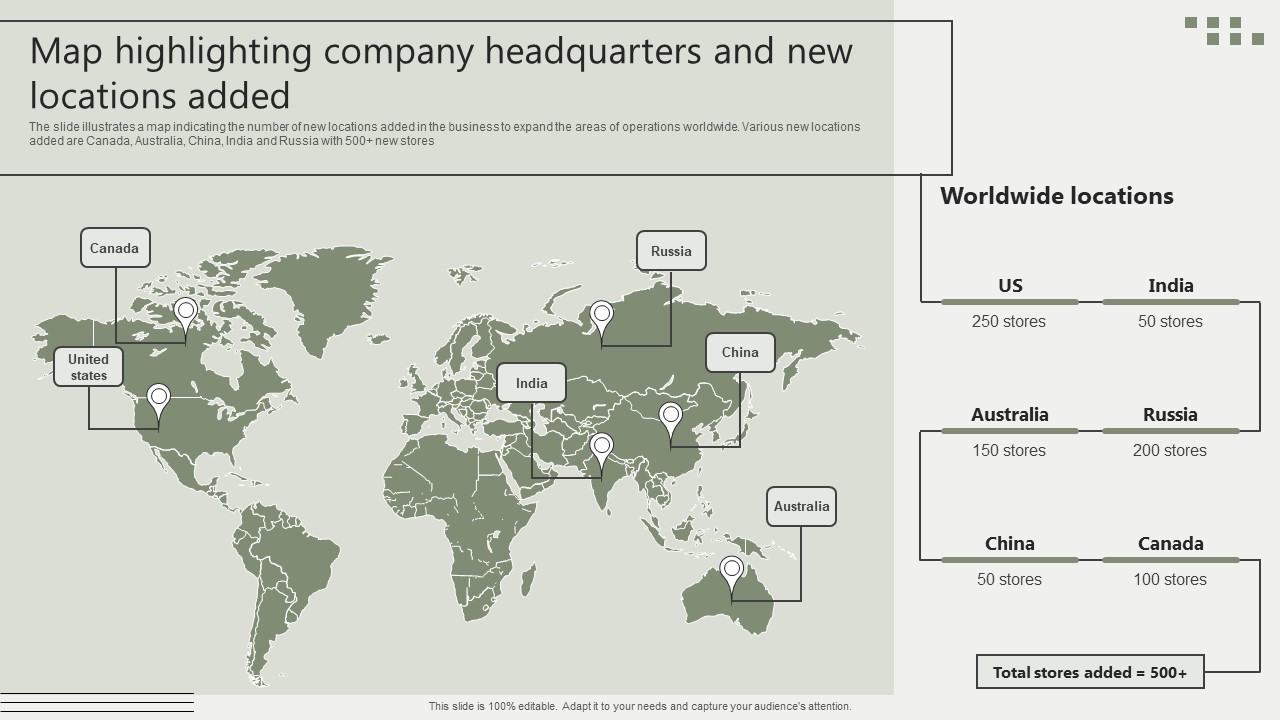

Mapping The Countrys Hottest New Business Locations

Apr 26, 2025

Mapping The Countrys Hottest New Business Locations

Apr 26, 2025 -

The Rise Of Chinese Car Brands A Look At Their Future Prospects

Apr 26, 2025

The Rise Of Chinese Car Brands A Look At Their Future Prospects

Apr 26, 2025 -

Chainalysis And Alterya A Strategic Partnership In Blockchain And Ai

Apr 26, 2025

Chainalysis And Alterya A Strategic Partnership In Blockchain And Ai

Apr 26, 2025 -

Cassidy Hutchinson Key Witness To January 6th Announces Memoir

Apr 26, 2025

Cassidy Hutchinson Key Witness To January 6th Announces Memoir

Apr 26, 2025 -

Post Roe America How Over The Counter Birth Control Changes The Game

Apr 26, 2025

Post Roe America How Over The Counter Birth Control Changes The Game

Apr 26, 2025