Is The U.S. Dollar Headed For Its Worst First 100 Days Since Nixon?

Table of Contents

Inflation and Interest Rate Hikes: A Looming Threat to the Dollar's Stability

Persistent inflation and aggressive interest rate hikes by the Federal Reserve represent significant headwinds for the dollar. This combination creates a complex and potentially volatile economic environment.

Persistent Inflation: Eroding Purchasing Power

Inflation remains stubbornly high, eroding the purchasing power of the dollar. The Consumer Price Index (CPI) and the Producer Price Index (PPI) continue to reflect elevated price levels across various sectors.

- CPI and PPI data: Recent reports show [insert current CPI and PPI data with source citation]. These figures indicate that inflation remains a significant concern.

- Impact on consumer confidence and spending: High inflation erodes consumer confidence, leading to reduced spending and potential economic slowdown. This decreased demand can further impact the dollar's value.

- Keywords: Inflation, CPI, PPI, purchasing power, consumer confidence, interest rates, Federal Reserve.

Aggressive Interest Rate Hikes by the Federal Reserve: A Risky Remedy?

The Federal Reserve's response to inflation has been aggressive interest rate hikes. While aiming to curb inflation, this monetary policy carries risks.

- Impact on borrowing costs: Higher interest rates increase borrowing costs for businesses and consumers, potentially slowing down economic growth.

- Impact on investment: Increased borrowing costs can stifle investment and hinder economic expansion.

- Potential for recession: The aggressive tightening of monetary policy raises concerns about a potential recession, which would negatively impact the dollar's value.

- Keywords: Federal Reserve, monetary policy, interest rate hikes, recession, economic growth, borrowing costs.

Geopolitical Uncertainty and its Impact on the Dollar's Value

Geopolitical instability significantly influences the dollar's value. The current global landscape is fraught with uncertainty, presenting substantial challenges.

The War in Ukraine and Global Energy Crisis: A Perfect Storm?

The war in Ukraine and the resulting global energy crisis have severely disrupted supply chains and created volatile commodity prices.

- Supply chain disruptions: The conflict has exacerbated existing supply chain issues, leading to shortages and price increases for various goods.

- Commodity price volatility: Oil and gas prices have surged, fueling inflation and increasing economic uncertainty globally. This volatility directly impacts the dollar's value as a safe haven asset.

- Keywords: Geopolitical risk, Ukraine conflict, energy crisis, supply chain disruptions, commodity prices, oil prices, gas prices.

US-China Relations and Global Trade Tensions: A Persistent Threat

Strained US-China relations and ongoing trade tensions add another layer of complexity to the global economic landscape.

- Trade wars and tariffs: Trade disputes and tariffs impact global trade flows and can negatively affect the dollar's value.

- Economic decoupling: The possibility of further economic decoupling between the US and China adds to the uncertainty surrounding the dollar's future.

- Keywords: US-China relations, trade war, tariffs, global trade, economic stability.

Comparison to the Post-Nixon Era: Parallels and Differences

Understanding the historical context of the Nixon shock is crucial to assessing the current situation.

The Nixon Shock and its Aftermath: A Historical Perspective

In 1971, President Nixon ended the Bretton Woods system, effectively ending the gold standard.

- Key events: The move was preceded by growing concerns about the dollar's convertibility to gold.

- Immediate consequences: The decision led to significant dollar devaluation and increased currency volatility.

- Long-term effects: The abandonment of the gold standard ushered in an era of floating exchange rates, fundamentally altering the global monetary system.

- Keywords: Bretton Woods, Nixon Shock, gold standard, devaluation, floating exchange rates.

Similarities and Differences with the Current Situation: A Comparative Analysis

While there are some parallels between the current environment and the post-Nixon era, crucial differences exist.

- Similarities: Both periods feature high inflation and significant geopolitical uncertainty.

- Differences: The current global financial system is more complex and interconnected than in the 1970s. The response mechanisms and tools available to central banks are also different.

- Keywords: Economic comparison, geopolitical comparison, financial landscape, currency fluctuations, global monetary system.

Conclusion: Is a Repeat of the Post-Nixon Era Inevitable for the U.S. Dollar?

The US dollar faces substantial challenges from persistent inflation, aggressive interest rate hikes, and significant geopolitical uncertainty. These factors create a volatile environment, raising concerns about the dollar's future stability. While a complete repeat of the post-Nixon era's drastic dollar devaluation is not necessarily inevitable, the current confluence of economic and geopolitical headwinds presents significant risks. The extent to which these risks materialize will depend on a variety of factors, including the effectiveness of the Federal Reserve's monetary policy, the evolution of the geopolitical landscape, and the overall resilience of the global economy.

Stay informed about developments affecting the U.S. dollar and learn more about strategies to navigate potential economic uncertainty. Understanding the factors that influence the U.S. dollar's value is crucial in these volatile times. Monitoring the CPI, PPI, Federal Reserve announcements, and geopolitical developments will help you stay ahead of the curve. The future of the U.S. dollar remains uncertain, but understanding the challenges ahead is the first step in preparing for potential volatility.

Featured Posts

-

Richard Jeffersons Espn Promotion Nba Finals Role Still Uncertain

Apr 28, 2025

Richard Jeffersons Espn Promotion Nba Finals Role Still Uncertain

Apr 28, 2025 -

Nintendos Action Leads To Ryujinx Emulator Development Cessation

Apr 28, 2025

Nintendos Action Leads To Ryujinx Emulator Development Cessation

Apr 28, 2025 -

10 Gb Uae Sim Card With Abu Dhabi Pass Save 15 On Attractions

Apr 28, 2025

10 Gb Uae Sim Card With Abu Dhabi Pass Save 15 On Attractions

Apr 28, 2025 -

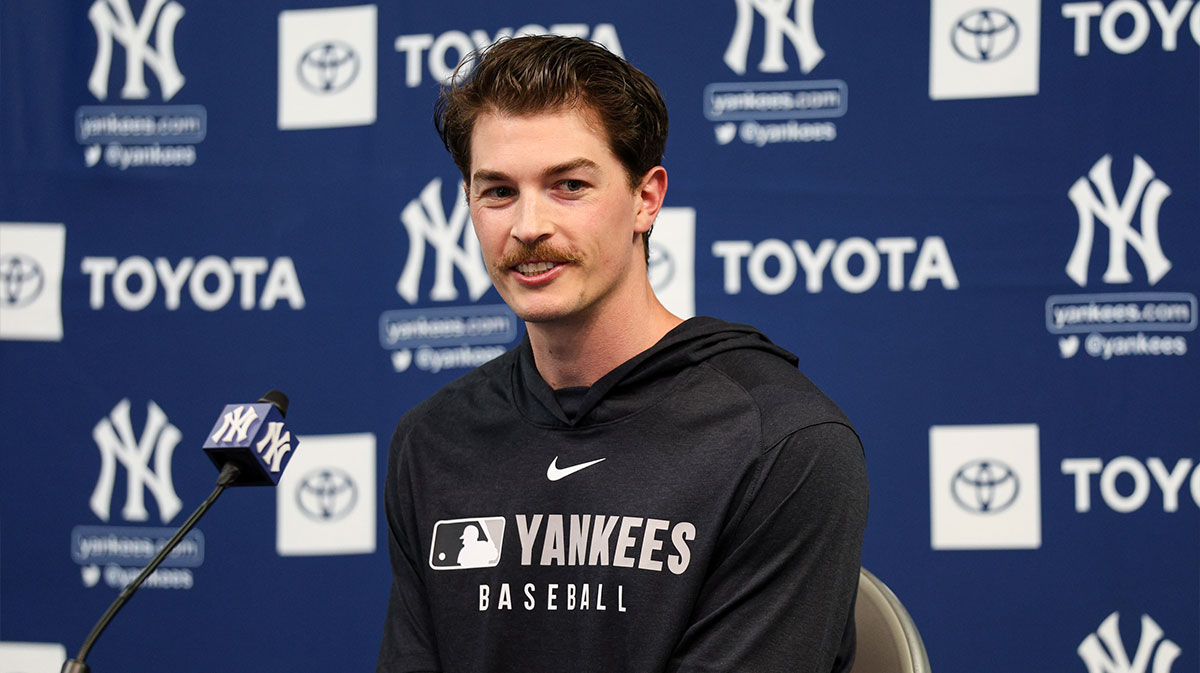

12 3 Rout Max Fried Impresses In First Game With Yankees

Apr 28, 2025

12 3 Rout Max Fried Impresses In First Game With Yankees

Apr 28, 2025 -

Mets Opening Day Roster Prediction Early Spring Training Insights

Apr 28, 2025

Mets Opening Day Roster Prediction Early Spring Training Insights

Apr 28, 2025