High Stock Market Valuations: A BofA Analysis For Investors

Table of Contents

Understanding BofA's Valuation Metrics

BofA employs several key valuation metrics to assess the current market environment and determine if valuations are stretched. These metrics provide a comprehensive picture, although each has its limitations. Key metrics include:

-

Price-to-Earnings ratio (P/E): This classic metric compares a company's stock price to its earnings per share (EPS). A high P/E ratio suggests investors are paying a premium for each dollar of earnings, indicating potentially high valuations. BofA likely uses this to compare current P/E ratios to historical averages across various sectors and the overall market.

-

Price-to-Sales ratio (P/S): This ratio compares a company's market capitalization to its revenue. It's particularly useful for evaluating companies with negative earnings or those in high-growth sectors. BofA's analysis probably uses this to identify potentially overvalued growth stocks.

-

Cyclically Adjusted Price-to-Earnings ratio (CAPE): Also known as the Shiller P/E, this metric adjusts the P/E ratio for inflation and cyclical variations in earnings, providing a smoother, long-term perspective. BofA likely utilizes CAPE to gain a more stable understanding of long-term valuations and compare them to historical market peaks and troughs.

BofA's analysis likely compares these metrics across different sectors, comparing current readings to historical averages and similar market cycles to gauge the extent of overvaluation. While these metrics offer valuable insights, it's important to remember their limitations. For instance, P/E ratios can be skewed by accounting practices, while P/S ratios don't account for profitability. CAPE, while smoothing cyclical effects, may not fully capture near-term market fluctuations.

Identifying Potential Risks Associated with High Valuations

Investing in a highly valued market inherently carries increased risk. BofA's analysis likely highlights several key concerns:

-

Risk of Overvaluation Leading to Market Corrections: High valuations often precede market corrections or even crashes. If investor sentiment shifts negatively, a sharp decline in prices can occur. BofA's analysis probably incorporates historical data on market corrections to assess the probability and potential severity of such an event.

-

Impact of Interest Rate Hikes on Stock Valuations: Increased interest rates make bonds more attractive, potentially diverting investment away from equities. Higher rates also increase borrowing costs for companies, impacting profitability and potentially reducing stock valuations. BofA's assessment would likely consider the Federal Reserve's monetary policy and its implications for stock prices.

-

Geopolitical Risks and Their Influence on Market Sentiment: Uncertain geopolitical events, such as international conflicts or trade wars, can significantly impact investor sentiment and lead to market volatility. BofA's analysis would factor in current geopolitical risks and their potential impact on market valuations.

BofA's Investment Strategies in a High-Valuation Environment

Given high valuations, BofA likely suggests a more cautious and diversified investment approach:

-

Diversification Across Asset Classes: Reducing reliance on equities by diversifying into bonds, real estate, or other asset classes can mitigate the risk associated with a potential market downturn.

-

Focusing on Undervalued Sectors or Companies: Identifying sectors or companies that are trading below their intrinsic value can offer better risk-adjusted returns compared to the overall market. This requires thorough fundamental analysis.

-

Considering Defensive Stocks: Investing in companies that are less susceptible to economic downturns, such as consumer staples or utilities, can provide relative stability during market corrections.

-

Importance of a Long-Term Investment Horizon: A longer-term perspective can help investors weather short-term market volatility and potentially benefit from long-term growth.

Comparing BofA's Analysis with Other Market Perspectives

While BofA offers valuable insights, it's crucial to compare their analysis with perspectives from other prominent financial institutions. Different firms may use varying methodologies and interpret data differently, leading to diverse conclusions. For example, some might argue that current valuations are justified by strong corporate earnings growth or low interest rates, while others might echo BofA's concerns about overvaluation. This comparison allows for a more comprehensive understanding of the market's current state. It also highlights the importance of independent research and due diligence before making investment decisions.

Conclusion: Navigating High Stock Market Valuations – A Call to Action

BofA's analysis of high stock market valuations highlights several key concerns, including the risk of market corrections, the impact of interest rate hikes, and the influence of geopolitical factors. However, opportunities remain for investors who adopt a cautious and diversified approach, focusing on undervalued sectors or defensive stocks. Understanding high stock market valuations is crucial for informed investment decisions. By carefully considering BofA's analysis, comparing it with other market perspectives, and conducting your own due diligence, you can navigate the current market landscape effectively. Remember to consult with a financial advisor before making any significant investment decisions.

Featured Posts

-

2025 New York Yankees Merchandise Where To Find Hats Jerseys And Gear

Apr 28, 2025

2025 New York Yankees Merchandise Where To Find Hats Jerseys And Gear

Apr 28, 2025 -

Addressing Americas Truck Bloat Innovative Solutions And Their Effectiveness

Apr 28, 2025

Addressing Americas Truck Bloat Innovative Solutions And Their Effectiveness

Apr 28, 2025 -

Official Mets Option Neuse Recall Megill To Starting Rotation

Apr 28, 2025

Official Mets Option Neuse Recall Megill To Starting Rotation

Apr 28, 2025 -

A Road Trip Through The Florida Keys The Overseas Highway

Apr 28, 2025

A Road Trip Through The Florida Keys The Overseas Highway

Apr 28, 2025 -

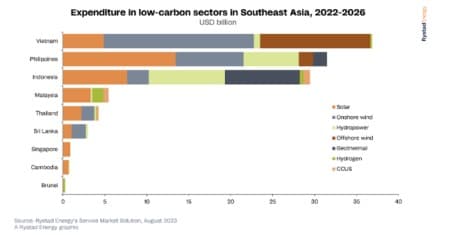

Canadian Trade Mission Fuels Southeast Asias Energy Growth

Apr 28, 2025

Canadian Trade Mission Fuels Southeast Asias Energy Growth

Apr 28, 2025