German Bundestag Elections And Their Impact On The Dax

Table of Contents

2.1. Political Uncertainty and Market Volatility: Pre-Election Jitters and the DAX

Pre-election periods are often characterized by heightened uncertainty, significantly influencing investor sentiment and leading to DAX volatility. The closer the election, the more pronounced this effect becomes. Investors become cautious, leading to potential market fluctuations as they assess the potential outcomes and their implications for their portfolios. Analyzing past elections reveals clear patterns of increased volatility in the months leading up to the voting.

-

Election Uncertainty and DAX Volatility: The closer the election date, the higher the volatility, as seen in the lead-up to the 2017 and 2021 elections. This is because investors react to shifting polling data and the potential for unexpected results.

-

Polling Data's Impact: Pre-election polls significantly influence market predictions. A sudden shift in favor of a particular party with drastically different economic policies can trigger immediate market reactions. For example, a sudden surge in support for a party advocating for significant regulatory changes could negatively impact specific sectors represented in the DAX.

-

Coalition Scenarios and Market Implications: The formation of a coalition government after the election introduces another layer of uncertainty. The composition of the coalition and its policy priorities directly impact investor confidence and subsequent market behavior. Negotiations can take time, prolonging the period of uncertainty.

-

Sectors Particularly Sensitive to Political Change: The automotive and energy sectors, crucial components of the DAX, are particularly vulnerable to policy changes related to environmental regulations and industrial policy.

2.2. Policy Platforms and Their Economic Implications: Analyzing Party Manifestos

Analyzing the economic policies proposed by major political parties before the election is crucial to understanding their potential impact on the DAX. Party manifestos often outline fiscal policy plans, tax reform proposals, and regulatory intentions, all of which have direct consequences for listed companies.

-

Economic Policy and DAX Company Performance: Policies related to taxation, subsidies, and infrastructure spending directly affect the profitability and competitiveness of DAX companies. For example, tax cuts for corporations could positively impact company earnings, leading to an increase in the DAX. Conversely, increased environmental regulations could negatively affect companies in polluting industries.

-

Fiscal Policy and its Impact: Government spending and borrowing significantly influence economic growth. Expansionary fiscal policies can boost economic activity but might also increase inflation. Conversely, austerity measures might lead to slower growth but could improve long-term fiscal stability. These differing approaches have significant implications for the DAX.

-

Tax Reforms and their Influence: Tax reforms, whether they involve corporate tax rates, personal income taxes, or consumption taxes (like VAT), directly affect businesses and consumer spending, consequently impacting the DAX.

-

Regulatory Impact on Specific Sectors: Changes in regulations impacting specific industries, like stricter environmental rules for the automotive sector or energy sector reforms, can have a considerable effect on DAX performance.

-

Examples of Past Policy Changes and their Effect on the DAX: Examining past instances of policy changes and their subsequent impact on the DAX allows for better prediction of future scenarios. For instance, the introduction of the “Energiewende” (energy transition) policy has had profound and ongoing effects on German energy companies and the DAX.

2.3. Post-Election Market Reactions: The DAX in the Aftermath of Bundestag Elections

Analyzing historical DAX performance following previous Bundestag elections provides valuable insights into post-election market reactions. These reactions can be categorized into short-term and long-term trends, influenced by various factors.

-

Post-Election Market Analysis and DAX Performance: Studying previous elections reveals that the immediate market reaction is often influenced by the election results themselves and the market's interpretation of the potential economic consequences. Short-term volatility is common.

-

Market Reaction Time: The market’s reaction time varies depending on the clarity of the election results and the speed of coalition negotiations. A clear victory with a stable coalition often leads to quicker market stabilization than a close election requiring lengthy negotiations.

-

Factors Influencing Post-Election Market Trends: Factors influencing post-election trends include the speed of government formation, the policies adopted by the new government, and the overall global economic environment.

-

Case Studies of Specific Elections: Examining specific elections, such as the 2005 and 2013 elections, helps illustrate the diverse range of post-election market responses and the factors driving them.

-

Investor Confidence Levels: Investor confidence plays a critical role in shaping post-election market trends. Positive sentiment, driven by policies perceived as growth-friendly, usually leads to positive DAX performance.

2.4. International Implications: The Bundestag Elections and Global Markets

Germany's significant role in the European Union and the global economy means that Bundestag elections have far-reaching international implications. The economic repercussions extend beyond Germany's borders.

-

Global Market Impact and German Economic Influence: The German economy is Europe's largest, and thus, its political stability and economic health have a considerable impact on the EU and the global market.

-

European Union Economics and German Election Outcomes: Changes in German economic policies, driven by election results, can significantly affect the European Union's overall economic performance, particularly given Germany's prominent role in the Eurozone.

-

International Market Reactions to German Election Results: Global investors closely monitor German elections, as the outcomes influence the stability of the Euro and affect international trade and investment flows.

-

Impact on the Euro and its Exchange Rate: The election results can directly impact the Euro's exchange rate, reflecting investor confidence in the German economy and the stability of the Eurozone.

-

Influence on the European Central Bank's Monetary Policy: The European Central Bank’s monetary policy decisions are partly influenced by the economic outlook of the Eurozone's largest economy, Germany, and thus by the election outcomes.

3. Conclusion: Understanding the Interplay Between German Bundestag Elections and the DAX

The relationship between German Bundestag elections and the DAX is complex but undeniably significant. Understanding the interplay between political uncertainty, policy platforms, and post-election market reactions is crucial for informed investment strategies. While short-term volatility is common, long-term trends are generally influenced by the effectiveness of the new government's economic policies. Investors should stay informed about the key economic policies of leading political parties before and after the elections to better assess their potential impact on their portfolios. Regularly researching “German Bundestag elections and their impact on the DAX” is key to navigating this dynamic relationship and making informed investment decisions.

Featured Posts

-

February 16 2025 Open Thread For Community Discussion

Apr 27, 2025

February 16 2025 Open Thread For Community Discussion

Apr 27, 2025 -

Wta 1000 Dubai Derrota Inesperada Para Paolini Y Pegula

Apr 27, 2025

Wta 1000 Dubai Derrota Inesperada Para Paolini Y Pegula

Apr 27, 2025 -

The Impact Of Ariana Grandes Hair And Tattoo Transformation A Professionals View

Apr 27, 2025

The Impact Of Ariana Grandes Hair And Tattoo Transformation A Professionals View

Apr 27, 2025 -

Trumps Presence At Pope Benedicts Funeral Politics And Papal Rites Intertwined

Apr 27, 2025

Trumps Presence At Pope Benedicts Funeral Politics And Papal Rites Intertwined

Apr 27, 2025 -

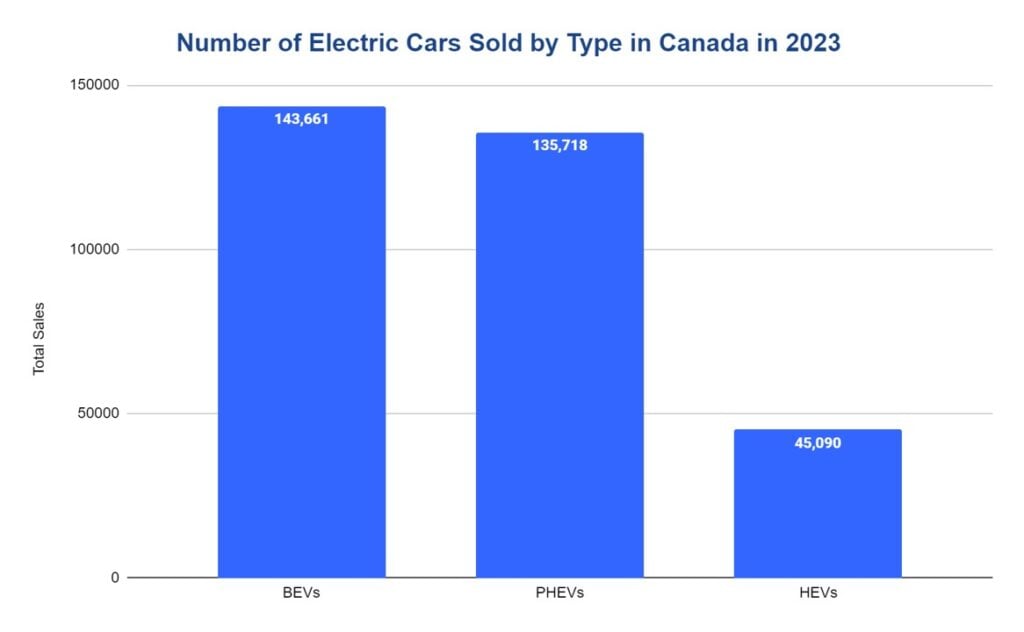

Canadians Ev Interest Dips For Third Consecutive Year

Apr 27, 2025

Canadians Ev Interest Dips For Third Consecutive Year

Apr 27, 2025