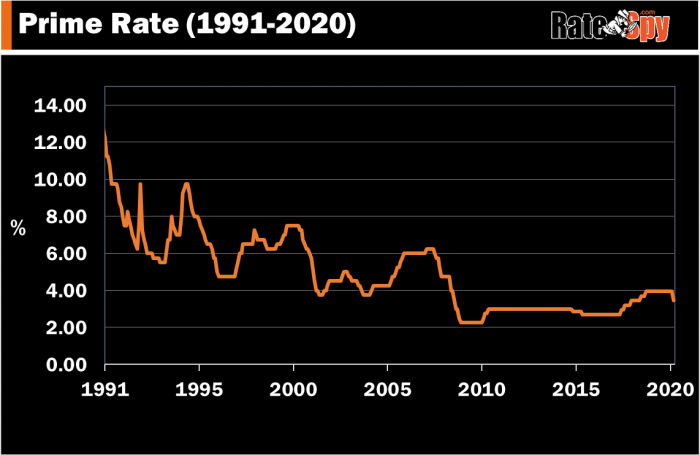

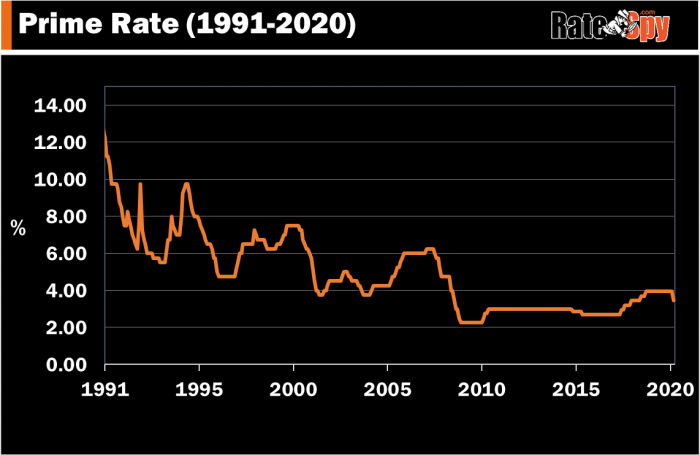

Falling Retail Numbers: Implications For Bank Of Canada Rate Decisions

Table of Contents

The Current State of Retail Sales in Canada

The most recent retail sales data paints a concerning picture for the Canadian economy. Statistics Canada reported a [insert percentage change]% decrease in retail sales for [insert month/quarter], marking a [insert description, e.g., continued downturn/sharp decline] in consumer spending. Several factors contribute to this worrying trend. High inflation, eroding consumer purchasing power, and decreased consumer confidence are all playing significant roles.

-

Specific examples of declining sales in key retail sectors: Clothing sales have fallen by [insert percentage]%, furniture sales are down by [insert percentage]%, and the automotive sector has experienced a significant drop of [insert percentage]%. These declines highlight the broad-based nature of the weakening consumer demand.

-

Regional variations in retail sales performance: While the national picture is bleak, regional variations exist. [Insert province/region] has seen a relatively milder decline, while [Insert province/region] has experienced a steeper fall, reflecting differing economic conditions across the country.

-

Impact of high inflation on consumer purchasing power: Soaring inflation has significantly reduced consumer purchasing power. With prices rising faster than wages, Canadians have less disposable income to spend on non-essential goods and services, directly impacting retail sales.

-

Relevant statistics and reports: These figures are drawn from the latest Statistics Canada reports on retail trade, providing a reliable picture of the current state of the Canadian retail sector. Further analysis can be found on the Statistics Canada website [insert link].

How Falling Retail Numbers Influence the Bank of Canada

The Bank of Canada's primary mandate is to maintain price stability and promote sustainable economic growth. Consumer spending is a key driver of economic activity, and weakening retail sales directly impact both of these objectives.

-

Weak retail sales suggest softening demand: A decline in retail sales indicates a reduction in overall consumer demand. This softening demand could signal that inflationary pressures are easing, as businesses may be forced to lower prices to stimulate sales.

-

Potential for a pause or slowdown in interest rate hikes: If the Bank of Canada interprets falling retail sales as a sign of cooling demand and easing inflation, it might pause or slow the pace of its interest rate hikes. This could prevent unnecessarily tightening monetary policy, which could further dampen economic activity.

-

Persistent inflation despite weak retail sales: However, the situation is complicated. The Bank of Canada must also consider the possibility of persistent inflation even with weak retail sales. This could indicate underlying inflationary pressures that require continued interest rate hikes to control.

-

Potential for a recessionary scenario: The combination of falling retail sales and persistent inflation could raise concerns about a potential recession. In such a scenario, the Bank of Canada would need to carefully balance its goals of controlling inflation and avoiding a deeper economic downturn.

Alternative Economic Indicators to Consider

The Bank of Canada considers a range of economic indicators beyond retail sales when making interest rate decisions. A holistic view is crucial for accurate assessment.

-

Job market data: Unemployment rates and job growth provide insight into the health of the labor market and consumer confidence. Strong job growth might suggest continued spending despite inflation, while rising unemployment could signal further economic weakness.

-

Housing market indicators: Housing sales and prices are significant indicators of economic activity and consumer sentiment. A downturn in the housing market could exacerbate the impact of falling retail sales.

-

Inflation rates: Consumer Price Index (CPI) and core inflation (excluding volatile food and energy prices) are crucial indicators of inflationary pressures. Persistent high inflation, irrespective of retail sales figures, would likely prompt continued interest rate increases.

-

Business investment and consumer confidence indices: These provide valuable insights into future economic activity. Low business investment and declining consumer confidence further reinforce concerns about slowing economic growth.

Potential Future Scenarios and Their Impacts

The interplay of falling retail numbers, inflation, and other economic indicators creates several possible scenarios:

-

Scenario 1: Continued weak retail sales lead to interest rate pause or cuts: If retail sales continue to fall and inflation shows signs of cooling, the Bank of Canada might pause or even cut interest rates to stimulate economic activity. This would benefit borrowers but could potentially fuel inflation later on.

-

Scenario 2: Inflation remains stubbornly high despite weak retail sales: This scenario poses a significant challenge. The Bank of Canada might need to continue raising interest rates to combat persistent inflation, even at the risk of further slowing economic growth and potentially triggering a recession. This would negatively impact borrowers with increased debt servicing costs.

-

Scenario 3: A balanced approach – moderate rate hikes or pauses: The Bank of Canada might opt for a more balanced approach, carefully monitoring incoming economic data and adjusting interest rates accordingly. This strategy aims to balance inflation control with minimizing the economic impact of rate hikes. This approach requires careful assessment of data flows and may lead to fluctuating interest rate policies.

Conclusion

Falling retail numbers significantly influence the Bank of Canada's rate decisions. The Bank must carefully consider the interplay between weakening consumer spending, persistent inflation, and other economic indicators to make informed choices. The resulting monetary policy will have far-reaching consequences for the Canadian economy.

Stay informed about the latest economic data and the Bank of Canada's announcements to better understand the implications of falling retail numbers for your financial well-being. Regularly check reputable financial news sources and government websites for updates on Canadian retail sales and interest rate decisions. Understanding the connection between retail sales and the Bank of Canada's monetary policy is crucial for navigating the current economic climate.

Featured Posts

-

Oppo Find X8 Ultra

Apr 28, 2025

Oppo Find X8 Ultra

Apr 28, 2025 -

Ttwrat Raydt Fy Mjal Tb Alhyat Alshyt Almdydt Mntda Abwzby

Apr 28, 2025

Ttwrat Raydt Fy Mjal Tb Alhyat Alshyt Almdydt Mntda Abwzby

Apr 28, 2025 -

Max Frieds Strong Yankees Debut Highlights 12 3 Victory Over Pirates

Apr 28, 2025

Max Frieds Strong Yankees Debut Highlights 12 3 Victory Over Pirates

Apr 28, 2025 -

Yankees Win Judge And Goldschmidts Impact On The Series

Apr 28, 2025

Yankees Win Judge And Goldschmidts Impact On The Series

Apr 28, 2025 -

E Ink Spectra

Apr 28, 2025

E Ink Spectra

Apr 28, 2025