ECB's Simkus Hints At Two Further Interest Rate Cuts Amidst Trade War Concerns

Table of Contents

Šimkus's Statements and Their Implications

Šimkus's statements regarding potential interest rate cuts have sent ripples through financial markets. While he hasn't explicitly confirmed a double cut, his comments strongly suggest the ECB is seriously considering this option. The context of these statements, primarily delivered in various interviews and press briefings over recent weeks, points towards a growing concern within the ECB about the Eurozone's economic outlook.

- Direct quote from Šimkus (example): "Given the persistent weakness in economic indicators and the heightened uncertainty stemming from global trade tensions, further monetary policy easing, including interest rate cuts, cannot be ruled out." (Note: This is a hypothetical example. A real quote should be inserted here if available).

- Summary of market response: Following Šimkus’s comments, the euro experienced a slight depreciation against other major currencies, while government bond yields across the eurozone fell, indicating increased investor demand for safer assets.

- Analysis of Šimkus's language: Šimkus's tone, while not explicitly committing to a double interest rate cut, was notably less cautious than in previous statements. The use of phrases like "cannot be ruled out" suggests a higher probability of such action than previously indicated.

The Impact of the Trade War on the Eurozone Economy

The ongoing US-China trade war, along with other global trade tensions, is significantly impacting the eurozone economy. Reduced exports, particularly in sectors heavily reliant on international trade, are contributing to a slowdown in economic growth. Investor uncertainty and decreased business investment are further exacerbating the situation. The resulting economic risks are significant and are a key driver behind the ECB's consideration of further interest rate cuts.

- Specific examples of trade war impact: The automotive and manufacturing sectors in the Eurozone have been particularly hard hit by the trade war, facing reduced demand and supply chain disruptions.

- Statistics illustrating the slowdown: Recent data shows a significant decline in Eurozone GDP growth, falling below expectations and highlighting the weakening economic conditions. (Insert relevant statistics here).

- Expert opinions: Many leading economists believe the trade war is a major contributing factor to the current economic slowdown and predict further negative consequences if the trade disputes remain unresolved.

Alternative Monetary Policy Tools and Their Effectiveness

The ECB has already implemented several monetary policy tools, including negative interest rates and quantitative easing (QE). However, their effectiveness is increasingly being questioned. Further interest rate cuts are debated as a means to stimulate the economy further, but also carry potential risks.

- Explanation of QE and its limitations: QE, while having had some positive effects, is now showing diminishing returns. The effectiveness of injecting further liquidity into the system is becoming less pronounced.

- Potential side effects of further interest rate cuts: Concerns exist that excessively low interest rates could negatively impact banks' profitability, potentially hindering lending and overall economic activity.

- Alternative policy options: Targeted lending programs, aimed at supporting specific sectors of the economy, could be considered as a complementary measure alongside interest rate cuts. However, this approach requires careful targeting and effective implementation.

The Challenges Facing the ECB

The ECB faces a daunting task in stimulating economic growth while battling potential deflationary pressures and the limitations of conventional monetary policy tools. Balancing various economic factors makes decision-making incredibly complex.

- Current inflation rates: Inflation in the Eurozone remains stubbornly below the ECB's target of "below, but close to, 2%". (Insert current inflation data here).

- The ECB's inflation targets and the potential gap: The widening gap between actual and target inflation levels necessitates aggressive action to stimulate demand.

- Risks associated with prolonged periods of low interest rates: The risks of prolonged low interest rates include asset bubbles, financial instability, and an erosion of bank profitability.

Conclusion

Šimkus's comments strongly suggest the ECB is seriously considering further ECB interest rate cuts to counter the economic slowdown exacerbated by the trade war. The effectiveness of this measure and alternative tools are debatable, while the ECB faces considerable challenges in navigating the current complex economic landscape. Understanding the interplay of these factors is crucial. To stay informed about the evolving situation and the ECB's response to trade war concerns and potential further interest rate cuts, regularly check reputable financial news sources and official ECB publications. Understanding the ECB's decisions is crucial for navigating the current economic climate and making informed financial decisions.

Featured Posts

-

Canadas Divided Response To Trump Albertas Unique Position

Apr 27, 2025

Canadas Divided Response To Trump Albertas Unique Position

Apr 27, 2025 -

Ariana Grandes Hair And Tattoo Transformation The Artists And Professionals Involved

Apr 27, 2025

Ariana Grandes Hair And Tattoo Transformation The Artists And Professionals Involved

Apr 27, 2025 -

Alaskan Romance Ariana Biermanns Chill Trip

Apr 27, 2025

Alaskan Romance Ariana Biermanns Chill Trip

Apr 27, 2025 -

Motherhood And Victory Belinda Bencics Wta Return

Apr 27, 2025

Motherhood And Victory Belinda Bencics Wta Return

Apr 27, 2025 -

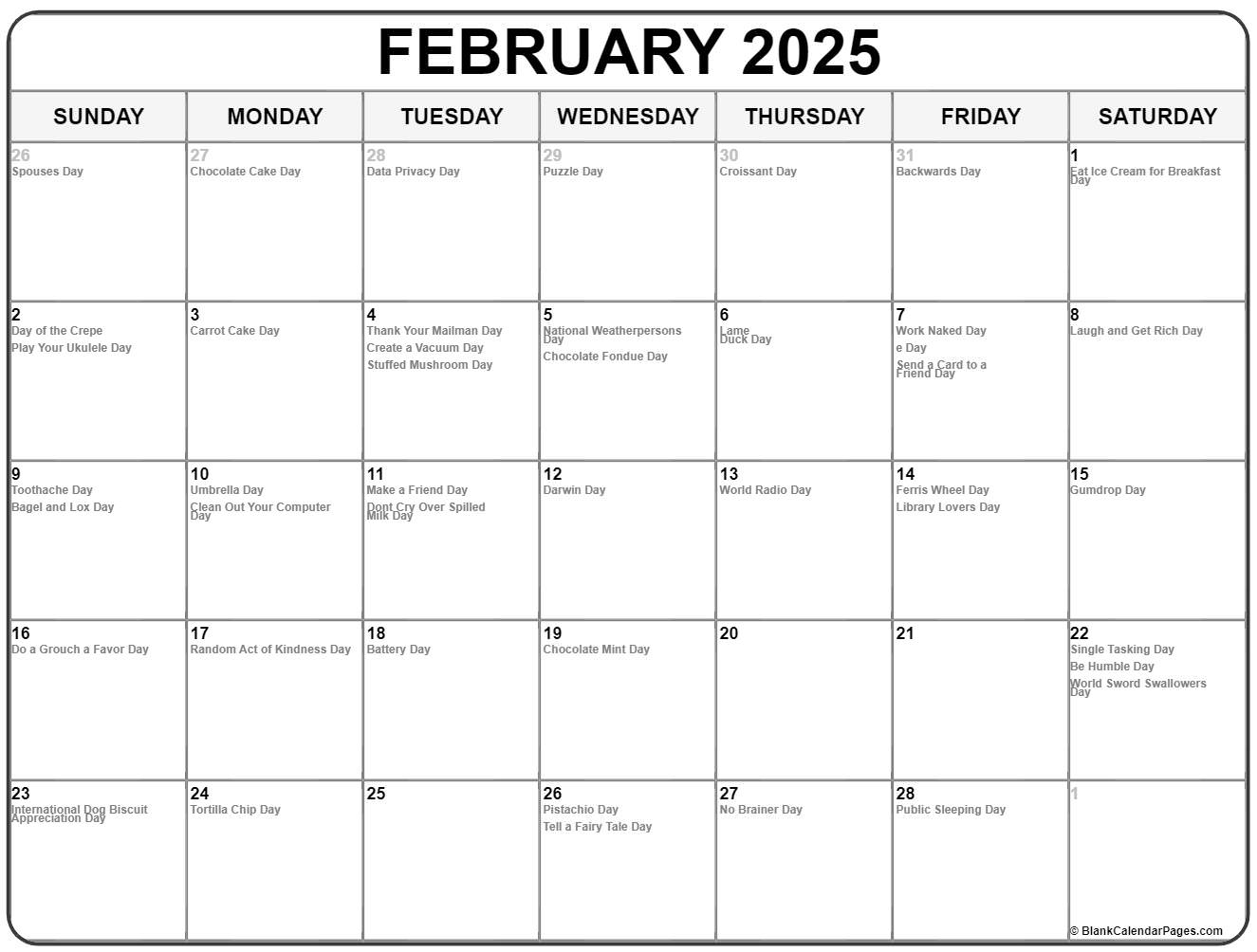

February 20 2025 A Happy Day

Apr 27, 2025

February 20 2025 A Happy Day

Apr 27, 2025