ECB's New Initiative: Simplifying Banking Rules

Table of Contents

Reduced Regulatory Burden for Banks

The ECB's new initiative directly tackles the excessive administrative burden currently weighing down banks. This simplification aims to free up resources, allowing banks to focus on core business activities, rather than getting bogged down in paperwork. The initiative involves a targeted approach to streamlining existing regulations, leading to significant improvements in efficiency.

- Simplification of capital requirements reporting: The new rules aim to reduce the complexity and volume of reporting requirements related to capital adequacy, freeing up valuable time and resources for banks. This involves modernizing reporting methods and clarifying reporting standards.

- Streamlining of anti-money laundering (AML) compliance procedures: The initiative will simplify AML compliance processes, making it easier for banks to meet their legal obligations while reducing the administrative burden. This could involve leveraging technology and creating clearer guidelines.

- Reduced paperwork and bureaucratic processes: The overall goal is to cut down on unnecessary paperwork and bureaucratic processes, making it easier for banks to operate and comply with regulations. This includes digitalizing processes wherever possible.

- Clarification of ambiguous regulations: The initiative aims to clarify ambiguous or conflicting regulations, reducing uncertainty and the risk of non-compliance. This involves providing clearer definitions and interpretations of existing rules.

Improved Access to Credit for Businesses and Consumers

Simplified banking regulations directly translate to improved access to credit for both businesses and consumers. By reducing the administrative burden on banks, the initiative lowers their operational costs, enabling them to offer more competitive interest rates and faster loan processing times.

- Lower processing costs for banks, translating to lower interest rates: Streamlined procedures mean lower processing costs, allowing banks to pass on these savings to borrowers in the form of reduced interest rates. This makes borrowing more attractive and accessible.

- Faster loan approval times for businesses and consumers: Simplified regulations result in faster loan application processing, leading to quicker access to vital funds for businesses and individuals. This speeds up investment and personal spending.

- Increased availability of credit for SMEs and underserved communities: Lower barriers to entry and reduced costs can make credit more available to small and medium-sized enterprises (SMEs) and underserved communities, fostering economic growth and inclusivity.

- Stimulation of economic activity through increased investment and consumption: Easier access to credit fuels investment and consumption, boosting economic activity and job creation across the Eurozone.

Enhanced Transparency and Competition in the Banking Sector

The ECB’s initiative fosters a more transparent and competitive banking sector. By simplifying regulations and clarifying information, consumers can more easily compare products and services, empowering them to make informed decisions.

- Easier comparison of banking products and services: Clearer regulations and standardized information make it easier for consumers to compare different banking products and services, fostering competition and driving down prices.

- Increased competition leading to lower fees and better interest rates: Enhanced competition among banks, driven by transparency, should result in lower fees and more competitive interest rates for consumers.

- Greater consumer protection through clearer regulations: The simplification of regulations will result in stronger consumer protection, ensuring clearer rights and responsibilities for both banks and customers.

- Improved efficiency and innovation in the banking sector: Reduced regulatory burden allows banks to focus on innovation and efficiency improvements, leading to better products and services for consumers.

Potential Challenges and Implementation

While the ECB's new initiative simplifying banking rules promises significant benefits, successful implementation requires careful planning and consideration of potential challenges.

- Ensuring consistent application of the simplified rules across the Eurozone: Maintaining consistency in the application of simplified rules across different member states is crucial to avoid creating new disparities and inconsistencies.

- Managing the transition from the old to the new regulatory framework: A smooth transition from the existing regulatory framework to the simplified rules is essential to minimize disruption and ensure a seamless process for banks.

- Addressing potential unintended consequences of the simplification: Careful monitoring and evaluation are necessary to identify and address any unintended negative consequences that may arise from the simplification of rules.

- Monitoring the effectiveness of the new rules and making adjustments as needed: Continuous monitoring and evaluation are vital to ensure the effectiveness of the simplified rules and to make necessary adjustments as needed.

Conclusion: The Impact of the ECB's New Initiative Simplifying Banking Rules

The ECB's new initiative simplifying banking rules offers significant potential for positive change in the European banking sector. By reducing the regulatory burden on banks, improving access to credit, and fostering greater transparency and competition, the initiative promises to benefit businesses, consumers, and the overall economy. The positive impact on economic growth, job creation, and consumer welfare is expected to be substantial. Stay informed about the ECB's new initiative simplifying banking rules and how it will impact your business or personal finances. Visit the ECB website for more details and learn how these changes could benefit you.

Featured Posts

-

Trumps Presence At Pope Benedicts Funeral Politics And Papal Rites Intertwined

Apr 27, 2025

Trumps Presence At Pope Benedicts Funeral Politics And Papal Rites Intertwined

Apr 27, 2025 -

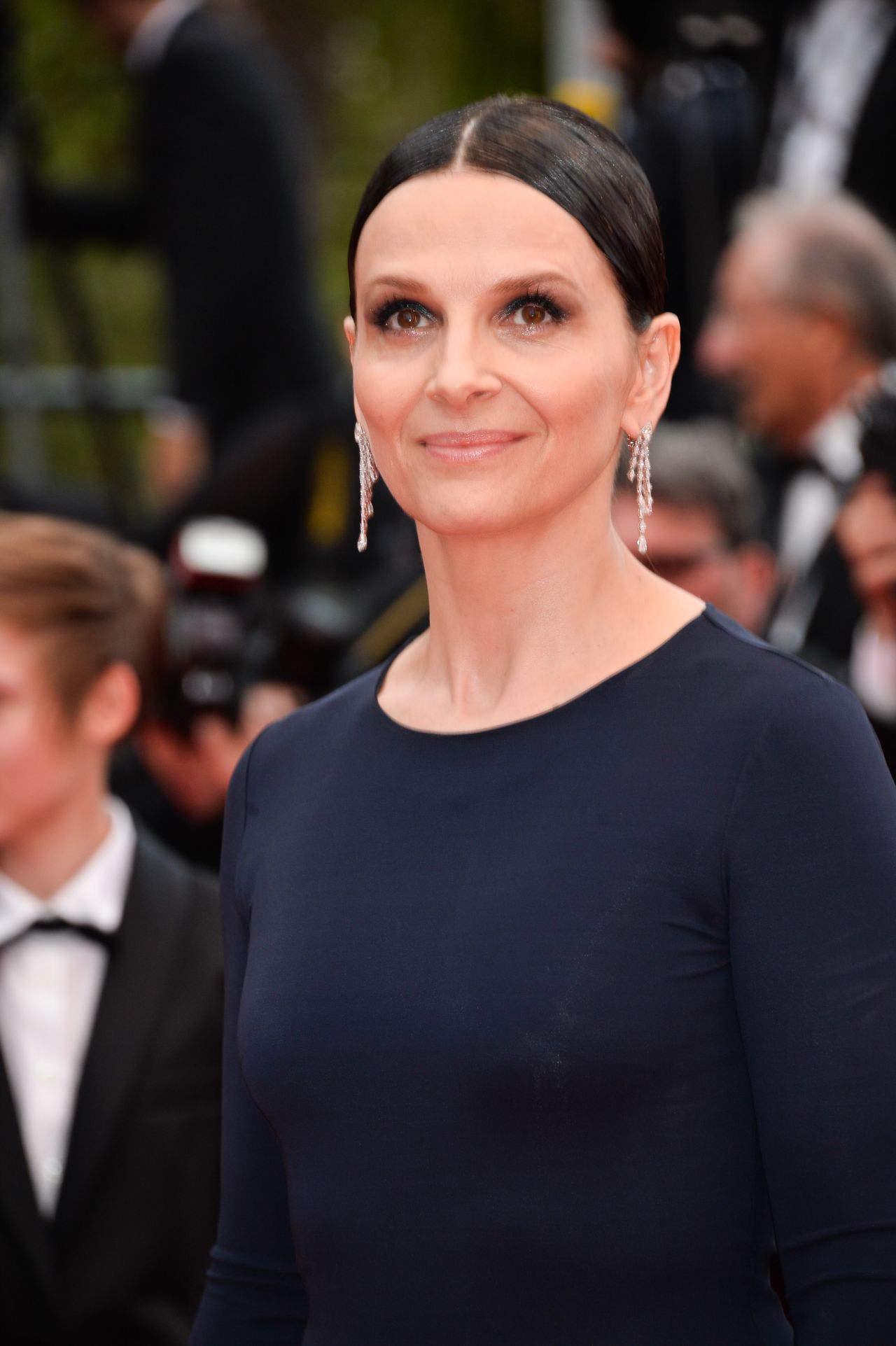

Juliette Binoche Cannes Film Festival Jury President 2025

Apr 27, 2025

Juliette Binoche Cannes Film Festival Jury President 2025

Apr 27, 2025 -

Un Ano De Salario Por Licencia De Maternidad El Nuevo Estandar En La Wta

Apr 27, 2025

Un Ano De Salario Por Licencia De Maternidad El Nuevo Estandar En La Wta

Apr 27, 2025 -

Grand National 2025 A Complete Guide To The Runners At Aintree

Apr 27, 2025

Grand National 2025 A Complete Guide To The Runners At Aintree

Apr 27, 2025 -

Untangling Sister Faith And Sister Chance In Andrzej Zulawskis Possession A Lady Killers Podcast Analysis

Apr 27, 2025

Untangling Sister Faith And Sister Chance In Andrzej Zulawskis Possession A Lady Killers Podcast Analysis

Apr 27, 2025