ECB Creates Task Force For Simpler Bank Regulations

Table of Contents

The Rationale Behind the Task Force

The ECB's decision to establish a task force dedicated to simplifying bank regulations stems from growing concerns about the current regulatory landscape. The sheer weight of existing rules creates significant burdens for banks, impacting their operational efficiency and strategic planning. The ECB recognizes that overly complex regulations create several key challenges:

- Increased Compliance Costs: Navigating intricate rules demands substantial resources, diverting funds away from core banking activities such as lending and investment. This directly impacts profitability and competitiveness.

- Reduced Lending Capacity: The administrative burden associated with complex regulations can restrict a bank's ability to extend credit to businesses and households, potentially stifling economic growth.

- Hindered Innovation: The focus on compliance can overshadow innovation, as banks prioritize meeting regulatory requirements over developing new products and services.

- Administrative Burden: The sheer volume of paperwork and reporting requirements associated with current regulations places an immense administrative burden on banks, diverting valuable human resources.

These challenges collectively contribute to a less dynamic and less efficient banking sector, ultimately impacting financial stability and economic growth within the Eurozone. The ECB’s initiative to simplify bank regulations directly addresses these critical concerns.

Composition and Mandate of the Task Force

The newly formed task force comprises a diverse group of experts, including representatives from various ECB departments with specialized knowledge in banking supervision, regulation, and financial stability. The inclusion of external experts with practical experience in the banking industry further strengthens the task force's ability to provide well-informed recommendations.

The task force's primary mandate is straightforward: to streamline existing banking regulations. This involves a thorough review of current rules, identifying areas of unnecessary complexity, and proposing concrete solutions to simplify the regulatory framework. Their work includes:

- Analyzing existing regulations to pinpoint areas of redundancy and overlap.

- Identifying regulations that disproportionately burden smaller banks.

- Proposing concrete changes to simplify regulations and enhance clarity.

- Developing a roadmap for the implementation of simplified regulations.

The task force is expected to deliver its recommendations within a specific timeframe, allowing the ECB to promptly assess and implement the proposed changes.

Key Areas of Focus for Simplification

The task force’s work will likely focus on several key areas where simplification is most urgently needed:

- Capital Requirements: Streamlining capital adequacy rules to reduce the complexity of calculations and reporting without compromising financial stability.

- Liquidity Rules: Simplifying liquidity coverage ratios and other liquidity regulations to lessen the burden on banks while maintaining adequate liquidity buffers.

- Reporting Obligations: Reducing the number and complexity of reporting requirements to minimize the administrative burden on banks.

For example, the task force may explore measures such as:

- Streamlining reporting requirements: Consolidating multiple reports into a single, more comprehensive report.

- Standardizing regulatory frameworks across member states: Harmonizing regulations across different countries to reduce inconsistencies and improve clarity.

- Improving the clarity and transparency of regulations: Making regulations easier to understand and interpret for banks.

- Leveraging technology: Utilizing technology to automate reporting processes and reduce manual effort.

Potential Impact and Benefits of Simpler Regulations

The simplification of bank regulations is expected to yield several significant benefits for the European banking sector and the wider economy:

- Reduced compliance costs for banks: Freeing up resources for investment in core business activities and innovation.

- Increased lending to businesses and households: Facilitating economic growth and job creation.

- Stimulated economic growth: A more efficient and competitive banking sector contributes to a stronger overall economy.

- Enhanced financial stability: Streamlined regulations can improve the resilience of the banking system.

- Improved competitiveness of European banks: Enabling European banks to compete more effectively on the global stage.

Conclusion: A New Era of Streamlined Banking Regulation?

The ECB's creation of a task force for simpler bank regulations represents a significant step towards improving the efficiency and competitiveness of the European banking sector. The task force's mandate to streamline existing rules, coupled with its diverse composition, offers hope for a more streamlined regulatory landscape. The potential benefits – reduced compliance costs, increased lending, and enhanced economic growth – are substantial. By following the developments of the ECB's task force for simpler bank regulations, stakeholders can stay informed about this crucial initiative and its potential impact on the future of European finance. Learn more about the ECB's efforts to simplify bank regulations and their impact on the European economy. The journey towards a more efficient and effective regulatory framework has begun.

Featured Posts

-

Werner Herzogs Bucking Fastard Casting News And Sisterly Leads

Apr 27, 2025

Werner Herzogs Bucking Fastard Casting News And Sisterly Leads

Apr 27, 2025 -

Lifting The Farm Import Ban Progress In South Africa Tanzania Discussions

Apr 27, 2025

Lifting The Farm Import Ban Progress In South Africa Tanzania Discussions

Apr 27, 2025 -

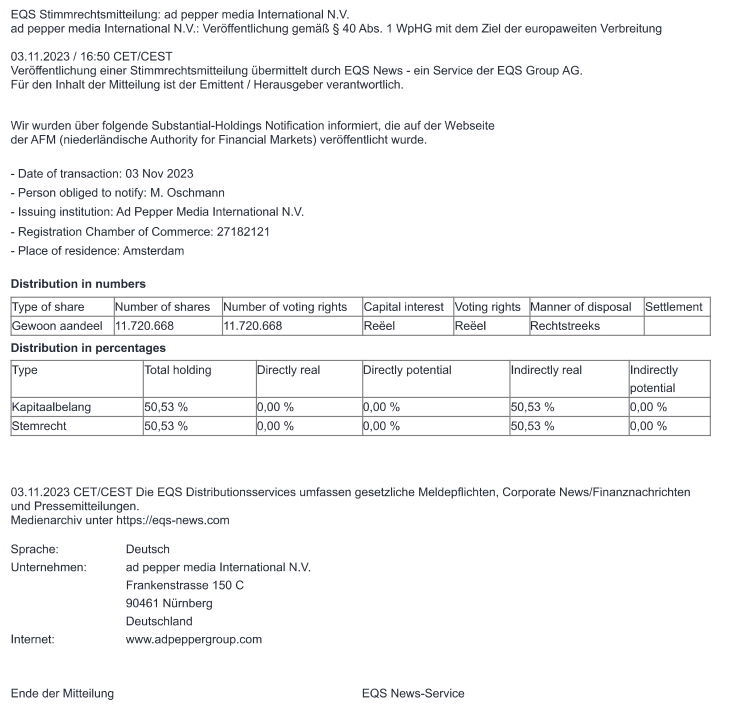

Offenlegung Nach Artikel 40 Absatz 1 Wp Hg Pne Ag

Apr 27, 2025

Offenlegung Nach Artikel 40 Absatz 1 Wp Hg Pne Ag

Apr 27, 2025 -

Sorpresivas Eliminaciones En Dubai Paolini Y Pegula Fuera Del Torneo

Apr 27, 2025

Sorpresivas Eliminaciones En Dubai Paolini Y Pegula Fuera Del Torneo

Apr 27, 2025 -

Where To Buy Ariana Grande Lovenote Fragrance Set Online A Price Comparison Guide

Apr 27, 2025

Where To Buy Ariana Grande Lovenote Fragrance Set Online A Price Comparison Guide

Apr 27, 2025