DRAM Market Share: SK Hynix Challenges Samsung's Dominance With AI

Table of Contents

The global DRAM market is booming, projected to reach a staggering $150 billion by 2028. This explosive growth is fueled, in large part, by the insatiable appetite of the burgeoning Artificial Intelligence (AI) sector for high-bandwidth memory. This article delves into the intense DRAM market share battle between industry giants Samsung and SK Hynix, highlighting the crucial role AI is playing in shaping this dynamic landscape. For years, Samsung held undisputed dominance, but SK Hynix is aggressively challenging that reign, leveraging strategic investments and AI-focused innovations. This analysis explores the strengths and weaknesses of both companies, their AI-driven strategies, and the future of the DRAM market share.

2. Samsung's Reign and its AI-Driven Strategies:

H2: Samsung's Market Leadership and its Strengths:

Samsung's historical dominance in the DRAM market is undeniable. Its strengths include:

- Market Share Leadership: Samsung consistently holds the largest market share, often exceeding 40%.

- Technological Prowess: Samsung consistently leads in advanced process nodes, producing high-density DRAM chips with superior performance and efficiency. This includes advancements in EUV lithography and 1z-nm technology.

- Strong Brand Reputation: Samsung’s reputation for quality and reliability ensures a strong foothold in various sectors.

- Vertical Integration: Samsung's control over the entire supply chain, from manufacturing to packaging, gives it a considerable cost and efficiency advantage.

Samsung's investment in R&D for AI-optimized DRAM is substantial. They are actively developing specialized DRAM solutions for AI applications, partnering with major cloud providers and AI hardware manufacturers. Their HBM (High Bandwidth Memory) solutions are a prime example, powering leading AI accelerators and data centers.

H2: Samsung's Challenges and Potential Vulnerabilities:

Despite its leadership, Samsung faces challenges:

- Intense Competition: SK Hynix is aggressively closing the gap, and other players are also vying for market share.

- Geopolitical Risks: Global trade tensions and regional instability could disrupt supply chains and impact production.

- Market Fluctuations: Demand from specific sectors, particularly smartphones, can be volatile, impacting overall DRAM sales.

- Emerging Technologies: New memory technologies like 3D XPoint could potentially disrupt Samsung's dominance.

3. SK Hynix's Aggressive Pursuit and AI Focus:

H2: SK Hynix's Growing Market Share and Strategic Moves:

SK Hynix has significantly increased its DRAM market share in recent years through several strategic moves:

- Aggressive Pricing: Competitive pricing strategies have allowed them to gain traction in various market segments.

- Targeted Market Focus: Concentrating on specific high-growth areas like server DRAM and AI-specific solutions.

- Strategic Partnerships: Collaborations with key players in the AI ecosystem enhance its market reach and technological capabilities.

- Strong R&D Investments: Significant investments in R&D are yielding cutting-edge DRAM technologies optimized for AI.

H2: SK Hynix's AI-Specific DRAM Technologies and Applications:

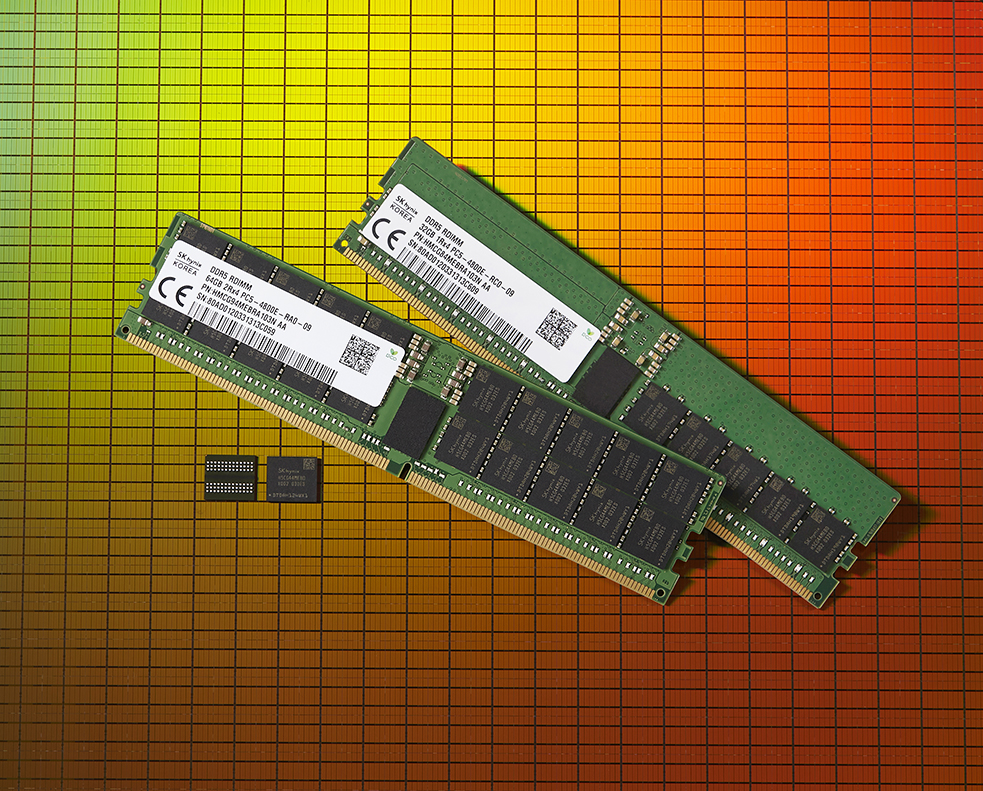

SK Hynix is making significant strides with AI-focused DRAM:

- High Bandwidth Memory (HBM): SK Hynix's HBM solutions offer exceptional bandwidth, crucial for demanding AI workloads.

- GDDR (Graphics Double Data Rate): GDDR DRAM is optimized for graphics processing and increasingly vital for AI applications involving image and video processing.

- Applications: These technologies are being deployed in data centers, autonomous vehicles, high-performance computing clusters, and various other AI-driven applications. The superior performance contributes to faster training times and improved AI model accuracy.

4. The Role of AI in Shaping the DRAM Market:

H2: The Explosive Growth of AI and its Impact on DRAM Demand:

The rapid growth of AI is fundamentally reshaping the DRAM market:

- Data-Intensive Nature of AI: AI algorithms, particularly deep learning models, require massive amounts of data for training and inference, driving demand for high-capacity DRAM.

- High Bandwidth Requirements: AI workloads necessitate high memory bandwidth to process data efficiently, fueling the demand for high-bandwidth DRAM solutions like HBM.

- AI Applications Driving Demand: Machine learning, deep learning, natural language processing, and computer vision are key drivers of increased DRAM demand.

H2: Future Trends and Predictions for DRAM Market Share:

Predicting future market share is complex, but several trends are apparent:

- Continued Competition: The rivalry between Samsung and SK Hynix will likely intensify, with both companies investing heavily in R&D to maintain a competitive edge.

- AI-Driven Innovation: Continued innovation in AI-optimized DRAM will be crucial for maintaining market leadership.

- Geopolitical and Economic Factors: Global events and economic conditions will influence market dynamics and impact supply chains.

5. Conclusion: The Ongoing DRAM Market Share Battle Fueled by AI

The DRAM market share battle between Samsung and SK Hynix is a dynamic and fiercely competitive landscape, significantly influenced by the exponential growth of AI. Both companies are leveraging substantial R&D investments to develop innovative DRAM solutions tailored to the unique demands of AI applications. While Samsung maintains its leadership, SK Hynix's aggressive pursuit and focus on AI-optimized technologies are narrowing the gap. The future of the DRAM market share will be determined by continued innovation, strategic partnerships, and the ever-evolving needs of the AI industry. To stay updated on the latest developments in this crucial sector, continue following industry news and analysis regarding DRAM market share trends and the ongoing competition between these technology titans.

Featured Posts

-

The Crucial Role Of Middle Managers In Business And Employee Development

Apr 24, 2025

The Crucial Role Of Middle Managers In Business And Employee Development

Apr 24, 2025 -

Canada U S Border White House Reports Fewer Apprehensions

Apr 24, 2025

Canada U S Border White House Reports Fewer Apprehensions

Apr 24, 2025 -

Emerging Markets Rally While Us Stocks Slump

Apr 24, 2025

Emerging Markets Rally While Us Stocks Slump

Apr 24, 2025 -

Bold And The Beautiful Recap April 3 Liams Health Crisis After Major Bill Dispute

Apr 24, 2025

Bold And The Beautiful Recap April 3 Liams Health Crisis After Major Bill Dispute

Apr 24, 2025 -

Fbi Investigation Millions Lost In Large Scale Office365 Data Breach

Apr 24, 2025

Fbi Investigation Millions Lost In Large Scale Office365 Data Breach

Apr 24, 2025