Dismissing Stock Market Valuation Concerns: BofA's Perspective

Table of Contents

BofA's Key Arguments Against High Valuations

BofA's analysts present a multifaceted argument against viewing current stock market valuations as inherently problematic. Their analysis suggests that several factors mitigate the risks associated with seemingly high valuations.

Strong Corporate Earnings and Profitability

BofA's research points to robust corporate earnings and profitability as a key factor supporting current stock prices. Many sectors are demonstrating exceptional strength, contributing significantly to the overall market health.

- Examples of strong-performing sectors: Technology, healthcare, and consumer staples have consistently shown robust earnings growth.

- Evidence of earnings growth exceeding expectations: Numerous companies have reported earnings that significantly surpassed analyst predictions, indicating a positive underlying trend.

- Projected future earnings: BofA's analysts predict continued earnings growth across various sectors, bolstering their argument against excessive valuation concerns.

Supporting this analysis, a recent BofA Securities report by Savita Subramanian and her team highlighted a significant upward revision in earnings expectations for the S&P 500, surpassing initial projections by a considerable margin. This data, coupled with positive forward-looking guidance from many companies, forms the bedrock of BofA's optimistic outlook.

Low Interest Rates and Monetary Policy

BofA acknowledges the impact of low interest rates and accommodative monetary policies on stock valuations. However, instead of viewing this as a negative factor driving unsustainable valuations, they see it as a supportive element.

- Role of central banks: BofA's analysis highlights the role of central banks in maintaining low interest rates, facilitating corporate borrowing and investment.

- Effect on borrowing costs for companies: Low interest rates reduce the cost of capital for businesses, allowing for increased investment and expansion, ultimately fueling growth.

- Impact on investment and growth: This increased investment translates into higher returns and sustained economic growth, which in turn justifies higher stock valuations.

BofA's research on interest rate forecasts and their implications for the market, available on their website, further explains their perspective on this crucial element.

Technological Innovation and Growth Sectors

BofA emphasizes the transformative power of technological innovation in driving future market growth, potentially offsetting any concerns about current valuations.

- Specific technology sectors and their potential for long-term growth: Artificial intelligence (AI), cloud computing, and biotechnology are cited as sectors with significant long-term growth potential.

- Examples of innovative companies and their impact on the broader market: BofA points to the success of numerous innovative companies as evidence of this growth potential and its impact on overall market performance.

- BofA's predictions for these sectors: The firm projects sustained, above-average growth for these sectors, further bolstering their argument.

This perspective highlights the long-term investment horizon that underpins BofA's optimistic view of stock market valuations.

Addressing Specific Valuation Metrics

Addressing common concerns about high valuations requires analyzing specific valuation metrics. BofA tackles these head-on.

Price-to-Earnings Ratio (P/E)

High P/E ratios are often cited as a signal of overvaluation. BofA contextualizes these ratios, considering factors such as low interest rates and future growth prospects.

- Examples of companies with high P/E ratios and BofA’s rationale for their valuations: BofA's analysis differentiates between high P/E ratios justified by strong growth prospects and those representing true overvaluation.

- Relevant charts and graphs illustrating BofA's analysis: BofA often uses visual aids to present their data and support their conclusions on P/E ratios.

Other Valuation Metrics (PEG Ratio, etc.)

Beyond P/E ratios, BofA addresses concerns raised by other common valuation metrics, such as the Price/Earnings to Growth (PEG) ratio.

- How BofA interprets these metrics and integrates them into their overall assessment: Their approach considers a range of metrics, not just relying on one indicator to determine valuation.

- Data from BofA's research to substantiate the arguments: They use comprehensive data analysis to support their interpretation of these various valuation metrics.

Conclusion: Dismissing Stock Market Valuation Concerns – A BofA Perspective

BofA's analysis presents a compelling case for dismissing concerns about high stock market valuations. Their arguments center on strong corporate earnings, the impact of low interest rates, and the growth potential of innovative sectors. By contextualizing common valuation metrics and presenting a holistic view, BofA offers a perspective that encourages investors to consider the broader economic landscape. While understanding stock market valuation concerns is crucial, BofA's analysis offers a compelling perspective on navigating these challenges. Explore BofA's research for a more in-depth understanding of dismissing stock market valuation concerns and formulating a sound investment strategy. Their insights into market outlook and investment strategy are invaluable for informed decision-making.

Featured Posts

-

Trumps Economic Agenda Winners And Losers

Apr 22, 2025

Trumps Economic Agenda Winners And Losers

Apr 22, 2025 -

Is Trumps Trade War Undermining Americas Economic Powerhouse Status

Apr 22, 2025

Is Trumps Trade War Undermining Americas Economic Powerhouse Status

Apr 22, 2025 -

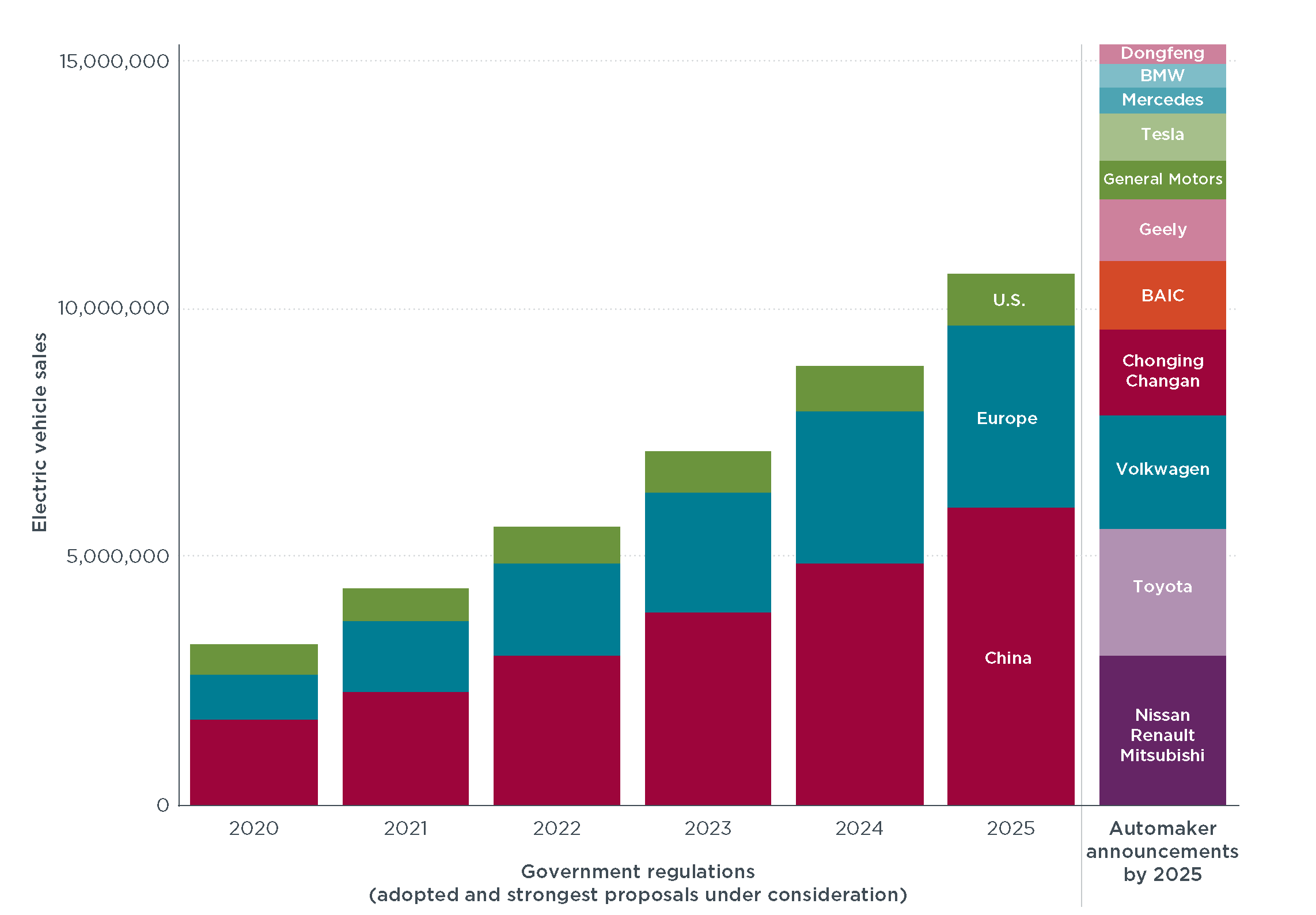

Auto Dealers Renew Resistance To Electric Vehicle Regulations

Apr 22, 2025

Auto Dealers Renew Resistance To Electric Vehicle Regulations

Apr 22, 2025 -

Kyiv Faces Trumps Ukraine Peace Plan A Ticking Clock

Apr 22, 2025

Kyiv Faces Trumps Ukraine Peace Plan A Ticking Clock

Apr 22, 2025 -

Technical Glitch Forces Blue Origin To Abort Rocket Launch

Apr 22, 2025

Technical Glitch Forces Blue Origin To Abort Rocket Launch

Apr 22, 2025