Deloitte's Economic Outlook: Predicting A Considerable Slowdown In US Growth

Table of Contents

Key Factors Contributing to the Projected Slowdown

Deloitte's analysis points to several interconnected factors driving the predicted US economic slowdown. Understanding these is crucial for navigating the economic forecast.

-

Persistently High Inflation: Deloitte highlights persistently high inflation as a primary drag on consumer spending and overall economic activity. This persistent inflation erodes purchasing power, forcing consumers to cut back on discretionary spending and dampening investment. High inflation rates directly impact the US growth rate.

-

Aggressive Interest Rate Hikes: The Federal Reserve's aggressive interest rate hikes, aimed at taming inflation, are expected to further slow economic growth. These hikes increase borrowing costs for businesses and consumers, reducing investment and dampening consumer spending. This is a significant factor in the Deloitte economic outlook.

-

Weakening Consumer Spending: Reduced consumer confidence and constrained budgets, directly resulting from inflation, are leading to a decrease in consumer spending. Consumer spending is a key driver of US economic growth, and its weakening significantly impacts the overall economic forecast.

-

Ongoing Supply Chain Disruptions: While improving, lingering supply chain issues continue to contribute to inflationary pressures and constrain economic expansion. These disruptions increase production costs and limit the availability of goods, further fueling inflation and hindering growth.

-

Global Geopolitical Uncertainty: The ongoing war in Ukraine and other geopolitical tensions add significant uncertainty to the economic outlook. These uncertainties impact global trade and investment flows, creating further headwinds for the US economy and impacting the Deloitte forecast.

Projected Impact on Key Economic Indicators

Deloitte's economic outlook provides projections for several key economic indicators. Understanding these projections is vital for businesses to adapt and strategize.

-

GDP Growth Forecast: Deloitte forecasts a significant decline in US GDP growth for the coming year, potentially falling below the historical average. While the exact numbers vary depending on the specific report, the general consensus points towards a considerable slowdown. This projected decrease in the US growth rate is a central theme of the Deloitte economic outlook.

-

Unemployment Rate Projections: The report likely indicates a potential increase in the unemployment rate as businesses respond to slowing demand and higher borrowing costs. Sectors particularly sensitive to economic downturns may experience higher job losses.

-

Inflation Rate Outlook: While interest rate hikes aim to control inflation, the report will likely discuss the projected path of inflation and whether it's expected to fall to target levels quickly or if a prolonged period of high inflation is anticipated. This is critical for assessing the long-term impact on the US growth rate.

-

Impact on Business Investment: Deloitte's analysis assesses the impact of the slowdown on business investment, considering reduced consumer demand and higher borrowing costs. Businesses may delay or cancel expansion plans, impacting job creation and overall economic activity.

-

Job Market Implications: The report addresses the potential impact of the slowdown on the US job market, examining potential job losses and sector-specific vulnerabilities. This analysis provides critical information for individuals and businesses planning for the future.

Sector-Specific Analyses

Deloitte's report likely provides sector-specific analyses, offering a nuanced understanding of the predicted slowdown's impact. For example, the real estate sector might experience a slowdown due to rising mortgage rates, while the technology sector may see a contraction in investment. Manufacturing and consumer goods sectors will also likely be impacted differently, offering varied opportunities and challenges.

Conclusion

Deloitte's economic outlook underscores a significant concern: a considerable slowdown in US economic growth. The combination of high inflation, aggressive interest rate hikes, weakening consumer spending, and geopolitical uncertainty points towards a challenging period ahead. Understanding these factors is crucial for businesses to adapt their strategies, manage risks, and navigate this potentially difficult economic environment. To stay informed on the evolving economic landscape and gain a deeper understanding of Deloitte's detailed analysis, access their full report [link to report]. Stay ahead of the curve by regularly reviewing Deloitte's economic outlook and preparing for a potential period of slower US growth. Proactive planning based on the Deloitte economic outlook is key to mitigating risks and navigating this potential US economic slowdown.

Featured Posts

-

A Review Of Horse Fatalities At The Grand National Ahead Of 2025

Apr 27, 2025

A Review Of Horse Fatalities At The Grand National Ahead Of 2025

Apr 27, 2025 -

Motherhood And Victory Belinda Bencics Wta Return

Apr 27, 2025

Motherhood And Victory Belinda Bencics Wta Return

Apr 27, 2025 -

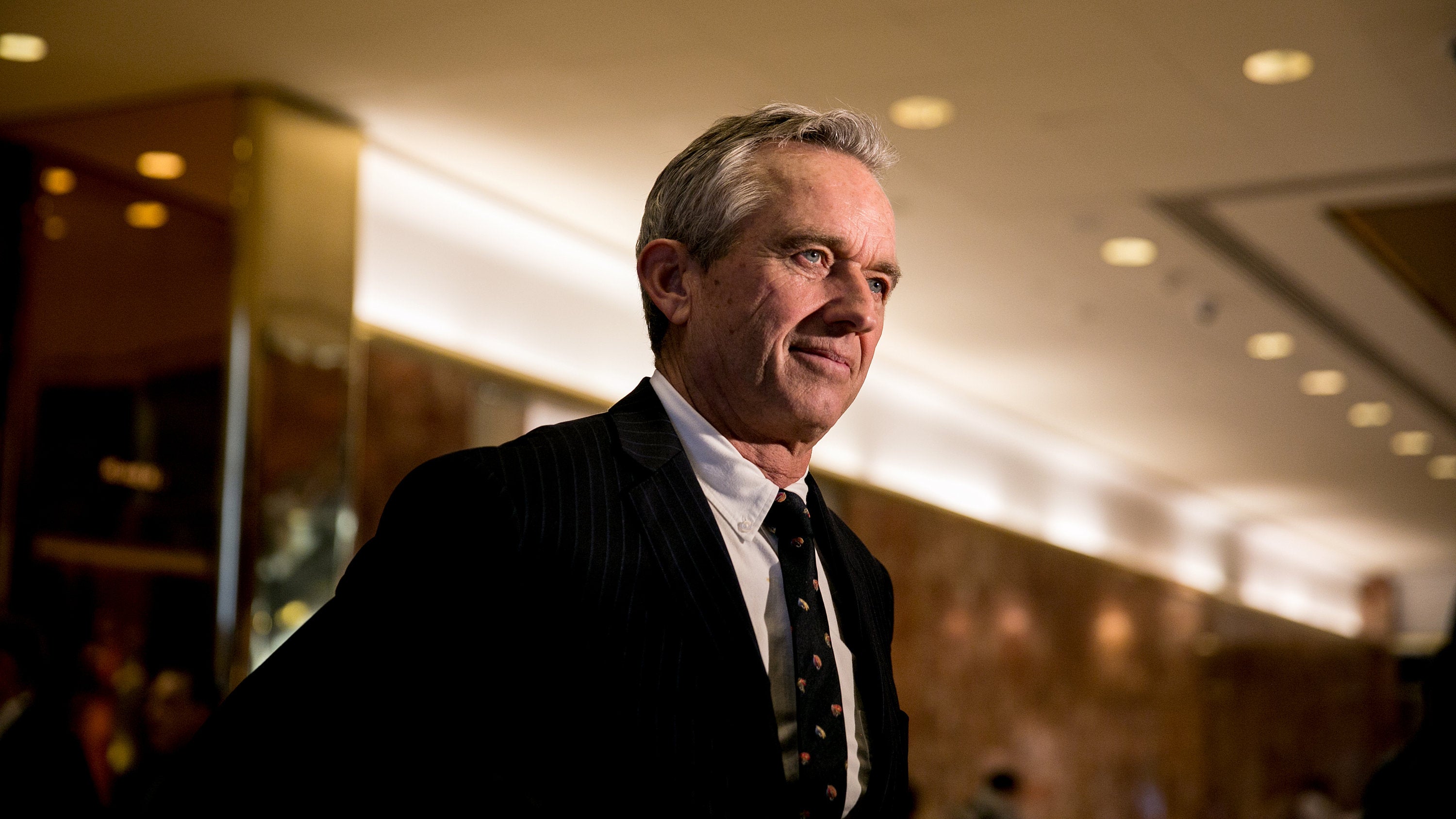

Hhs Investigation Into Autism And Vaccines Concerns Over Anti Vaccine Activist Appointment

Apr 27, 2025

Hhs Investigation Into Autism And Vaccines Concerns Over Anti Vaccine Activist Appointment

Apr 27, 2025 -

Legal Implications Of Selling Banned Chemicals On E Bay Section 230s Limits

Apr 27, 2025

Legal Implications Of Selling Banned Chemicals On E Bay Section 230s Limits

Apr 27, 2025 -

Ariana Grandes Style Evolution Professional Insights Into Her Hair And Tattoo Choices

Apr 27, 2025

Ariana Grandes Style Evolution Professional Insights Into Her Hair And Tattoo Choices

Apr 27, 2025