Crack The Code: 5 Do's & Don'ts To Land Your Dream Private Credit Job

Table of Contents

5 Do's to Maximize Your Chances

Do 1: Network Strategically

Building a strong network is paramount in the private credit industry. It's not just about who you know, but about cultivating meaningful relationships.

- Attend industry events: Conferences, workshops, and even smaller networking events offer invaluable opportunities to meet potential employers and learn about new trends in private credit lending.

- Master LinkedIn: Optimize your LinkedIn profile with relevant keywords like "private credit analyst," "credit fund," "debt investing," and "structured finance." Actively engage with posts, join relevant groups, and connect with professionals in the field.

- Informational Interviews: Reach out to professionals in private credit for informational interviews. These conversations provide invaluable insights into the industry and can lead to unexpected opportunities. Target specific firms and individuals within those firms whose work genuinely interests you.

- Social Media Engagement: Follow influential figures and firms in private credit on platforms like LinkedIn and Twitter to stay updated on industry news and expand your network organically.

Do 2: Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. They must showcase your qualifications and enthusiasm for a private credit job.

- Highlight Relevant Skills: Quantify your accomplishments whenever possible. Instead of saying "improved efficiency," say "improved efficiency by 15% through process optimization." Emphasize skills like financial modeling (Excel, DCF, LBO modeling), credit analysis, deal structuring, and underwriting.

- Keyword Optimization: Use keywords from job descriptions to ensure your application gets noticed by Applicant Tracking Systems (ATS).

- Customization: Never submit a generic application. Tailor your resume and cover letter to each specific job description and company culture.

- Showcase Understanding: Demonstrate your knowledge of the private credit market, including current trends, challenges, and opportunities.

Do 3: Master the Interview Process

The interview is your chance to shine. Preparation is key.

- Practice Common Questions: Prepare answers to behavioral questions (e.g., "Tell me about a time you failed") and technical questions related to credit analysis, valuation, and financial modeling.

- Thorough Research: Research the firm's investment strategy, recent deals, and the interviewer's background.

- Demonstrate Knowledge: Showcase your understanding of private credit investment strategies, such as direct lending, mezzanine financing, and distressed debt. Stay up-to-date on market trends and regulatory changes.

- Ask Insightful Questions: Prepare thoughtful questions to demonstrate your genuine interest and understanding of the firm and the role.

- Follow Up: Always send a thank-you note within 24 hours, reiterating your interest and highlighting key points from the conversation.

Do 4: Showcase Your Financial Acumen

Private credit roles demand strong financial skills.

- Financial Modeling Proficiency: Master Excel, and develop expertise in discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and other relevant financial modeling techniques.

- Credit Analysis Expertise: Demonstrate a solid understanding of credit risk assessment, including financial statement analysis, ratio analysis, and credit scoring methodologies.

- Software Proficiency: Familiarity with financial software and databases (e.g., Bloomberg Terminal, Capital IQ) is highly advantageous.

- Highlight Relevant Experience: Showcase relevant coursework, projects, or internships that demonstrate your financial acumen. Consider pursuing relevant certifications like the Chartered Financial Analyst (CFA) designation.

Do 5: Highlight Your Soft Skills

Technical skills are crucial, but soft skills are equally important in a collaborative environment.

- Communication Skills: Excellent written and verbal communication is essential for interacting with clients, colleagues, and senior management.

- Teamwork: Demonstrate your ability to work effectively as part of a team, contributing to a shared goal.

- Problem-Solving: Showcase your ability to analyze complex situations, identify potential problems, and develop effective solutions.

- Time Management: Highlight your ability to prioritize tasks, manage deadlines, and work efficiently under pressure.

5 Don'ts That Could Sabotage Your Application

Don't 1: Neglect Networking

Don't rely solely on online job boards. Networking is crucial for uncovering hidden opportunities and making valuable connections within the private credit industry.

Don't 2: Submit Generic Applications

Avoid sending cookie-cutter applications. Each application should be tailored to the specific requirements of the role and the company. Thorough company research is non-negotiable.

Don't 3: Underprepare for Interviews

Thoroughly prepare for interviews by practicing your responses, researching the firm and interviewer, and anticipating potential questions.

Don't 4: Downplay Your Skills

Be confident and articulate your achievements and qualifications. Don't be afraid to highlight your strengths and expertise.

Don't 5: Neglect Follow-Up

Always send a thank-you note after each interview and consider a polite follow-up after a reasonable timeframe.

Conclusion

Securing your dream private credit job requires a strategic approach. By following these five "dos" and avoiding the five "don'ts," you'll significantly improve your chances of success. Remember, combining strong technical skills with effective networking and communication is the key to unlocking your dream private credit role. Start networking today to land your dream private credit job! Use these tips to crack the code and secure your desired private credit role. Don't delay; apply these do's and don'ts to your private credit job search now!

Featured Posts

-

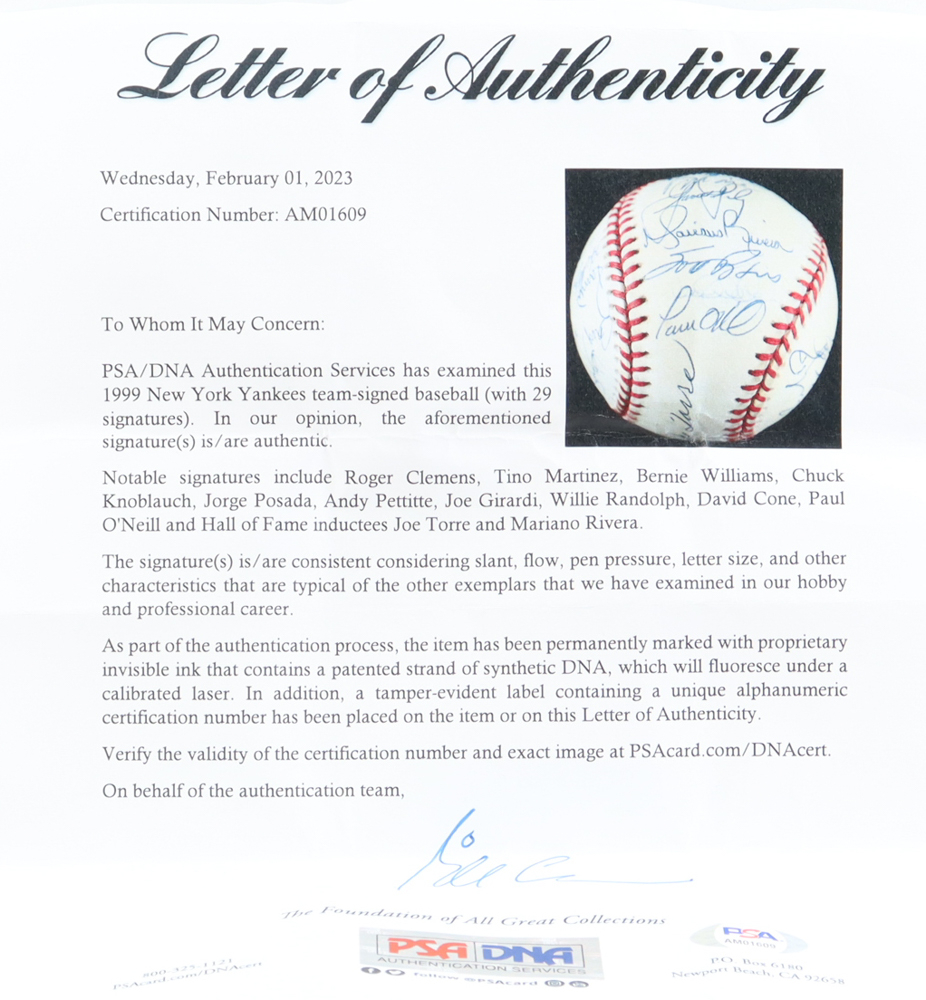

2000 Yankees Diary Remembering The Win Against The Royals

Apr 28, 2025

2000 Yankees Diary Remembering The Win Against The Royals

Apr 28, 2025 -

Leaders From Around The Globe Honor Pope Francis

Apr 28, 2025

Leaders From Around The Globe Honor Pope Francis

Apr 28, 2025 -

9 Billion Dow Project In Alberta Delayed Impact Of Tariffs

Apr 28, 2025

9 Billion Dow Project In Alberta Delayed Impact Of Tariffs

Apr 28, 2025 -

A Look Back The 2000 Yankees Joe Torre And Andy Pettittes Key Game

Apr 28, 2025

A Look Back The 2000 Yankees Joe Torre And Andy Pettittes Key Game

Apr 28, 2025 -

Analyzing Espns Prediction For The Red Sox 2025 Outfield

Apr 28, 2025

Analyzing Espns Prediction For The Red Sox 2025 Outfield

Apr 28, 2025