Cantor In Advanced Talks For Massive $3 Billion Crypto SPAC

Table of Contents

The Significance of Cantor Fitzgerald's Involvement

Cantor Fitzgerald's involvement in this potential $3 billion crypto SPAC is monumental. Their reputation as a respected and established financial institution lends significant credibility to the cryptocurrency space, a sector often viewed with skepticism by traditional finance players. This deal highlights the growing institutional interest in cryptocurrency investments, a trend that has been gathering momentum in recent years. The firm's established track record adds weight to the burgeoning crypto market.

- Established track record in mergers and acquisitions: Cantor Fitzgerald possesses extensive experience in successfully navigating complex financial transactions, providing expertise crucial for a deal of this magnitude.

- Strong network of investors and financial relationships: Their vast network provides access to a wider pool of capital and strategic partners, bolstering the success prospects of the SPAC.

- Expertise in navigating complex regulatory environments: Cantor Fitzgerald's understanding of financial regulations, particularly in the evolving crypto landscape, is invaluable in mitigating potential regulatory hurdles.

This move by Cantor Fitzgerald could act as a catalyst, attracting further institutional investment into the crypto market, lending it increased legitimacy and stability.

Details of the Potential $3 Billion Crypto SPAC

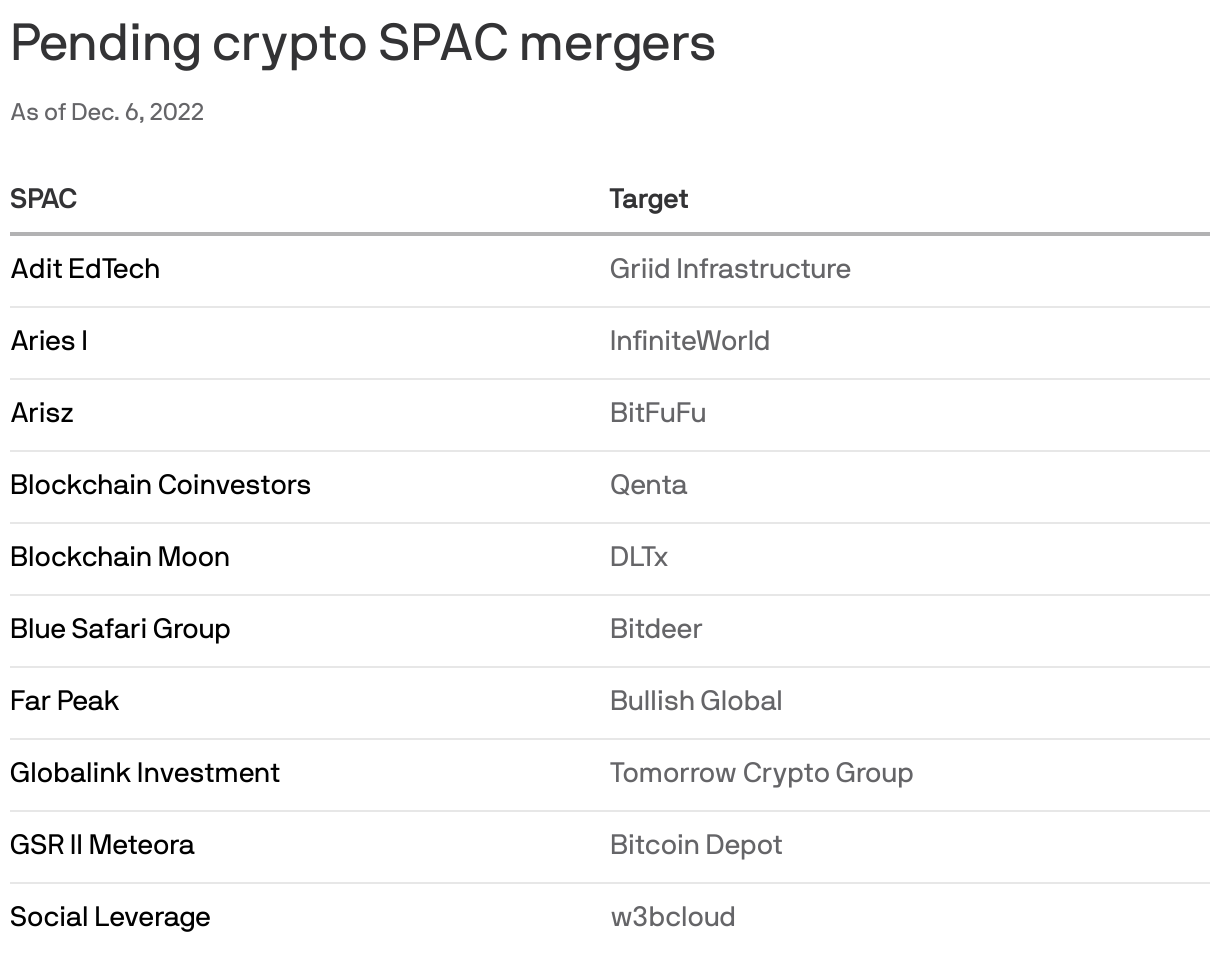

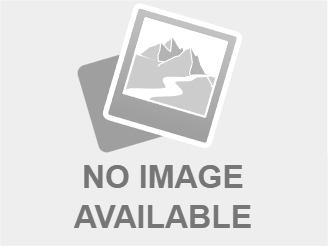

The proposed SPAC, if finalized, is poised to be one of the largest ever focused on the cryptocurrency sector. This demonstrates a significant vote of confidence in the long-term potential of cryptocurrencies and the companies building within the space. While details are still emerging, it's anticipated that the target company will be a significant player in the established crypto ecosystem.

- Discussions are in advanced stages, but details are still emerging: While the exact terms of the deal remain confidential, the fact that negotiations are this far along suggests a high probability of completion.

- The target company's identity remains undisclosed: Speculation is rife within the crypto community, with several prominent companies being named as potential acquisition targets.

- The deal's valuation reflects the rapidly growing crypto market capitalization: The $3 billion figure underscores the substantial growth and market potential of the cryptocurrency industry.

The sheer size of the deal reflects the growing confidence in the long-term potential of cryptocurrencies and their increasing integration into mainstream finance.

Implications for the Crypto Market and Investors

A successful Cantor Fitzgerald crypto SPAC merger would have far-reaching implications for the crypto market and investors. It signifies a significant step towards mainstream adoption of cryptocurrencies, bringing them further into the realm of traditional finance. However, it also signals a potential increase in regulatory scrutiny.

- Potential impact on the price of crypto assets: The merger could positively influence the price of crypto assets associated with the target company and potentially the broader crypto market.

- Increased liquidity and trading volume: The influx of institutional capital through the SPAC could boost liquidity and trading volume in the cryptocurrency markets.

- Attracting more sophisticated investors to the cryptocurrency market: Cantor Fitzgerald's involvement could encourage more institutional and sophisticated investors to enter the crypto space.

Investors should closely monitor the deal's progression for potential investment opportunities. Understanding the potential risks and rewards is crucial for making informed decisions.

Potential Regulatory Challenges and Opportunities

The deal will undoubtedly face regulatory challenges, given the relatively nascent and evolving regulatory landscape for cryptocurrencies. Navigating these complexities will be crucial for the deal's success.

- SEC scrutiny of SPACs and crypto investments: The Securities and Exchange Commission (SEC) is actively scrutinizing SPACs and crypto investments, requiring careful compliance.

- Navigating international regulatory differences: Crypto regulations vary significantly across jurisdictions, necessitating a comprehensive understanding of international regulatory frameworks.

- Potential for future regulatory clarity to benefit the market: The successful negotiation of these regulatory hurdles could contribute to greater regulatory clarity in the long run, benefiting the entire crypto market.

The successful navigation of these regulatory hurdles could set a precedent for future crypto SPACs, paving the way for increased institutional participation in the sector.

Conclusion

Cantor Fitzgerald's potential $3 billion crypto SPAC deal represents a monumental shift in the cryptocurrency landscape, signifying a surge in institutional interest and the potential for further mainstream adoption. This deal, should it materialize, will profoundly impact the crypto market, its regulation, and investor confidence. Stay informed about the progress of this massive Cantor Fitzgerald crypto SPAC deal and its potential consequences for your investment portfolio. Understanding the evolution of SPAC acquisitions in the crypto world will be critical for navigating this exciting and rapidly changing sector. Continue to follow developments in the $3 billion SPAC market for more updates.

Featured Posts

-

Loss Of Independence Prompts 60 Minutes Executive Producer To Resign

Apr 24, 2025

Loss Of Independence Prompts 60 Minutes Executive Producer To Resign

Apr 24, 2025 -

Bethesda Confirms Oblivion Remastered Launch

Apr 24, 2025

Bethesda Confirms Oblivion Remastered Launch

Apr 24, 2025 -

Rare Earth Supply Chain Issues Impede Teslas Optimus Humanoid Robot Development

Apr 24, 2025

Rare Earth Supply Chain Issues Impede Teslas Optimus Humanoid Robot Development

Apr 24, 2025 -

Is Voting Liberal Right For You William Watsons Platform Review

Apr 24, 2025

Is Voting Liberal Right For You William Watsons Platform Review

Apr 24, 2025 -

Kci Johna Travolte Ella Bleu Travolta Njezina Nevjerojatna Tranzicija

Apr 24, 2025

Kci Johna Travolte Ella Bleu Travolta Njezina Nevjerojatna Tranzicija

Apr 24, 2025