Canadian Investors Pour Into US Stocks: Trade War Impact Analyzed

Table of Contents

The Allure of the US Stock Market for Canadian Investors

The US stock market holds considerable appeal for Canadian investors, driven by several key factors.

Diversification Benefits

Investing in US stocks provides crucial diversification away from the Canadian market, significantly reducing overall portfolio risk.

- Sector Diversification: Access to a wider range of sectors, including robust technology, healthcare, and consumer goods companies, allows for a more balanced portfolio than solely investing in Canadian equities.

- Currency Diversification: Investing in USD-denominated assets provides exposure to the US dollar, hedging against potential CAD fluctuations.

- Access to Larger Companies: The US market boasts many large-cap companies not listed on the Toronto Stock Exchange (TSX), offering opportunities for growth and potentially higher returns.

The potential for higher returns in the US market compared to the Canadian market is a significant draw, although this depends heavily on prevailing market conditions and individual investment strategies. Careful consideration of risk tolerance is crucial.

Access to Innovative Companies and Technologies

The US market is home to many leading-edge companies at the forefront of technological innovation.

- Tech Giants: Companies like Apple, Microsoft, Google, and Amazon offer exposure to significant growth potential in the technology sector, an area of increasing importance in a globally connected economy.

- Biotechnology and Pharmaceuticals: The US boasts a thriving biotech and pharmaceutical industry, providing Canadian investors with access to cutting-edge advancements in healthcare.

This access to innovative companies and emerging technologies presents exciting opportunities for Canadian investors seeking higher growth potential compared to more established sectors.

Ease of Access and Investment Options

Investing in US stocks is surprisingly straightforward for Canadian investors thanks to readily available resources.

- Online Brokerage Platforms: Numerous online brokerage platforms offer seamless access to US exchanges, facilitating straightforward buying and selling of US stocks.

- Registered Investment Accounts: Canadian investors can easily include US stocks within their Registered Retirement Savings Plans (RRSPs) and Tax-Free Savings Accounts (TFSAs), benefiting from tax advantages.

The simplicity and convenience of trading US stocks, combined with the availability of various investment options tailored to different risk profiles, makes the US market very attractive for Canadian investors.

The Impact of the US-China Trade War on Canadian Investment Decisions

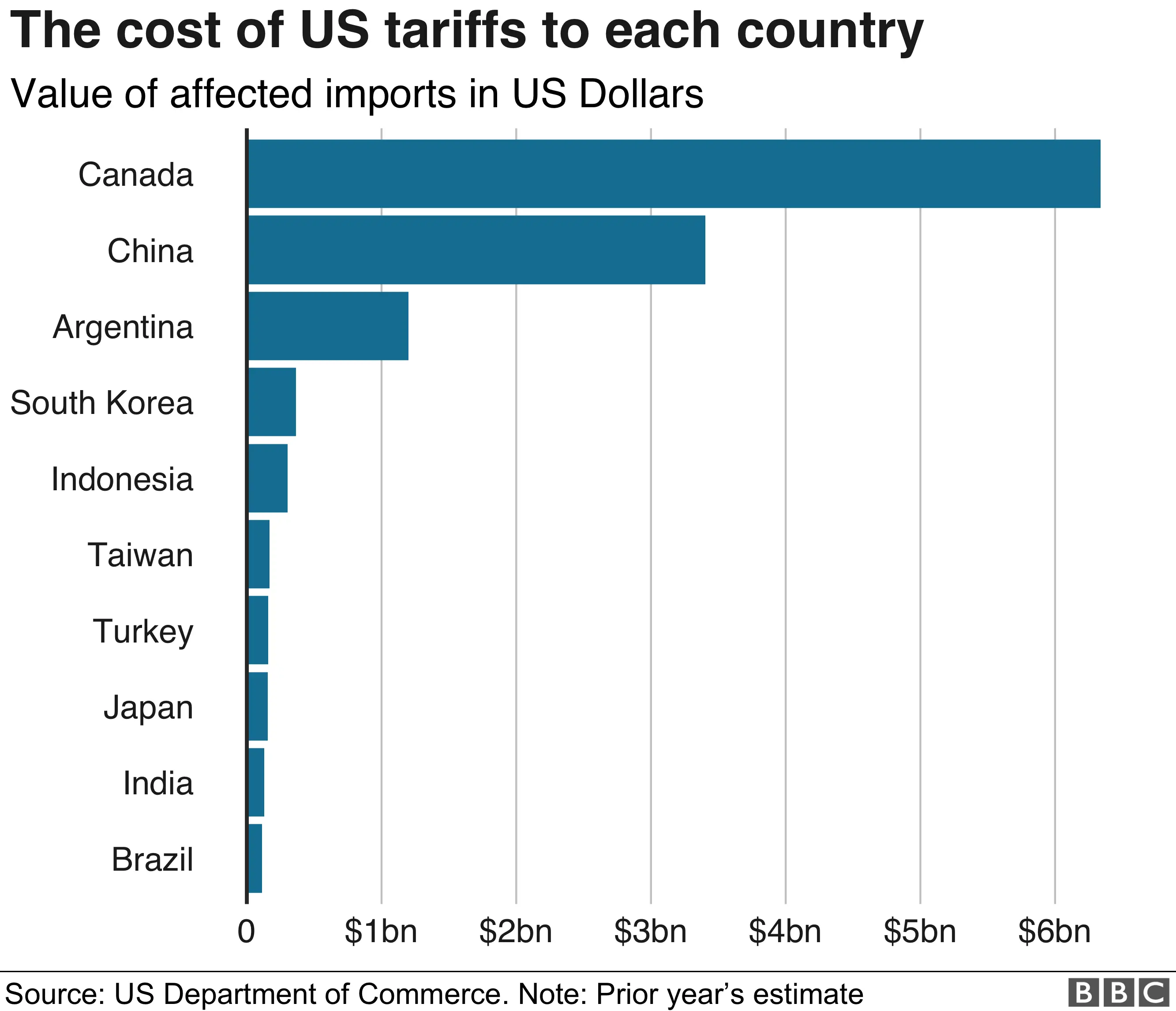

The US-China trade war significantly influenced investment decisions, prompting some Canadian investors to re-evaluate their portfolios.

Safe-Haven Effect

The trade war's uncertainty pushed some investors towards perceived safe havens, leading to increased investment in established US companies.

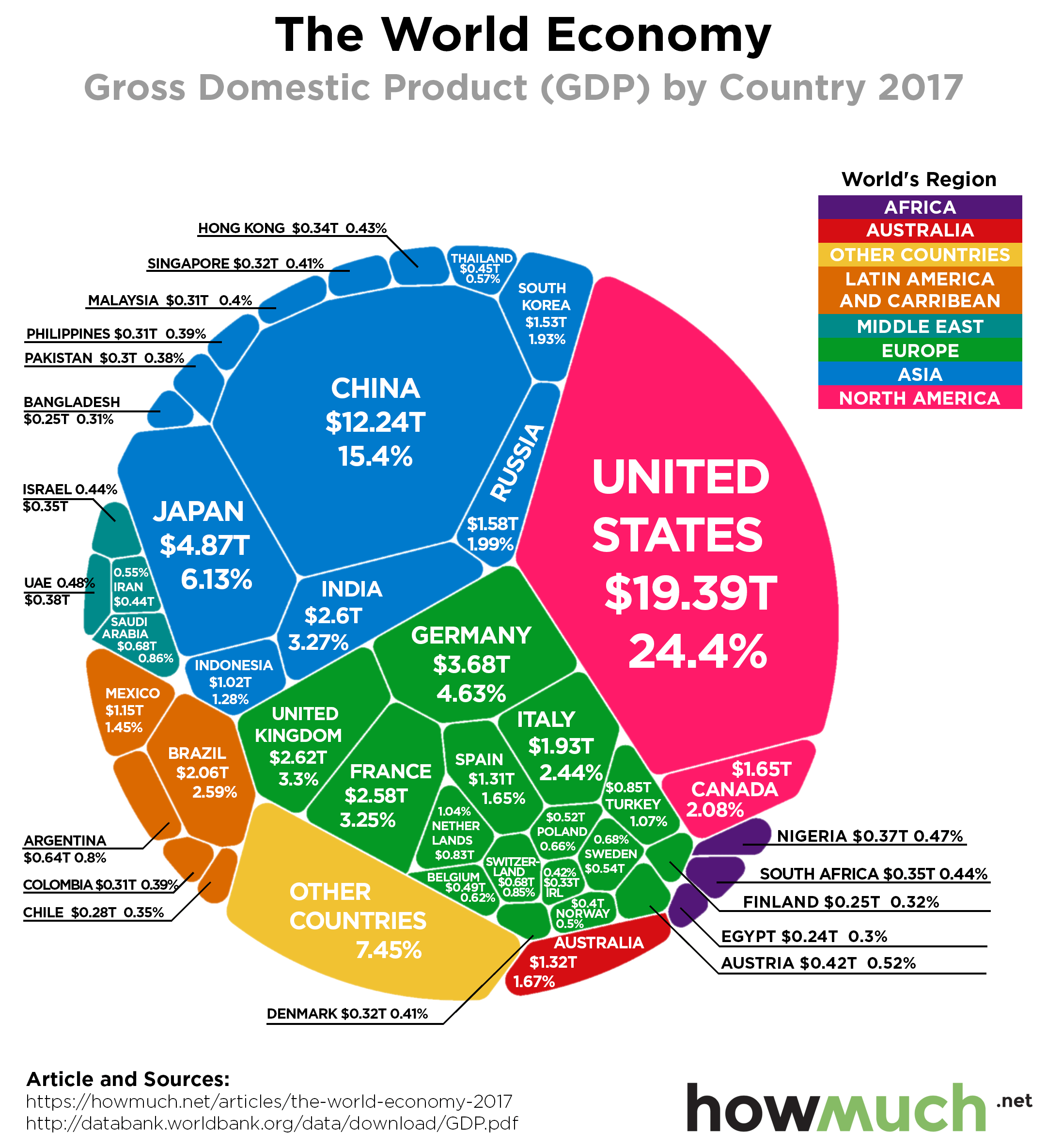

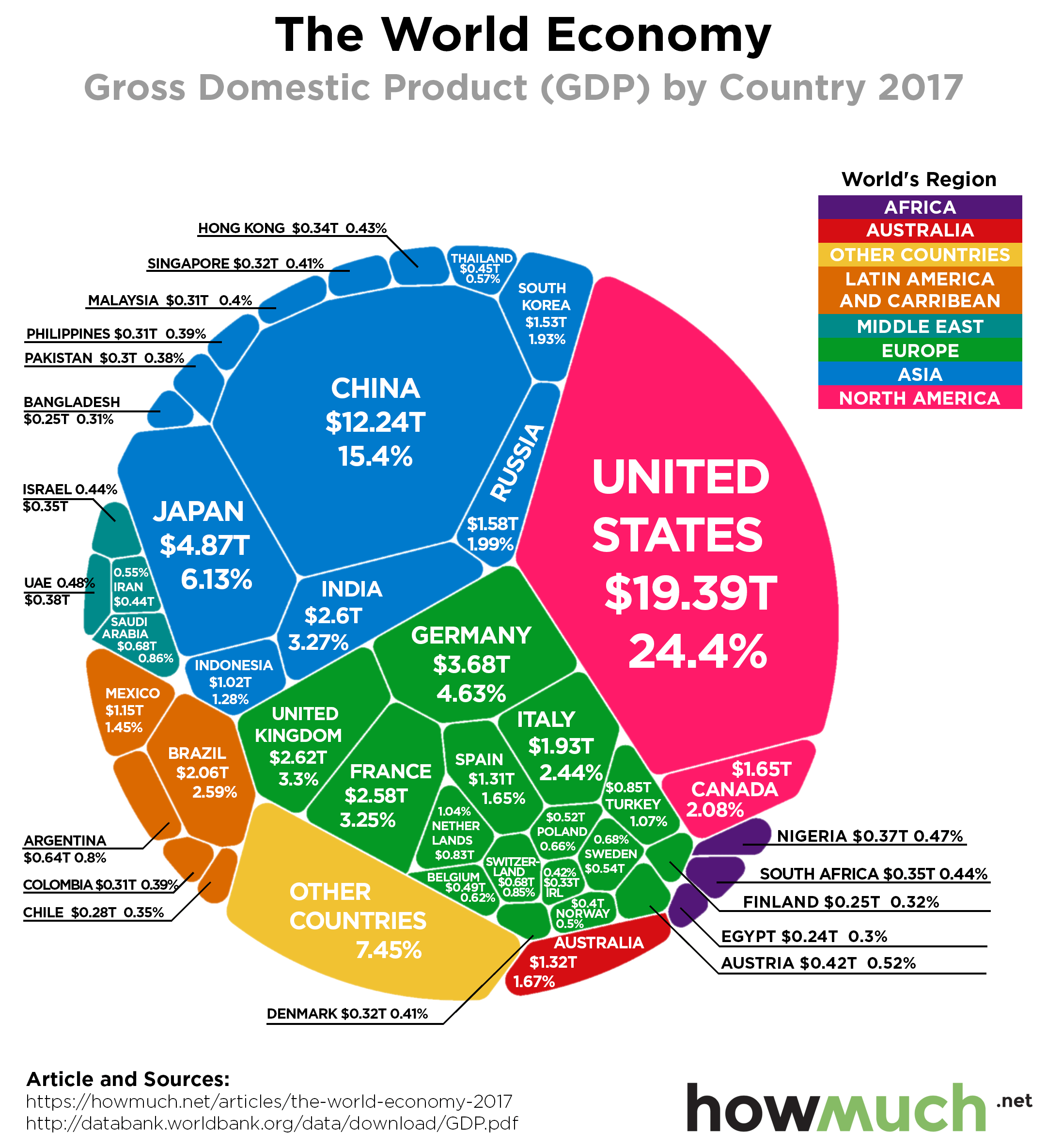

- Economic Stability: The US economy, despite trade tensions, was seen as relatively stable, making US stocks a more appealing option compared to markets experiencing greater uncertainty.

- Dollar Strength: The US dollar often acts as a safe-haven currency during times of global economic uncertainty, further bolstering the appeal of US stock investments.

Market data from this period demonstrates a clear shift towards US equities as investors sought stability amidst the global trade conflict.

Shifting Global Economic Dynamics

The trade war reshaped global supply chains and influenced Canadian investment strategies.

- Sectoral Impacts: Some sectors, like manufacturing and agriculture, experienced disruptions due to tariffs and trade restrictions. This influenced Canadian investors to diversify away from these directly impacted sectors.

- Strategic Adjustments: Canadian companies adjusted their investment strategies, potentially seeking opportunities in less affected US sectors or those benefitting from the trade war's restructuring of global supply chains.

Currency Fluctuations and Their Role

Fluctuations in the USD/CAD exchange rate directly impact the returns Canadian investors receive from US stock investments.

- Exchange Rate Impact: A stronger USD relative to the CAD reduces the value of returns when converted back to Canadian dollars. Conversely, a weaker USD increases returns.

- Investment Decisions: Exchange rate forecasts influence the attractiveness of US stocks; periods of expected USD strength might deter investment, while expected USD weakness could encourage it.

Historical USD/CAD fluctuations clearly demonstrate the significant effect exchange rates can have on the profitability of Canadian investment in US stocks.

Risks and Considerations for Canadian Investors in the US Market

While the US market offers opportunities, Canadian investors must be aware of potential risks.

Currency Risk

Fluctuations in the USD/CAD exchange rate pose a significant risk, potentially eroding returns.

- Hedging Strategies: Investors can utilize hedging strategies, like currency forwards or options, to mitigate this risk. However, these strategies come with their own costs and complexities.

Careful consideration of currency risk and potential hedging options is essential for managing potential losses.

Political and Economic Uncertainty

US political developments and economic instability can negatively impact investments.

- Political Risks: US elections and changes in economic policy can introduce significant market volatility.

- Economic Shocks: Unexpected economic downturns or policy changes can significantly impact the performance of US stocks.

Keeping abreast of US political and economic news is crucial for making informed investment decisions.

Tax Implications

Canadians investing in US stocks face unique tax implications.

- Withholding Taxes: The US government withholds taxes on dividends and capital gains from non-US residents.

- Tax Treaties: The Canada-US tax treaty can mitigate some of these taxes, but careful tax planning is still necessary.

Seeking professional tax advice is highly recommended to ensure compliance and minimize tax liabilities.

Conclusion: Making Informed Decisions about Canadian Investment in US Stocks

The surge in Canadian investment in US stocks is driven by diversification benefits, access to innovative companies, and the relative ease of investment. The US-China trade war further shaped these decisions, with some investors seeking safe havens in established US companies. However, Canadian investors should carefully consider currency risk, political and economic uncertainty, and tax implications before investing. Thorough research, understanding your personal risk tolerance, and seeking professional financial and tax advice are crucial steps before committing to Canadian investment in US stocks. Consider your individual financial goals and risk profile before making any investment decisions.

Featured Posts

-

Nationals Reliever Jorge Lopez Receives Three Game Suspension

Apr 23, 2025

Nationals Reliever Jorge Lopez Receives Three Game Suspension

Apr 23, 2025 -

Trump Condemns Fed Chair Powell Calls For Termination

Apr 23, 2025

Trump Condemns Fed Chair Powell Calls For Termination

Apr 23, 2025 -

Rpl Spartak Oderzhal Krupnuyu Pobedu Nad Rostovom V 23 Ture

Apr 23, 2025

Rpl Spartak Oderzhal Krupnuyu Pobedu Nad Rostovom V 23 Ture

Apr 23, 2025 -

Limited Options Canadian Households Struggle Under Trumps Tariffs

Apr 23, 2025

Limited Options Canadian Households Struggle Under Trumps Tariffs

Apr 23, 2025 -

Rezultat Matchu Dinamo Obolon 18 Kvitnya Upl

Apr 23, 2025

Rezultat Matchu Dinamo Obolon 18 Kvitnya Upl

Apr 23, 2025